The Federal Budget

Every year, the Executive Branch and Congress develop a budget for spending areas that Congress controls on an annual basis called the discretionary budget. This does not include mandatory spending, such as for entitlement programs like Social Security. At any time, Congress can make changes to general revenues, and some such changes are often incorporated into the annual budget proposal.

A central consideration in the development of the budget is the deficit and the growing national debt which now stands at $36 trillion. The Congressional Budget Office estimates that on its current trajectory the debt could grow to over 150% of GDP by 2050, a level not seen in US history.

- National Sample: 1,214 Adults

- Field Dates: May 30- June 16, 2025

- Questionnaire with Toplines, Crosstabs and Methodology

- Report: Americans on the FY2025 Budget

- Summary Tables of Spending and Revenue Changes

- Take the Federal Budget Simulation Yourself

Respondents were initially told that they would be dealing with the discretionary budget and general revenues. They were also told about the projected budget deficit.

To introduce the issue of the budget deficit, respondents were presented two graphs putting the deficit into historical perspective:

- Deficits as a percentage of Gross Domestic Product (GDP), 1990-2024

- Debt held by the public as a percentage of GDP, 1990-2024

To evaluate spending, respondents were presented the most recent discretionary budget (FY2024) broken out into 32 line items with a short description of each item and shown spending levels for the past two years and the projected level for the current year. They were asked to specify their proposed level for each line item. They were also asked to specify their proposed spending level for the mandatory programs Medicaid and the Supplemental Nutrition Assistance Program (SNAP, or food stamps)

To evaluate taxes, respondents were presented options for changing existing taxes and adopting new taxes.

As respondents made their selections, an interactive feature gave them immediate and cumulative feedback on the impact of their choices on the deficit.

There were no questions asking respondents whether they would find certain changes tolerable.

- National Sample: 2,403 Registered Voters

- Margin of Error: +/- 2.0%

- Fielded: April 10 - May 13, 2019

- Questionnaire with Toplines and Crosstabs

- Full Report

- National Sample: 2,339 Registered Voters

- Oversample in California and Ohio: 375 Registered Voters

- Margin of Error: +/- 2.0%

- Fielded: June 8 - 25, 2018

- Questionnaire with Frequencies

- Full Report

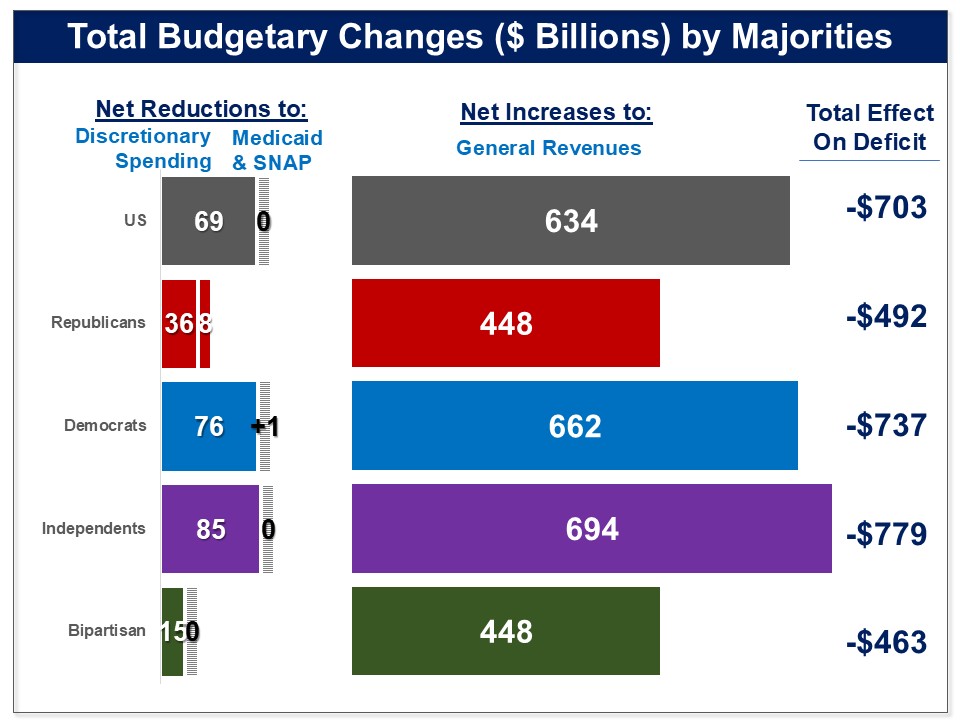

Presented the discretionary budget broken into 32 line items and given the opportunity to make changes, majorities only increased one line item, but reduced nine, creating a net cut of $69 billion. The largest reduction was to the core defense budget, which a majority reduced by $60 billion. Other areas cut by $1-2 billion were: intelligence agencies, nuclear weapons, homeland security, enforcement of federal laws, the space program, foreign development aid, conservation and land management, and subsidies to large agricultural companies.

DISCRETIONARY SPENDING

Respondents were shown 32 line items from the budget, with a brief description of what each included and the amount of spending authorized for FY2024. Respondents were told that they could specify their recommended spending levels for each line item, either increasing it, decreasing it, or leaving it the same. A bubble containing the amount of the deficit (initially $1.9 trillion) followed them as they scrolled through the line items and went down or up with each change they made.

Respondents were presented information about the federal debt and deficit, and evaluated several pairs of arguments related to the deficit, the size of the Federal government, public investments, and defense spending.

The Federal Budget Deficit

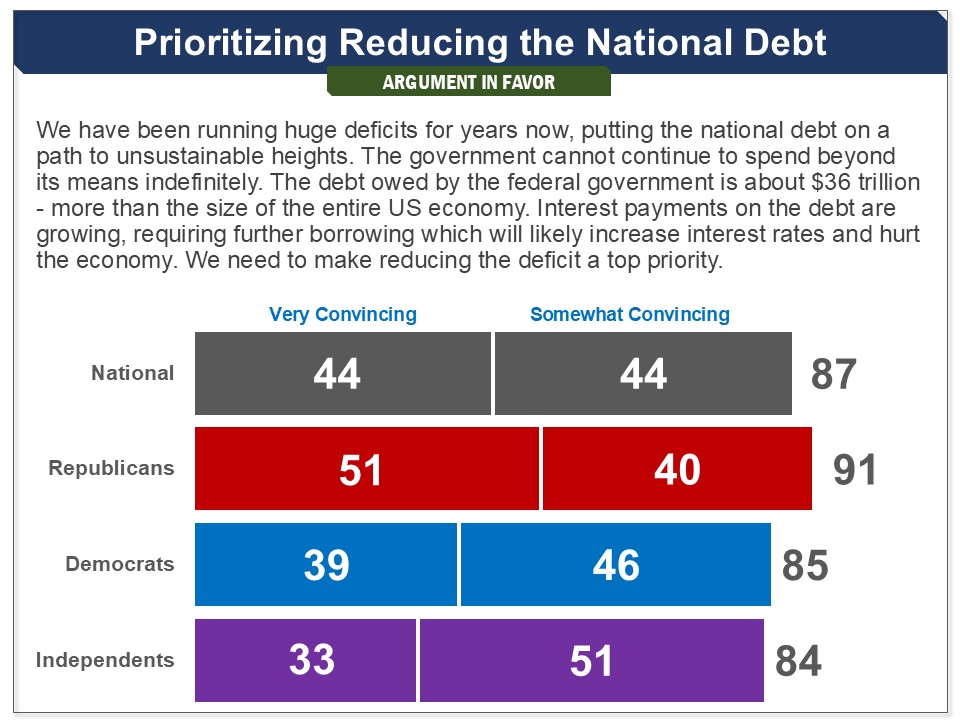

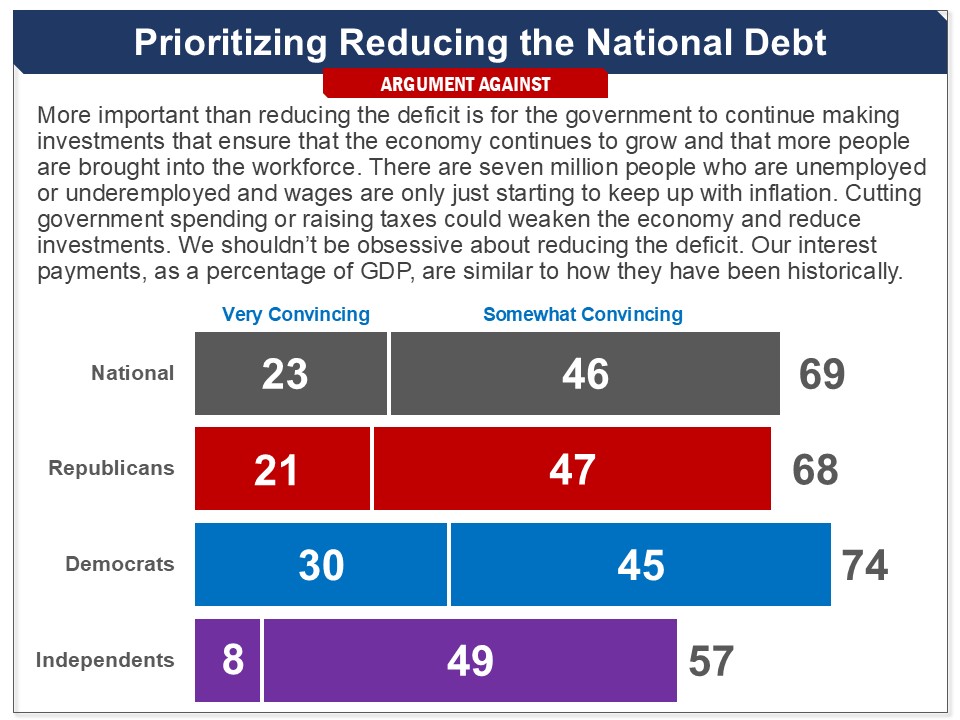

Respondents then assessed an argument declaring that reducing the deficit should be a top priority. An overwhelming bipartisan majority of 87% found it convincing, including 91% of Republicans and 85% of Democrats. The counter‐argument called the deficit important, but said it should be secondary to the goal of sustaining economic growth. A smaller, but still very large bipartisan majority of 69% found that convincing, including 68% of Republicans and 74% of Democrats.

