|

Respondents were introduced to individual income taxes, as follows:

The first revenue area we will explore is income taxes - the biggest source of revenues. The table below shows the effective tax rates that people with different income levels pay, on average, to the federal government, most often by money being withheld from their paychecks.

The effective tax rate shown below is the percentage of their income that people actually pay, after exemptions, credits and deductions. These are lower than a person’s marginal tax rate, which you may have read about, and only applies to some of their earnings. These effective tax rates include FICA payments that are made to Social Security and Medicare.

They were then told that they could increase or decrease the effective rates for eight different income categories, starting at $40,000. Rates based on the 2017 tax bill were presented as the base line. For each income bracket they were given the opportunity to:

- decrease the tax rate further by increments of 1 percentage point,

- raise the tax rate by reinstating the higher tax rates previous that were in place before the 2017 tax bill

- increase the tax rate above the 2017 rate by increments of 1 percentage point.

The effect this would have on the amount of revenue generated was specified at each level. Naturally, decreases in the tax rates resulted in increases in the budget deficit shown in the bubble that followed them, just as increases in the tax rates resulted in decreases to the deficit.

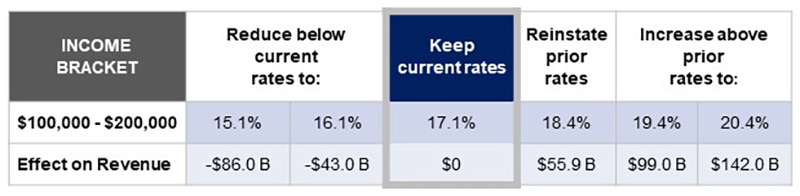

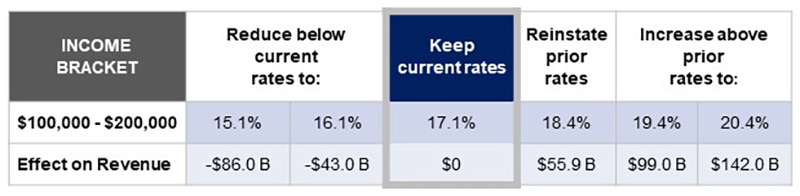

Here is an example of what they saw, in this case for the $100,000 to $200,000 income bracket:

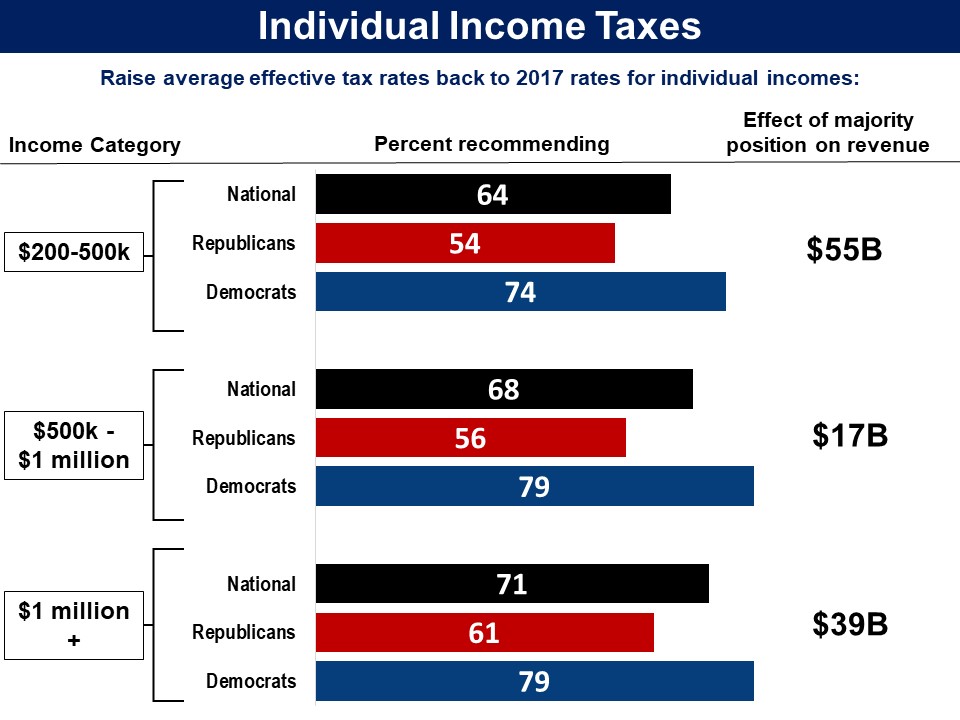

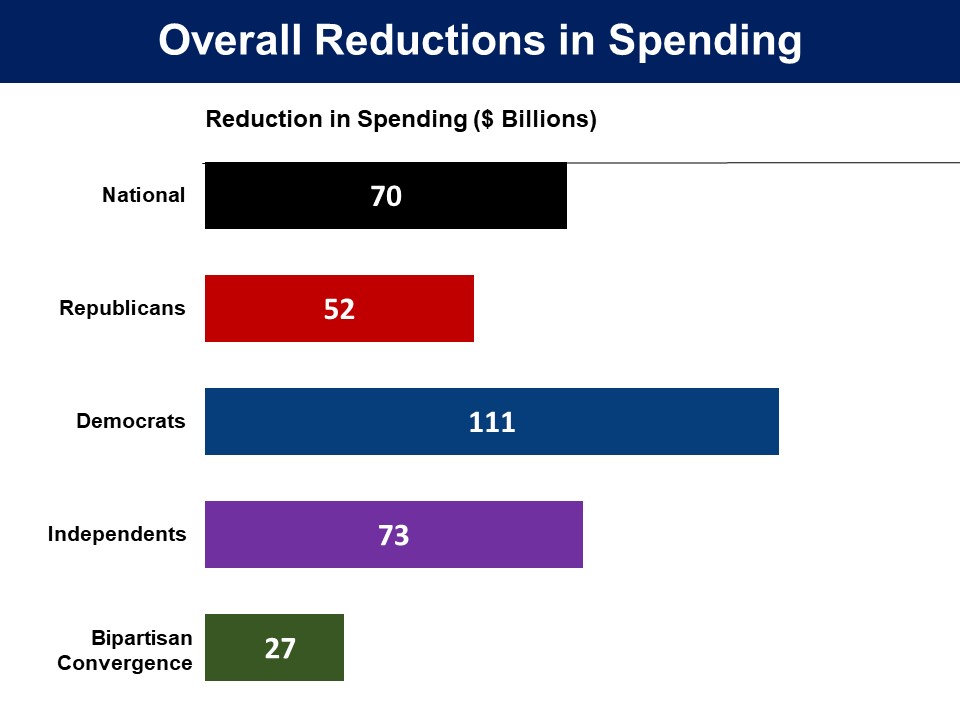

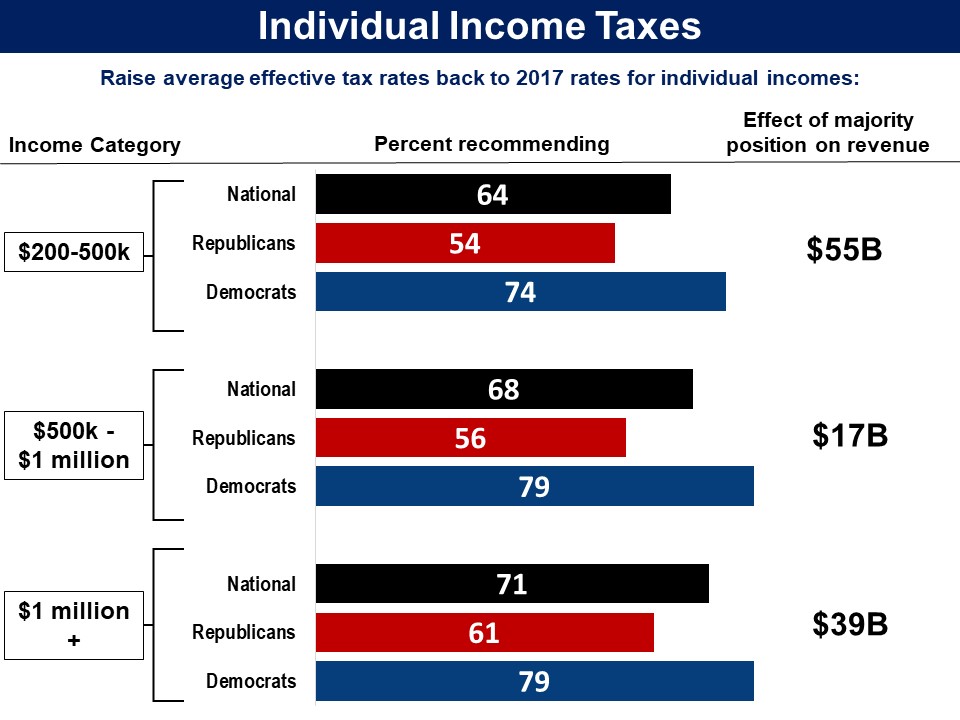

Majorities of Republicans and Democrats converged on reinstating 2017 rates for incomes above $200,000, generating $111 billion. This was the same as the Republican majority position.

The overall majority and a majority of Democrats reinstated the 2017 rates for incomes over $100,000, generating an additional $56 billion in deficit reduction, for a total deficit reduction of $167 billion deficit reduction.

Democrats went even further, with a majority increasing the rate for incomes above $500,000 by one percentage point above the 2017 rate. These generated an additional $32 billion, for a total deficit reduction of $199 billion.

Related Standard Polls

In standard polls the overall majority and Democrats have consistently shown support for increasing taxes on upper incomes. Republicans, though, respond differently to different types of questions, consistent with their ambivalent responses to the arguments for and against increasing taxes on the wealthy.

A large majority, including Republicans has said that the wealthy pay too little in taxes:

- Asked whether “wealthy households” pay “too much, too little, or about the right amount in federal taxes,” 72% said they pay too little (Democrats 83%, Republicans 56%). (October 2017, AP-NORC)

When asked whether they favor or oppose raising taxes on Americans earning over $250,000 a robust bipartisan majority has favored it.

- Asked whether they favor “increasing the tax rate on Americans earning more than $250,000,” 77% were in favor, including 88% of Democrats and 61% of Republicans. (2017, PRRI)

