Energy & Environment

The United States has had a longstanding tension between its needs for protection of the environment and for reasonably-priced energy. The challenge of finding the right balance between these priorities has been a perennial of policymaking for some time now.

A longstanding concern has been the health effects from air pollution caused by the emissions from the use of fossil fuels. These are particularly significant for certain vulnerable populations such as children, the elderly and those with asthma.

More recently, the concern has extended to the effect of the use of fossil fuels on the global climate. There is now a clear consensus in the scientific community that energy production from fossil fuels creates greenhouse gases, especially carbon dioxide, with destabilizing effects on the global climate.

To address both of these effects there have been numerous proposals to promote clean energy–i.e. alternatives to fossil fuels, such as wind and solar, that do not produce negative health effects or destabilize the climate–and to promote greater energy efficiency so as to reduce the demand for energy produced by fossil fuels. These proposals primarily focus on tax incentives and regulations. All of these proposals are controversial as tax incentives reduce public revenues and regulations can increase the cost of cars, trucks and buildings.

In addition, there have been numerous proposals for the US to make commitments to gradually reduce the level of greenhouse gases. The US has participated in a series of international conferences that have led to international agreements to seek such reductions, most recently the “Paris agreement.”

In August 2022, after two years of negotiating a climate change bill, Congress passed the Inflation Reduction Act, which provides funding for reducing emissions and developing clean energy technology in US history, and is estimated to reduce emissions by 40% by 2030 — bringing the US close to its Paris Agreement goal. Included in the bill are numerous tax credits for energy efficiency-improvement and clean energy projects which have bipartisan support (see PPC survey results below). Such tax credits, however, sunset in 5-10 years, and so have been kept on the list of common ground proposals for when debate over their extension occurs.

Another area of controversy has been the extraction of fossil fuels offshore and in environmentally sensitive areas. Offshore drilling has resulted in environmentally damaging numerous oil spills and fossil fuel extraction in certain sensitive areas has posed threats to wildlife. These concerns align with the broader goals of reducing the use of fossil fuels due to its impact on health and the climate. But, once again, imposing constraints on the extraction of fossil fuels has the potential to reduce supply and increase the cost of energy.

- National sample: 2,700

- Margin of Error: +/- 1.9%

- Fielded: February 1 - 14, 2023

- Questionnaire with Frequencies (PDF)

Proposals with bipartisan support discussed below:

- Requiring higher fuel efficiency standards for cars and trucks

Proposals that did not receive bipartisan support:

- Tax credits for:

- Biogas production

- Purchase of new and used electric vehicles

- National Sample: 4,828

- Margin of Error: +/- 1.4%

- Fielded: September 17 – October 1, 2020

- Questionnaire with Frequencies (PDF)

- Full Report (PDF)

Proposals with bipartisan support discussed below:

- Updating existing tax incentives for:

- clean energy production

- making energy-efficient upgrades to homes and commercial buildings

- building new energy-efficient homes and commercial buildings

- Creating new tax incentives for:

- investing in first-of-its-kind clean energy technology

- producing electric buses

- installing electric vehicle charging stations

Proposals that did not receive bipartisan support:

- Creating new tax incentives for:

- installing and producing energy from first-of-its-kind clean energy technology

- purchasing electric vehicles

- National Sample: 3,826

- Margin of Error: +/- 1.6%

- Fielded: April 16 - June 10, 2016

There were also an oversample of 2,149 respondents in Oklahoma, Texas, California, Florida, Ohio, Virginia, Maryland and New York. These data can be found in the questionnaire.

- Questionnaire with Frequencies (PDF)

- Full Report (PDF)

Proposals with bipartisan support discussed below:

- Providing tax credits for various clean energy and energy efficiency products and investments

- Requiring higher fuel efficiency standards for cars and trucks

- Requiring electric companies to have a minimum portion of their electricity come from renewable energy

- Adopting stricter regulations on hydrofluorocarbons (HFCs)

TAX INCENTIVES |

|

|

Respondents were first given a general introduction to the negative impacts of the way energy is currently produced. This included information about the health effects of air pollution, and the likely effects on climate change caused by greenhouse gases. They also evaluated arguments for and against the government making it a high priority to reduce these negative impacts of energy production. Finally, they rated how high a priority it should be for the government to reduce these negative impacts. Reducing air pollution that causes negative health effects was given a high priority by over three in four (78%, very high 47%). This included 54% of Republicans, 98% of Democrats, and eight in ten independents. Reducing greenhouse gases was given a high priority by three in four (74%, very high 50%). Nearly all Democrats (98%), eight in ten independents (79%), but only 45% of Republicans made it a high priority. Respondents were told that Members of Congress have proposed tax credits to incentivize the transition to cleaner forms of energy and more energy efficient infrastructure. Currently, these are bills to renew these tax credits, or to merge them and create new technology-neutral tax credits. The proposals evaluated to reinstate and update existing tax incentives, were based on the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288). Proposals for new tax credits were for:

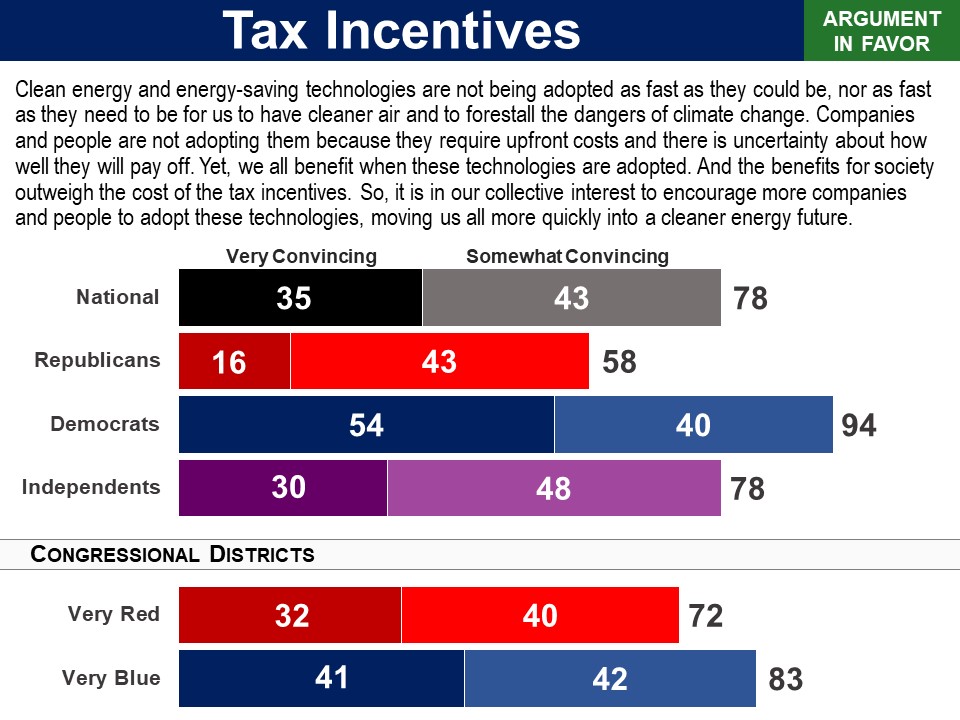

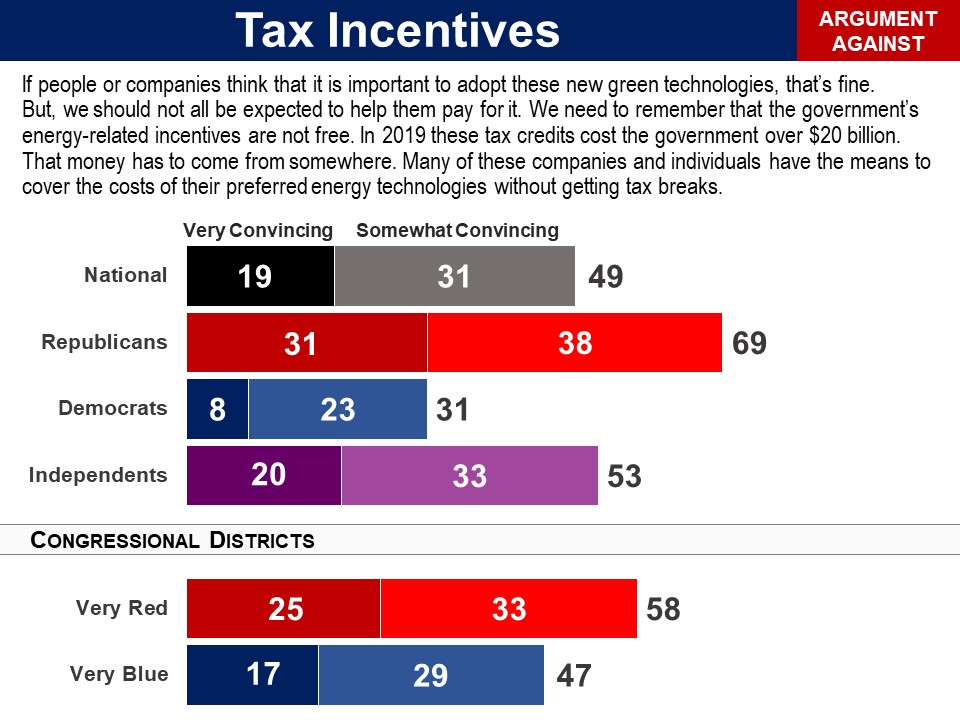

Briefing and Arguments Another way that the government can encourage people and companies to adopt clean energy or energy-saving technologies is to provide them tax incentives. As you may know, a tax credit reduces the total amount of taxes a person or company owes. For example, if a person owes $5,000 in taxes and gets a $1,000 tax credit, then they will only owe $4,000. Currently, there are a number of such tax credits in place to encourage people and companies to adopt clean energy or energy-saving technologies. Most will expire within the next couple of years but could be renewed. Thus, there is a debate about whether the government should provide such tax credits. Respondents evaluated general arguments for and against using tax credits as incentives. The pro argument was found convincing by a bipartisan majority. The con argument did less well, with just under half finding it convincing. There were substantial partisan differences, with a majority of Republicans finding it convincing, but just three in ten Democrats. Asked how acceptable they find, “the idea of providing tax credits to encourage people and companies to adopt clean energy or energy-saving technologies,” using a 0-10 scale, 69% found it acceptable (6-10), including 88% of Democrats and 49% of Republicans. Including the middle option of “just tolerable”, 83% found the idea at least tolerable (5-10), including over two thirds of Republicans (68%). Majorities in very red (59%) to very blue (77%) found the idea acceptable (6-10). In the 2016 PPC survey, respondents evaluated arguments for and against using tax incentives and then evaluated two general options which received bipartisan support:

Turning back to the 2020 PPC survey after evaluating pro and con arguments and weighing in on the general principle of using tax incentives, respondents then evaluated specific tax credit proposals to further:

Center for Deliberative Democracy Results Before receiving any briefing materials or engaging in the deliberation process respondents were given the same poll question as those asked afterwards. Support increased from the pre-deliberation poll to the post-deliberation poll, overall (61% to 72%), and among Republicans (34% to 52%) and Democrats (80% to 89%). Related Standard Polls

|

|

|

PRODUCING CLEAN ENERGY |

|

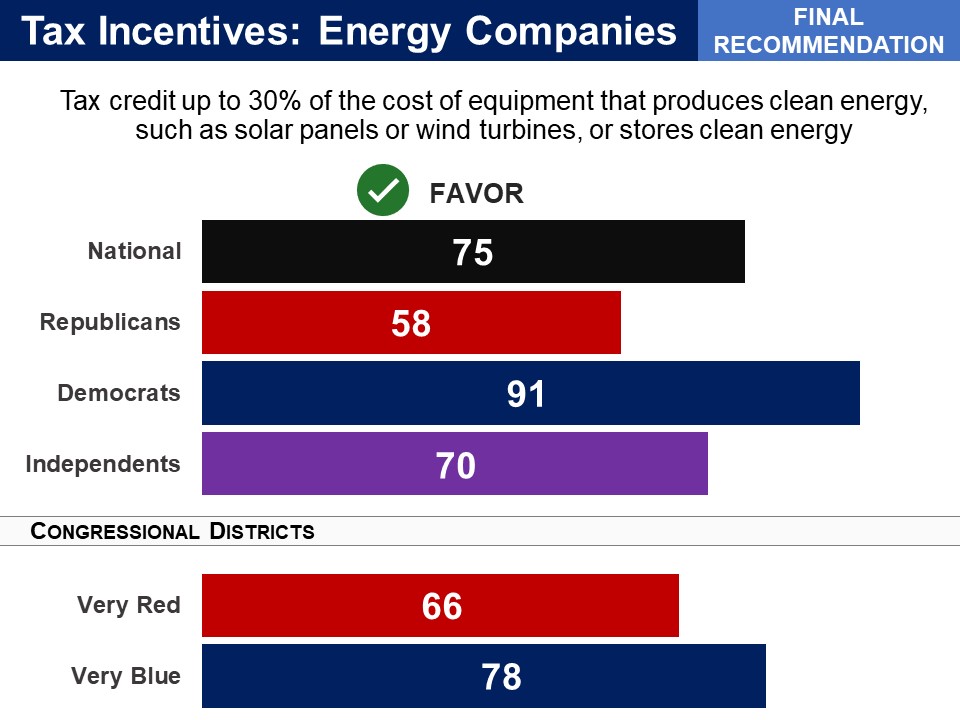

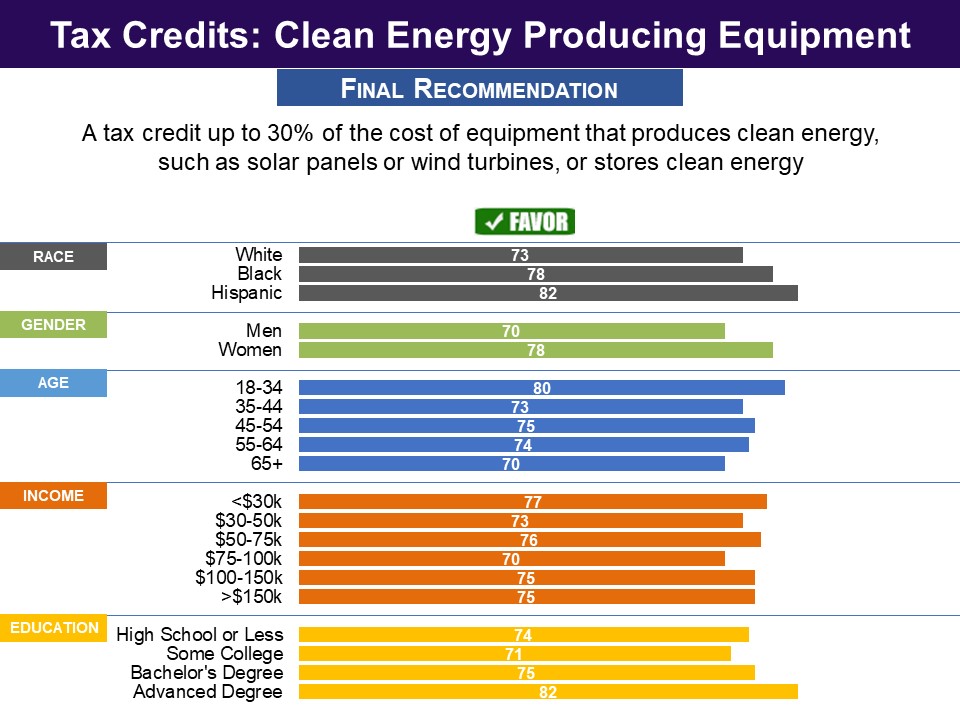

This proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. Respondents evaluated three tax incentives related to the production of clean energy, the first of which received bipartisan majority support: “A tax credit up to 30% of the cost of equipment that produces clean energy, such as solar panels or wind turbines, or stores clean energy,” was favored by 75%, including 58% of Republicans and 91% of Democrats. The proposal was also in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. |

|

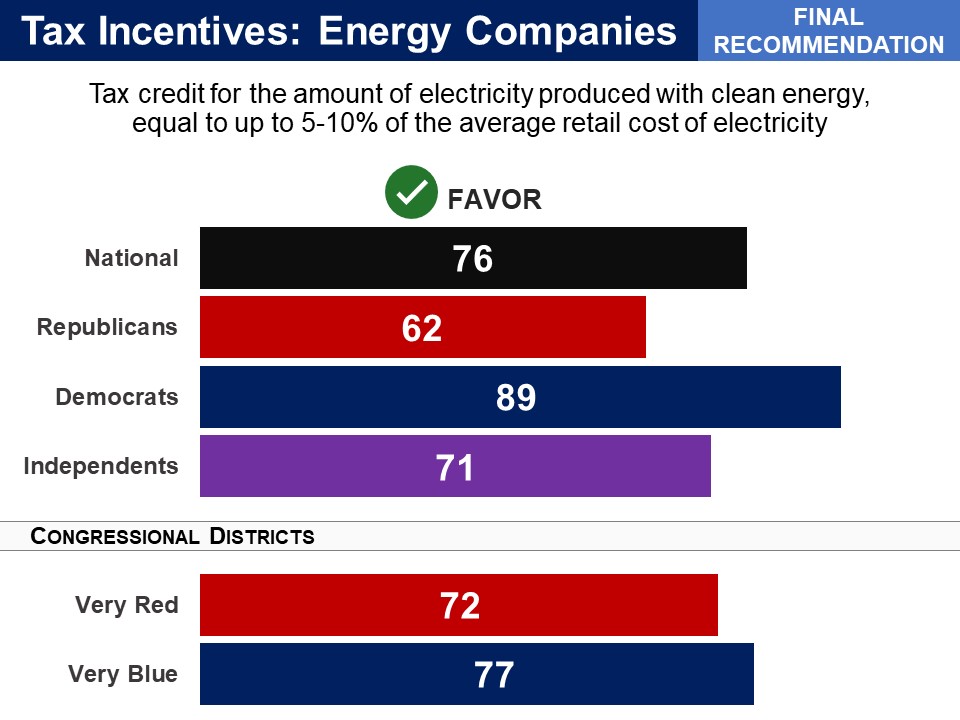

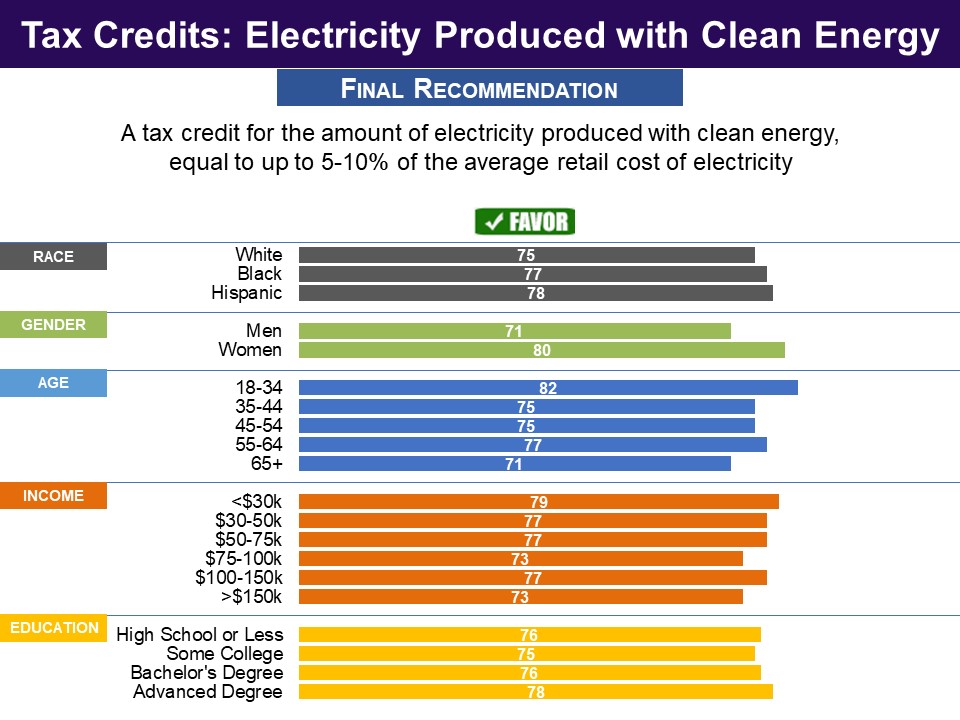

A similar proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. The second clean energy production credit they evaluated was, “a tax credit for the amount of electricity produced with clean energy, equal to up to 5-10% of the average retail cost of electricity.” This was favored by 76%, including 62% of Republicans and 89% of Democrats. The exact proposal to provide a tax credit for clean energy production equal to 5-10% of the average retail cost was in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. |