Size of the Federal Government

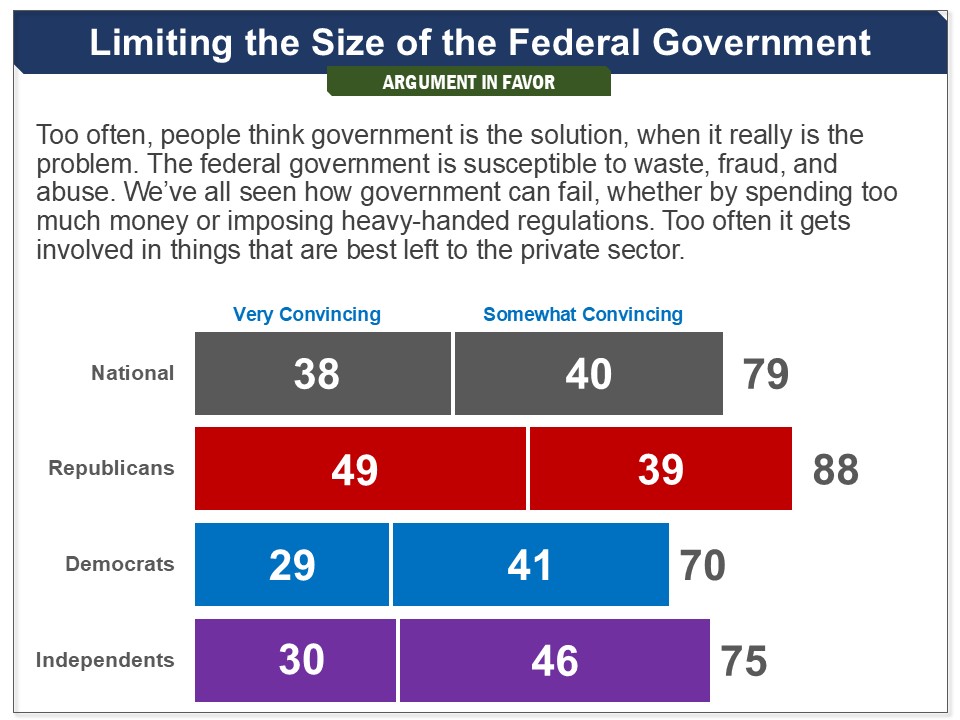

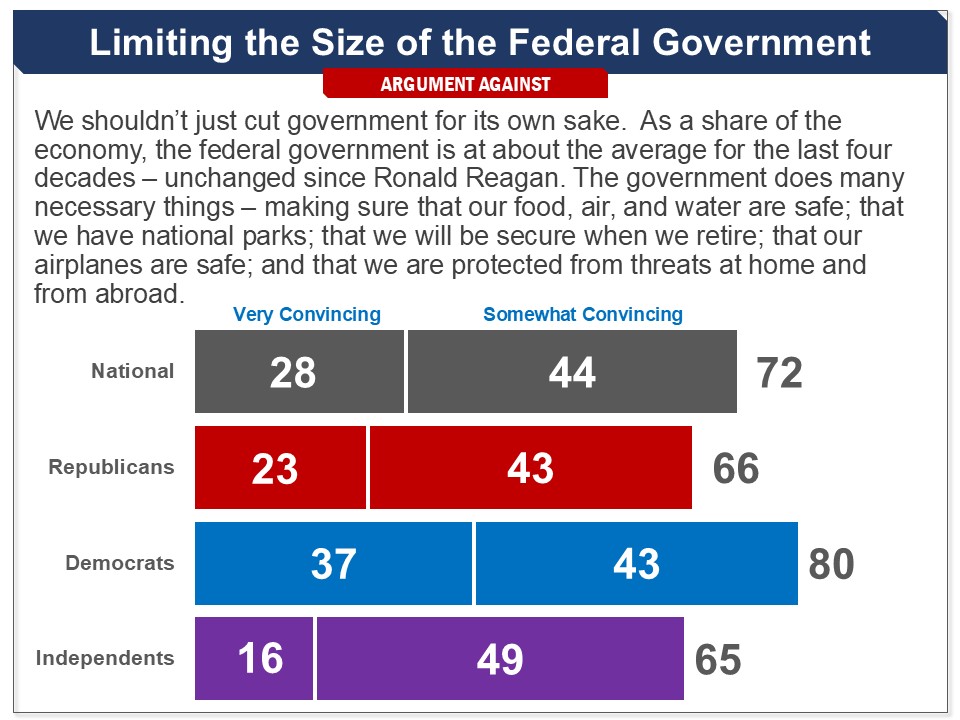

Respondents assessed an argument in favor of a smaller government. This was found convincing by a large bipartisan majority of 79%, including 88% of Republicans and 70% of Democrats. The counter‐argument stressed that the federal government has been a larger share of the US economy in the past than it is now, and reminded respondents of the various services it provides. The argument was also found convincing by a large bipartisan majority (72%, Republicans 66%, Democrats 80%).

Public Investments

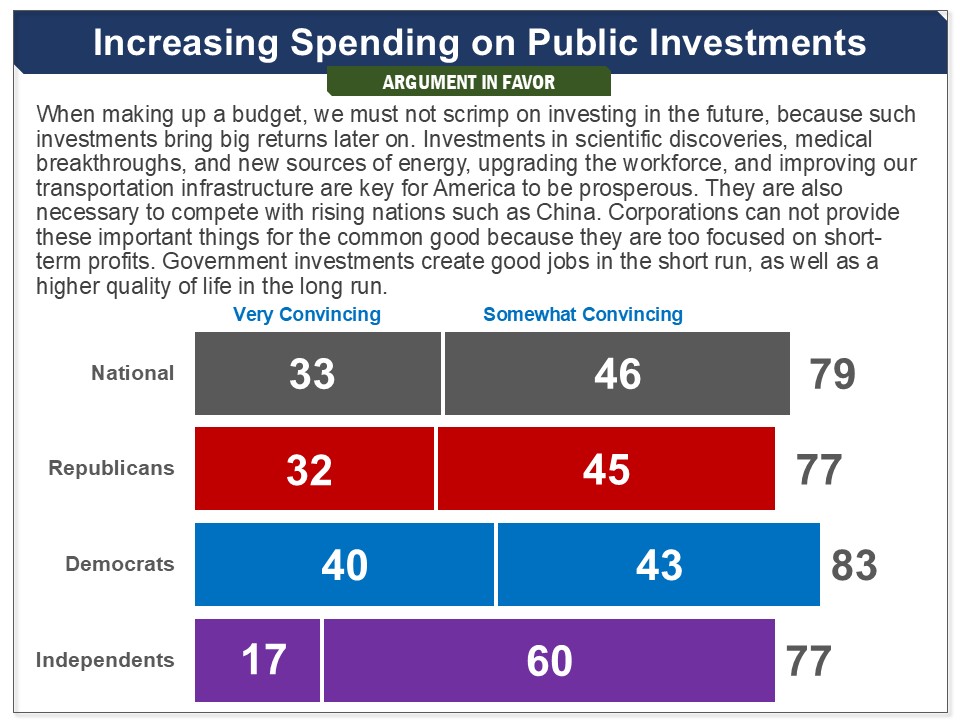

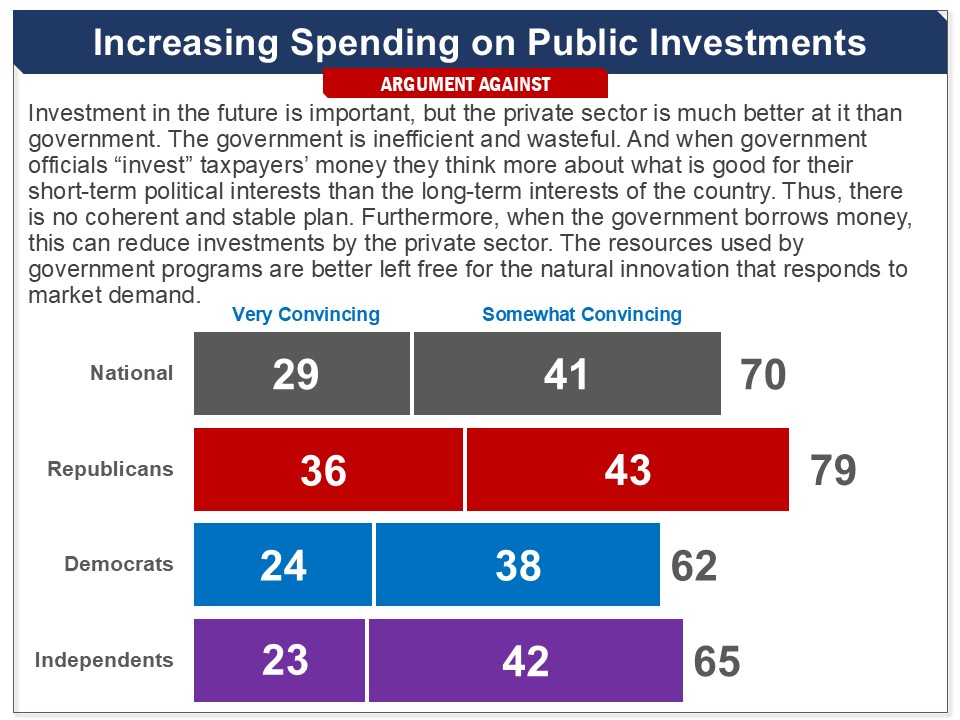

The next broad issue addressed the question of how much the government should invest for future capacities “such as scientific and medical research, development of new sources of energy, development and maintenance of transportation infrastructure, and educating the population which provides the workforce.”

The pro argument held that “investing in the future…can bring big returns later on” and that corporations are necessarily profit‐driven and cannot be counted on to deliver public goods. A very large majority of 79% found this convincing, as did 83% of Democrats and 77% of Republicans (a 25 point increase from 2016.) The counter‐argument stated that the private sector is better than the government at investing in the future, and that government investments can deflect capital from innovation in the private sector. This also elicited a bipartisan majority response with 70% finding it convincing, including 79% of Republicans and 62% of Democrats.