However when they are given the opportunity to increase, decrease or keep taxes the same, and neither given information on what those rates are and what change they are proposing, Republicans do not increase taxes on incomes over $250,000 or the wealthy in general, while the overall majority and Democrats do.

- Asked whether “tax rates on household income over $250,000,” should be raised, kept the same or lowered, 58% said they should be raised (up from 43% in 2017), including 71% of Democrats, but just 44% of Republicans (Republicans kept the same 31%, lowered 21%). (September 2019, Pew)

- Asked whether “wealthy Americans,” should pay more in taxes, pay less, or if the amount shouldn’t be changed, 54% felt they should pay more, including a majority of Democrats (78%), but just 29% of Republicans (amount shouldn’t change 49%, pay less 15%). (January 2019, CBS News)

When asked whether they favor increasing tax rates on families earning over $250,000 support has been lower.

- Asked whether they favor, “increasing tax rates only on families earning over 250,000 dollars a year,” 44% were in favor while 48% opposed. Among Democrats, 56% were in favor. Among Republicans only 32% were in favor (59% opposed). (January 2019, Fox News)

For income over $400,000 a majority has supported raising taxes:

- Asked whether they support, “raising taxes on Americans making $400,000 or more and keeping tax rates at current levels for those making less than $400,000,” 67% were in support, including 88% of Democrats. Among Republicans, 45% were in support and 54% opposed. (November 2020, SurveyMonkey)

For incomes over $1 million pluralities or modest majorities of Republicans have joined in calling for increases, even when the term “families” is used.