|

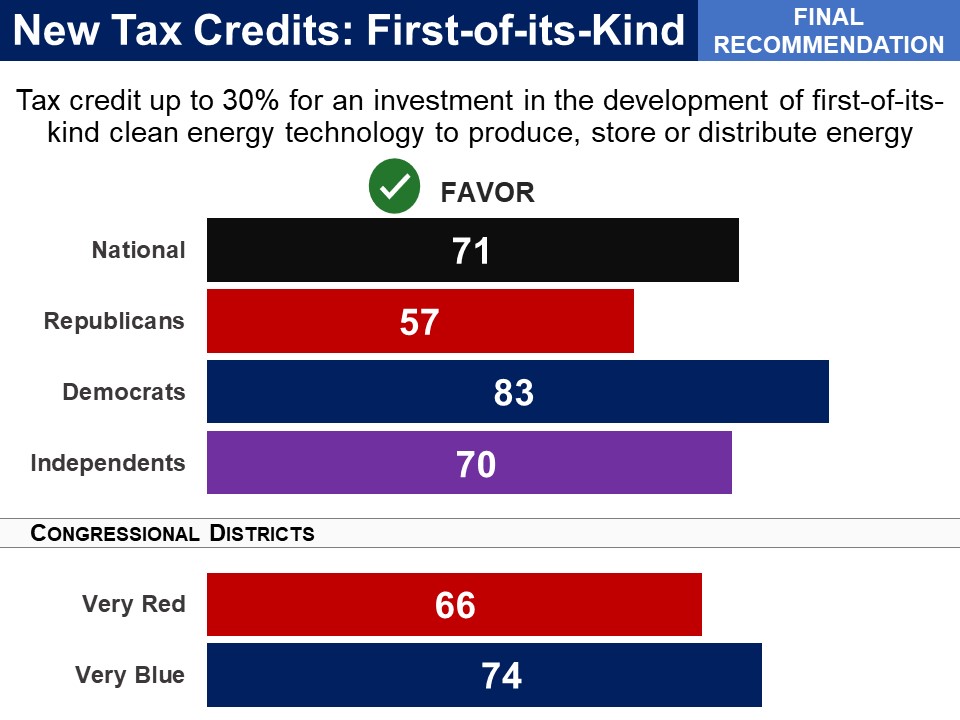

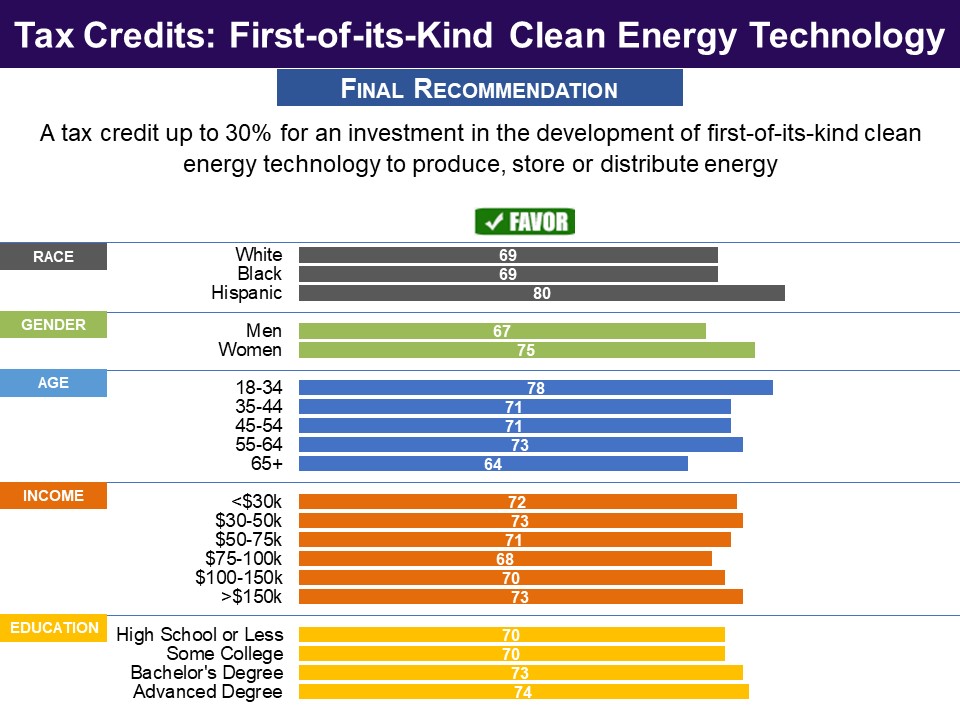

Respondents were introduced to the idea of having tax incentives for first-of-its-kind clean energy technology, based on H.R. 5523 sponsored by Rep. Tom Reed (R), as follows: We are now going to look at some possible new tax credits for companies that invest in, install, and sell energy from new and innovative “first-of-its-kind” clean energy technology. When the technology becomes more established and popular the tax credit is reduced. They then evaluated three tax incentives, one of which received bipartisan majority support: “A tax credit up to 30% for an investment in the development of first-of-its-kind clean energy technology to produce, store or distribute energy,” was favored by 71%, including 57% of Republicans and 83% of Democrats.

Status of Legislation |

|

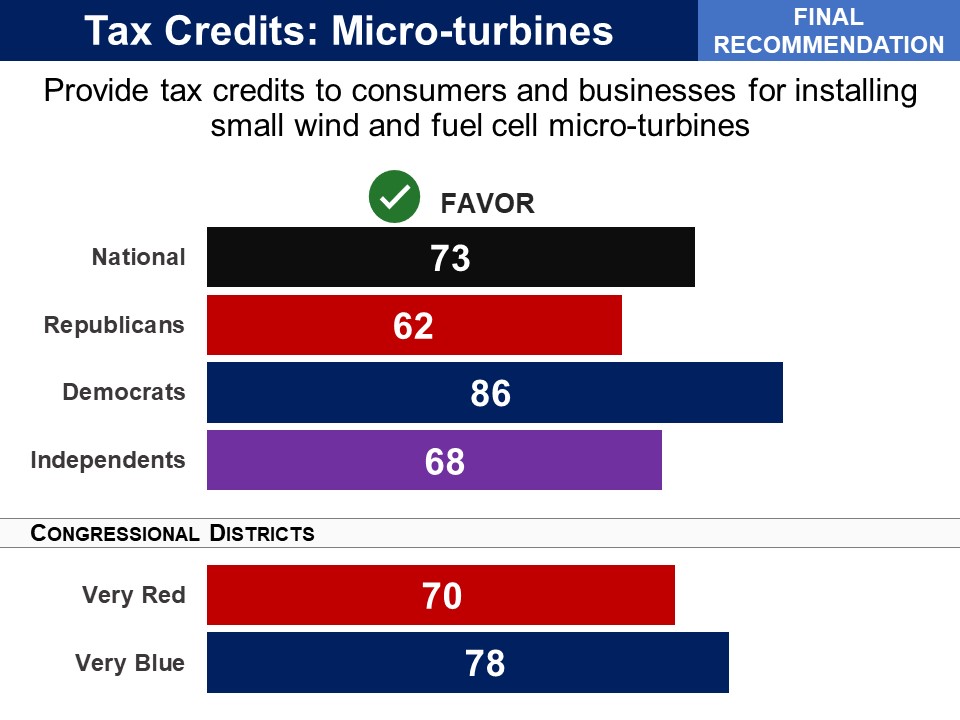

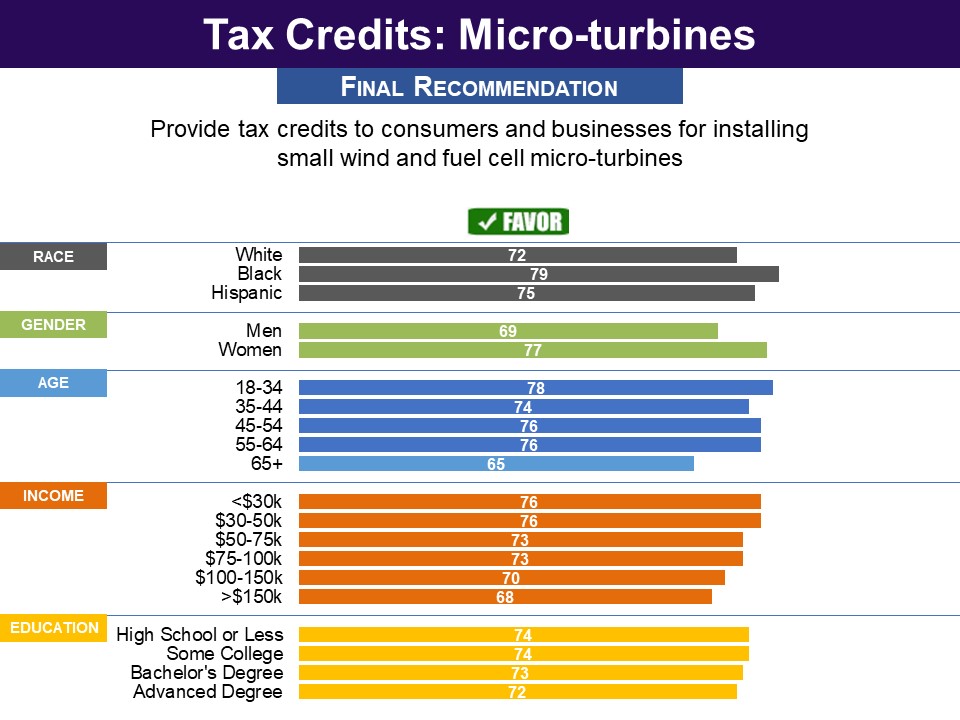

This proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. In the 2016 PPC survey, large bipartisan majorities favored providing tax credits (the amount was not specified) for : “Installing small residential wind and fuel cell micro-turbines to generate energy for homes.” Similar proposals were in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. Response Without Undergoing Policymaking Simulation

|

|

ENERGY EFFICIENT BUILDINGS |

|

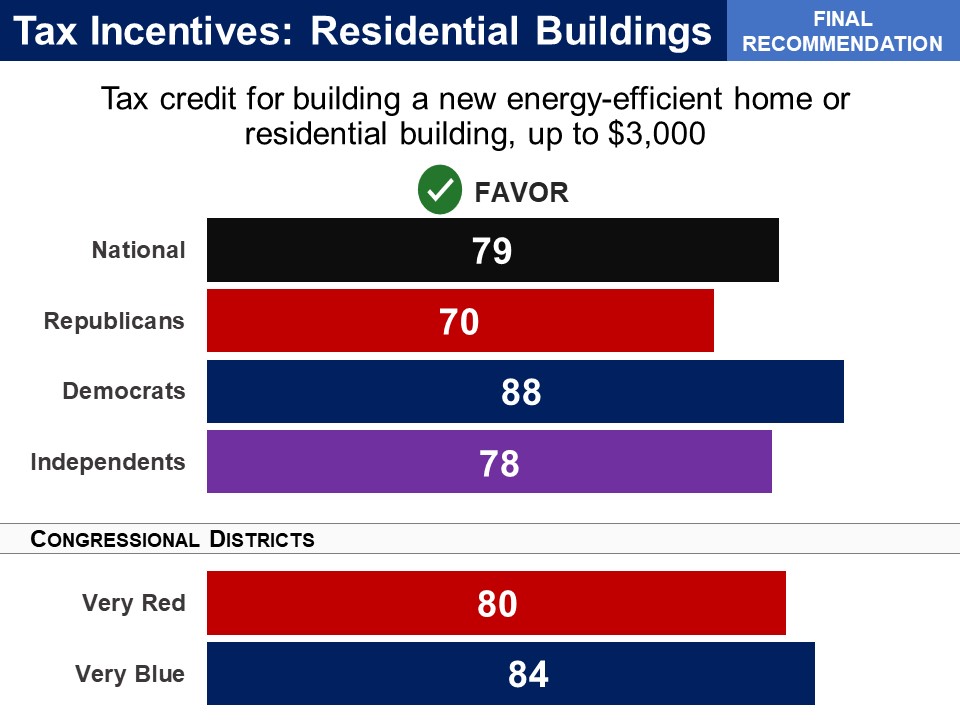

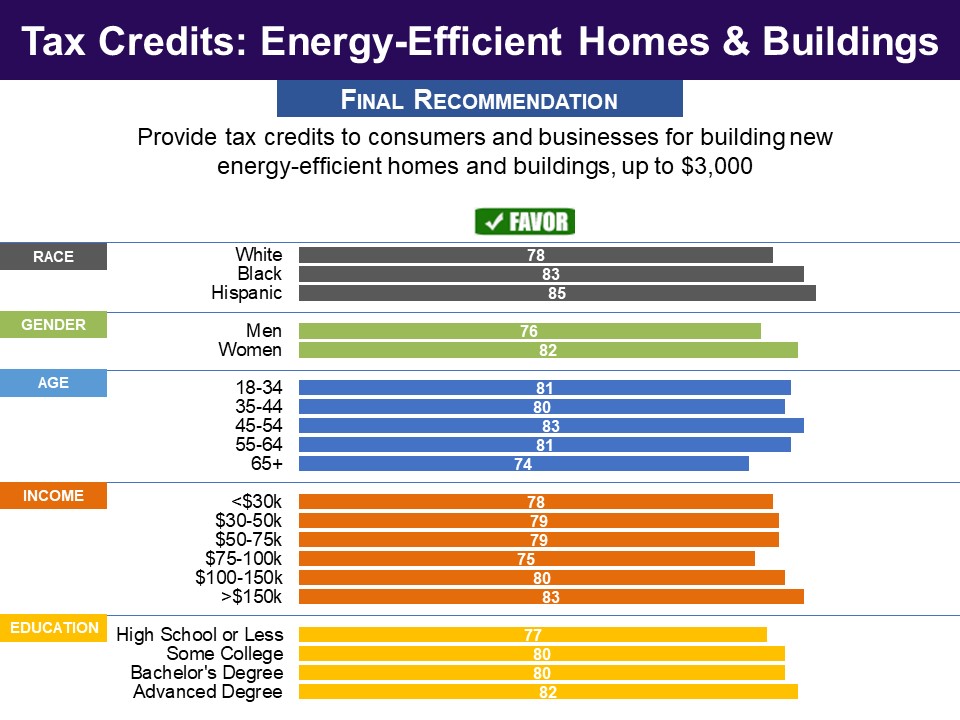

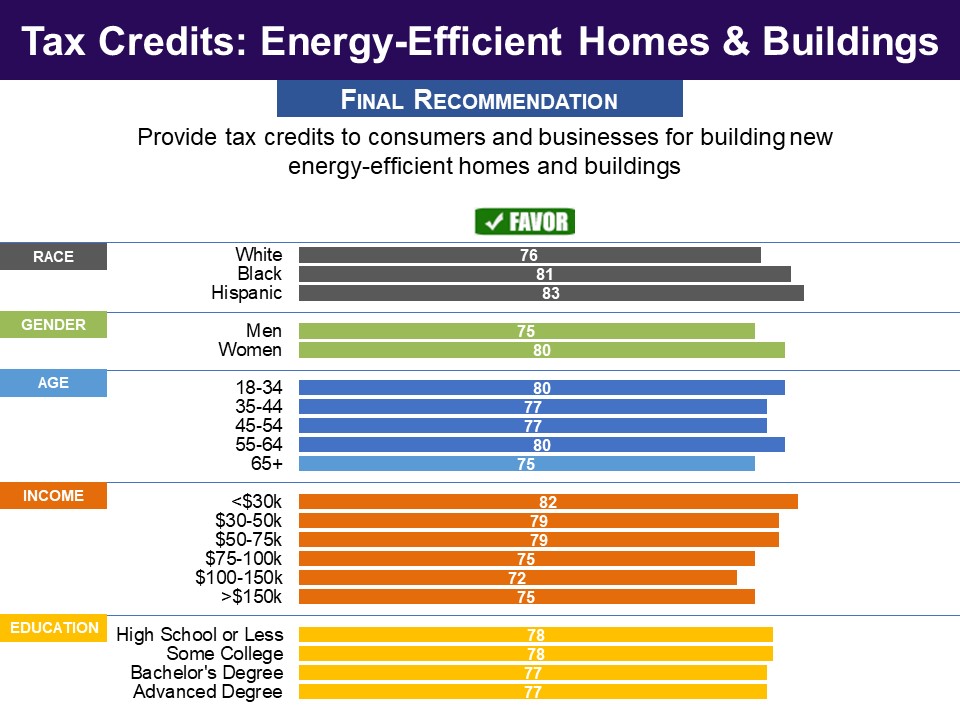

A similar proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. Respondents evaluated tax incentives for making energy-efficiency upgrades, or building new energy-efficient homes or residential buildings. The first of three proposals elicited bipartisan support was: “A tax credit up to $3,000 for building a new energy-efficient home or residential building,” was favored by 79%, including 70% of Republicans and 88% of Democrats. The proposal to provide a tax credit up to $3,000 was in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. Response Without Undergoing Policymaking Simulation

|

|

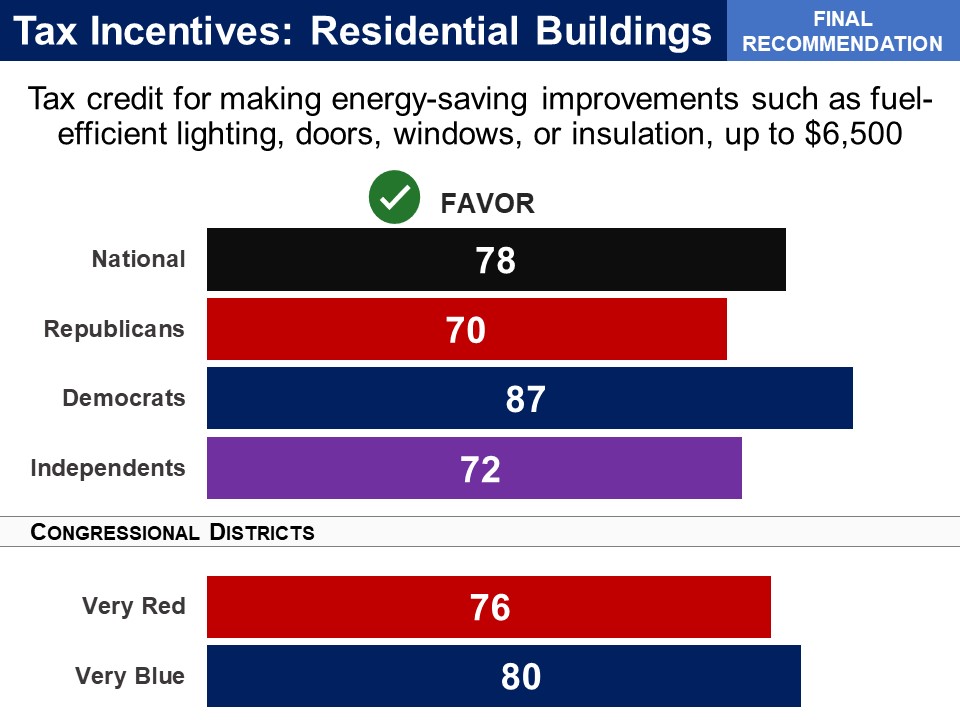

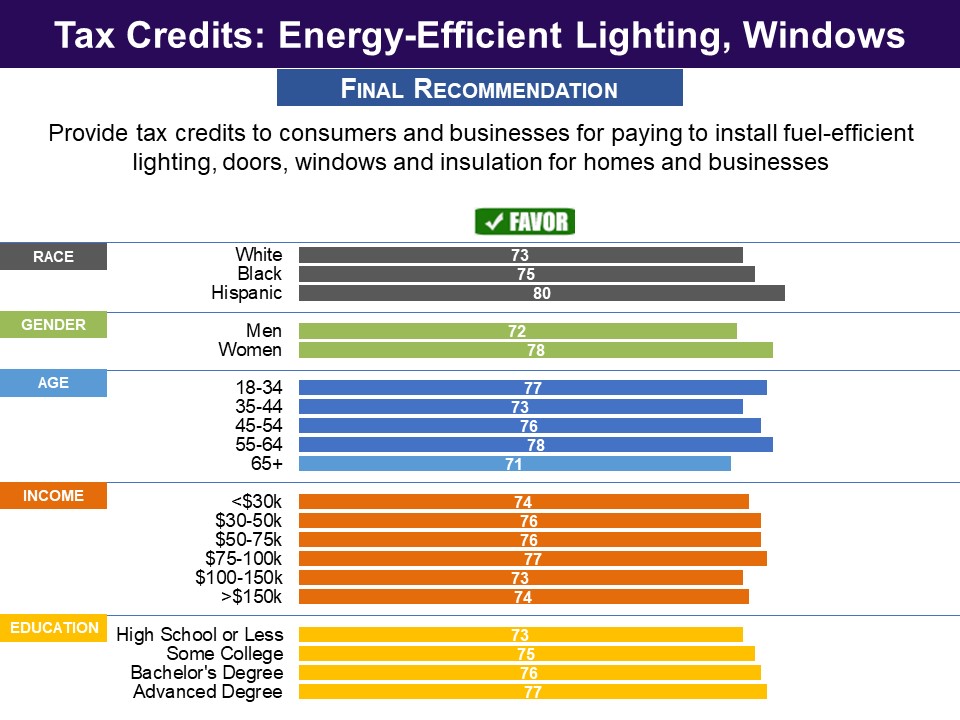

A similar proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. Respondents evaluated tax incentives for making energy-efficiency upgrades, or building new energy-efficient homes or residential buildings. The second of three proposals that elicited bipartisan support was: “A tax credit up to $6,500 for making energy-saving improvements such as fuel-efficient lighting, doors, windows, or insulation,” was favored by 78%, including 70% of Republicans and 87% of Democrats. The proposal to provide a tax credit up to $6,5000 was in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. Response Without Undergoing Policymaking Simulation