Defense Spending

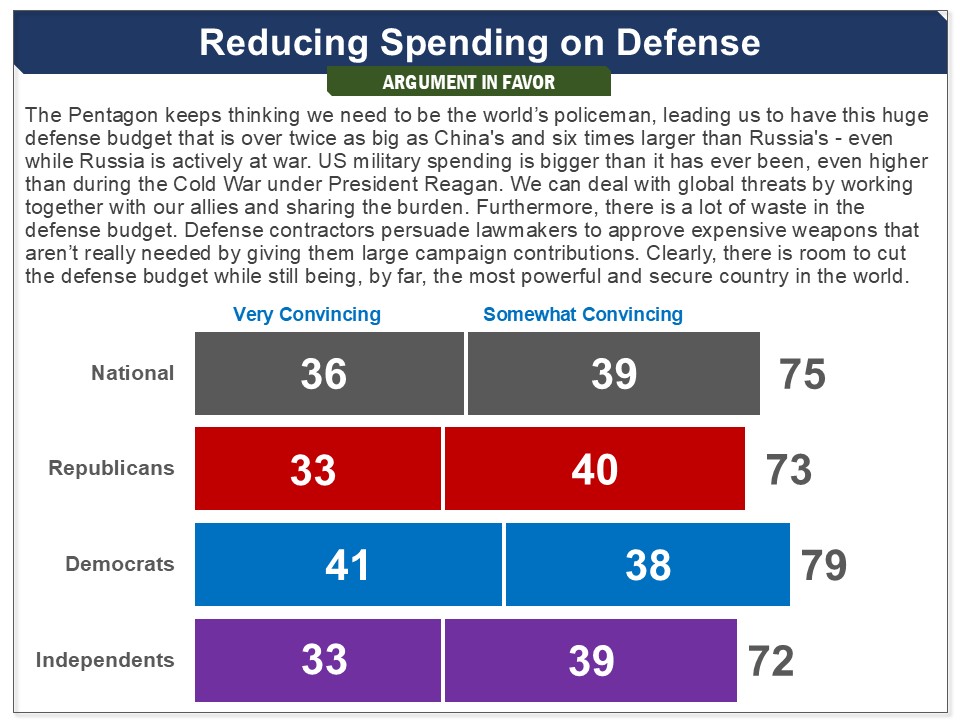

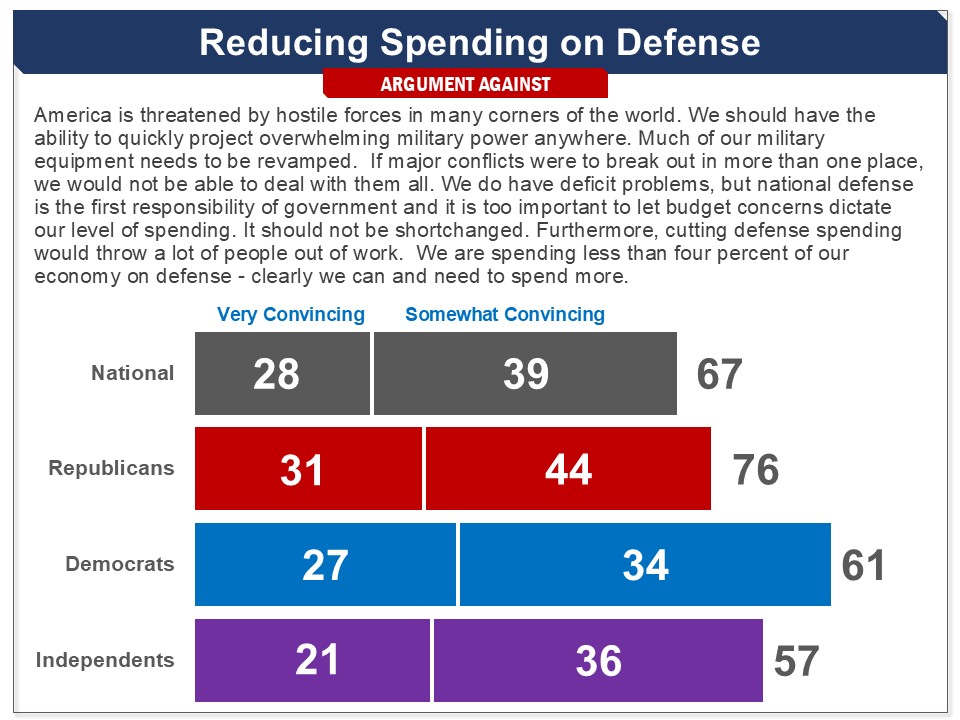

The last broad issue before respondents tackled concerned spending on defense. The argument for reducing defense spending, which stated that the US defense budget is “twice as big as China's and six times larger than Russia's - even while Russia is actively at war,” was found convincing by a very large majority 75%, including 79% of Democrats and 73% of Republicans (a 23 point increase since 2019.)

|

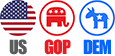

The spending changes on which majorities of Republicans and Democrats converged yielded $15 billion in spending cuts. The most prominent convergences were a $10 billion cut to the core defense budget, and $2 billion cuts to intelligence agencies and the space program. They also converged on $1 billion cuts to the enforcement of federal laws and subsidies to large agricultural corporations. They agreed on a $1 billion increase to subsidies for small farmers.

Related Standard Polls Several polls have presented respondents a number of discretionary spending areas--without any spending level specified--and given the respondent the opportunity to call for increases or decreases, or to say that spending was too much or too little. In several areas, a majority has increased spending, or said that spending was too little. In only one instance did a majority say spending was too much: assistance to other countries, but this was not the case in another poll that asked about foreign aid. Assessment of Multiple Areas of Spending A 2025 YouGov survey had respondents assess federal spending in 40 areas:

A 2025 AP-NORC survey had respondents evaluate six areas, including both discretionary and mandatory spending programs:

A 2018 NORC General Social Survey had respondents assess 16 areas of discretionary spending:

A 2019 Kaiser Family Foundation had respondents assess six areas:

A 2018 Kaiser Family Foundation had respondents assess four areas:

A Pew 2017 survey had respondents assess 12 areas:

Defense Spending Majorities of Americans consistently opposed increasing spending on defense, but Republicans have at times supported an increase, including in the most recent polling.

Asked whether they support or oppose, “increasing military spending by about $150 billion,” just 39% were in support, including just 27% of Democrats, but a majority of Republicans (62%). (Ipsos/Washington Post, June 2025) |

|

Reduce defense budget for general operations by $10 billion |

|

Reduce budget for intelligence agencies by $2 billion |

|

Reduce subsidies to agricultural corporations by $1 billion |

|

Reduce budget for the space program (NASA) by $2 billion |

|

Reduce spending on agencies that enforce federal law by $1 billion |

|

Increase subsidies for small farmers by $1 billion |

REVENUES

Before beginning to assess options for changes to general revenues, respondents assessed broad arguments on the tax policy that are foreground in current Congressional debates. These arguments dealt with whether taxes should be reduced, whether taxes on the wealthy should be increased and whether the Federal government should use taxes to discourage people from doing things that are harmful and create costs for society.

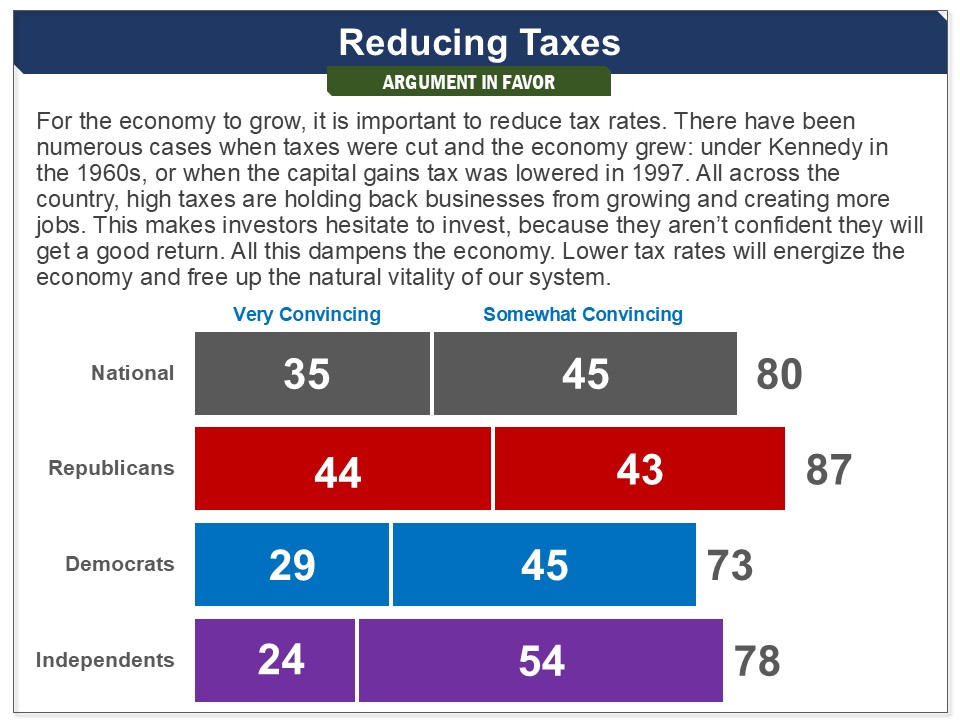

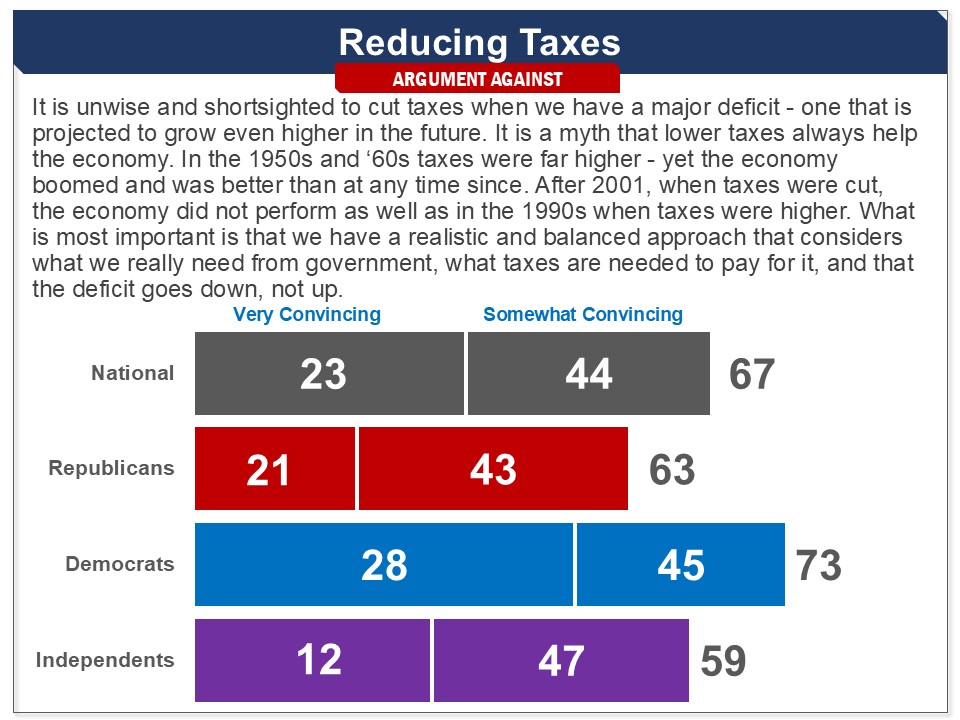

Reducing Taxes

Respondents first assessed an argument in favor of tax cuts saying that they stimulate economic growth. Eight in ten found this convincing (80%), including 87% of Republicans. Strikingly, Democrats have become substantially more receptive to this argument, with just half finding it convincing in 2019, and 73% finding it convincing in this survey. Respondents then read a counter‐argument that pointed to other times when taxes were higher while this was accompanied by economic growth. This argument was found convincing by a bipartisan majority of 67%, including 73% of Democrats. Republicans have become more receptive to this argument, with just half finding it convincing in 2019, but 63% finding it convincing in this survey.