- Asked whether they favor “increasing tax rates only on families earning over one million dollars a year,” 65% were in favor, including 81% of Democrats and 47% of Republicans (opposed 43%). (January 2019, Fox News)

- Asked whether they favor “increasing income taxes on people making over one million dollars per year,” 66% were in favor, including 80% of Democrats and 50% of Republicans (opposed 25%). (2016, American National Election Survey)

- Asked whether they favor, “raising taxes on people earning more than $1 million per year,” 68% were in favor, including 87% of Democrats and 53% of Republicans. (May 2015, CBS/New York Times)

For household with incomes over $10 million, a bipartisan majority has favored increases:

- Asked whether they favor, “increasing tax rates only on families earning over ten million dollars a year,” 70% were in favor, including 85% of Democrats and 54% of Republicans. (January 2019, Fox News)

|

|

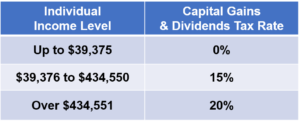

Respondents were presented a proposal to eliminate the special treatment of capital gains and dividends, and instead tax them as ordinary income. This would increase the tax rates for that income and raise revenue — a change that would mostly affect those with upper incomes.

They were first introduced to taxes on capital gains and dividends, as follows:

As you may know, income from capital gains and dividends are taxed differently than other kinds of income (such as income from wages and salaries).

- Capital gains are profits from the sale of investments, such as stocks and property.

- Dividends are profits distributed to people who own stock in a company.

They were told that increases to these taxes would primarily effect those with higher incomes:

About 90% of capital gains go to people making above $200,000. Thus, increases to this tax rate, while affecting all income groups, will primarily affect people in the highest income brackets.

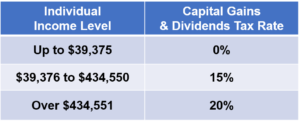

Alongside the briefing, they were shown a chart with the current tax rates on capital gains and dividends for different income levels. Alongside the briefing, they were shown a chart with the current tax rates on capital gains and dividends for different income levels.

Respondents were then presented the proposal:

There is a proposal for changing the tax rate for capital gains and dividends: capital gains and/or dividends would be taxed as ordinary income rather than at the special tax rates indicated on the previous screen.

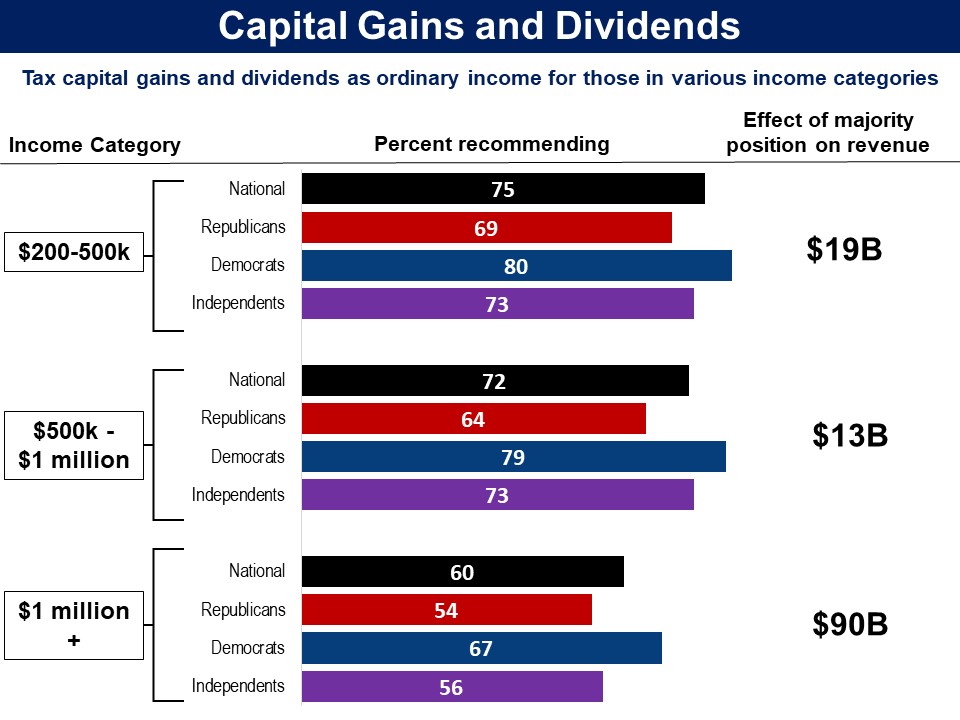

They were then shown seven income levels, starting from $40,000 to $50,000 and ending at $1 million and over. For each income level, they were given the option to have taxpayers in that bracket have their capital gains and dividends treated like ordinary income, and were shown how much revenue that would generate.