|

|

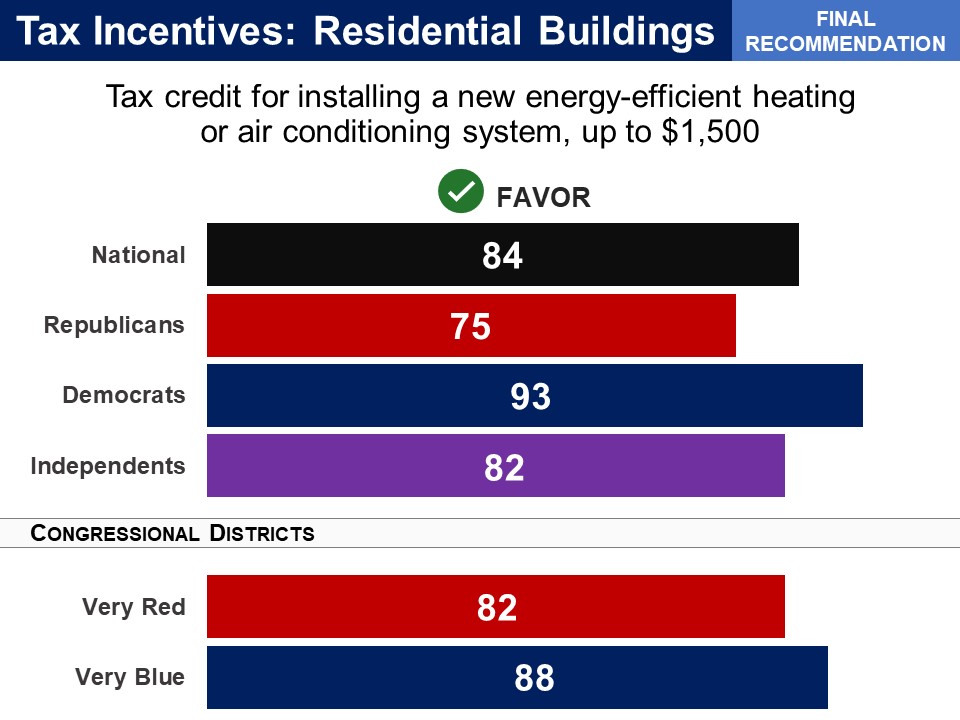

A nearly identical proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. Respondents evaluated tax incentives for making energy-efficiency upgrades, or building new energy-efficient homes or residential buildings. The third proposal that elicited bipartisan support was: “A tax credit up to $1,500 for installing a new energy-efficient heating or air conditioning system,” was favored by 84%, including 75% of Republicans and 93% of Democrats. The proposal to provide a tax credit worth up to $1,500 was in the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. Response Without Undergoing Policymaking Simulation

|

|

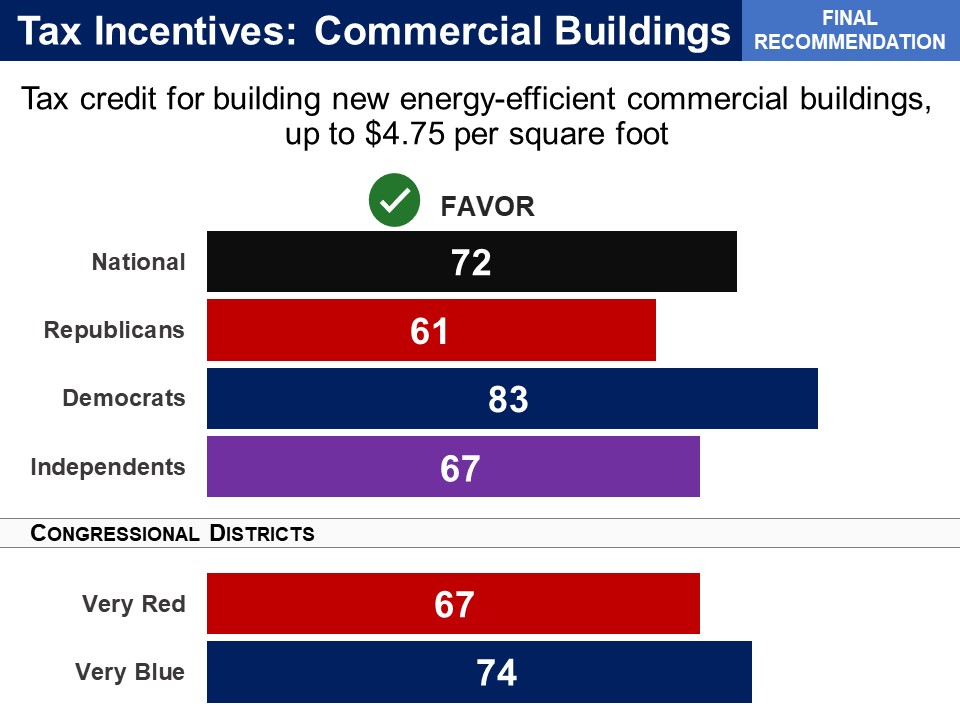

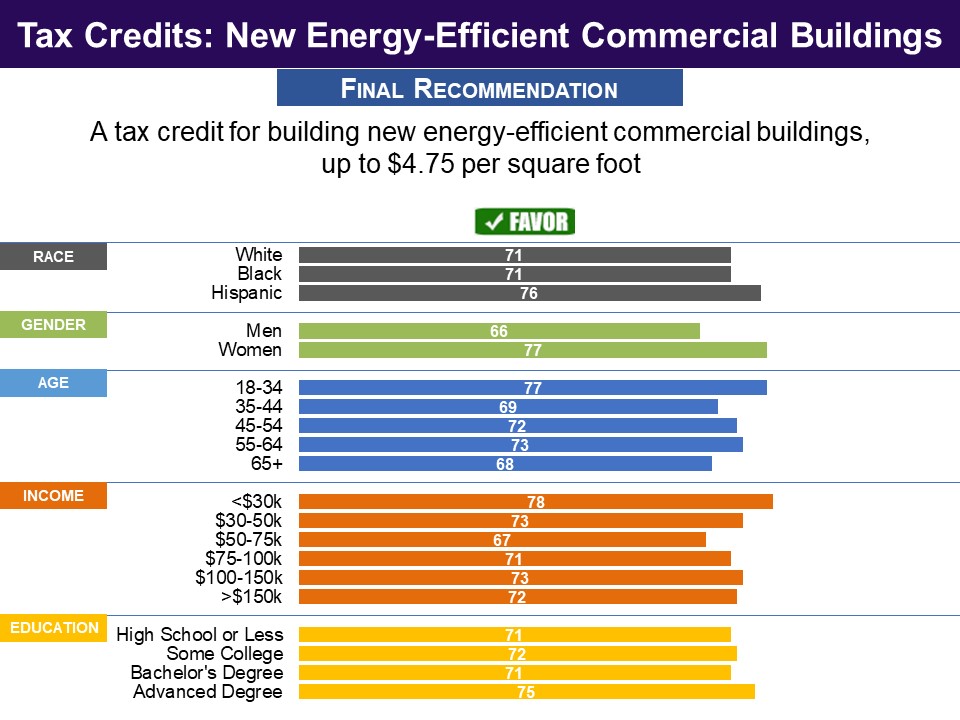

Respondents evaluated two tax incentives for making energy-efficiency upgrades, or building new energy-efficient commercial buildings. The first of two proposals that elicited bipartisan support was: “A tax credit up to $4.75 per square foot for building new energy-efficient commercial buildings,” was favored by 72%, including 61% of Republicans and 83% of Democrats. Response Without Undergoing Policymaking Simulation

|

|

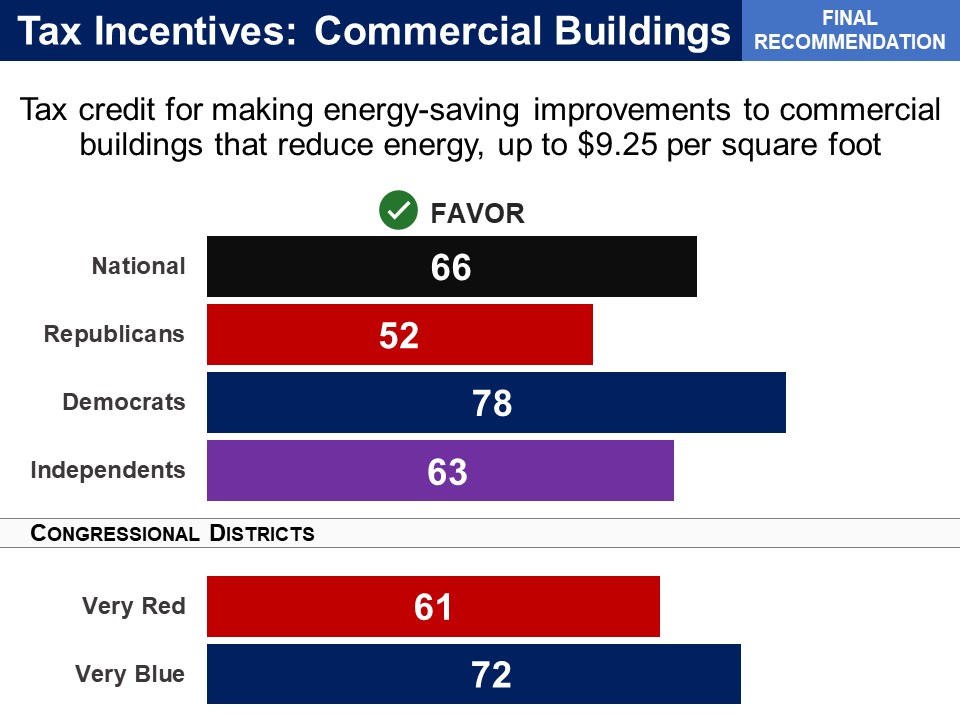

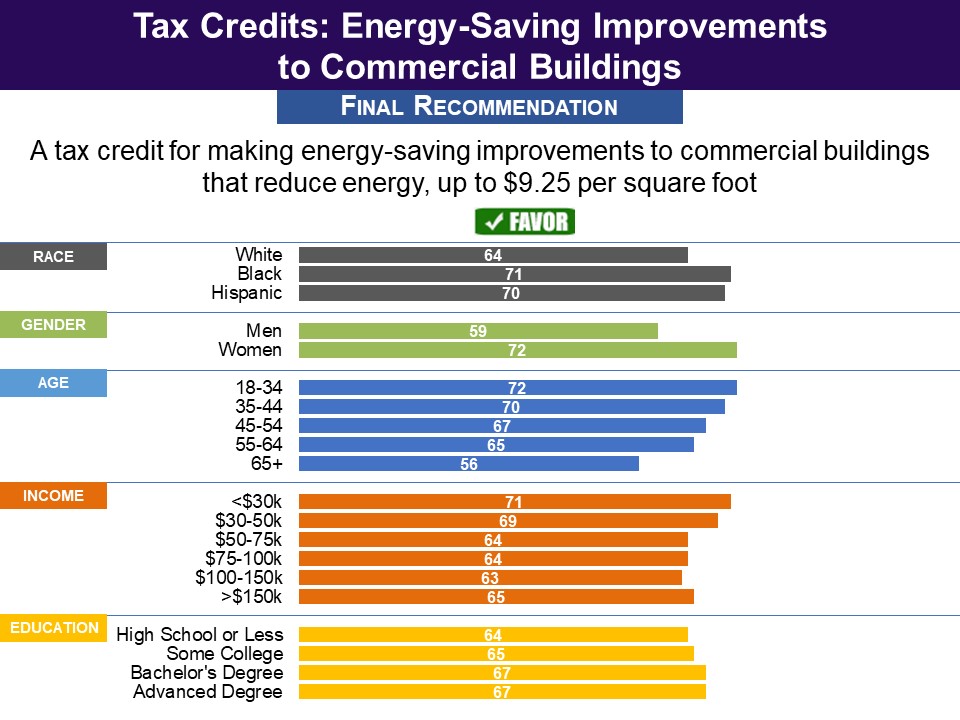

A similar proposal was passed into law with the Inflation Reduction Act (2022). The provision will sunset in 2032. Respondents evaluated two tax incentives for making energy-efficiency upgrades, or building new energy-efficient commercial buildings. There was also bipartisan support for: “A tax credit up to $9.25 per square foot for making energy-saving improvements to commercial buildings that reduce energy,” was favored by 66%, including a bare majority of Republicans (52%) and 78% of Democrats. The proposal is from the Clean Energy for America Act by Sen. Ron Wyden (D) (S. 1288) and the GREEN Act by Rep. Mike Thompson (D) (H.R. 848) from the 117th Congress. Response Without Undergoing Policymaking Simulation

|

|

ELECTRIC VEHICLES |

|

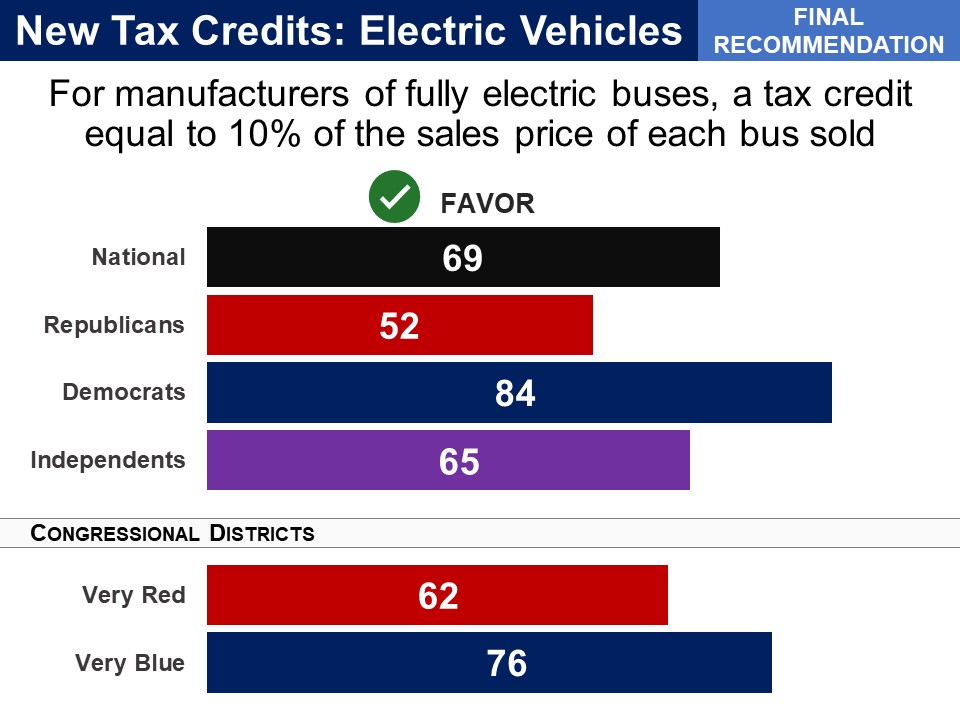

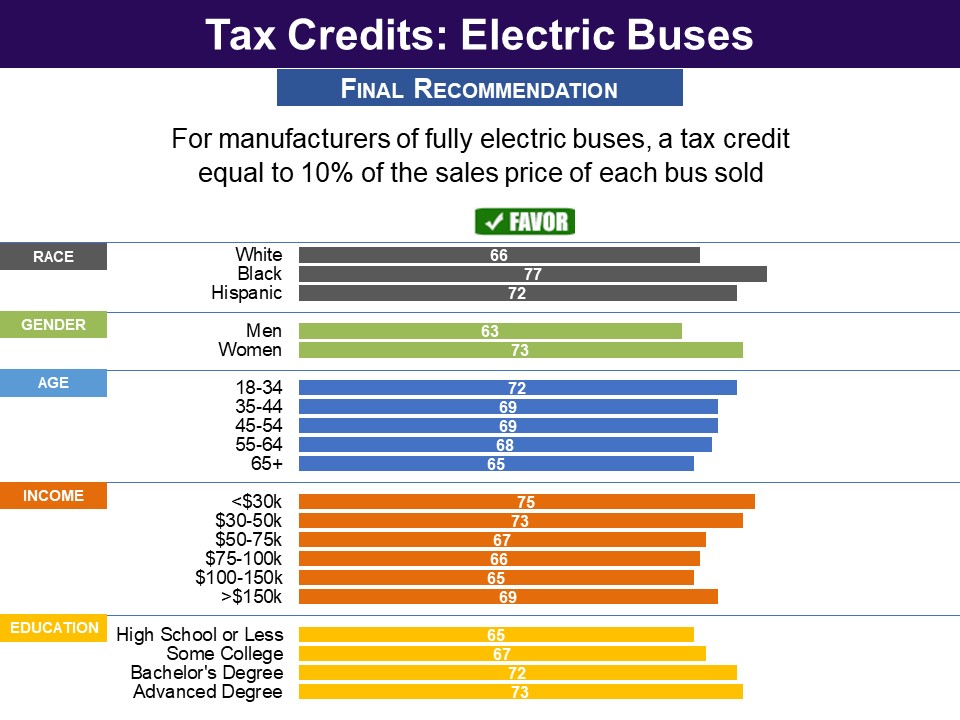

Manufacturers of fully electric buses: a tax credit equal to 10% of the sales price of each bus soldElectric vehicles are more energy efficient than gas-driven cars and they use electricity which is currently substantially derived from a mix of energy sources some of which are not fossil fuels. Respondents evaluated proposals for three tax incentives to encourage the production and sale of electric vehicles, one of which received bipartisan support: “For manufacturers of fully electric buses, a tax credit equal to 10% of the sales price of each bus sold,” was favored by 69%, including 52% of Republicans and 84% of Democrats.