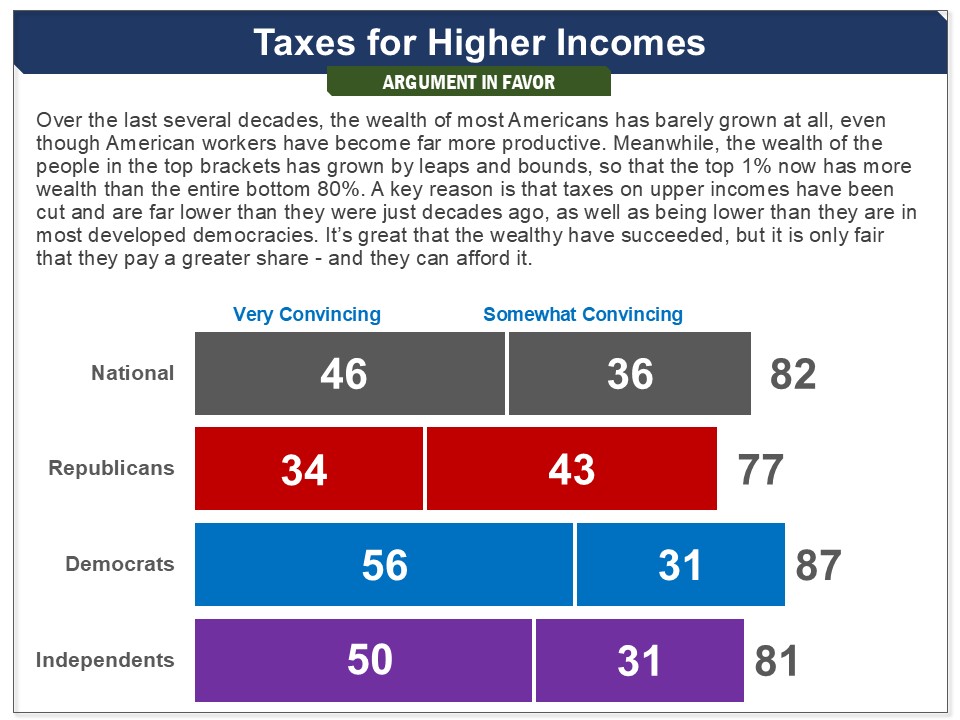

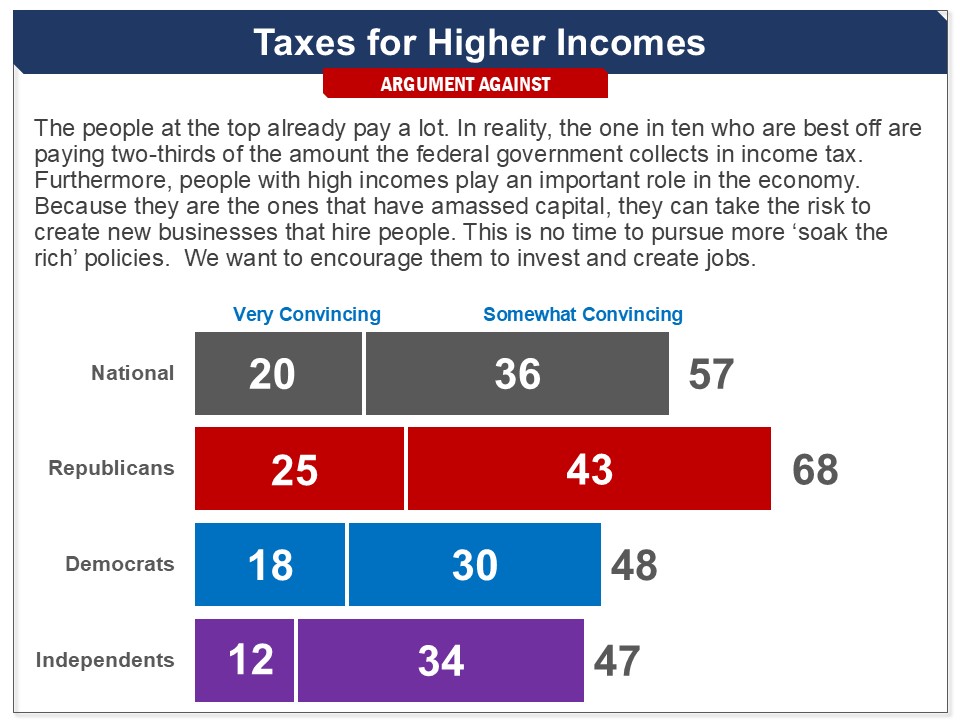

Increasing Taxes on High Incomes

The argument in favor of higher taxes for the top income levels said this is justified by increased inequality. This argument did very well, with a large bipartisan majority of 82% finding it convincing, including 77% of Republicans and 87% of Democrats. The rebuttal stated that such people can create jobs and should not be discouraged from doing so. This argument was not as successful, but still, a 57% majority found it convincing, including 68% of Republicans. Less than half of Democrats (48%) and independents (47%) concurred.

|

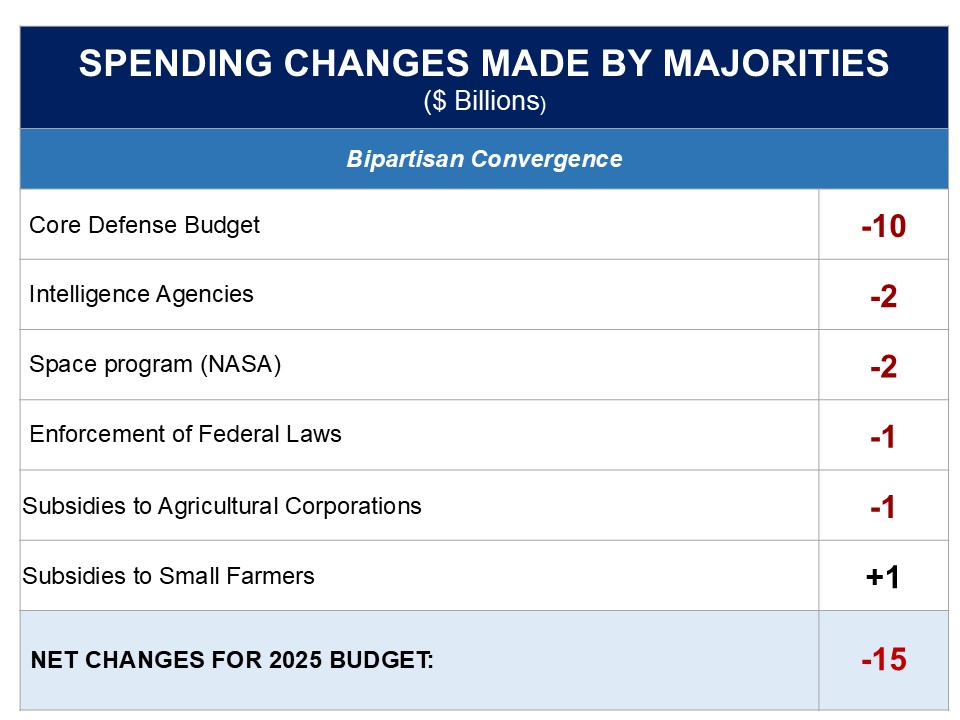

Bipartisan majorities increased tax rates for income over $500,000, generating $121 billion, by reverting them to their pre-2017 tax reform rates. Increasing the tax rate for income $500,000 to $1 million was chosen by 58% (Republicans 53%, Democrats 64%). Increasing the tax rate for income $1 million and over was chosen by 61% (Republicans 56%, Democrats 67%). A majority nationally (55%) and among Democrats (62%) went further and reverted tax rates to pre-2017 levels for income $200-500,000, generating an additional $145 billion. For the income groups under $200,000, there was not majority support for decreasing nor increasing the tax rates, with 21-46% decreasing them, 32-37% keeping it the same, and 21-44% increasing them. Among both Democrats and Republicans, there were also no majorities choosing to increase or decrease them.

More Information Briefing Respondents were presented the following briefing on individual income taxes, and the effective tax rate: The first revenue area we will explore is income taxes - the biggest source of revenues. The table below shows the effective tax rates that people with different income levels pay, on average, to the federal government, most often by money being withheld from their paychecks. The effective tax rate shown below is the percentage of their income that people actually pay, after exemptions, credits and deductions. These are lower than a person’s marginal tax rate, which you may have read about, and only applies to some of their earnings. These effective tax rates include FICA payments that are made to Social Security and Medicare. They were also informed about the changes made to the tax rates in 2018 by the 2017 Tax Cuts and Jobs Act: As you may know, in 2018 the government enacted temporary tax reductions that are scheduled to expire later this year, and tax rates will go back to 2017 rates. You can decide to keep those lower rates (or reduce them further) or go back to the higher 2017 rates (or increase them further). Respondents were then given the opportunity to increase or decrease effective personal income tax rates by specific amounts on eight income groups, ranging from $40,000-$50,000 to $1 million and more. The effect these changes would have on the effective tax rate and the amount of revenue generated was specified at each level. Decreases in the tax rates resulted in increases in the budget deficit presented in the bubble that moved with them through the exercise, just as increases in the tax rates resulted in decreases to the deficit. Related Standard Polls In standard polls the overall majority and Democrats have consistently shown support for increasing taxes on upper incomes. Republicans, though, respond differently to different types of questions, consistent with their ambivalent responses to the arguments for and against increasing taxes on high incomes. High incomes in general For over 30 years, Gallup has asked whether upper-income people “are paying their FAIR share in federal taxes, paying too MUCH or paying too LITTLE,” and consistently found majorities saying they pay too little (55% in 2024). (Gallup, 2024) Specific income levels When the question is about whether to extend the 2017 tax cuts for higher incomes, less than half are in favor, including less than half of Republicans.

When asked whether they favor or oppose raising taxes on high incomes, bipartisan majorities have been in favor.

However when they are given the opportunity to increase, decrease or keep taxes the same, and neither given information on what those rates are and what change they are proposing, Republicans do not increase taxes on high incomes, while the overall majority and Democrats do.

When asked whether they favor increasing tax rates on families earning over $250,000 support has been substantially lower.

For incomes over $1 million pluralities or modest majorities of Republicans have joined in calling for increases, even when the term “families” is used.

For household with incomes over $10 million, a bipartisan majority has favored increases:

|

|

|

|

|

|

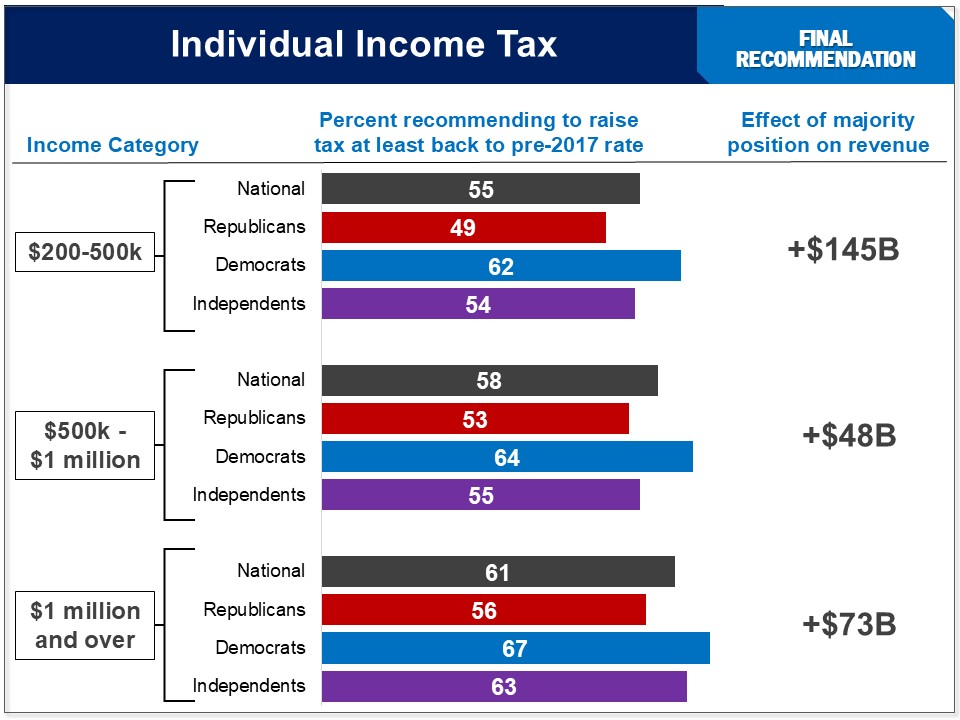

Bipartisan majorities of 60-68% recommended removing the special tax treatment on long-term capital gains and dividends for income groups of $200,000 and over, and taxing them as ordinary income, generating $164 billion. This included 59-65% of Republicans and 63-71% of Democrats. A majority of Democrats (54%) went further and recommended that option for $100-200k, generating an additional $11 billion.