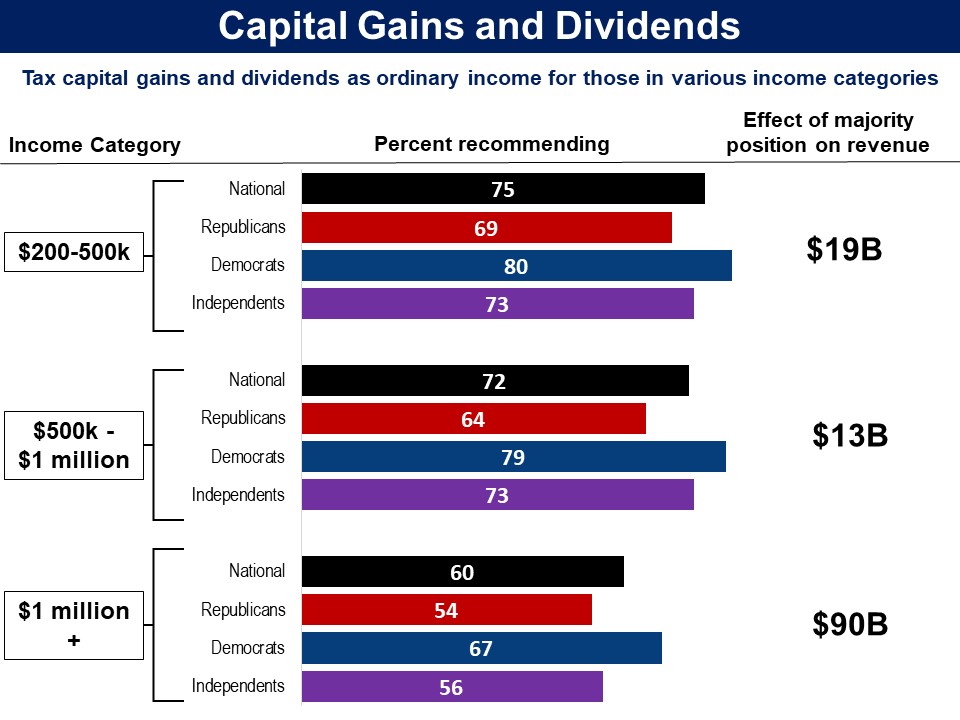

Bipartisan majorities recommended taxing capital gains and dividends as ordinary income for income groups above $200,000, generating a total of $122 billion. A majority of Democrats went further and recommended that option for incomes between $100,000 and $200,000, generating $12 billion.

No majority recommended applying the ordinary rate to those with incomes under $100,000.

Results from CDD

In the deliberative poll done in 2019 by Stanford University’s Center for Deliberative Democracy, respondents were asked whether, “Capital gains — income earned when an investment that has increased in value is sold — should be taxed the same as ordinary wage income.” Before providing their final response, they were presented with briefing materials on capital gains, and arguments for and against taxing them like ordinary income, and participated in an in-person deliberation. However, unlike the PPC survey, they were only able to make an across the board change, while in the PPC survey they were able to vary their response for different income levels. Asked for their final recommendation on a 0-10 scale, with 5 being “in the middle”, 50% were in favor (6-10) of treating capital gains the same as ordinary income (Democrats 60%, Republicans 40%). Including the middle option (5-10), 66% were not opposed to the proposal, including 80% of Democrats and 54% of Republicans.

