Ban on Stock Trading for Members of Congress Favored by Overwhelming Bipartisan Majority

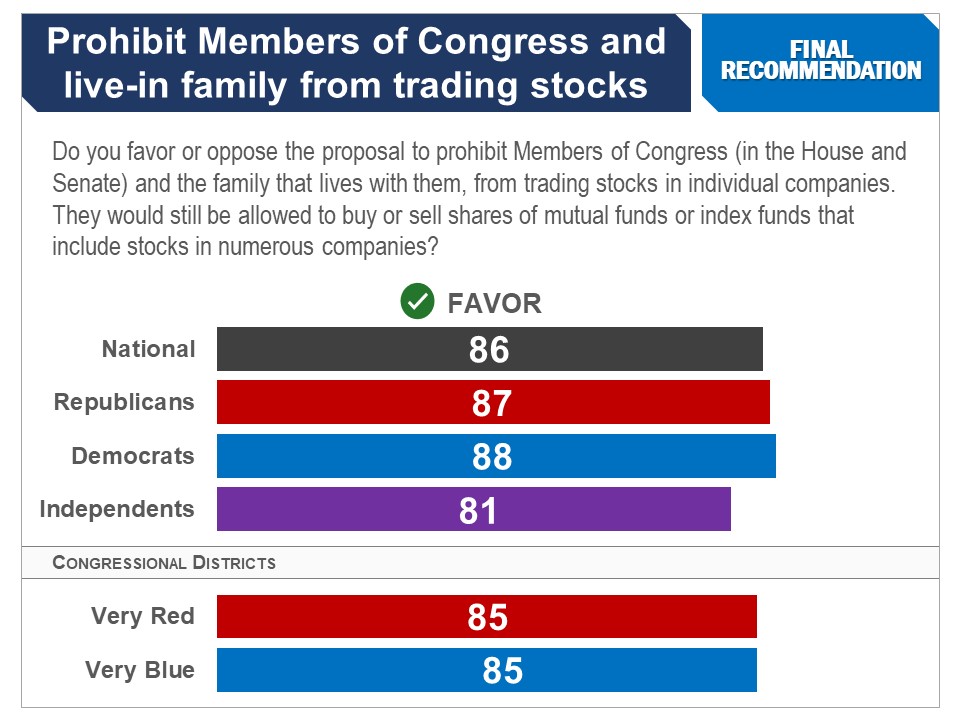

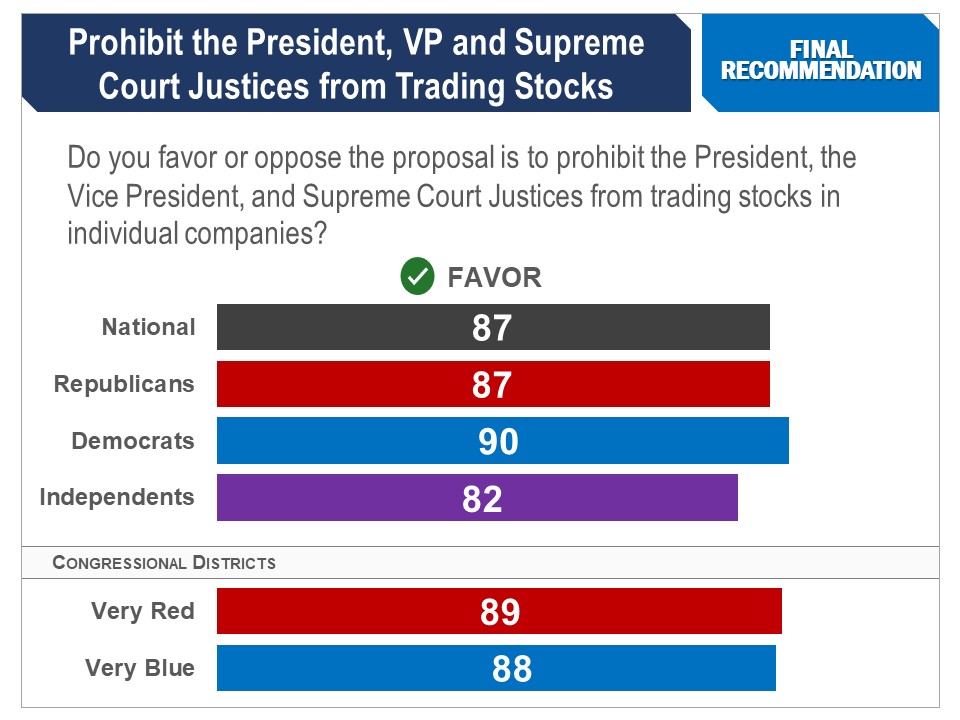

Overwhelming bipartisan majorities favor prohibiting stock-trading in individual companies by Members of Congress (86%, Republicans 87%, Democrats 88%, independents 81%), as well as the President, Vice President, and Supreme Court Justices (87%, Republicans 87%, Democrats 90%, independents 82%) according to an in-depth survey by the Program for Public Consultation (PPC) at the University of Maryland’s School of Public Policy.