More Information Briefing Respondents were presented the following briefing on capital gains and dividends: Capital gains are profits from the sale of investments, such as stocks and property. Dividends are profits distributed by companies to people who own stock in that company. Over two-thirds of all capital gains go to people making over $1 million a year. Thus, any increases to this tax rate will primarily affect very high-income people. They were informed of the special tax treatment on capital gains and dividends: Currently, income from capital gains and dividends is taxed differently – often less – than income from wages or salaries. Here is the capital gains tax rate currently paid by individuals in different income tax brackets. They were then given the opportunity to choose, for eight income groups ranging from $40,000-$50,000 to $1 million and more, whether to tax capital gains and dividends as ordinary income, thus raising the tax rates and generating additional revenue. Results from CDD Before receiving any briefing materials or engaging in the deliberation process respondents were given the same poll question as those asked afterwards. Support for treating all capital gains the same as ordinary income increased from the pre-deliberation poll to the post-deliberation poll, overall (44% to 50%), and among Republicans (38% to 40%) and Democrats (54% to 60%). Including the middle option (5), those not opposed to the proposal (5-10) remained the same overall and among Democrats, but decreased among Republicans (58% to 54%). Related Standard Polls

|

|

|

|

|

|

|

|

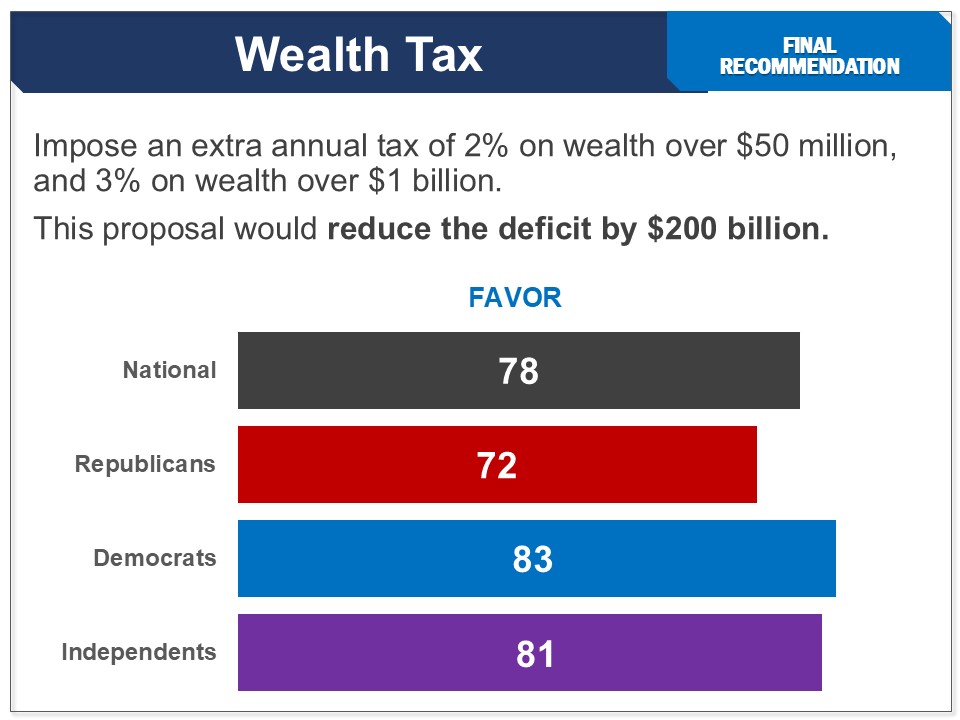

A bipartisan majority of 78% favored a proposal to, “impose an extra annual tax of 2% on wealth over $50 million, and 3% on wealth over $1 billion,” which they were told would generate $200 billion in revenue. This included 72% of Republicans and 83% of Democrats.

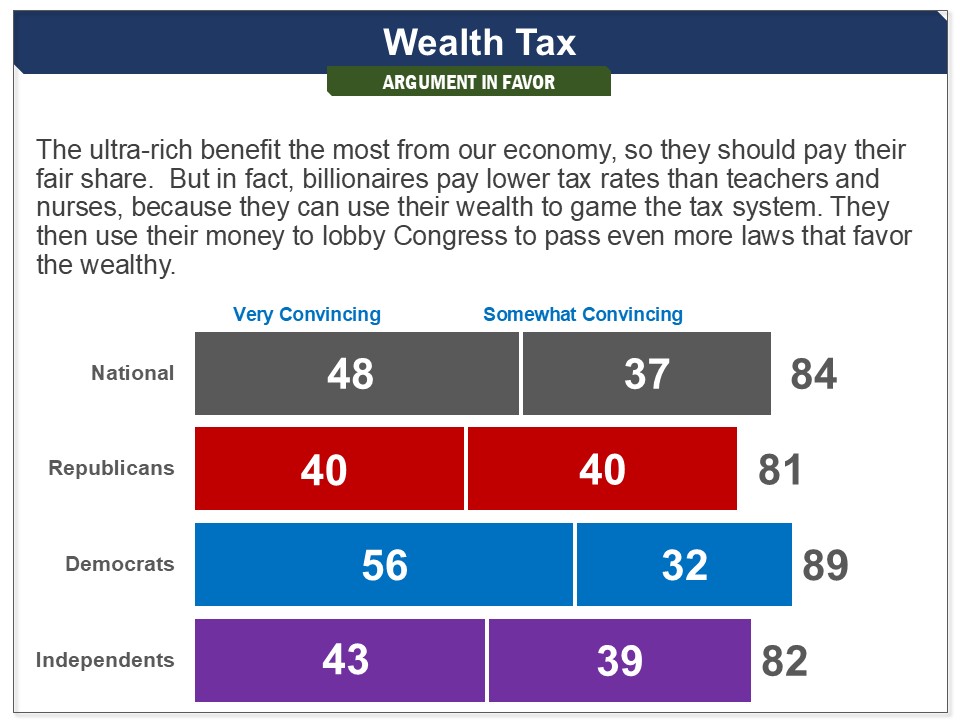

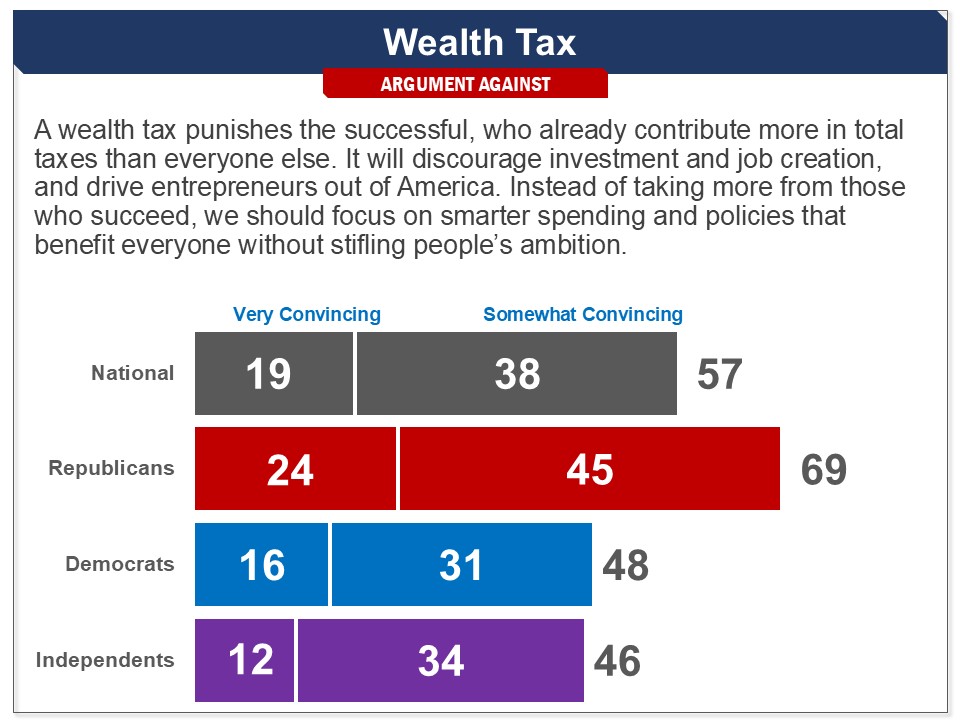

More Information Briefing Respondents were presented the proposal to adopt a wealth tax as follows: Another proposal is to impose a tax on the wealth of individuals or married couples with very high net worth–the top one tenth of one percent of the population. A proposal has been introduced to impose an extra tax of 2% on the amount of wealth over $50 million, and 3% on the amount of wealth over $1 billion. 43 The 2% tax would affect about 120,000 households. 44 The 3% tax would affect about 800 households. This proposal would reduce the deficit by $200 billion a year. Arguments The pro argument that, “The ultra-rich benefit the most from our economy, so they should pay their fair share,” was found convincing by an overwhelming majority of 84%, including 81% of Republicans and 89% of Democrats. The con argument that, “A wealth tax punishes the successful, who already contribute more in total taxes than everyone else,” did not do nearly as well, with just 57% finding it convincing, including less than half of Democrats (48%), but a solid majority of Republicans (69%).

Related Standard Polls Large majorities have supported increasing taxes on the wealthy, with differing responses among Republicans:

Status of Legislation The proposal was in the Ultra-Millionaire Tax Act of 2024 by Rep. Jayapal (H.R.7749) and Sen. Warren (S. 4017) in the 118th Congress. It did not make it out of committee. |

|

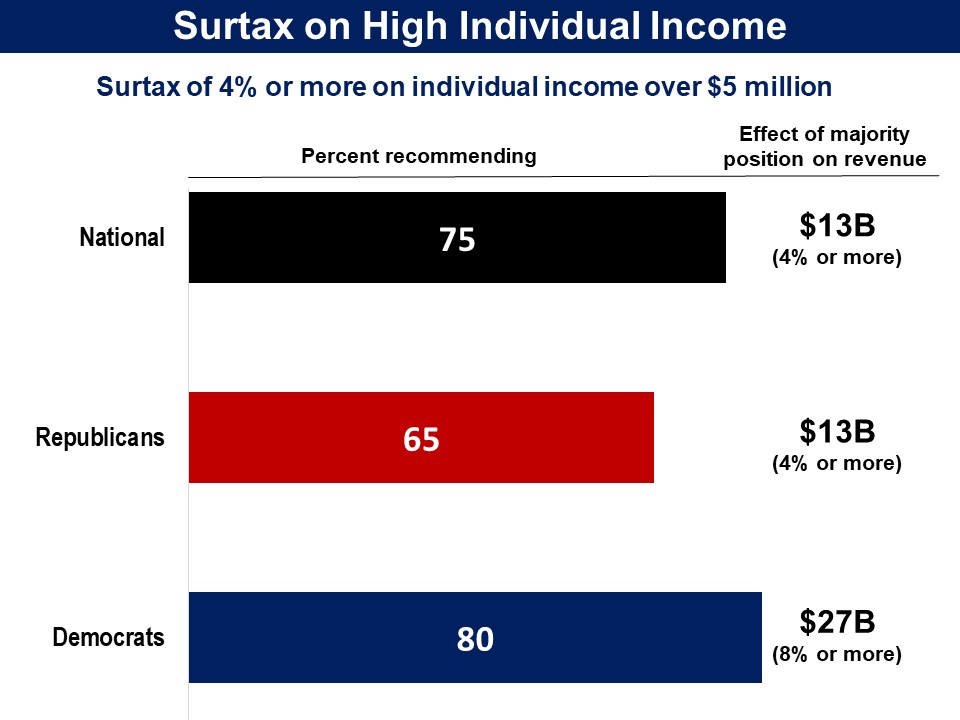

Respondents were introduced to a proposal to increase revenue by adopting a surtax of 4 percent on income over $5 million that was put forward by Warren Buffett and former Presidential candidate Hillary Clinton, which she referred to as the “Fair Share Surcharge”. They were given the opportunity to charge an “extra tax” on income above $5 million (of 4, 8, 12, 16 or 20%). They were told that, “it would have no effect on the first $5 million of income, but there would be an extra tax on the amount over $5 million.” Three quarters of respondents imposed a surtax of at least 4%, generating $13 billion. This included nearly two thirds of Republicans and over eight in ten Democrats (83%). Democrats went further, with six in ten imposing an 8% surtax, generating an additional $14 billion.