Before receiving any briefing materials or engaging in the deliberation process respondents were given the same poll question as those asked afterwards. Support for treating all capital gains the same as ordinary income increased from the pre-deliberation poll to the post-deliberation poll, overall (44% to 50%), and among Republicans (38% to 40%) and Democrats (54% to 60%). Including the middle option (5), those not opposed to the proposal (5-10) remained the same overall and among Democrats, but decreased among Republicans (58% to 54%).

Related Standard Polls

Without being given information about the tax rates on capital gains, a modest majority has favored raising the capital gains tax, but not a majority of Republicans. A large number did not express an opinion either way.

- Asked whether, as a way, “to reduce the budget deficit,” they would favor, “increasing the capital gains tax rate on income from investments,” 52% favored, including 59% of Democrats, but just 42% of Republicans (opposed 49%). (March 2013, CBS News)

- Asked whether, “as a way to pay for tax cuts or additional government spending,” they would favor, “increasing the capital gains tax on the stocks held by people in households making more than $500,000 a year,” 56% were in favor, including 71% of Democrats and 46% of Republicans. Twenty five percent chose “neither favor or oppose.” (January 2015, AP/GfK)

|

|

- $200k-500k* (generates $19 billion)

|

|

- $500k-$1 million* (generates $13 billion)

|

|

- Above $1 million* (generates $90 billion)