Status of Legislation A similar proposal, which provides a consumer tax credit for up to 30% of the price of medium- and heavy-duty electric vehicles, including buses, was in the Inflation Reduction Act, sponsored by Rep. John Yarmouth (D) in the 117th Congress. It passed the House with 220D voting in favor, and 212R and 1D voting against; and passed the Senate with 48D, 2I and the Vice President voting in favor and 50R voting against. The tax credit is temporary and will sunset by 2032. This proposal is based on H.R. 5163 by Rep. Jimmy Panetta (D), H.R. 2256 by Rep. Dan Kildee (D), and H.R. 5161 by Rep. Jimmy Gomez (D) from the 117th Congress. |

|

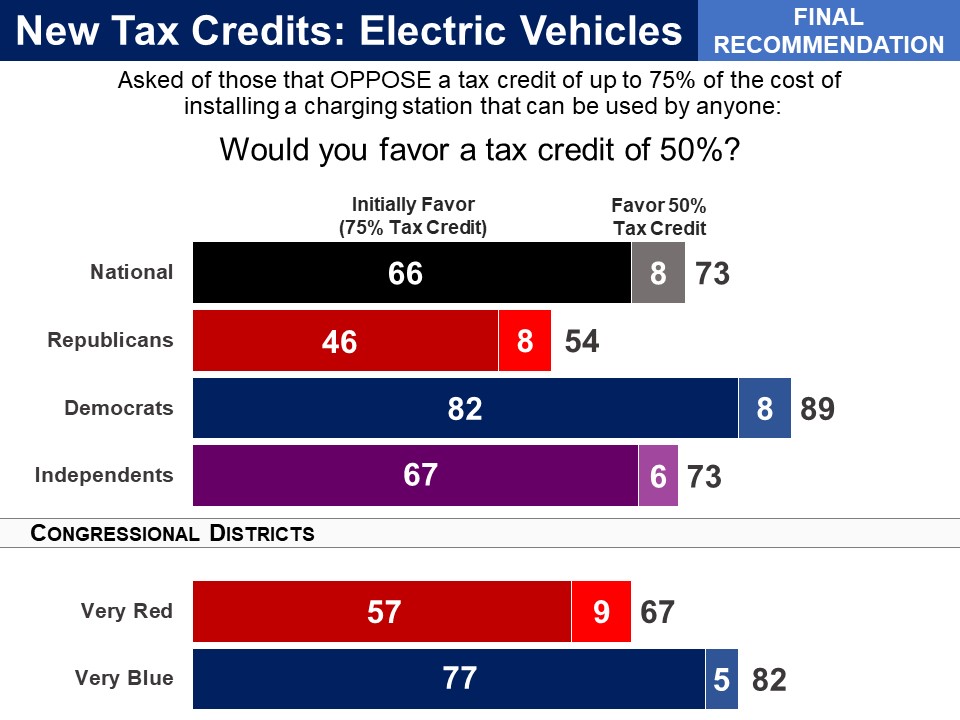

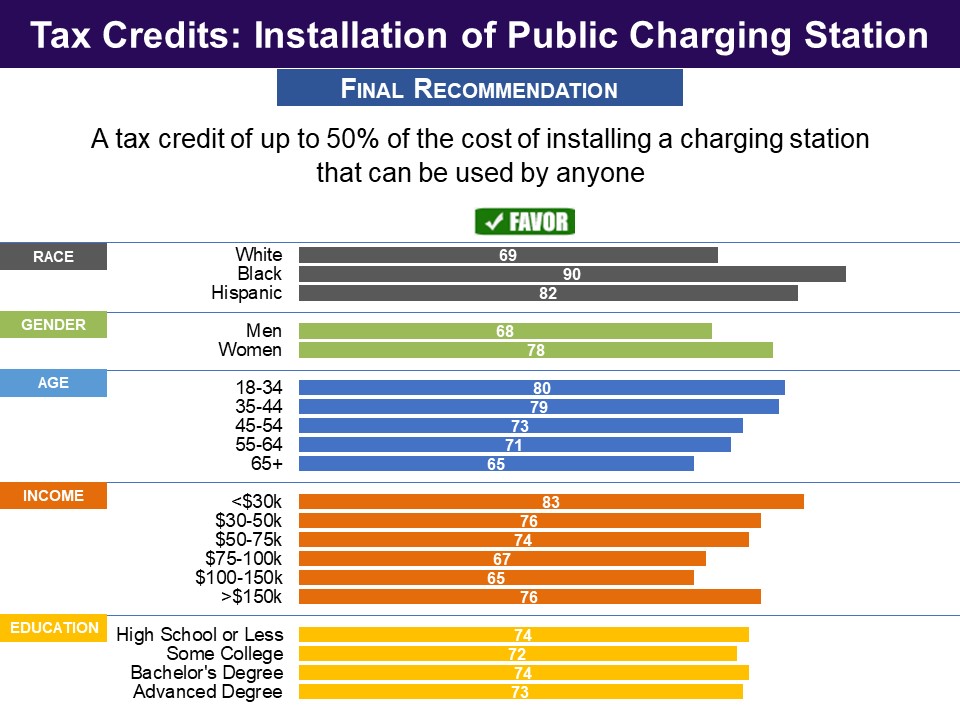

The last proposal involved a tax credit for installing electric vehicle charging stations. Respondents were also provided with the reasoning behind this tax credit: Naturally, many people will only buy electric cars if they can have access to charging stations. For example, people who live in an apartment building or condo may not have a way to charge their car. Having more charging stations would encourage people to buy electric cars. Therefore, to encourage apartment buildings and companies to build charging stations, the following tax credit has been proposed: A tax credit of up to 75% of the cost of installing a charging station that can be used by anyone. A majority of two in three (66%) favored this proposal, including 82% of Democrats. Less than half of Republicans (46%) were in favor. Combining these respondents with those that favored the initial proposal, a bipartisan majority of 73% favors a tax credit of at least fifty percent of the cost of installing a publicly available charging station, including 54% of Republicans and 89% of Democrats. |

|

REGULATIONS |

|

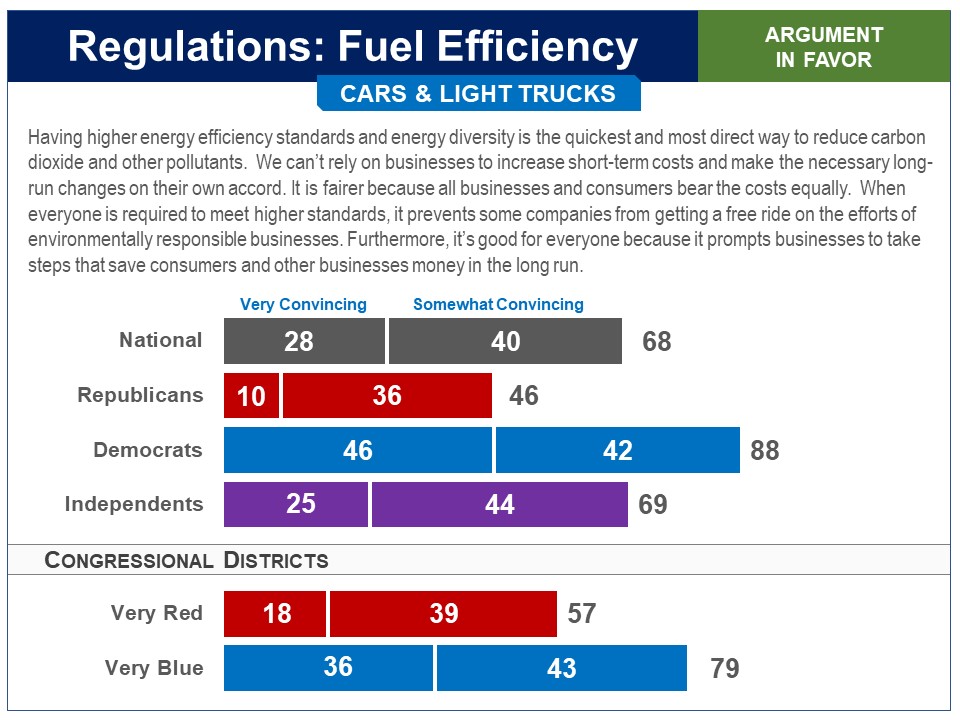

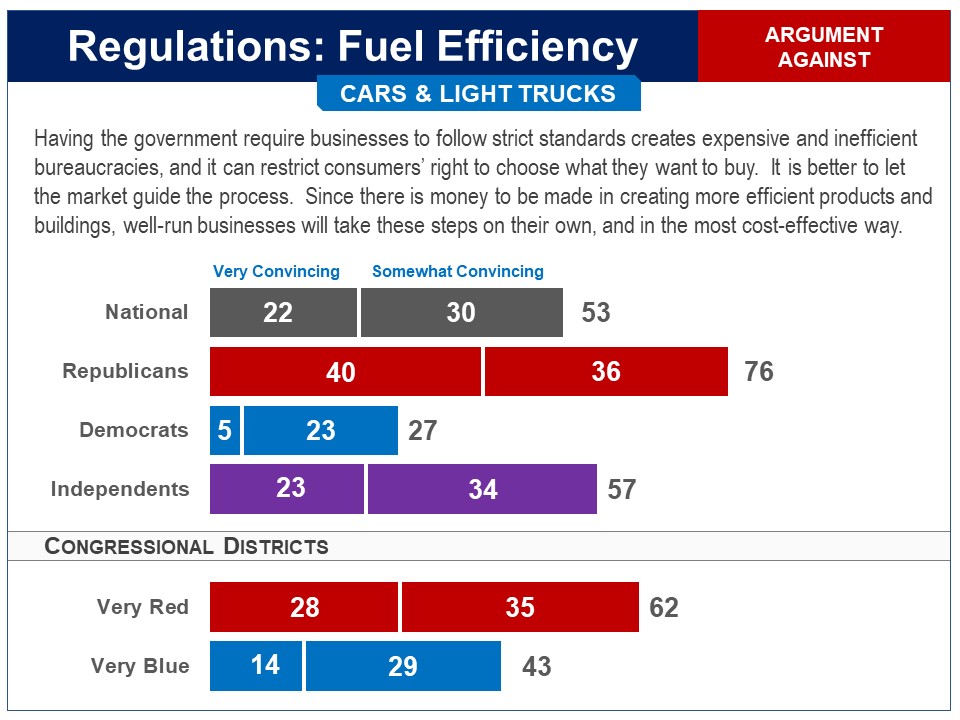

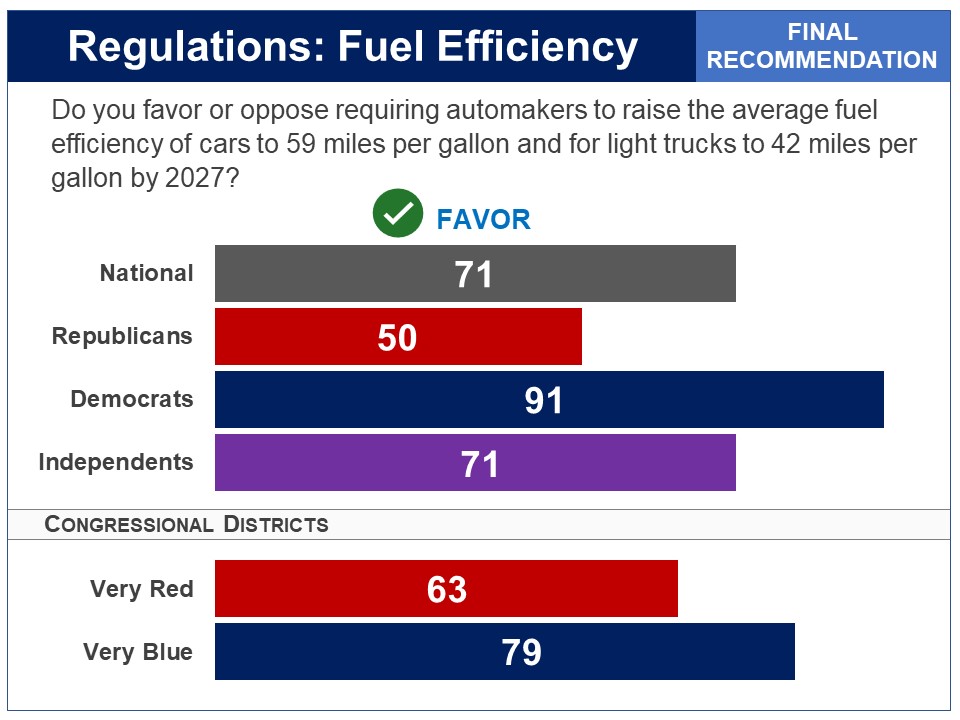

In 2012, the Obama Administration implemented regulations to continually increase the fuel efficiency of vehicles, known as CAFE standards.. Respondents considered the use of government regulations to reduce carbon dioxide and other pollutants. First they evaluated arguments for and against regulatory standards in general. The argument in favor was found convincing 68%, including 88% of Democrats, but just 46% of Republicans. By 2027, new cars and light trucks would need to get 20-30% more miles per gallon (mpg) on average than cars and light trucks being made today. For cars: this would be a gradual increase to an average of 59 miles per gallon by 2027. For light trucks: this would be a gradual increase to an average of 42 miles per gallon by 2027. They were told the effects of this proposal on prices and society in general: This proposal would increase the cost of a new car or light truck by an average of $1,100. However, owners would save an average of $1,400 in lower fuel costs over the life of the car or light truck. The government also estimates that increasing fuel efficiency to this level would have other economic benefits that they estimate to be about $95 billion over the next 30 years. These include reductions in healthcare spending from reduced air pollution, and reduced costs from reductions in the effects of climate change such as extreme weather events. In the end, seven-in-ten favored the proposal (71%), including 91% of Democrats and half of Republicans. Results from CDD Before receiving any briefing materials or engaging in the deliberation process respondents were given the same poll question as those asked afterwards. Support decreased from the pre-deliberation poll to the post-deliberation poll, overall (42% to 39%) and among Democrats (64% to 56%). Including the middle option, those who were not opposed decreased, overall (66% to 56%), and among Republicans (40% to 34%) and Democrats ( 85% to 75%). Related Standard Polls

Large bipartisan majorities have favored increasing fuel efficiency standards:

Status of Proposals There is one proposal in the 118th Congress to repeal the EPA's ability to regulate fuel efficiency standards: H.R. 2779 by Rep. Scott Perry (R), but it has yet to make it out of committee. |

|

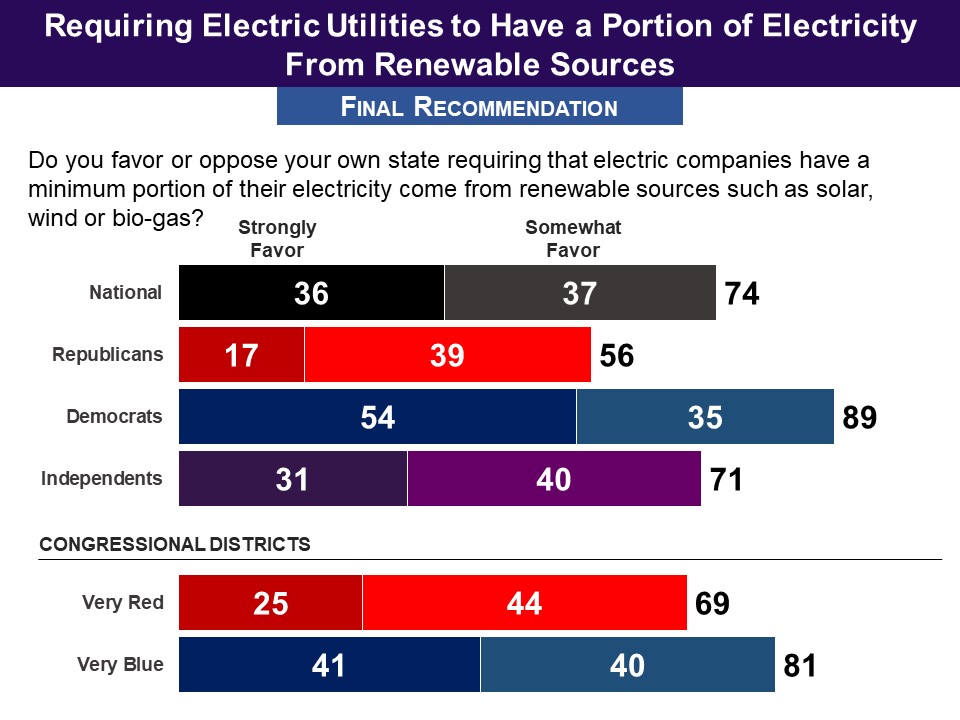

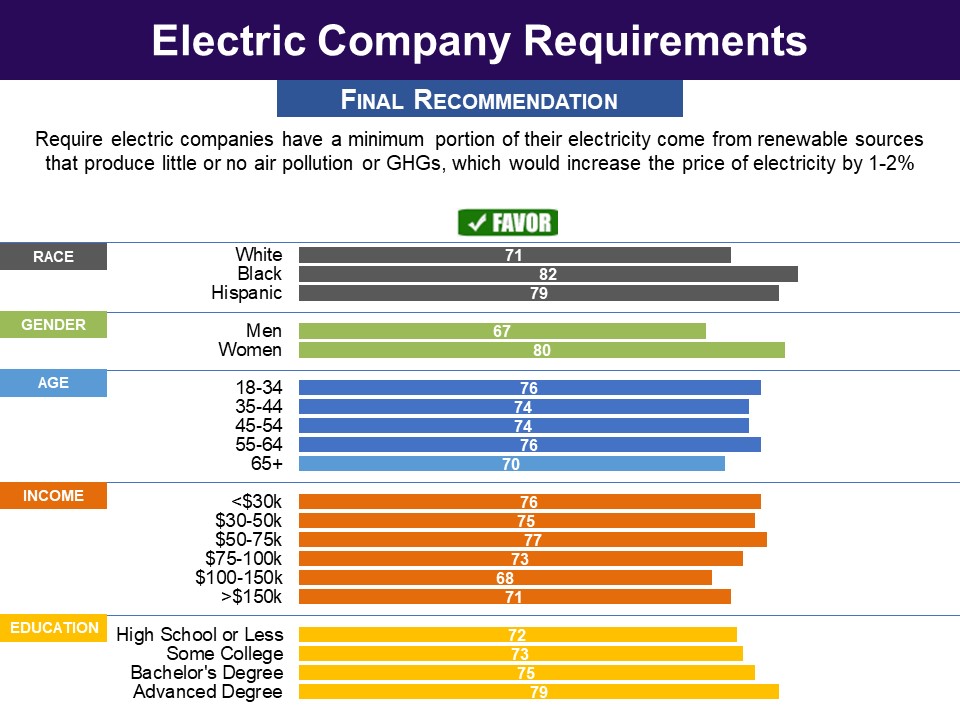

There has been a proposal in Congress requiring electricity providers nationwide to increase their supply of renewable energy, as a percentage of their total retail sale of electricity. Following the evaluation of arguments for and against the use of government regulations to reduce carbon dioxide and other pollutants (discussed above), respondents were informed about the policies of 29 state governments, requiring electric utilities to have a minimum portion of their electricity come from renewable sources. They were told that these state policies are estimated to currently lower greenhouse gases from power production for the entire US by 3.6% from what it would otherwise be. They also learned that the costs have been mostly passed on to consumers, increasing their price of electricity by 1 to 2%. Asked whether they favored such a policy in their own state, three in four supported it (74%, 36% strongly) with a quarter opposed. Among Republicans, 56% supported it; among Democrats, this was nine in ten. Respondents in the 29 states that currently require utilities to include renewables were compared with those living in the states that do not require it. In both groups of states, over seven in ten favored the requirement; the differences were not statistically significant. Related Standard Polls

A bipartisan majority, after being given pros and cons, favored a similar proposal to set emission limits on power plants:

A partisan majority favored keeping the Clean Power Plan rules to reduce power plant emissions:

Status of Proposal A similar bill was introduced in the 117th Congress by Rep. Welch (D): The American Renewable Energy Act pf 2021 (H.R. 3959). It has yet to make it out of committee. |

|

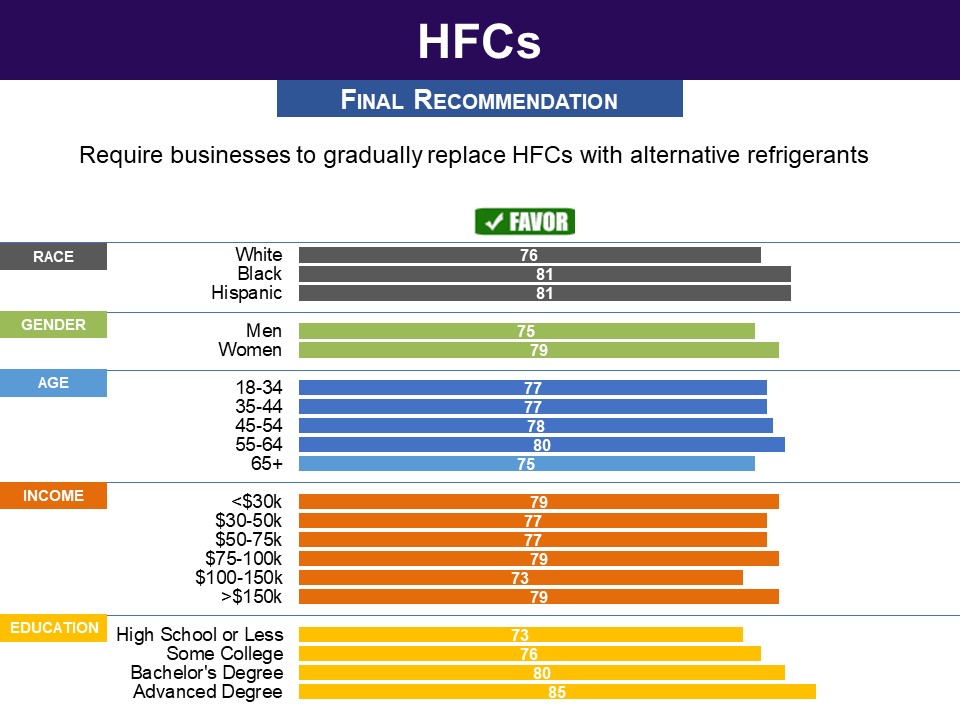

Regulations were introduced in the Clean Air Act in 1970 to reduce the use of hydrofluorocarbons (HFCs), which have significant greenhouse gas effects. In 2016, regulations were introduced by the Obama administration to expand those regulations. Following the evaluation of arguments for and against the use of government regulations to reduce carbon dioxide and other pollutants (discussed above), respondents were introduced to the issue of hydrofluorocarbons, used in air conditioning systems, refrigerators and freezers, and were told that HFCs are at least 400 times more harmful than carbon dioxide. They learned of a pending regulation that would require businesses to gradually replace HFCs with more energy-efficient alternatives and meet new standards in the disposal of HFCs. They were told the overall cost to all affected businesses would be $63 million a year, though most of the cost would be offset by energy savings. A bipartisan majority supported for this new regulation (77%), including two thirds of Republicans and nine in ten Democrats. |