While criticism of Members of Congress trading stocks while in office has been present for some time, the issue was given new life with accusations of Members making lucrative purchases of pharmaceutical stocks based on insider information on Covid-19 vaccines.

Legislation to prohibit any stock trading in individual companies among Members was introduced in 2022 (S. 3494, S.1171, S. 439, H.R. 345, H.R. 1138, H.R.2678), as well as a ban on the President, the Vice President and the Supreme Court (S. 693, H.R. 389). Officials would still be able to buy and sell stocks in large portfolios, like mutual funds; and would still be able to own their existing stocks as long as they are put into an independently managed fund, also known as a blind trust. The ban would apply to any family that live with them.

The public consultation survey of 2,625 registered voters ensured that respondents understood the issue by first providing a short briefing on the legislative proposals. They also evaluated strongly-stated arguments for and against. The content was reviewed by expert proponents and opponents to ensure that the briefing was accurate and balanced and that the arguments presented were the strongest ones being made.

“While the prospect of a stock trading ban is controversial within Congress, public support approaches unanimity,” commented Steven Kull, director of PPC.

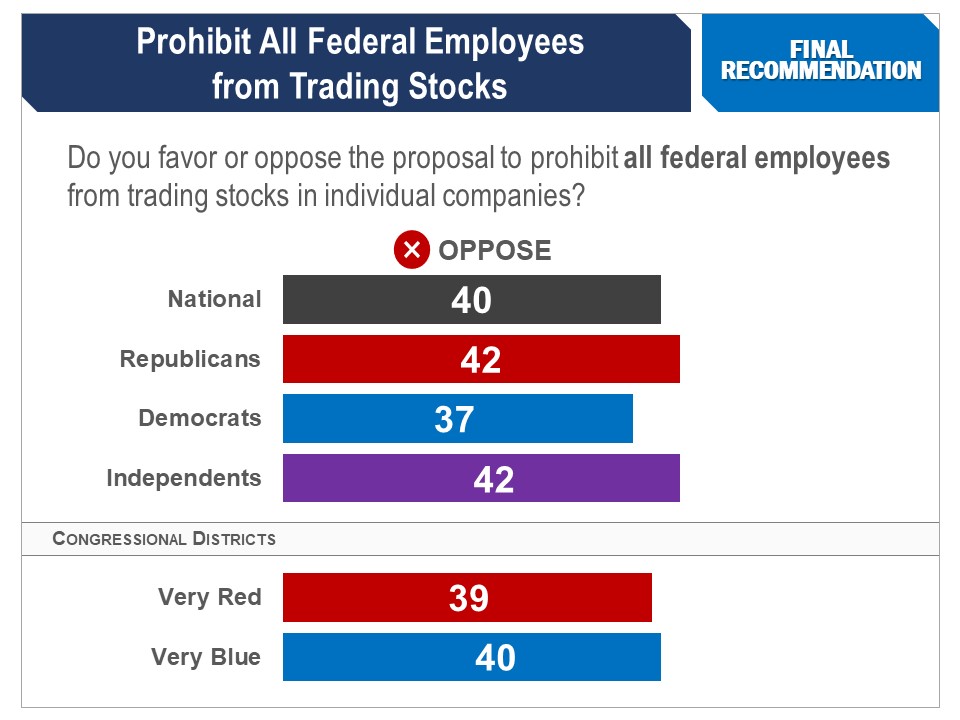

However, majorities did not favor a proposal to ban stock-trading for all federal employees (H.R. 389). This was favored by just 40%, including just 42% of Republicans, 37% of Democrats and 42% of independents.

The most popular argument in favor of the prohibition on Members asserted that there are, “too many potential conflicts of interest when Members of Congress can hold and trade stocks in individual companies” (92% convincing, Republicans 92%, Democrats 93%).The con arguments did not do as well. The most convincing was that this new law is not necessary, since there are already laws against insider trading that apply to Members of Congress but was found convincing by minorities (28% overall, Republicans 25%, Democrats 30%).

The sample was large enough to enable analysis of attitudes in very Republican to very Democratic districts based on Cook PVI ratings. In all types of districts, very large majorities were in favor of a stock-trading ban on Members, from very red (85%) to very blue districts (85%).

The survey was fielded online May 19-30, 2023 with a probability-based national sample of 2,625 registered voters provided by Nielsen Scarborough from its larger sample, which is recruited by telephone and mail from a random sample of households. There is a margin of error of +/- 1.9%.

Be the first to comment