|

|

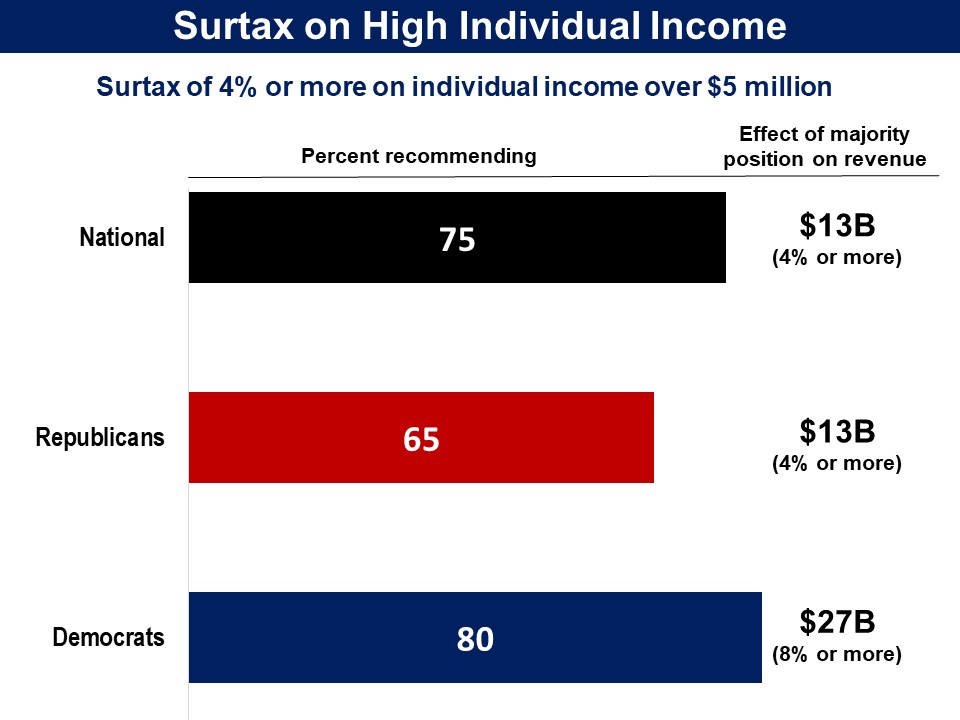

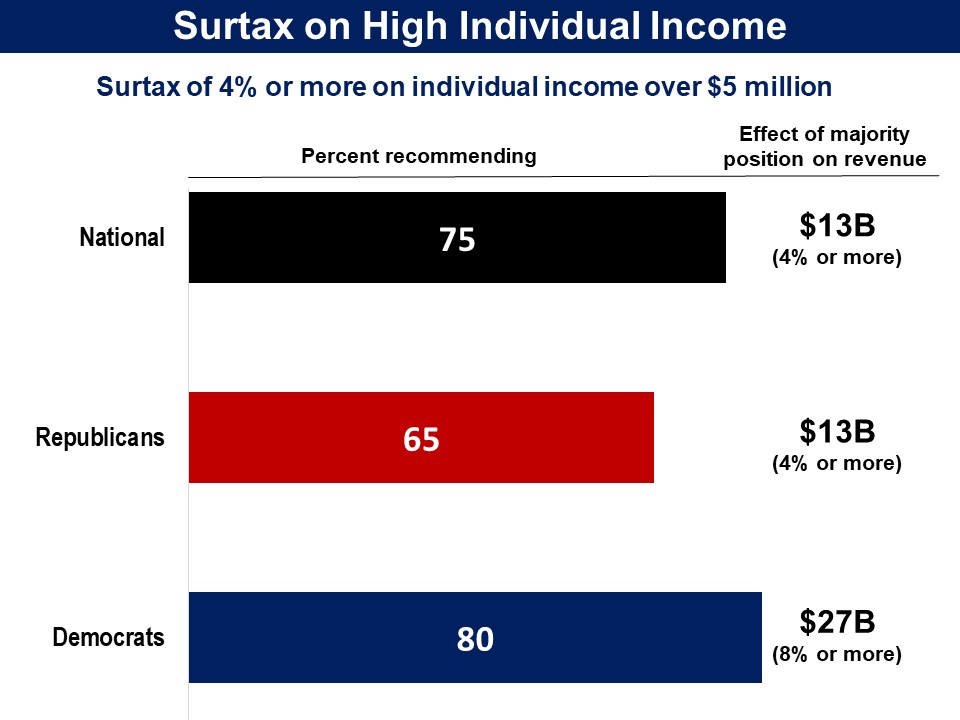

Respondents were introduced to a proposal to increase revenue by adopting a surtax of 4 percent on income over $5 million that was put forward by Warren Buffett and former Presidential candidate Hillary Clinton, which she referred to as the “Fair Share Surcharge”.

They were given the opportunity to charge an “extra tax” on income above $5 million (of 4, 8, 12, 16 or 20%). They were told that, “it would have no effect on the first $5 million of income, but there would be an extra tax on the amount over $5 million.”

Three quarters of respondents imposed a surtax of at least 4%, generating $13 billion. This included nearly two thirds of Republicans and over eight in ten Democrats (83%). Democrats went further, with six in ten imposing an 8% surtax, generating an additional $14 billion.

Results from CDD

The Center for Deliberative Democracy’s 2019 deliberative poll found similar support for a higher tax rate on income over $2 million, without the amount of the increase being specified. Before providing their final response, they were presented with briefing materials on the tax system and income inequality, and arguments for and against adopting a higher income tax for income over $2 million, and participated in an in-person deliberation. On a 0-10 scale, with 5 being “in the middle”, 72% gave the proposal a favorable rating (6-10), including 53% of Republicans and 86% of Democrats.

Before receiving any briefing materials or engaging in the deliberation process respondents were given the same poll question as those asked afterwards. Support was relatively unchanged from the pre-deliberation poll to the post-deliberation poll, overall (70% to 72%) and among Republicans (52% to 53%) and Democrats (87% to 86%).

Related Standard Polls

Majorities have consistently felt, over the last few decades, that upper-income people are paying too little in taxes:

- In 2018, asked whether “upper-income people,” are “paying their FAIR share in federal taxes, paying too MUCH or paying too LITTLE,” 62% felt they were paying too little, 26% their fair share, and 10% too much. Since the question was first asked in 1992, the lowest share saying upper-income people pay too little was 55%. Partisan breakouts were not provided. (Gallup)

A large and bipartisan majority has felt that the wealthy pay too little in taxes:

- Asked whether “wealthy households” pay “too much, too little, or about the right amount in federal taxes,” 72% felt they pay too little (Democrats 83%, Republicans 56%). (October 2017, AP-NORC)