COMMITMENTS TO REDUCE GREENHOUSE GASES Center for Deliberative Democracy (CDD) Survey

Proposals with bipartisan support discussed below:

Program for Public Consultation (PPC) Survey

There were also an oversample of 2,149 respondents in Oklahoma, Texas, California, Florida, Ohio, Virginia, Maryland and New York. These data can be found in the questionnaire. Proposals with bipartisan support discussed below:

|

|

|

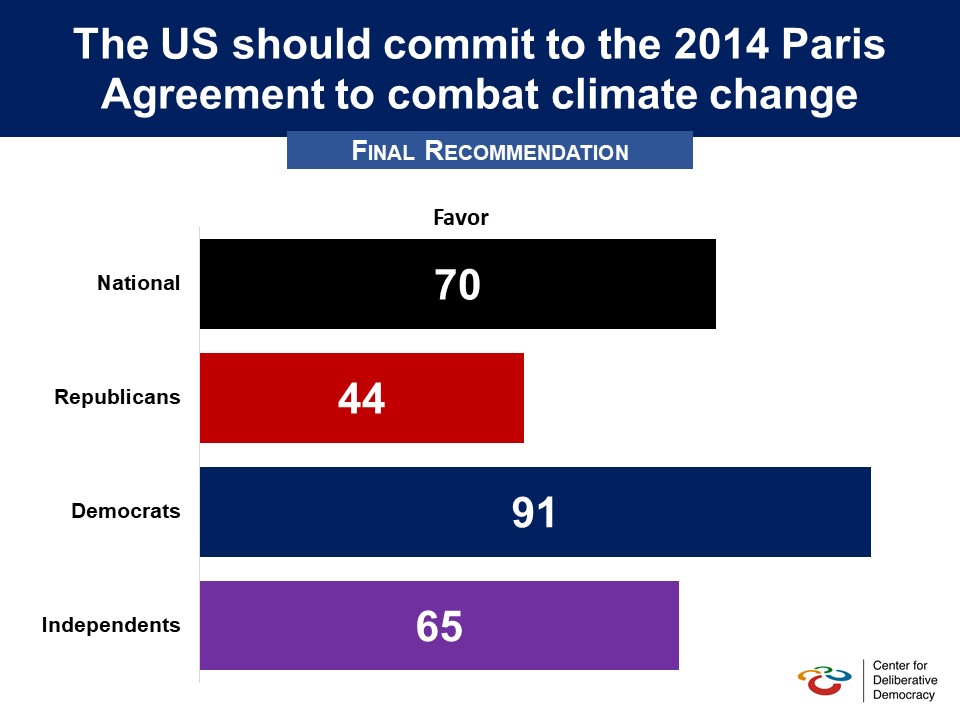

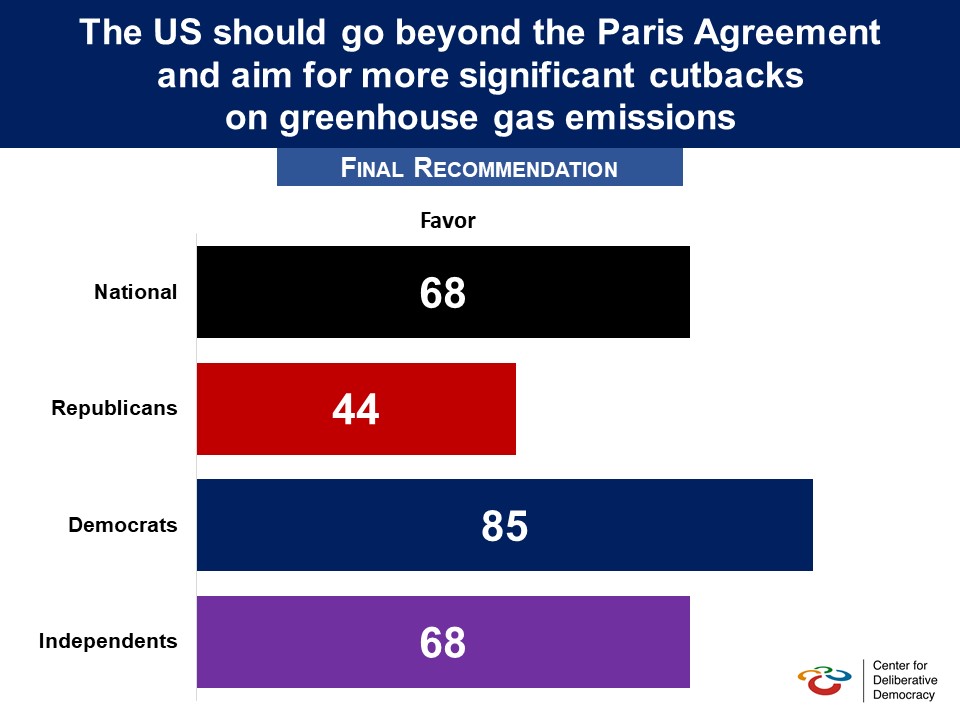

Respondents were presented with the following briefing material as part of an in-person deliberation conducted by Stanford University’s Center for Deliberative Democracy in September 2019: In 2016, the US government signed the Paris Agreement, a framework for tackling climate change across the globe that was signed by nearly all of the world’s nations (but not Russia, Turkey, or Iran). In 2017, the US government announced it would withdraw from the treaty. Some Americans believe the US should re-commit to the Paris Agreement to combat climate change, which they say is a rapidly escalating global threat requiring urgent global action.4 After all, greenhouse gases emitted anywhere affect the people everywhere.5 From this perspective, climate change is one of the most serious long-term threats to the health and wellbeing of Americans, and even American military readiness is being affected.6 Additionally, some advocates believe the US needs to participate in the Paris Agreement in order not to give up its claim of global leadership on climate change to China and other nations. Opponents of the Paris Agreement believe the US government was right to withdraw because it included only voluntary commitments and imposed no consequences on countries that failed to follow through. Critics also object that the American commitment was much larger than those of other countries, and that it would prove costly to US households and harmful to American competitiveness in the energy market. As a result, spending US taxpayer dollars on this problem would benefit other countries more than the US.8 Advocates respond that US leadership is critical to mobilizing global action, and that some other nations have actually made commitments far more serious than ours. Some believe the US should go beyond the Paris Agreement to more ambitiously reduce greenhouse gas emissions. They say that the Paris Agreement only seeks to hold the rise in average world temperatures to 3.6 degrees Fahrenheit, and that it does not go far enough. Many scientists predict more severe droughts, wildfires, flooding, food shortages and refugee flows unless we can keep global temperatures from rising beyond an additional 2.7 degrees. Advocates for strong action argue we have been warned by scientists about the dangers of global warming for over three decades — and have done relatively little as a nation. Because adverse climate changes are so profound and so difficult to reverse, but take place so slowly over time, it is important to take action as soon as possible — both to minimize the damage as much as possible, and to minimize the costs of preventive action, which will rise dramatically with time. For the sake of the next generation we need to start acting now. Critics believe that moving beyond the current Paris Agreement goal is unrealistic. Industrialized countries and other big polluters like China and India would be unlikely to agree to the immediate and costly actions that a larger goal would require. Greater real-world progress will come, they suggest, by aiming for a more attainable objective. They were then presented two proposals and arguments for and against each. Afterwards, they deliberated on the proposals in-person, and were asked to give their final recommendation. The first proposal went as follows: Proposal: The US should commit to the 2014 Paris Agreement to combat climate change. Argument in Favor: Climate change is an urgent global threat requiring global solutions. It demands international cooperation, since greenhouse gases emitted anywhere affect people everywhere. The US should not cede its claim of global leadership in this arena to China and others. Argument Against: The Paris Agreement is harmful to American energy competitiveness and is expensive and ineffective. Overall, the agreement requires a vast expenditure of taxpayer dollars in ways that benefits other countries more than the US. On a 0-10 scale, 70% favored the proposal (6-10), including 91% of Democrats, but less than half of Republicans (44%). The percent not in opposition to the proposal was 80% nationally, 97% of Democrats and a majority of Republicans (60%). Going Beyond the Paris Agreement Proposal: The US should go beyond the Paris Agreement and aim for even greater reductions in greenhouse gas emissions. Argument in Favor: The Paris Agreement tries to assure that global temperatures do not rise more than 3.6 degrees Fahrenheit. But many scientists predict grave consequences of extreme weather and flooding if temperatures rise beyond 2.7 degrees. The agreement must be revised. Argument Against: Moving beyond the Paris goal is unrealistic. Countries responsible for the bulk of greenhouse emissions would not consent to the immediate and costly actions that would be required of their citizens. It is better to aim for a more attainable objective. This proposal was favored (6-10) by 68%, including 85% of Democrats, but less than half of Republicans (44%). The percent not in opposition to the proposal was 81% nationally, including 97% of Democrats and a majority of Republicans (60%). Related Standard Polls on Paris Agreement

Majorities and pluralities have opposed President Trump withdrawing from the Paris Agreement, with large partisan divisions:

|

|

|

|

|

|

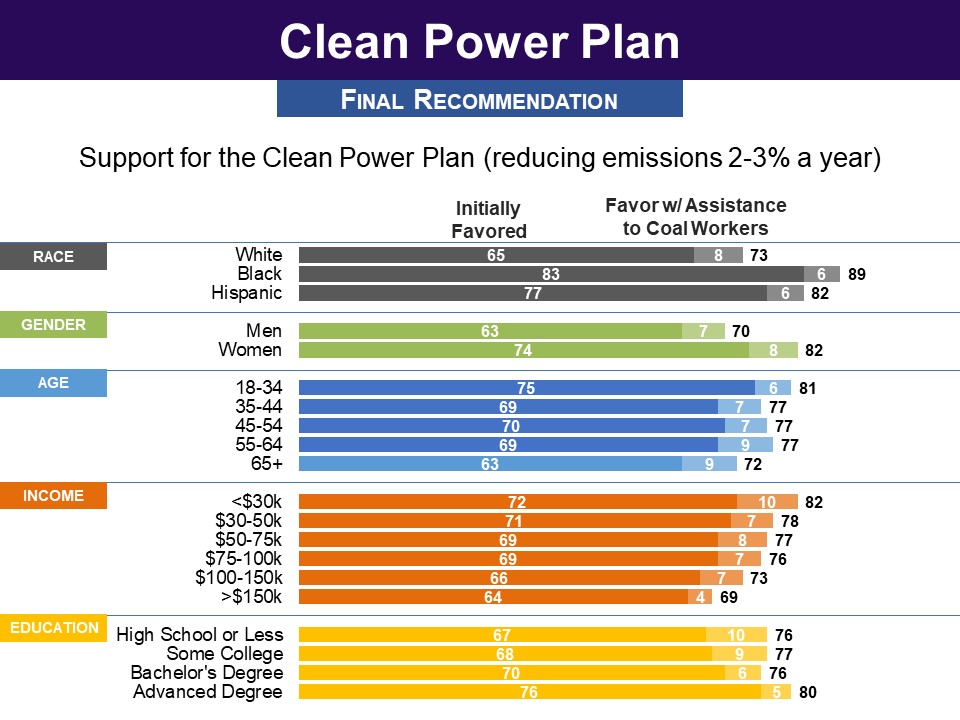

PPC survey respondents were first given a general introduction to the negative impacts of the way energy is currently produced. This included information about the health effects of air pollution, and the likely effects on climate change caused by greenhouse gases. They also evaluated arguments for and against the government making it a high priority to reduce these negative impacts of energy production. Finally, rated how high a priority it should be for the government to reduce these negative impacts. Reducing air pollution that causes negative health effects was given a high priority by over three in four (78%, very high 47%). This included 54% of Republicans, 98% of Democrats, and eight in ten independents. Reducing greenhouse gases was given a high priority by three in four (74%, very high 50%). Nearly all Democrats (98%), eight in ten independents (79%), but only 45% of Republicans made it a high priority. Respondents then moved on to evaluating specific proposals for reducing harmful emissions from energy production. Effect of Possible Mitigation on Support for CPP Combining the respondents who initially favored the Clean Power Plan with those who favored providing assistance to coal workers who lose their jobs and would favor the Clean Power Plan if such assistance is provided brings support to 77% overall, 59% among Republicans and 93% among Democrats. Related Standard Polls

Given no information about the Clean Power Plan and the opportunity to took a neutral position overall a plurality was opposed to its repeal, Democrats were opposed and half of Republicans took a neutral position:

Status of Clean Power Plan and Legislation Clean Power Plan Adjustment Assistance for Coal Workers There are several pieces of legislation in the 116th Congress that would use revenue from a new carbon fee to support displaced fossil fuel workers and coal-dependent communities affected by the carbon fee, and help them transition to a clean energy economy: the American Opportunity Carbon Fee Act (S. 1128) sponsored by Sen. Sheldon Whitehouse (D), the Climate Action Rebate Act by Rep. Jimmy Panetta (D) (H.R. 4051) and Sen. Chris Coons (D) (S. 2284), and the America Wins Act (H.R. 4142) by Rep. John Larson (D). These bills have not made it out of committee. |

|

One proposal would require the US to adopt the Paris Agreement goal of reducing emissions by about two percent a year. Respondents were introduced to the international framework for addressing climate change as follows: Scientists that study atmospheric changes emphasize that climate change is a global problem. The temperature changes that occur are for the planet as a whole and the greenhouse gases that each nation generates contribute to the global problem. As a result there have been numerous efforts, sponsored by the UN, to try to arrive at an international agreement for reducing greenhouse gases. A series of international conferences have been held. They were then introduced to a debate in these conferences that has posed a major obstacle to achieving an international agreement: whether the developing countries should be required to limit their greenhouse gases. Illustrated with charts, it was explained that developed countries, such as the US, argue that developing countries now produce large total amounts of emissions, while developing countries argue that they are still growing out of poverty and produce much lower levels of emissions per capita. It was then explained that at the December 2015 conference of 200 countries in Paris, for the first time all of the countries—including developing countries as well as developed countries—came to an agreement to seek to limit the increase in global temperatures to no more than 3.4 degrees Fahrenheit. Respondents also learned that: All countries, including the US, presented their national plans for limiting their greenhouse gases in line with this goal. The countries have not made legally binding commitments to meet this goal, but the agreement does require them to:

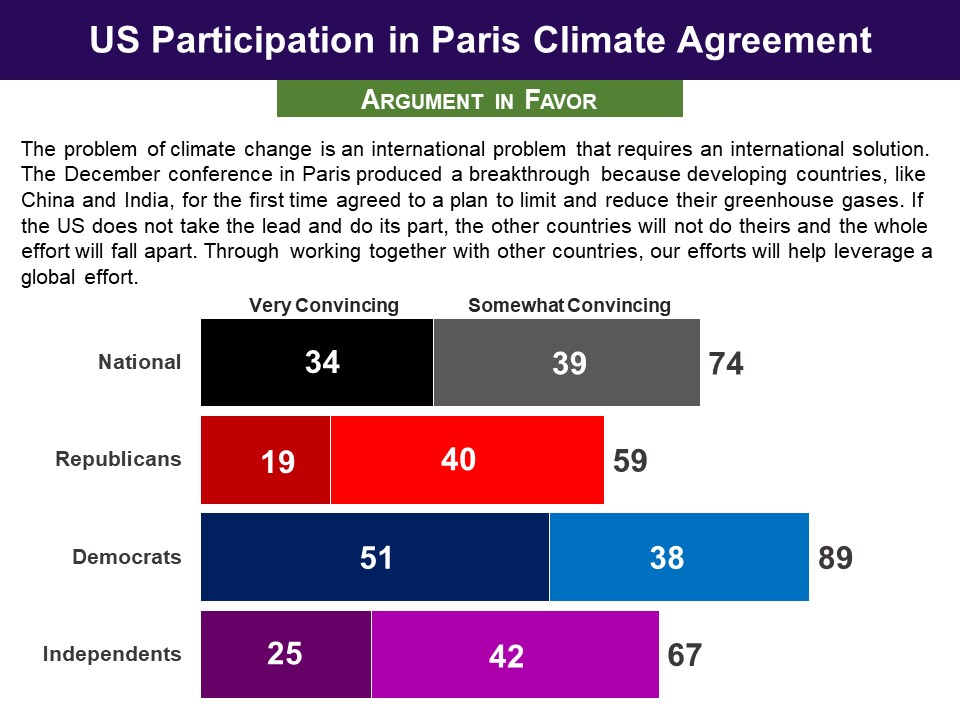

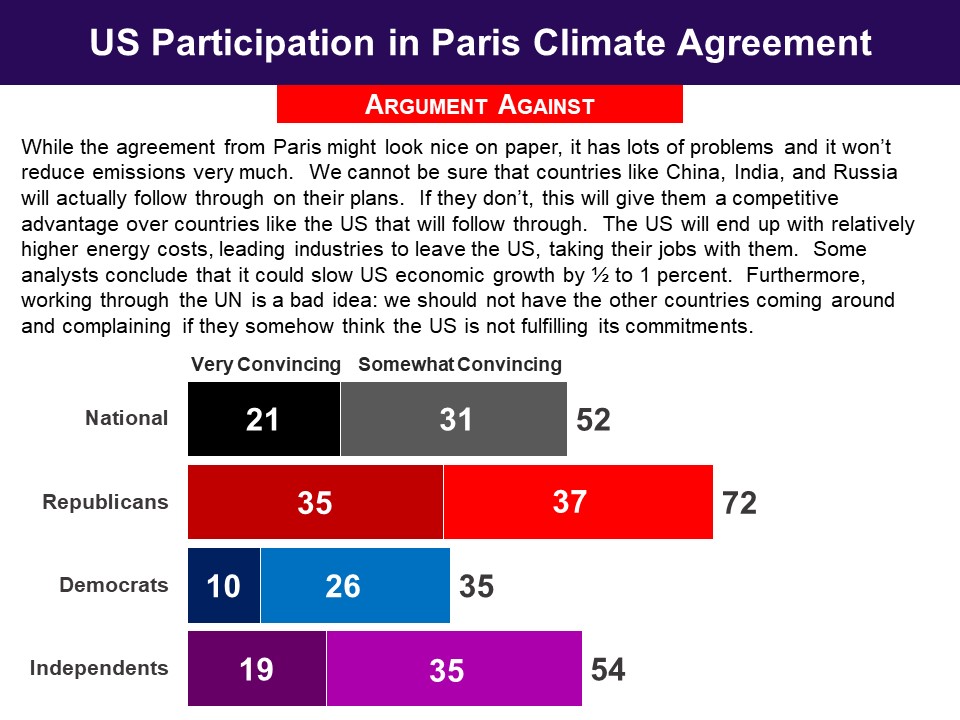

The agreement refers to the assessment of the International Panel on Climate Change (IPCC) that meeting the goal of limiting temperature increases to 3.4 degrees will require 2%-a-year reductions on average between now and 2050 While developed countries like the US have submitted plans for reducing greenhouse gases right away, developing countries, such as China and India, have submitted plans for a more gradual path of first slowing, and then, within several years, beginning to reduce their gases. They then evaluated arguments for and against the US continuing to participate in the international agreement to reduce its greenhouse gases in pursuit of the goal of limiting the global temperature increase to no more than 3.4 degrees Fahrenheit. The argument in favor was found convincing by a bipartisan majority. The argument against did less well and elicited a substantially more partisan response, with a majority of Republicans finding it convincing, but just a third of Democrats. |