Results from DDL A 2019 deliberative poll by the Deliberative Democracy Lab found similar support for a higher tax rate on income over $2 million, without the amount of the increase being specified. Before providing their final response, they were presented with briefing materials on the tax system and income inequality, and arguments for and against adopting a higher income tax for income over $2 million, and participated in an in-person deliberation. On a 0-10 scale, with 5 being “in the middle”, 72% gave the proposal a favorable rating (6-10), including 53% of Republicans and 86% of Democrats. Related Standard Polls Majorities have consistently felt, over the last few decades, that very high income people are paying too little in taxes: For incomes over $1 million, majorities have favored increasing taxes, including pluralities or modest majorities of Republicans.

For household with incomes over $10 million, a bipartisan majority has favored increases:

Status of Legislation The proposal to adopt a surtax of 4 percent on income over $5 million was put forward by Warren Buffet and Hillary Clinton, but was never introduced as legislation. There was a similar proposal in the Millionaires Surtax Act, sponsored in the House by Rep. Don Beyer (D) (H.R. 5043) and in the Senate by Sen. Chris Van Hollen (D) (S. 2809) in the 116th Congress. This legislation would apply an additional ten percent tax on income over $1 million ($2 million for married couples). It would apply equally to wages and salaries as well as to capital gains and other investment income. The bill has not made it out of committee. |

|

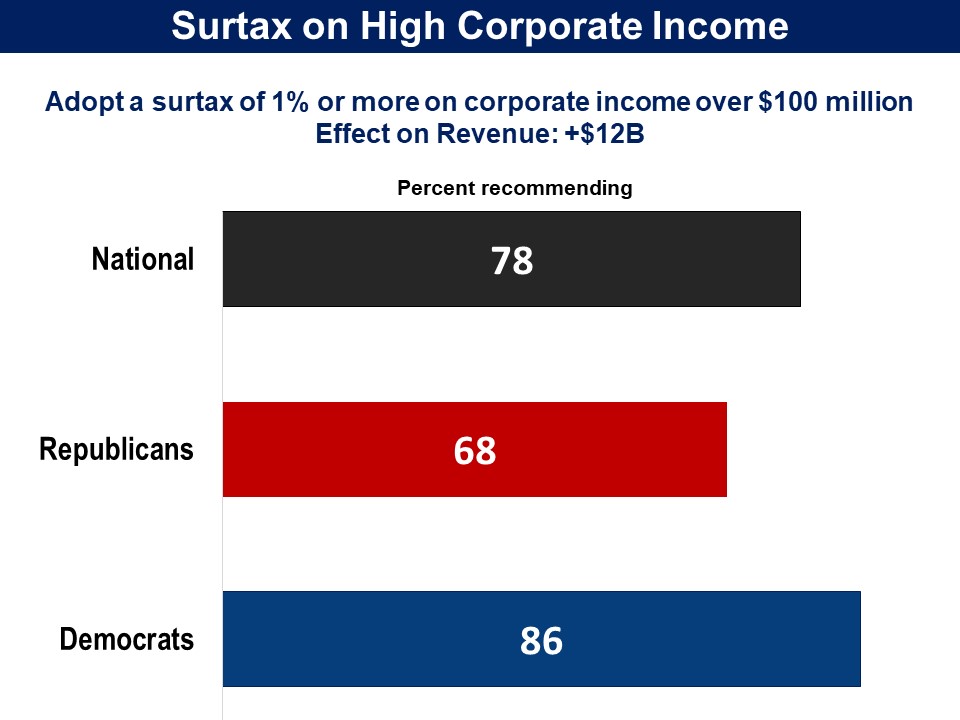

Overall, 78% chose to charge a surtax of one percent or higher, generating $12 billion. This included 68% of Republics and 86% of Democrats. Democrats went further, with 63% imposing a three percent surtax, generating an additional $24 billion.

More Information Briefing Respondents were introduced to a proposal to increase revenue by adopting a seven percent surtax on corporate income over $100 million. They were told that this, “would affect approximately 1,200 corporations.” They were given the opportunity to adopt a surtax on corporate income over $100 million of one, three, five, seven or nine percent. Related Standard Polls When asked whether they favor or oppose raising taxes on corporations, without the option to lower them or keep them the same, a bipartisan majority has been in favor.

When the question asks whether corporations pay too much, too little, or their fair share in taxes, majorities say that pay too little, including majorities of Democrats and half or more Republicans:

When asked whether tax rates on corporations should be raised, lowered, or kept the same, majorities say they should be raised, but less than half of Republicans.

|

|

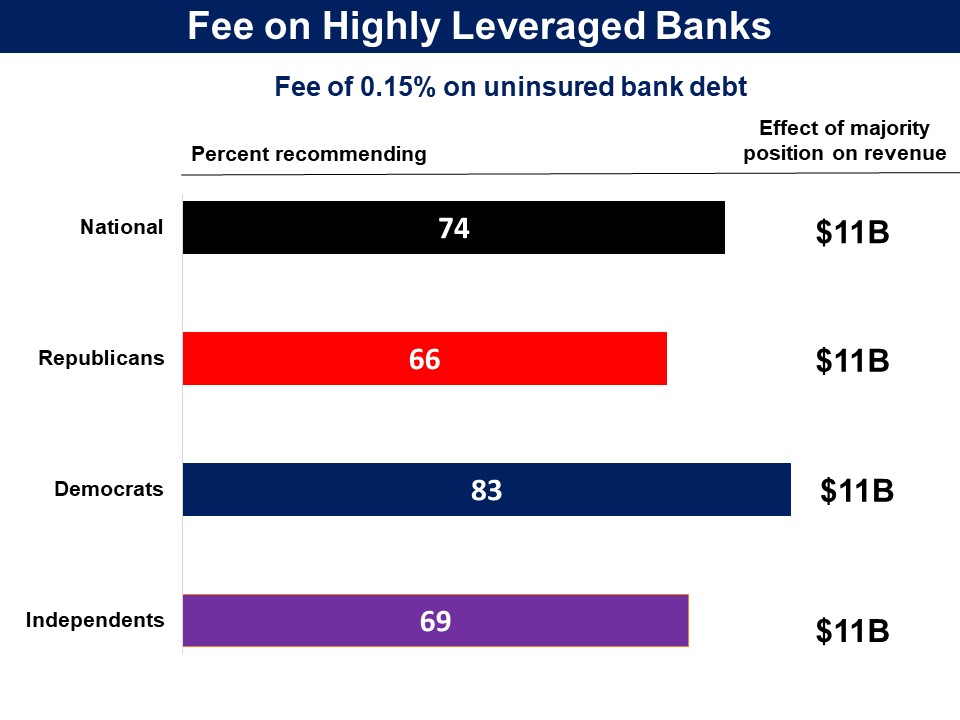

A bipartisan majority of 74% favored adopting a 0.15% fee on uninsured debt of financial institutions, generating $11 billion in revenue. Two thirds of Republicans were supportive of this fee as were 83% of Democrats.

Briefing Respondents were introduced to a proposal to adopt a fee on the uninsured debt of large financial institutions that is based on a Congressional Budget Office recommendation for reducing the federal deficit: One proposal is to impose a fee on very large financial institutions (such as banks) that have taken on large amounts of uninsured debt. This is meant to discourage them from taking on high levels of risk, as well as to generate revenue for the federal government. Institutions with assets over $50 billion (these are roughly the 100 largest firms) would pay a fee of 0.15 percent of their uninsured debt. This would increase revenues by $11 billion. Related Standard Poll When presented the proposal for a fee on the largest banks and financial institutions, paired with a financial transactions tax, and the rationale for doing so, a bipartisan majority has been in favor:

Without the rationale included, and without the stipulation that it would apply to uninsured debt, only a plurality has been in favor of adopting a fee on the debt of large financial institutions:

|

|

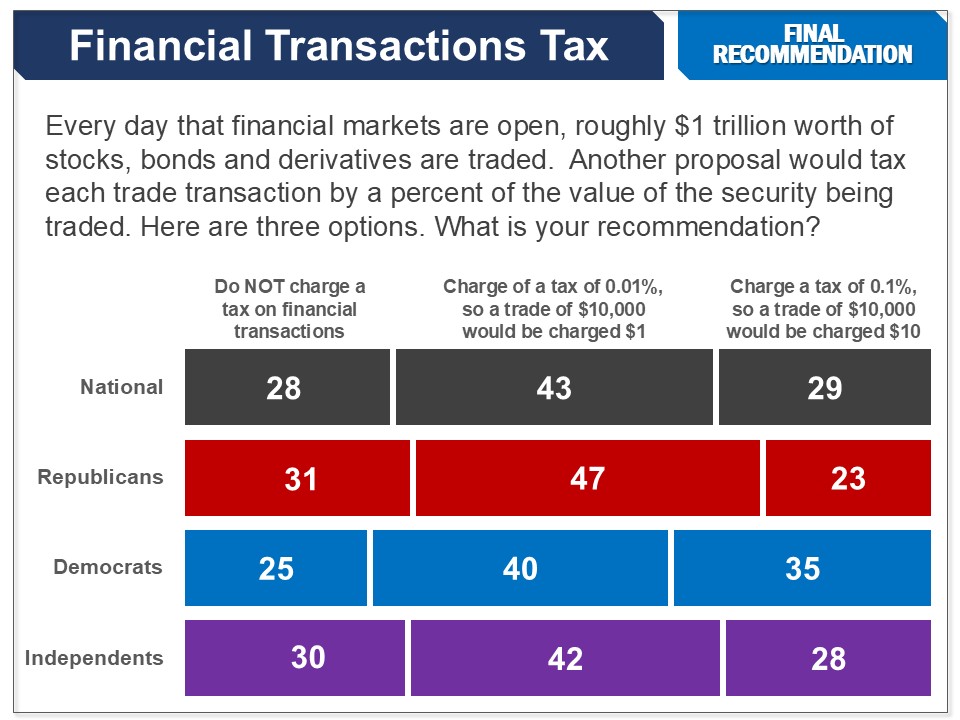

A majority of 72% chose to adopt a tax of at least 0.01% on financial trades, such as the sale of stocks and bonds, generating $30 billion. This included 70% of Republicans and 76% of Democrats.

