Experiment in Democracy:

Northeast Ohio Residents Create Their Own Federal Budget, Urge Congress to Listen to the People

As Congress nears closer to its deadline to finalize the 2026 federal budget, the civic nonprofits Braver Angels and Voice of the People teamed up in two purple congressional districts in Ohio – the 7th and 13th – to let the public create their own federal budget and give elected officials their spending and tax recommendations.

A survey was conducted of a representative sample of residents in those districts, followed by an in-person event in which 25 Ohio residents deliberated on the survey findings, and on democracy and methods of civic engagement. Staff from the office of Rep. Miller (OH-7) attended to listen to the Ohio residents.

As it turns out, Republicans and Democrats in Northeast Ohio agree on much more than Congress does, and recommended changes to spending and taxes that would reduce the current budget deficit by over $800 billion.

Survey Results: Ohio’s 7th and 13th District Residents on the Federal Budget

From July 5th through August 13th, Voice of the People conducted a public opinion survey about the federal budget, with a representative sample of 649 adults in Ohio’s 7th and 13th congressional districts.

In the survey, respondents created their own federal budget, in which they could change spending levels for 34 discretionary spending areas, as well as for Medicaid and SNAP (food stamps), from their 2024 levels; and change or adopt new taxes. Respondents were shown the effect of each of their decisions on the budget deficit. The budget simulation was designed by the University of Maryland’s Program for Public Consultation, and is publicly available for anyone to take.

The survey found that majorities of both Republicans and Democrats agreed on changes that would increase tax revenue by $841 billion, as well as increase spending by $21 billion, resulting in a net reduction to the current deficit of $820 billion. (Estimates of revenue effects were derived from data from the Congressional Budget Office and Joint Committee on Taxation.) Residents in these Ohio districts went further in reducing the deficit than bipartisan majorities nationally (in a June 2025 survey), who reduced the deficit by $463 billion by cutting spending by $15 billion and increasing revenues by $448 billion.

Bipartisan majorities in Ohio’s 7th and 13th districts recommended the following changes to spending.

- Increase spending above 2024 levels for Medicaid (Republicans 56%, Democrats 85%) and SNAP (Republicans 55%, Democrats 79%).

- Increase spending above 2024 levels for: air travel and railroads, highways, mass public transit, scientific research, homeland security, veterans benefits, job training, special education, and subsidies to small farmers.

- There was no bipartisan majority support for decreasing spending in any area. With regards to the the core defense budget, which was $860 billion in 2024, neither a Republican nor Democratic majority decreased it (40% and 47%, respectively) or increased it (48% and 47%).

- While bare majorities of Republicans (51%) decreased spending on foreign aid for development and subsidies to large agricultural corporations, no majority of Democrats decreased spending in any area.

Bipartisan majorities recommended the following changes to revenues.

- Increase tax rates on:

- income of $80,000 to $1 million, back to the rate they were before the 2017 tax cuts (Republicans 51-73%, Democrats 66-87%), and higher for income of $1 million or more (Republicans 57%, Democrats 83%)

- capital gains and dividends for those with income of $200,000 or more, by taxing those earnings as ordinary income (Republicans 65-79%, Democrats 67-89%)

- corporations, by raising the effective tax rate on profits from 12 to 14 percent (Republicans 68%, Democrats 86%). (This change is roughly equivalent to raising the current flat rate of 21 percent up to 25 percent.)

- Adopt new taxes:

- 2% on wealth over $50 million and 3% over $1 billion (Republicans 71%, Democrats 84%)

- 0.01% on trades of stocks and bonds (Republicans 74%, Democrats 79%).

- Adopt two tax-relief measures which were recently passed into law:

- eliminate income taxes on tips (Republicans 67%, Democrats 55%)

- eliminate income taxes on overtime pay (Republicans 64%, Democrats 55%).

- Do not eliminate the estate tax (Republicans 81%, Democrats 94%)

Because the recently passed spending and tax bill – the One Big Beautiful Bill – reduced taxes and spending in many areas, including Medicaid and SNAP, and substantially increased spending on defense and homeland security, enacting the above changes would require Congress to reverse several of the provisions of that bill.