|

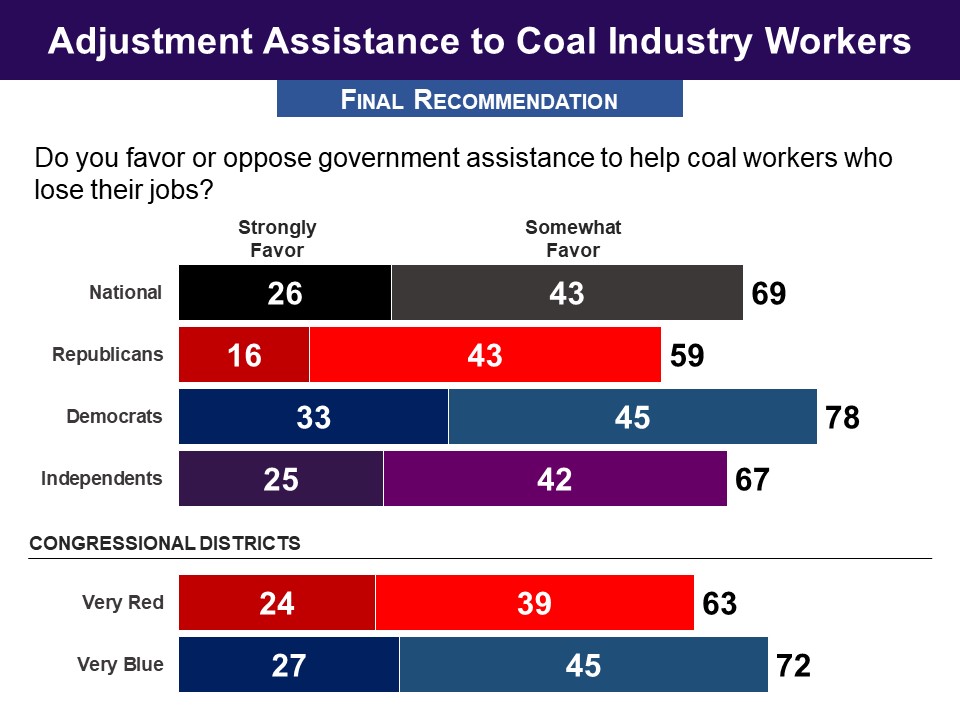

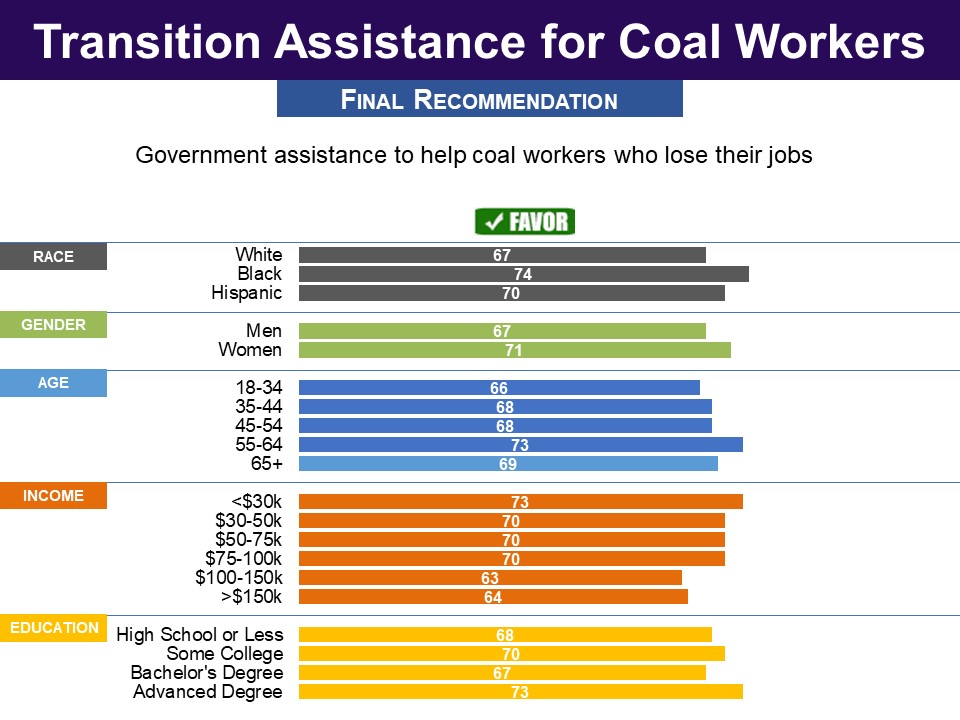

Assistance for Coal Workers Respondents were first asked to consider the problem from the workers’ standpoint. They were told that, “it is likely that some older coal plants will be shut and unlikely that new ones will be built, because cleaner forms of energy are now less expensive.” They were then told about a proposal in Congress, based on H.R. 5669 and S. 2398, to provide coal industry employees who lose their jobs federal support and training to make the transition to other employment. They learned that, if enacted, this would cost $500 million in its first year. They were told that proponents “say it is not fair for coal workers to take the brunt of the changes that come with changing energy sources, and thus they should get help,“ while opponents “say it is not the government’s job to take care of everyone affected by economic change and these programs are often not effective.” When asked if they favored the plan, seven in ten (69%) favored it, including six in ten Republicans and eight in ten Democrats. Support was not significantly different among those with a family member who has worked in the coal industry. |

|

Clean Power Plan Respondents were provided a briefing in which they learned that, while the CPP’s main focus is on reducing carbon dioxide, the steps to do this will also reduce pollutants such as sulfur dioxide. They learned that the plan calls for each state in the US to reduce carbon dioxide from power plants by 2-3% a year. Each state is to come up with a plan suited to its circumstances and energy mix. They were told that these reductions can be achieved through:

Respondents were then given information about the likely economic impact and given opportunities to react. First they were told about the estimated costs of the CPP, learning that the price of electricity will increase initially by about 3%. After 5-10 years, the price will go down to less than 1% higher than it would otherwise be. They were told that according to government analyses, the CPP would slow economic growth so that:

Respondents then got information about projected benefits of CPP, in terms of health effects and greenhouse gas reductions. They were told: Because the Clean Power Plan will reduce air pollution—reducing soot and smog—this will have health benefits. According to government analyses, these benefits will increase each year so that by the year 2030 it will result in the following benefits for that year:

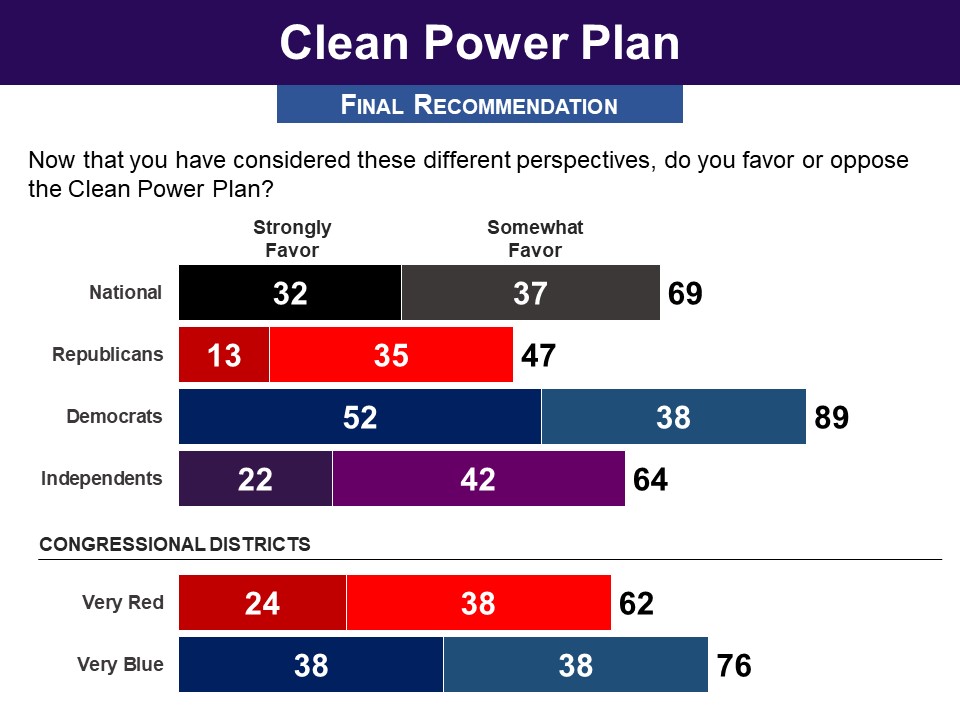

Respondents were also told about the benefits relative to greenhouse gases, as follows: Another benefit from the Clean Power Plan is that it helps the US meet the goal it set, together with other countries, to reduce its greenhouse gases by about 2% a year in an effort to slow the process of climate change. After the briefing, arguments for and against the CPP were evaluated. Both pro and con arguments were found convincing by a majority overall, with partisan differences. The pro argument was found convincing by a majority of Democrats but less than half of Republicans, while the con argument elicited the opposite response. Asked for their final recommendation, 69% favored the Clean Power Plan, including 89% of Democrats but just 47% of Republicans. |

|

There have been proposals in Congress to subsidize carbon sequestration, as a way to take carbon dioxide out of the air. Following the evaluation of arguments for and against the use of government regulations to reduce carbon dioxide and other pollutants (discussed above), respondents received a briefing on the sequestration of carbon dioxide from burning coal, often referred to as ‘clean coal.’ They were informed that: There is a method being developed for greatly reducing the carbon dioxide from coal. It is known as ‘sequestration.’ What it does is to capture the carbon dioxide from coal plants and store it underground in caverns and empty oil wells, rather than releasing it into the air. The problem, though, is the only way it can be economical is if the government covers much of the cost of developing and building the technology. Respondents were then presented pros and cons to subsidizing carbon sequestration, as follows: Some people argue in favor of this idea saying:

Others argue against this idea saying:

In the end, a majority of 55% opposed the “federal government providing subsidies for developing and building new technologies to capture and store carbon dioxide from coal plants,” including 57% of Republicans, 52% of Democrats, and 58% of independents. Among those who have or have a family member who has worked in the coal industry, support was a bit higher but still surprisingly low—51% in favor, 47% opposed. |

CONSTRAINING FOSSIL FUEL EXTRACTION Program for Public Consultation (PPC) Survey

Proposals with bipartisan support discussed below:

Proposals that did not receive bipartisan support:

Center for Deliberative Democracy (CDD) Survey

Proposals with bipartisan support discussed below:

|

|

|

OFFSHORE DRILLING |

|

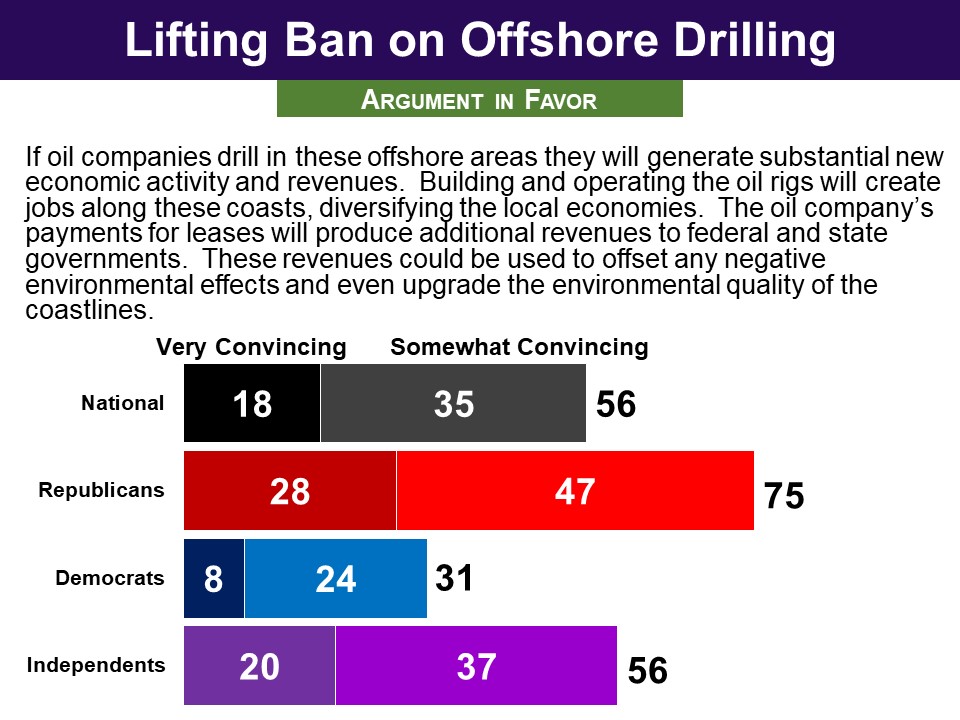

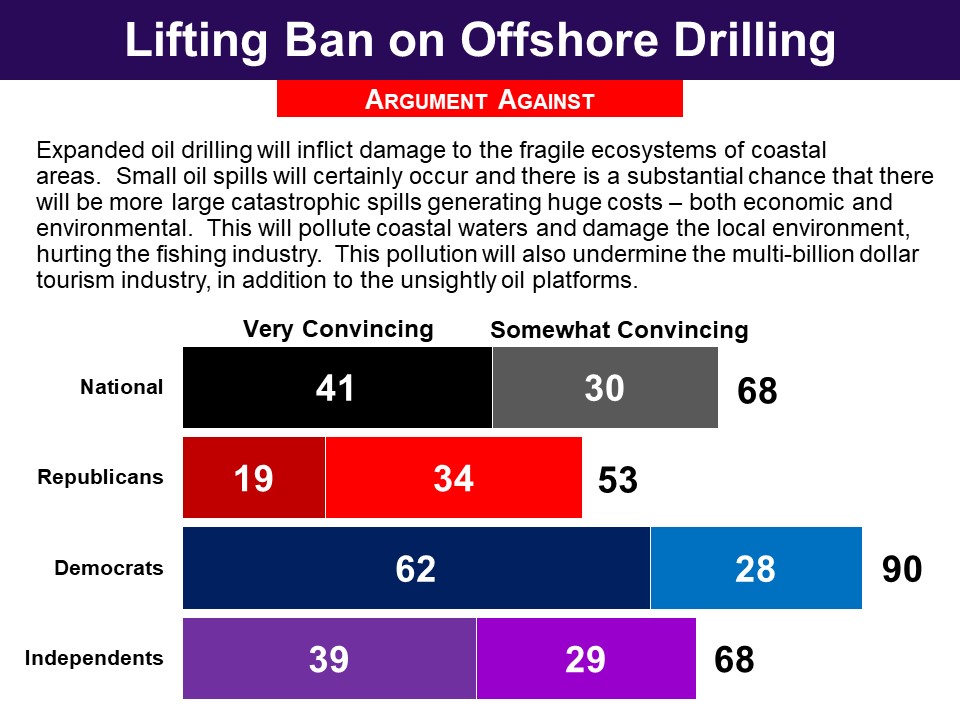

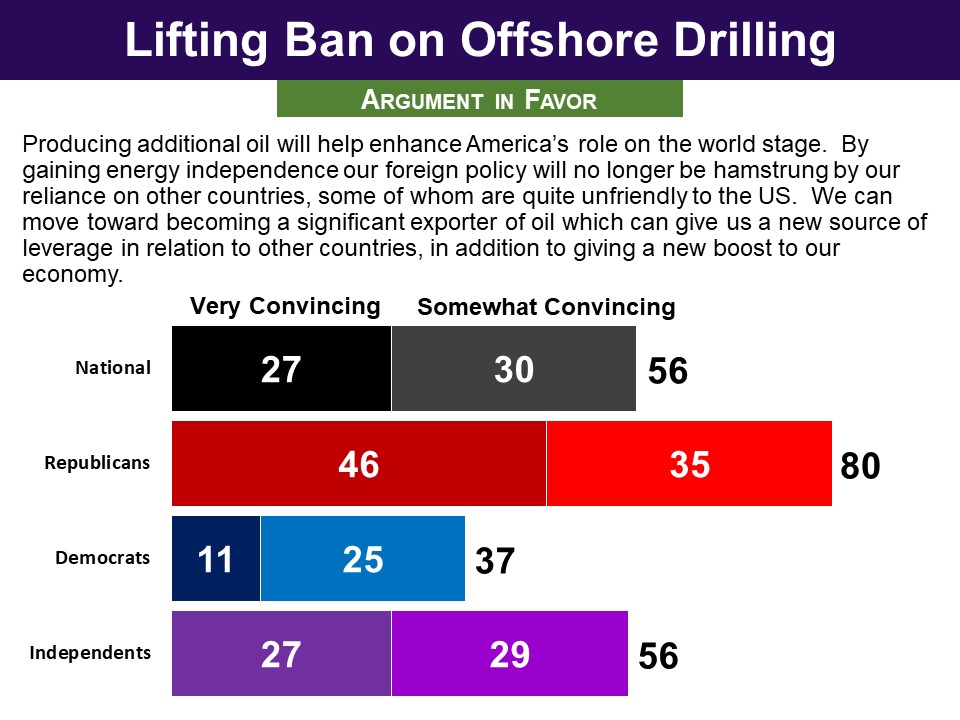

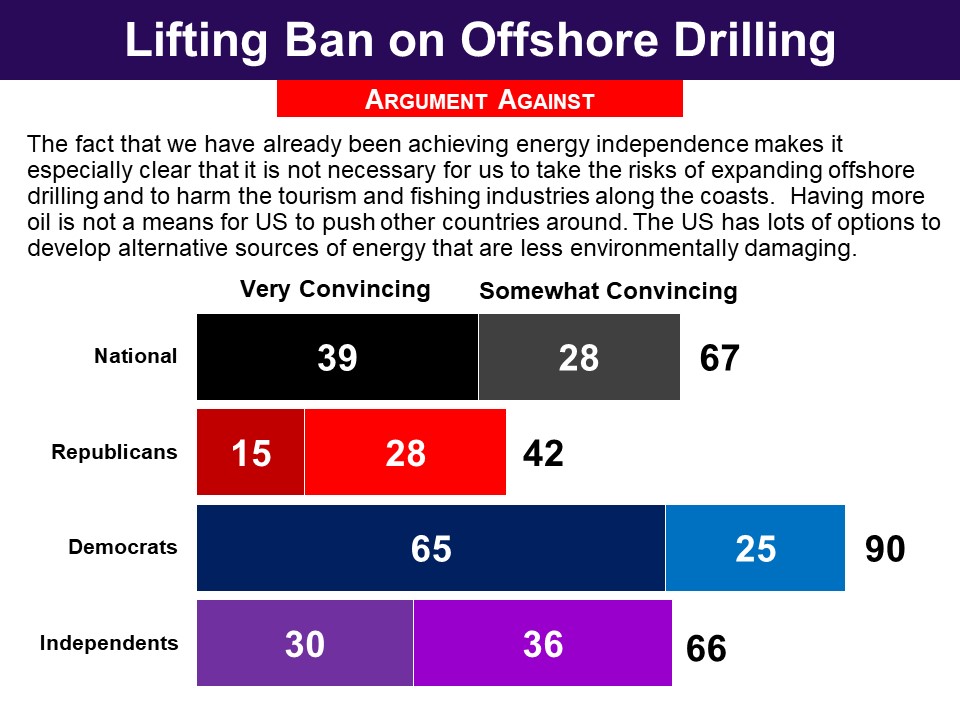

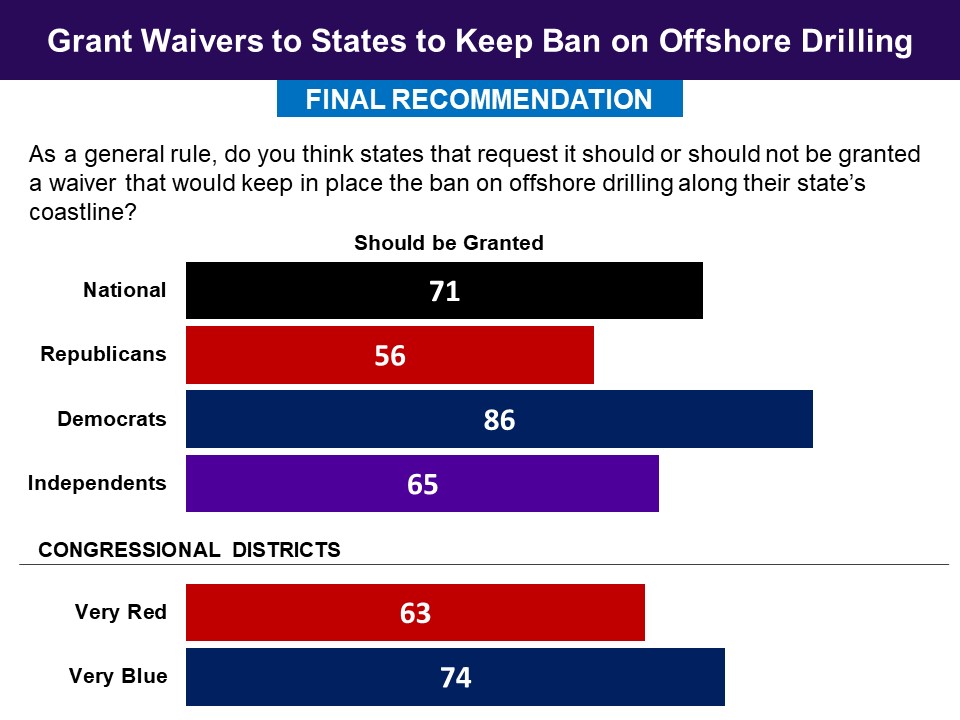

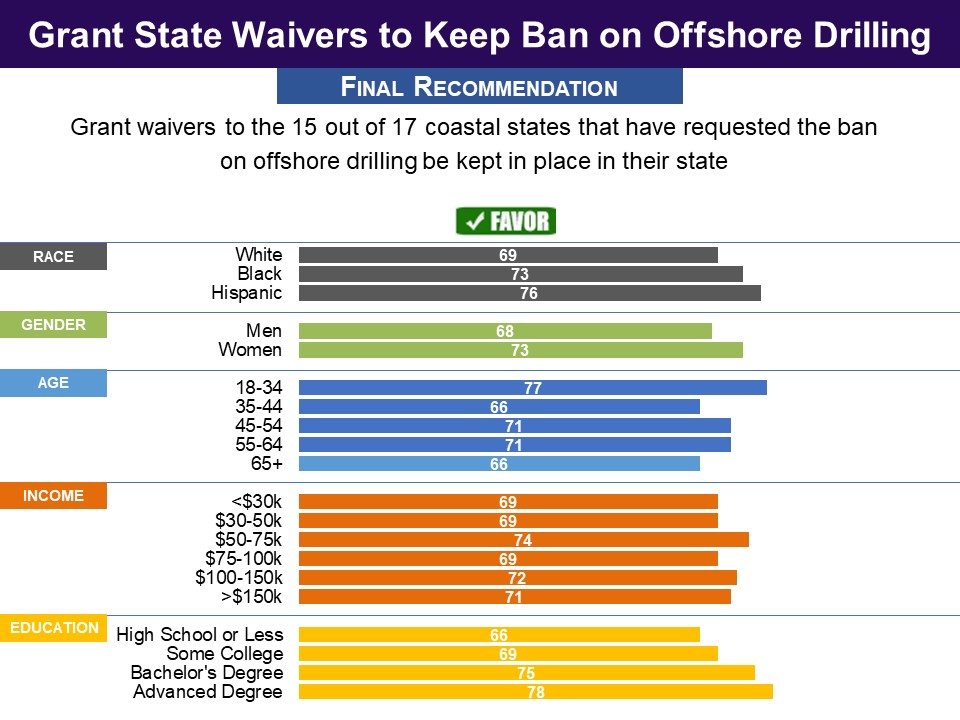

Respondents were first introduced to the policy which bans offshore drilling, as follows: Currently, oil and gas are only being drilled along the Gulf Coast. There have been bans on drilling in the Atlantic and the Pacific coast since a series of major damaging oil spills, including the Santa Barbara spill in 1969 and the Exxon Valdez in 1989. There are also limits on the Alaska coast. The new proposal is to lift these bans and allow drilling for oil and gas along all of the Atlantic and Pacific coasts and to expand the allowed area around Alaska. They then evaluated two sets of arguments for and against that proposal. The arguments against lifting the ban were found convincing by a larger and more bipartisan majority. There were significant partisan differences, with Republicans more likely to find the arguments in favor convincing, and vice versa for Democrats. They were then introduced to a proposal concerning state-level action: The proposal to allow offshore drilling along the Atlantic and Pacific coasts affects 17 states. As you may know, governors in 15 of the 17 states have requested waivers that would keep in place the ban on offshore drilling for their states. The states requesting this waiver include -- Florida, South Carolina, North Carolina, Virginia, Maryland, Delaware, New Jersey, New York, Connecticut, Rhode Island, Massachusetts, New Hampshire, California, Oregon and Washington. Florida has already been granted this waiver. Asked whether they favored granting these waivers, a bipartisan majority were in favor (71%), including 86% of Democrats and 56% of Republicans. Related Standard Polls

However, when asked about their support for drilling in the Alaskan Wildlife Refuge in particular, large bipartisan majorities has been opposed:

Status of Proposal There were also several pieces of legislation in the 116th Congress to prohibit offshore drilling:

|

|

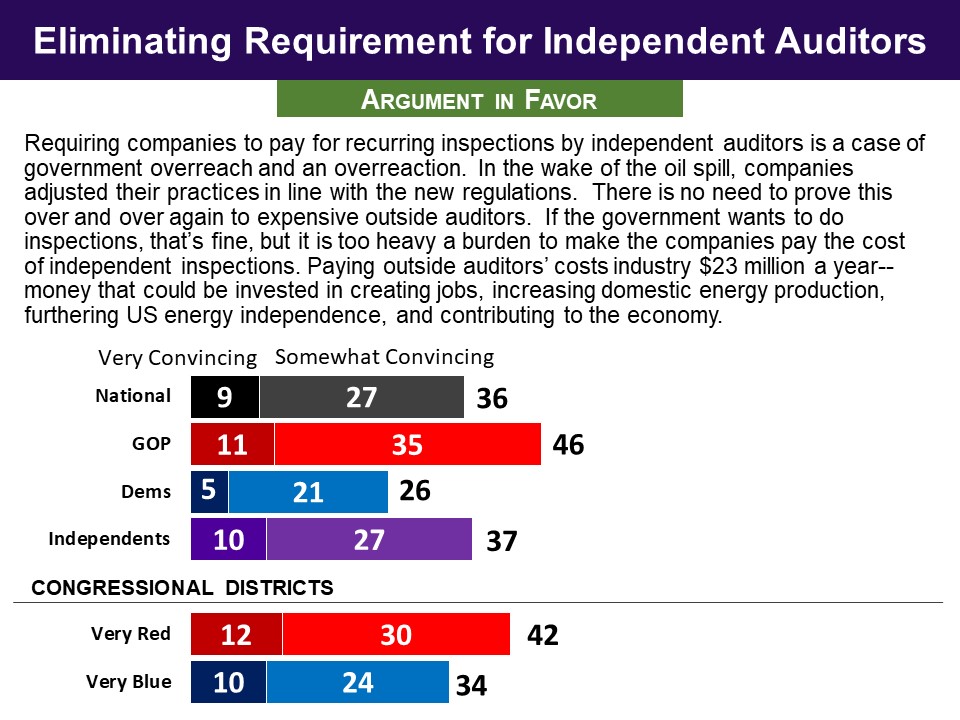

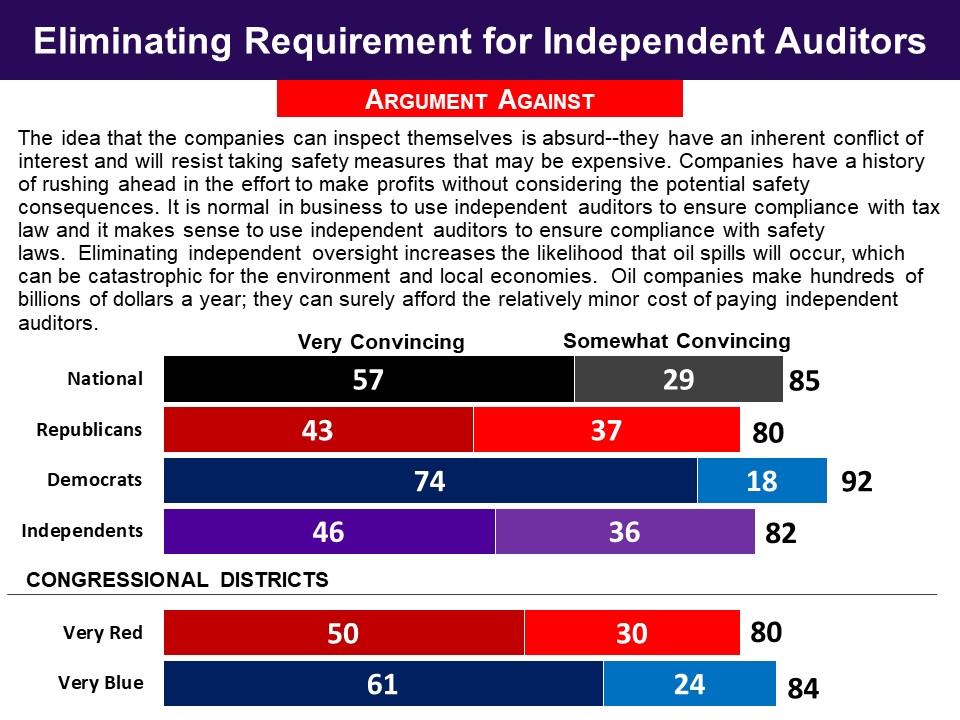

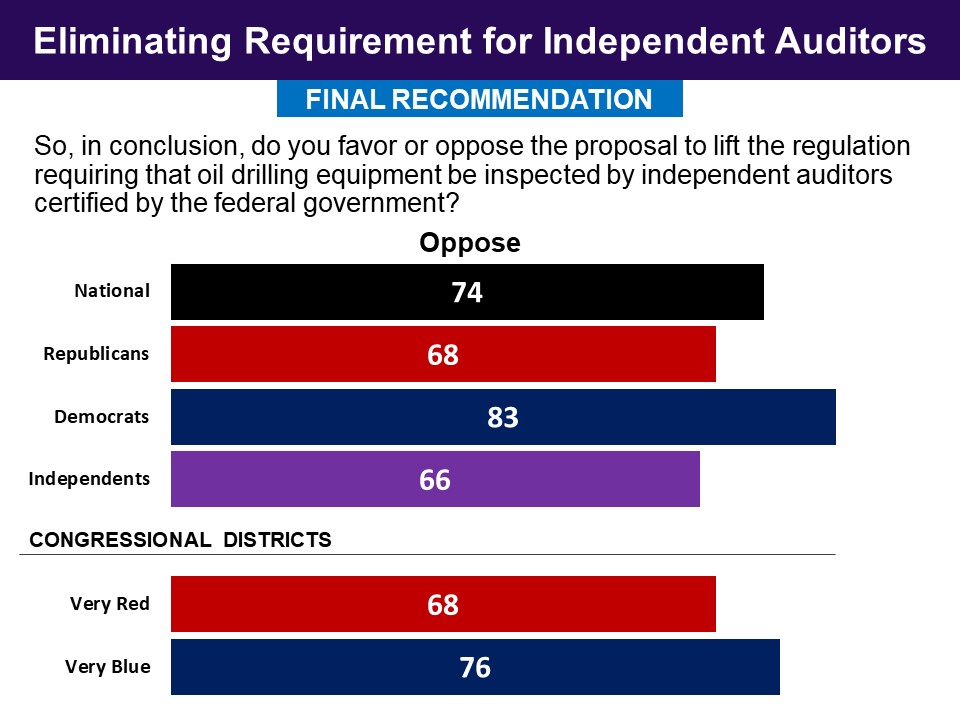

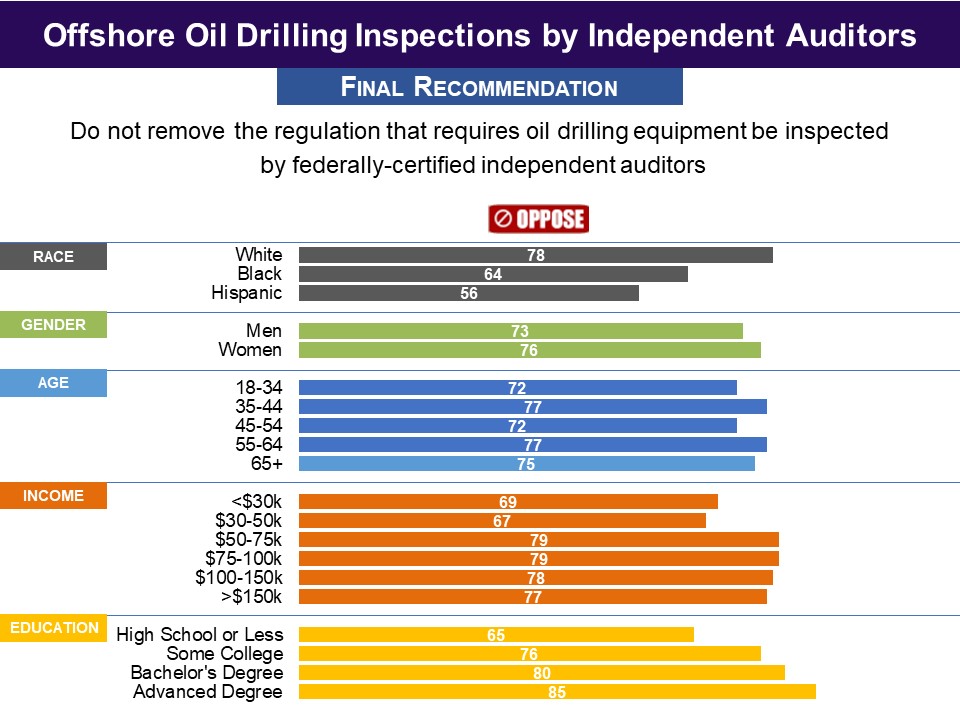

The Gulf of Mexico oil spill in 2010 caused increased concern over the safety and reliability of equipment used for offshore drilling. To address this concern, the federal government adopted a policy requiring this equipment to be inspected by federally-certified auditors. In 2017, the Department of Interior recommended removing this policy, but this recommendation has not been carried out. This has sparked debate between those who support the regulations as necessary safety precautions, and those who see it as unnecessary government overreach. Respondents were first presented a briefing on oil spills and the safety requirements imposed to reduce the risk of their occurrence: As you may recall, in 2010, there was a major oil spill in the Gulf of Mexico by the company British Petroleum. After the spill, a bipartisan presidential commission was established to look at what went wrong and to make recommendations. The Commission concluded that the government oversight of compliance with safety standards was not adequate. The commission recommended higher safety standards and that outside independent auditors, certified by the federal government, conduct inspections to ensure companies’ compliance with the safety standards. The cost of the inspection was to be covered by the companies. These recommendations were adopted by the government and independent auditors have been conducting regular inspections. They were then told about a proposal to change the safety requirements: Currently, there is a proposal to eliminate the requirement that companies hire independent auditors, certified by the federal government, to conduct inspections to ensure compliance with safety standards. Arguments for and against the proposal were then evaluated. The argument in favor was not found convincing by a majority of any group, while the argument against was found convincing by a large bipartisan majority. |