More Information Briefing Respondents were introduced to a proposal to adopt a tax on financial transactions that is based on a Congressional Budget Office recommendation for reducing the federal deficit: Every day that financial markets are open, roughly $1 trillion worth of stocks, bonds and derivatives are traded. Another proposal would tax each trade transaction by a percent of the value of the security being traded. They were presented three options:

Related Standard Polls When the amount of the tax is not presented, a majority overall, including a majority of Republicans and a plurality of Democrats, has opposed increasing taxes on financial transactions:

When presented the proposal for a a financial transactions tax and financial institutions, paired with a fee on the largest banks, and the rationale for doing so, a bipartisan majority has been in favor:

Status of Legislation The proposal is based on the Wall Street Tax Act by Sen. Schatz in the 118th Congress. It did not make it out of committee. |

|

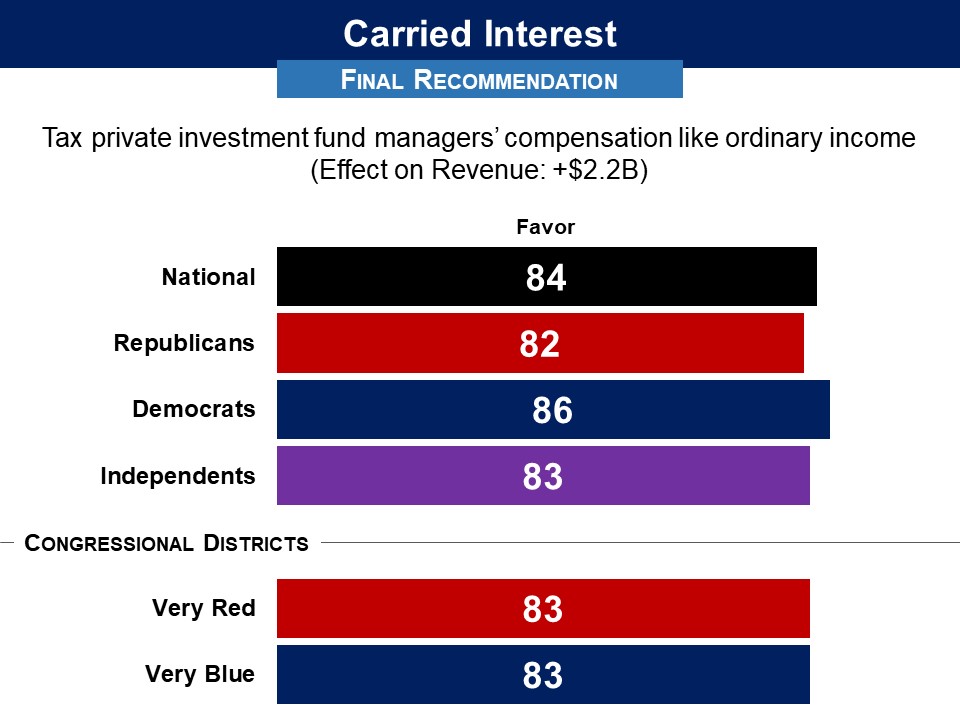

A bipartisan majority of 78% favored taxing carried interest as ordinary income, which they were told would generate $2.1 billion. This included 75% of Republicans and 81% of Democrats.

More Information Briefing Respondents were introduced to a proposal to eliminate a special tax break known as the ‘hedge fund managers tax’. They were briefed on the ‘hedge fund managers’ tax as follows: Managers of private investment funds, such as hedge funds, are paid in part by giving them a percentage of the profits of the firm even though they have not invested money that is at risk. Currently this income is taxed at the same level as dividends or capital gains – that is, with a top rate of 23.8%, which for high income managers is substantially less than it would be if it were taxed like ordinary income. The proposal was presented as follows: tax this “carried interest” compensation like ordinary income, such as wages. This would raise extra revenue of $2.1 billion and reduce the deficit accordingly. Status of Legislation The Carried Interest Fairness Act, sponsored in the House by Rep. Bill Pascrell (D) (H.R. 1735) and in the Senate by Sen. Tammy Baldwin (D) (S. 781) were introduced in the 116th Congress. |

|

A bipartisan majority of 75% did not choose to eliminate the estate tax, instead choosing to either to keep it the same (29%) or raise it back to the levels they were at before the 2017 Tax Cuts and Jobs Act (46%). This included 69% of Republicans (keep same 29%, raise 40%) and 82% of Democrats (keep same 30%, raise 52%). More Information Briefing The estate tax was explained to respondents as follows: Another option is to change the tax applied to wealth that is passed on to a person’s heirs when they die. This is known as the estate tax. The estate tax only applies to inherited wealth over a certain amount. The tax rate also has a cap. They were informed that the estate tax has changed over the years, most recently with the 2017 tax reforms. These amounts have changed over the years. In 2009, the first $3.5 million for individuals and $7 million for couples was tax-free. For the amounts over that level, the top tax rate was 45%. In 2011, the tax-free amount went up to $5.5 million for individuals and $11 million for couples, and the top tax rate was lowered to 40%. In 2018, the tax-free amount was again raised to $14 million for individuals and $28 million for couples. The top tax rate was kept at 40% Related Standard Polls A bipartisan plurality has favored lowering the threshold for the estate tax from the current $11 million to $3.5 million, which is where it was in 2009. A large share of respondents did not provide any answer.

When given information about the existing estate tax and given four options, a bipartisan majority has not chosen to eliminate it, but there was also not majority support for increasing it when no alternative is provided:

When told that the estate tax applies to inheritances of $11 million or more, a plurality has opposed repealing it, but a plurality of Republicans has favored it, with a remarkably large share of respondents not expressing an opinion.

|

TAXES THAT DISCOURAGE CERTAIN BEHAVIORS |

|

|

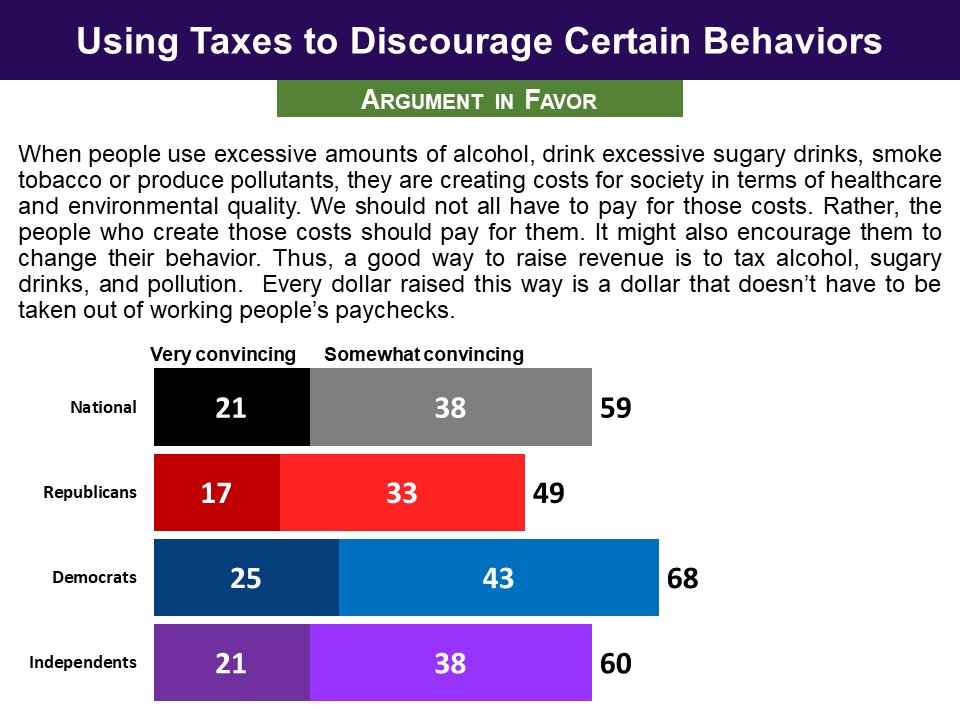

Respondents were told: We are next going to explore another kind of tax that, in addition to raising revenues, discourages certain activities that create costs for society - such as consuming alcohol, or producing pollutants. They evaluated arguments for and against the Federal government using taxes to discourage people from doing things that are harmful and create costs for society (e.g. smoking, drinking). The argument in favor of using taxes as disincentives for activities that create costs to society, was found convincing by six in ten (59%) including about two thirds of Democrats (68%). Republicans were divided.

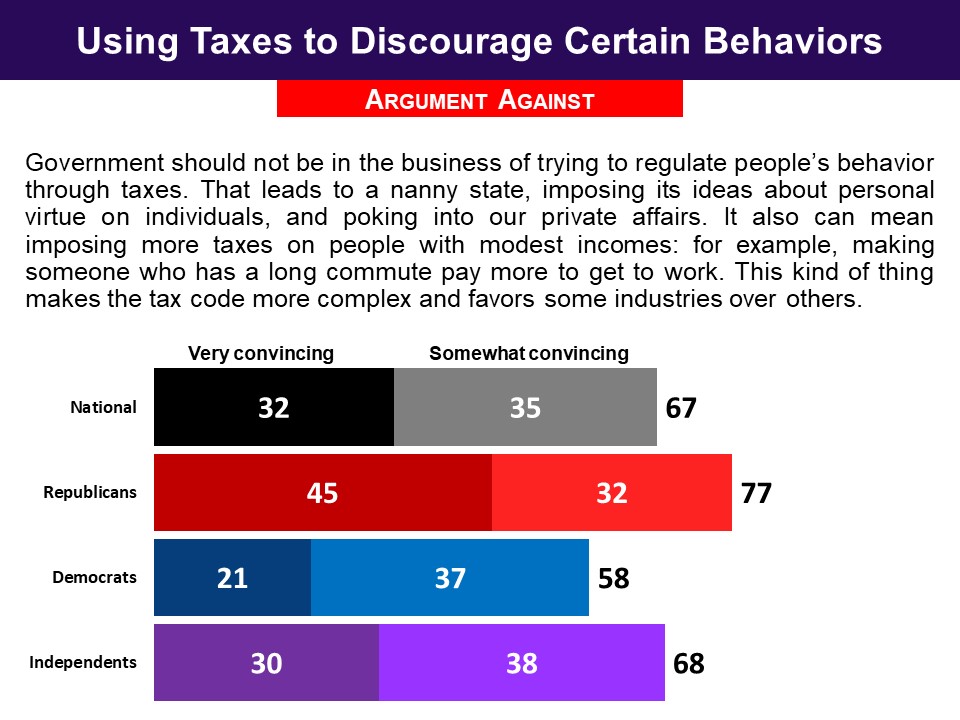

The argument against invoked the “nanny state” as something to be avoided and argued that these kinds of taxes are regressive, falling disproportionately on people with low or modest incomes. This argument did a little better with 67% finding it convincing, including over three quarters of Republicans and nearly six in ten Democrats.

|

|

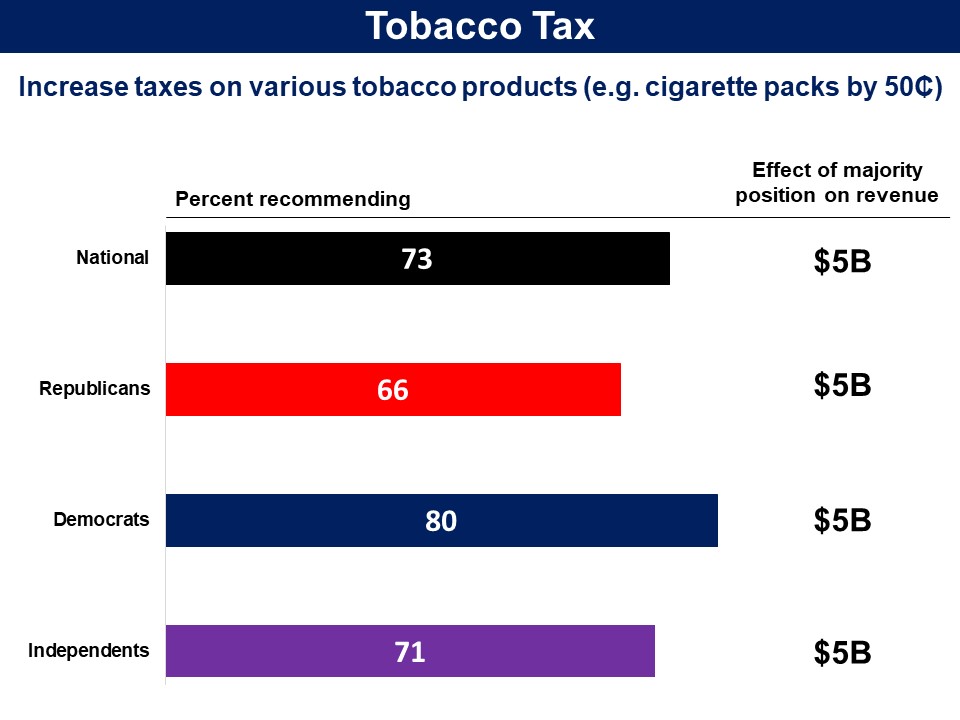

A bipartisan majority chose to raise taxes on various tobacco products, generating $5 billion in revenue. This included 66% of Republicans and 80% of Democrats.