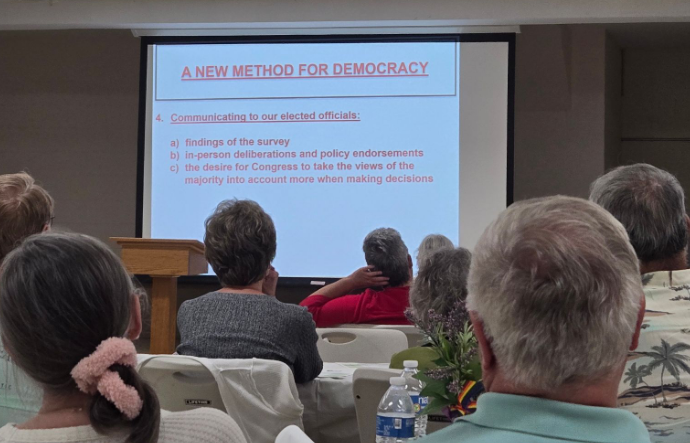

Civic Engagement Event: In-Person Forum in Brecksville, Ohio

Twenty-five residents of Northeast Ohio gathered in Brecksville, Ohio at an in-person forum hosted by Braver Angels to deliberate on the survey findings, the federal budget in general, and how elected officials should listen to the public. A member of Rep. Miller’s office (OH-7) attended to listen to the deliberations.

Attendees were all surprised at the level of bipartisan agreement on meaningful changes. “I’m amazed at how 600 ordinary citizens were able to agree on ways to put a meaningful dent in the deficit,” noted one attendee. Another commented that the survey reveals, “more agreement than disagreement,” and that she “hopes this shows elected officials not to keep listening only to the loudest voices.”

Many also acknowledged the large gap between the budgetary decisions made by bipartisan majorities of the public, and those enacted by Congress.

A large majority of attendees endorsed, with reservations, their Member of Congress voting for the major spending and tax changes that had bipartisan majority support. Among the reservations were the tax raises on middle incomes, increases in spending that they felt were the responsibility of local governments, such as education, and the lack of spending reductions. Four attendees did not endorse their Member voting for the policies.

Despite minor disagreements, attendees overwhelmingly endorsed a method of democracy in which elected officials rely more on representative-sample surveys to understand the views of their constituents, and take into account the majority position. They also endorsed the method of civic engagement in which citizens communicate constructively with their elected officials, leveraging the results of representative-sample surveys

“As opposed to the original town hall model that often fails for both the public and elected officials, this model is a beautiful example of a non-inflammatory way of bringing together people to discuss and advocate for real policy solutions,” voiced an attendee in the closing segment.

Future Civic Engagement Events

Braver Angels and VOP are hoping that this project will help constituents more constructively engage with their elected officials, help officials be more responsive to their constituents, and serve as a starting point for improving democracy across the nation.

The outcome of this pilot will be reported to the national Braver Angels organization, with the hope that the methods will be adopted in more districts and on more topics. To stay updated, subscribe to the Voice of the People and the Braver Angels newsletters.

About the Survey

The survey was a “public consultation survey” developed by the Program for Public Consultation at the University of Maryland’s School of Public Policy. Respondents are provided briefings and arguments for and against proposals. Content was reviewed by experts from each side of the debate to ensure that the briefings are accurate and balanced and that the arguments presented are the strongest ones being made.

The survey was fielded by Voice of the People, July 5th through August 13th, 2025 with 649 adults in Ohio’s 7th and 13th congressional districts (326 and 323, respectively). Samples were obtained from multiple online opt-in panels, including Cint, Dynata and Prodege. Sample collection and quality control was managed by QuantifyAI under the direction of Voice of the People. Samples were pre-stratified and weighted by age, race, gender, education, income, and home ownership to match the general adult population. The survey was offered in both English and Spanish. The confidence interval is +/- 4.0% and the response rate for the sample was 5.5%.