|

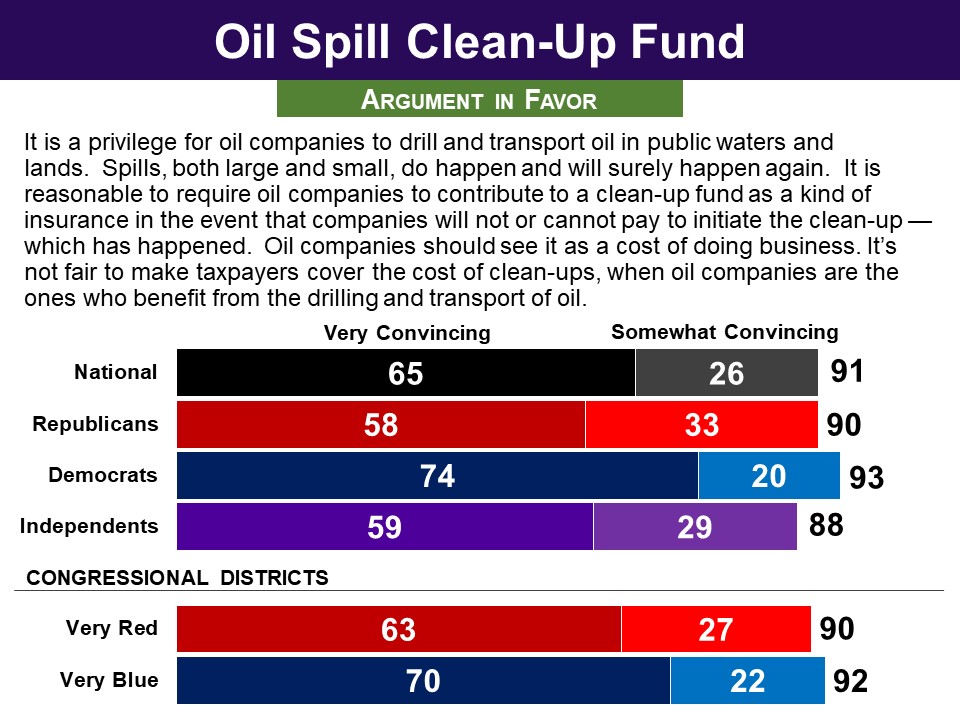

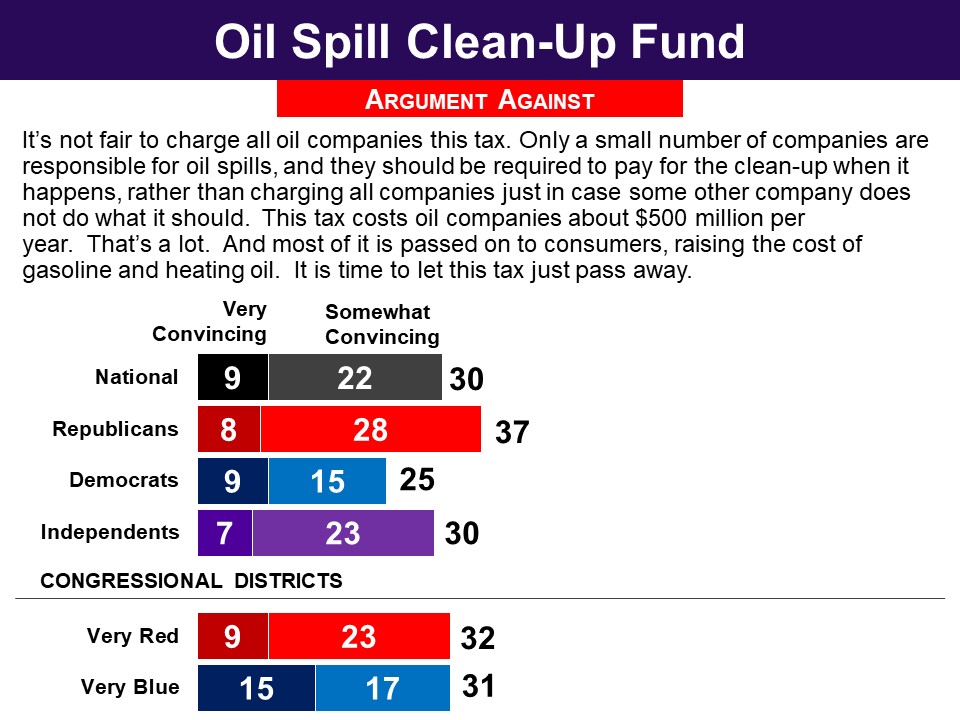

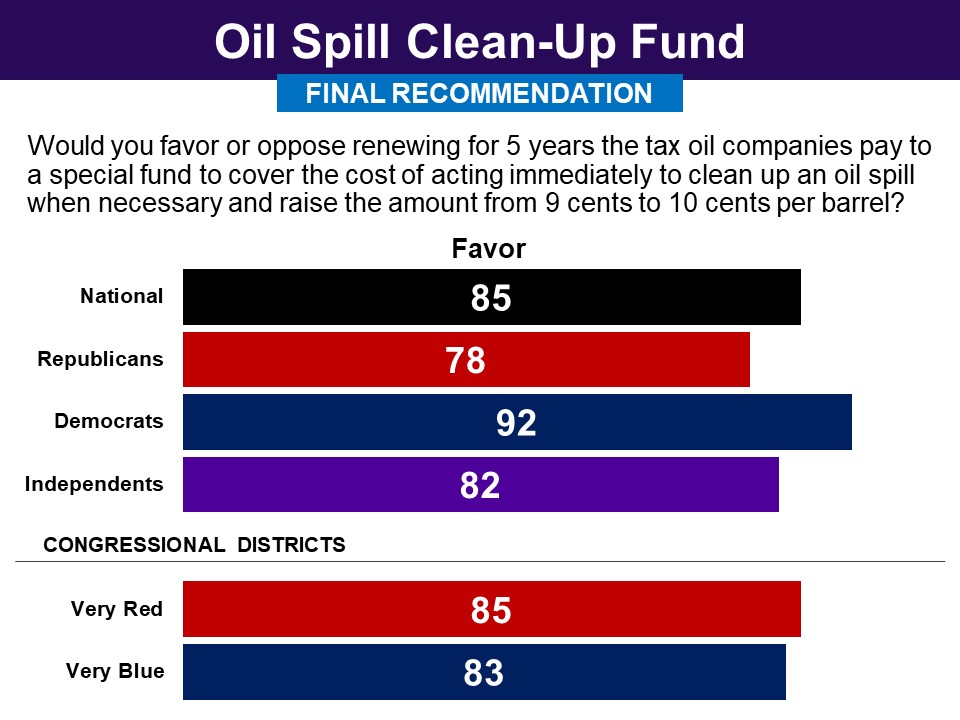

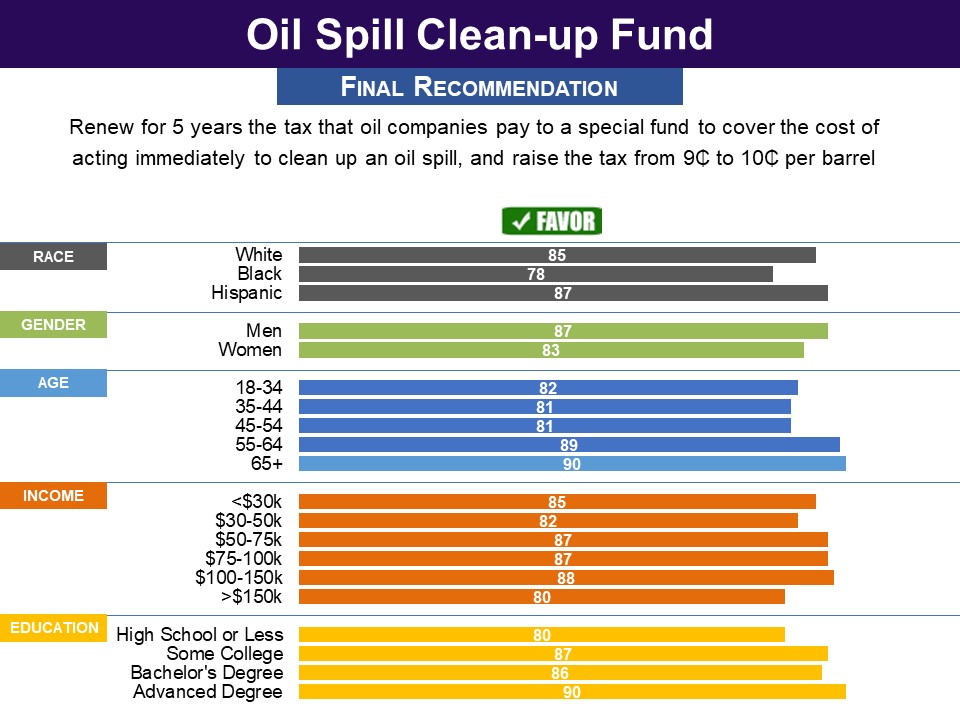

There has been a concern over how the clean-up of oil spills should be paid for, as some oil companies are not able to fully cover the costs. To address this concern, in 1990 the federal government implemented a tax on oil companies that would go into a clean-up fund if the company responsible for the spill couldn’t cover the costs or if the responsible party was unknown. In 2018, this tax expired. In 2019, the tax was renewed by the Further Consolidated Appropriations Act. Respondents were presented a briefing on oil spills and policies for funding their clean-up: As you probably know, there have been many oil spills, both on land as well as offshore, when there is an accident or breakdown of an oil carrier, a pipeline, or an oil rig. While you may have heard about the big spills, there are also many small and medium spills. As a general rule, the company that owns the system that caused the spill is responsible for paying the costs of the cleanup. However, in some cases the company does not have the financial means to pay for the cleanup or they resist taking responsibility. Because it is important to react quickly to an oil spill in order to prevent further damage, in 1986, Congress created a special fund to pay the cost of acting immediately in the event that the responsible company does not act promptly. The federal government is still empowered to pursue companies to cover those costs later. Though most companies repay the fund, sometimes there is a legal battle and sometimes the company does not have the means to pay or goes out of business. To pay for this fund, Congress imposed a 9 cent per barrel tax on all oil companies. The fund has received about $500 million per year from oil companies. They were then informed that: While this tax has been renewed numerous times over the years, it has at times lapsed, and most recently was only renewed for one year. Finally, they were presented with a proposal “to renew the tax for a 5 year period and to raise the amount to 10 cents. (The amount has not been adjusted for inflation since the tax was established in 1986.)” Arguments for and against this proposal were evaluated, with the argument in favor doing overwhelmingly better among all groups, by around 60 points. Status of Proposal |

|

OIL AND GAS DRILLING IN ENVIRONMENTALLY SENSITIVE AREAS |

|

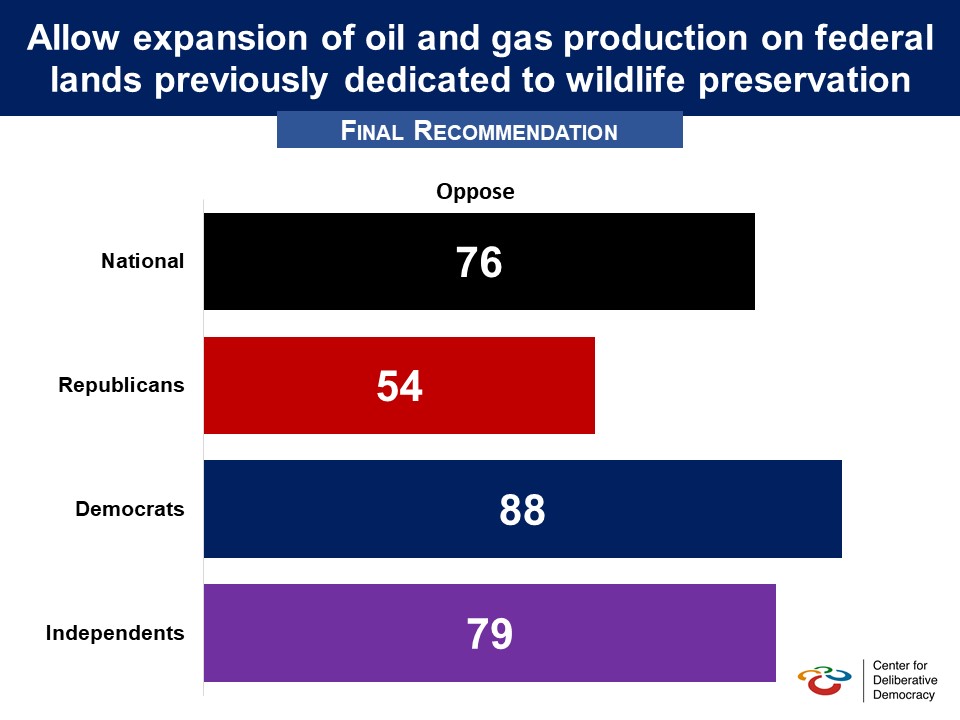

Respondents were presented with the following briefing material as part of an in-person deliberation conducted by Stanford University’s Center for Deliberative Democracy in September 2019: Instead of focusing on climate change, some Americans believe the US should expand oil and gas production. This focus, they maintain, can ensure an abundant, secure supply of energy for the US, increase prosperity and jobs, and lower energy prices for consumers. Even though the US is the world’s largest oil producer, it still imports more oil and gas than it exports, and, they say, energy independence is important for our national security. Additionally, many believe that government regulation should not constrain private sector innovation. In contrast, advocates for a rapid switch to renewable energy sources stress that human reliance on fossil fuels is driving a disastrous acceleration of climate change; that renewable energy is the ultimate form of energy security, and that the private sector can be incentivized to speed up innovation for renewable energy. Some advocate expanded oil and gas production on federal lands now dedicated to wildlife preservation. They believe we can design less restrictive regulations, while still maintaining our national commitment to protecting endangered species and ecosystems. But critics of this approach assert that the Department of Interior’s current efforts to protect federal lands are already too weak, and that we need stronger restrictions in light of the growing threat of extinction faced by many species and natural environments. Another issue in environmental and energy policy today concerns the pros and cons of fracking. Advocates want to allow fracking in oil and gas fields throughout the United States in order to increase oil and gas production. Fracking, they argue, will create many new jobs and bring forth new sources of oil and gas and will enable us to speed up the closing of much dirtier coal-burning power plants. But critics believe fracking only deepens our dependence on fossil fuels, increasing greenhouse gas emissions, while also contaminating drinking water and posing other risks to health for workers and people in nearby communities. They were then presented with a proposal and arguments for and against: Proposal: The US should expand oil and gas production on federal lands previously dedicated to wildlife preservation. Argument in Favor: We need more domestic oil and gas production for our prosperity and security, and it is possible to design less restrictive Regulations in a fashion that continues to protect endangered species and ecosystems. Argument Against: The Department of Interior’s current efforts to protect the environmental integrity of federal lands are too weak, not too strong. They need strengthened in light of the growing threat of extinction faced by many species and possible other harm to natural environments. After receiving the briefing material, respondents deliberated on the proposals in-person. Finally, they were asked for their final recommendation. On a 0-10 scale, 76% opposed the proposal (0-4), including 54% of Republicans and 88% of Democrats. Related Standard Polls

When it comes to drilling in public land in general, partisan majorities have been opposed, with a majority of Democrats opposed, and a majority of Republicans in favor:

|

The other two received majority support, but less than half of Republicans were in favor:

The other two received majority support, but less than half of Republicans were in favor:

Status of Legislation

Status of Legislation

Status of Legislation

Status of Legislation

Status of Legislation

Status of Legislation

Status of Legislation

Status of Legislation

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Pre-Deliberation Poll

Pre-Deliberation Poll Pre-Deliberation Poll

Pre-Deliberation Poll

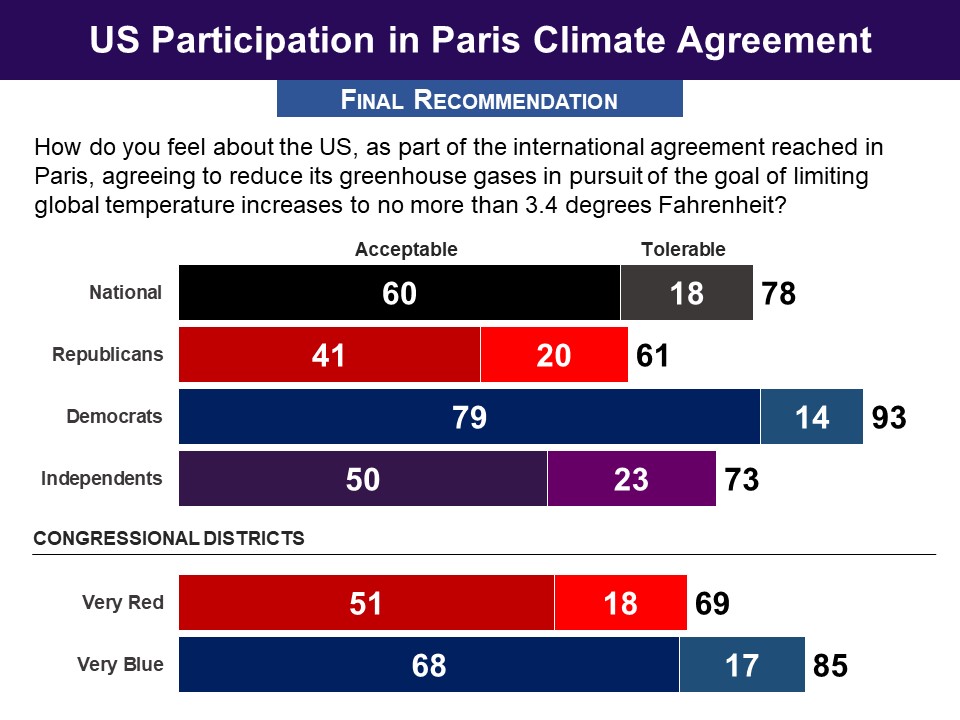

Respondents were asked how acceptable the proposal, for the US to agree to reduce its greenhouse gases, would be using a 0-10 scale, with 5 being ‘just tolerable’. Six in ten found the proposal acceptable (6-10), including 79% of Democrats but just 41% of Republicans. It was found at least tolerable (5-10) by 77%, including 93% of Democrats and 61% of Republicans.

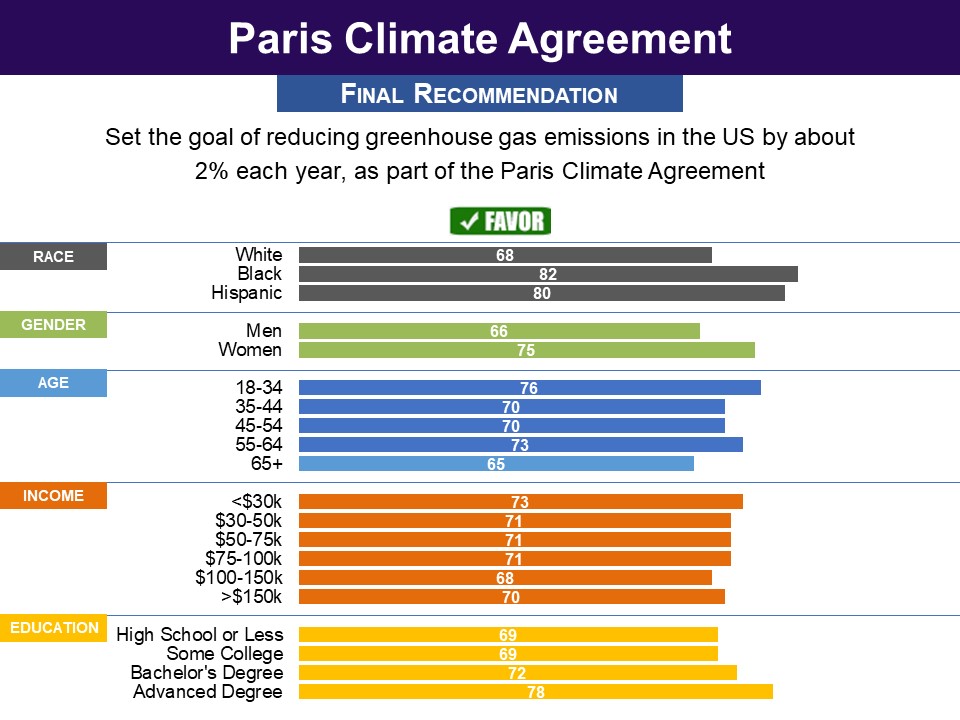

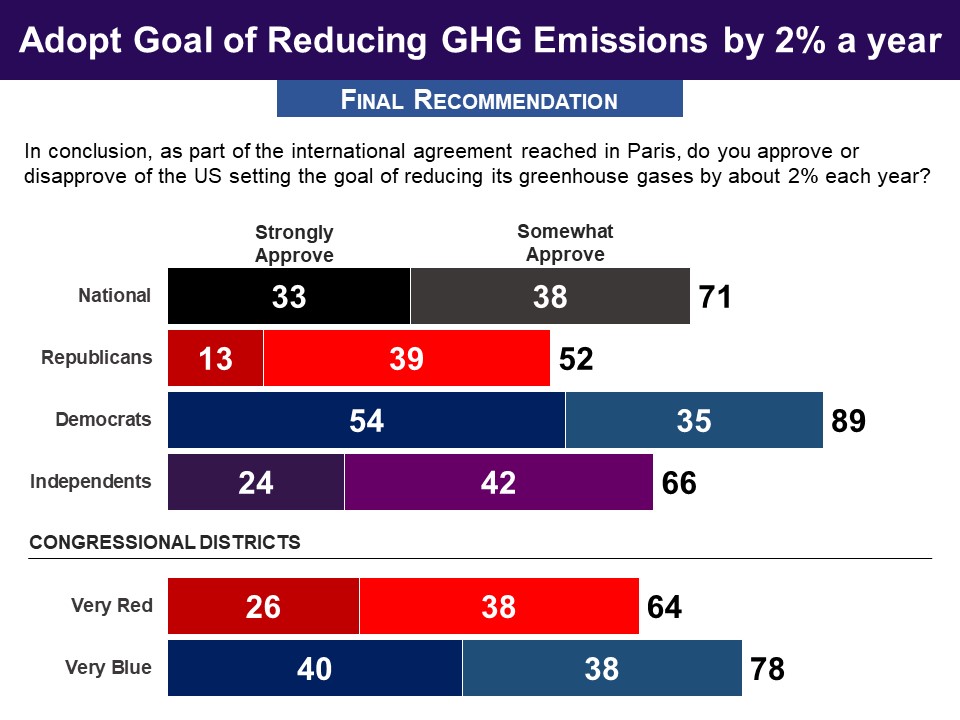

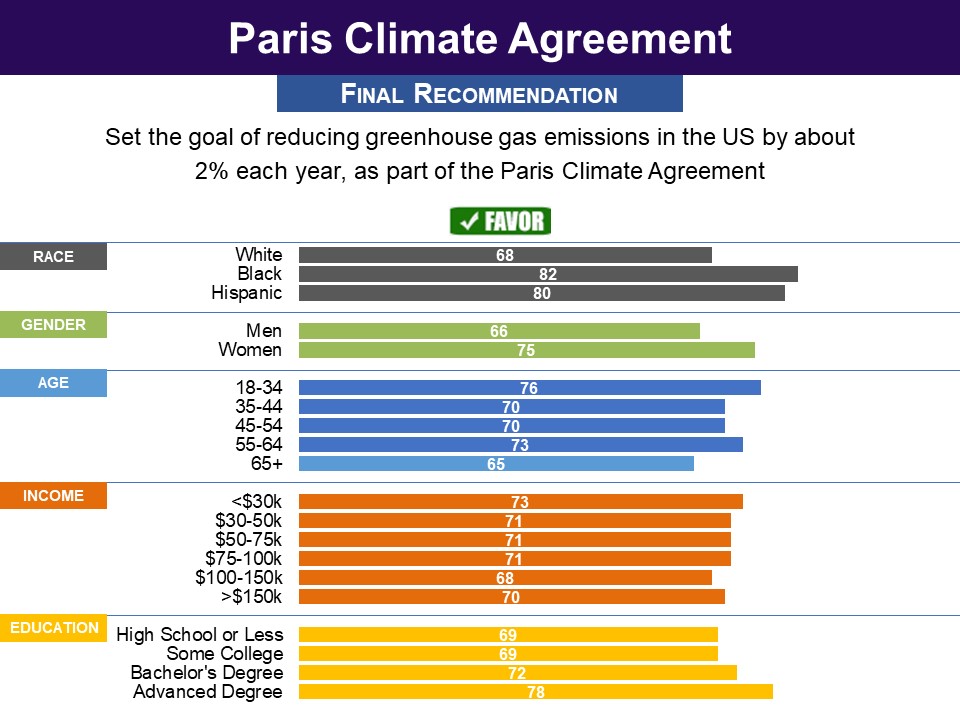

Respondents were asked how acceptable the proposal, for the US to agree to reduce its greenhouse gases, would be using a 0-10 scale, with 5 being ‘just tolerable’. Six in ten found the proposal acceptable (6-10), including 79% of Democrats but just 41% of Republicans. It was found at least tolerable (5-10) by 77%, including 93% of Democrats and 61% of Republicans.  At the end of the survey—after respondents had evaluated a range of concrete options aimed at reducing US greenhouse gases—they were provided a summary of the arguments previously given for and against US participation in the Paris agreement. Finally, they were asked whether they approved or disapproved of the US setting the goal of reducing its greenhouse gases by about 2% each year, as part of the international agreement reached in Paris. Seven in ten (71%) approved of the goal, including 52% of Republicans and 89% of Democrats.

At the end of the survey—after respondents had evaluated a range of concrete options aimed at reducing US greenhouse gases—they were provided a summary of the arguments previously given for and against US participation in the Paris agreement. Finally, they were asked whether they approved or disapproved of the US setting the goal of reducing its greenhouse gases by about 2% each year, as part of the international agreement reached in Paris. Seven in ten (71%) approved of the goal, including 52% of Republicans and 89% of Democrats.

They were then asked whether they favored lifting the ban. Six in ten opposed this policy, but this was not bipartisan. While 86% of Democrats opposed it but just one third of Republicans.

They were then asked whether they favored lifting the ban. Six in ten opposed this policy, but this was not bipartisan. While 86% of Democrats opposed it but just one third of Republicans.

Respondents in the 15 states with governors who requested a waiver were also asked if they approved of that request. In those states, seven in ten approved, including 88% of Democrats and half of Republicans.

Respondents in the 15 states with governors who requested a waiver were also asked if they approved of that request. In those states, seven in ten approved, including 88% of Democrats and half of Republicans.

Finally, asked whether they favored removing the requirement that oil drilling companies hire independent auditors to conduct safety inspections, a large bipartisan majority of three in four opposed, including 68% of Republicans and 83% of Democrats.

Finally, asked whether they favored removing the requirement that oil drilling companies hire independent auditors to conduct safety inspections, a large bipartisan majority of three in four opposed, including 68% of Republicans and 83% of Democrats.

Status of Proposal

Status of Proposal

In the end, a large bipartisan majority of 85% favored the proposal, including 78% of Republicans and 92% of Democrats.

In the end, a large bipartisan majority of 85% favored the proposal, including 78% of Republicans and 92% of Democrats.

Pre-Deliberation Poll

Pre-Deliberation Poll