Briefing Respondents were introduced to a proposal to increase taxes on various tobacco products that is based on a Congressional Budget Office recommendation for reducing the federal deficit:

They were informed that, “Research shows that increasing tobacco taxes leads to reduced tobacco consumption, which has health benefits, particularly among teenagers and low-income people.” They were also told that the proposal would generate $5 billion in revenue. |

|

A bipartisan majority of 61% chose to raise the alcohol taxes at least to at a rate of 25 cents per ounce of alcohol, generating $5 billion. This included 65% of Democrats and 56% of Republicans. .

Respondents were introduced to a proposal to raise alcohol taxes that is based on a Congressional Budget Office recommendation for reducing the federal deficit: Currently, alcoholic drinks carry a federal tax of 8 cents per ounce of alcohol in wine, 10 cents per ounce in beer, and 21 cents per ounce in spirits, such as whisky or vodka. They were offered three positions:

|

|

ADDITIONAL TAX REFORMS FROM OTHER SURVEYS |

|

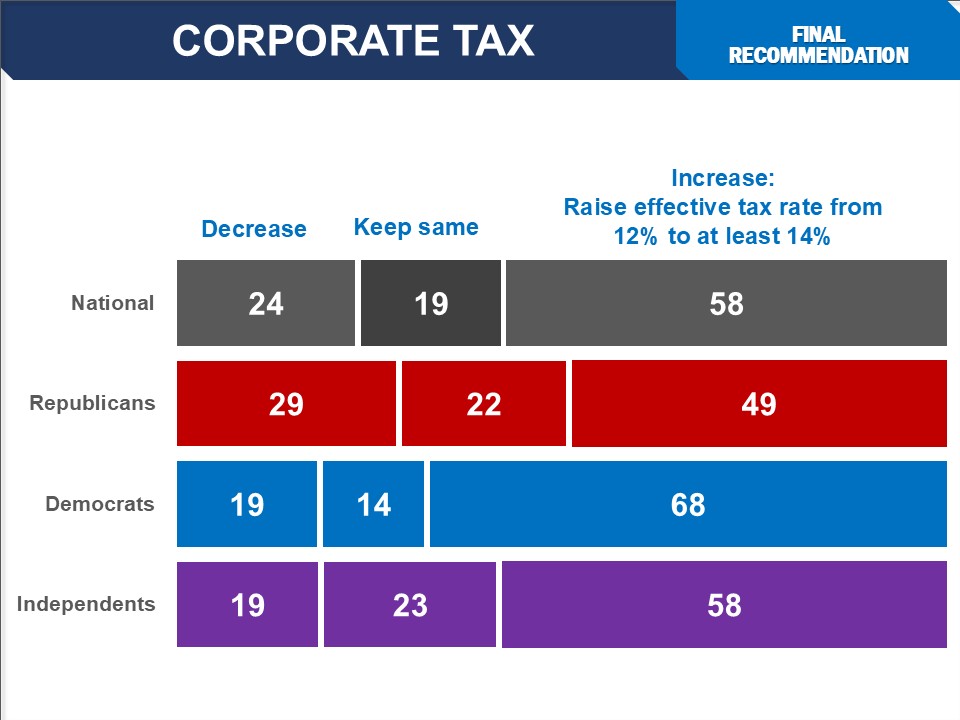

Asked whether the effective corporate tax rate should be lowered, kept the same, or raised, a bipartisan majority of 76% chose to either keep it the same or raise it, including 71% of Republicans and 81% of Democrats. A majority nationally (58%) and among Democrats (68%) chose to increase the effective tax rate by two percentage points (roughly equivalent to increasing the actual rate from 21 to 25 percent.) Just under half of Republicans (49%) chose to increase it.

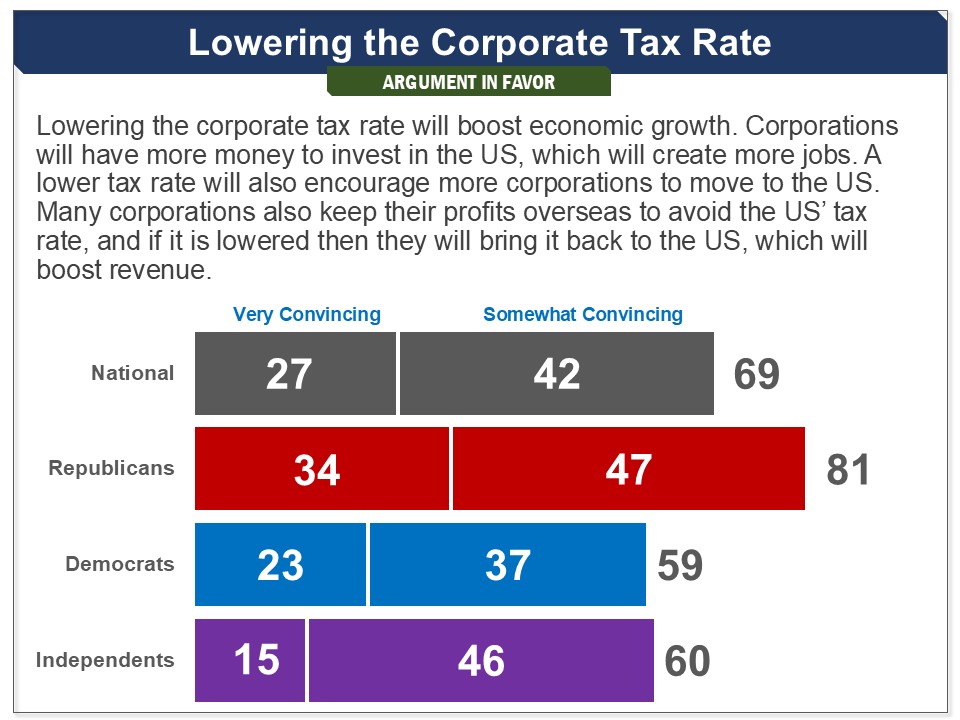

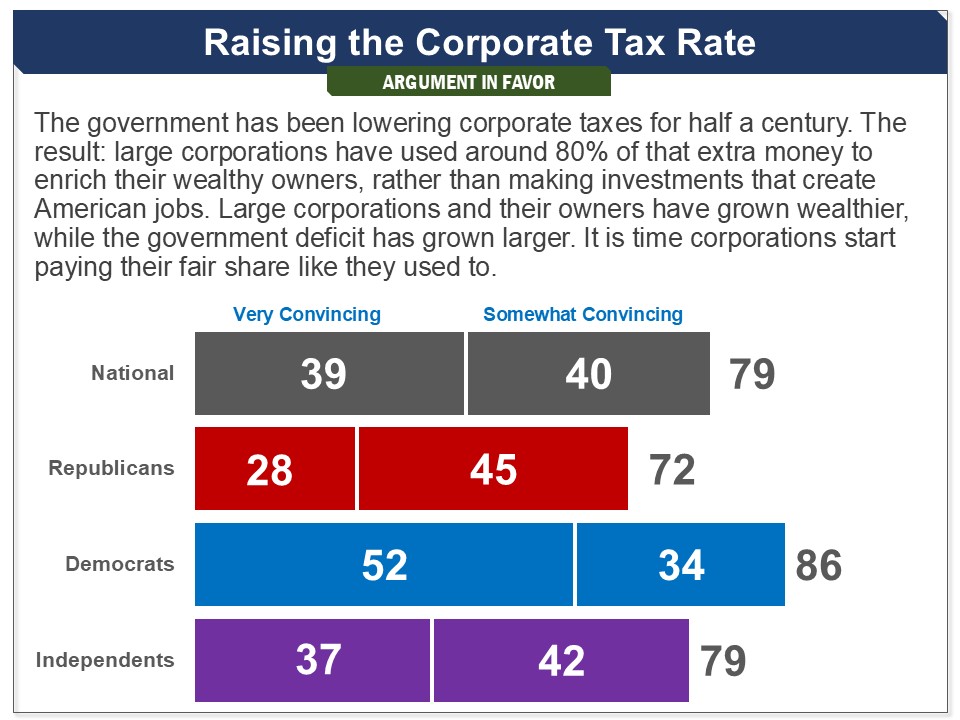

More Information Briefing Respondents were presented a briefing on the corporate tax rate: We are now going to look at corporate taxes. Corporations do not pay tax on their entire income; they only pay tax on their profits (income minus spending). The top corporate tax rate has been changed several times over the last century. It was at its highest in 1950, when the top corporate tax rate was about 50%. In the 1980s, the top rate was lowered to about 35%. And then in 2017 it was lowered to a flat rate of 21% for all corporations. Just like individuals, corporations have exemptions, credits, and deductions that they apply to their profits before calculating their tax. Therefore, their effective tax rate—the amount that they actually pay—is on average about 12%. Large corporations pay a lower effective rate, of less than 10% on average. This is often because they have a greater ability to use specialized tax maneuvers. Arguments The argument for lowering the corporate tax rate, that it will boost economic growth and incentivize US companies to bring their profits from overseas back to the US, was found convincing by a bipartisan majority of 69% (Republicans 81%, Democrats 59%). The argument for raising it was found convincing by a larger majority of 79% (Republicans 72%, Democrats 86%). It stated that corporate tax cuts have been primarily used to enrich corporate owners rather than invest in the US, and that corporations need to start paying their fair share.

Results from DDL A deliberative poll conducted by Stanford University’s Deliberative Democracy Lab in September 2019 found 74% opposed to the proposal to lower the corporate tax rate from 21 to 15 percent. Related Standard Polls Majorities have consistently been against reducing corporate taxes, including majorities of Democrats, and in most cases majorities of Republicans.

When the question asks whether they favor or oppose lowering taxes on corporations, or extending tax cuts for them, majorities or pluralities have been opposed, but half or more Republicans are in favor.

Status of Proposal The One Big Beautiful Bill, which passed in July 2025, made permanent the 2017 tax reforms that lowered the corporate tax rate to 21%. The Trump administration has called for lowering the corporate tax rate further to 15%. |

Briefing

Briefing