However, when asked whether taxes on the wealthy should be increased, kept the same or decreased, a smaller and much more partisan majority has chosen to increase them, with the largest share of Republicans opting to keep them the same:

- Asked whether “wealthy Americans,” should pay more in taxes, pay less, or if the amount shouldn’t be changed, 54% felt they should pay more, including a majority of Democrats (78%), but just 29% of Republicans (Republicans amount shouldn’t change 49%, pay less 15%). (January 2019, CBS News)

A large and bipartisan majority has favored increasing the tax rate on households with income over $10 million:

- Asked whether they favor, “increasing tax rates only on families earning over ten million dollars a year,” 70% were in favor, including 85% of Democrats and 54% of Republicans. (January 2019, Fox News)

A smaller majority, that does not include a majority of Republicans, has favored increasing the top tax rate on income over $10 million, from the current 37% rate to a new 70% rate:

- Told that, “Currently the top tax rate is 37%,” and asked whether they favor a, “tax proposal that would apply a 70% rate to the 10 millionth dollar and beyond for individuals making $10 million a year or more in reportable income,” 59% were in favor, including 71% of Democrats and 45% of Republicans (oppose 55%). (January 2019, Hill/Harris-X)

Status of Legislation

The proposal to adopt a surtax of 4 percent on income over $5 million was put forward by Warren Buffet and Hillary Clinton, but was never introduced as legislation.

Currently, there is a similar proposal in the Millionaires Surtax Act, sponsored in the House by Rep. Don Beyer (D) (H.R. 5043) and in the Senate by Sen. Chris Van Hollen (D) (S. 2809) in the 116th Congress. This legislation would apply an additional ten percent tax on income over $1 million ($2 million for married couples). It would apply equally to wages and salaries as well as to capital gains and other investment income. The bill has not made it out of committee.

|

|

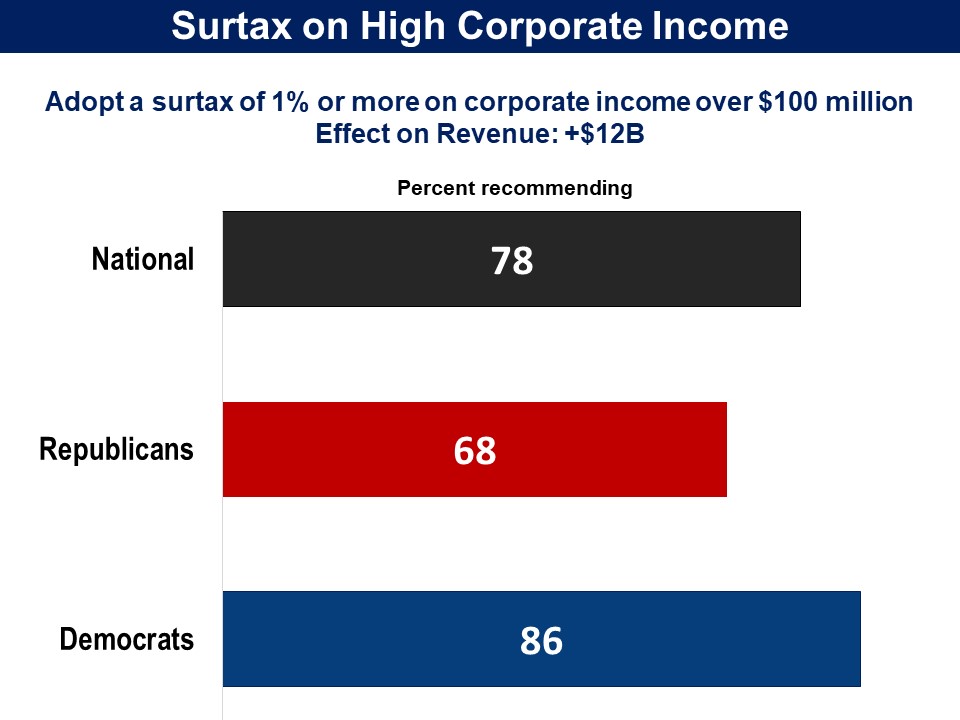

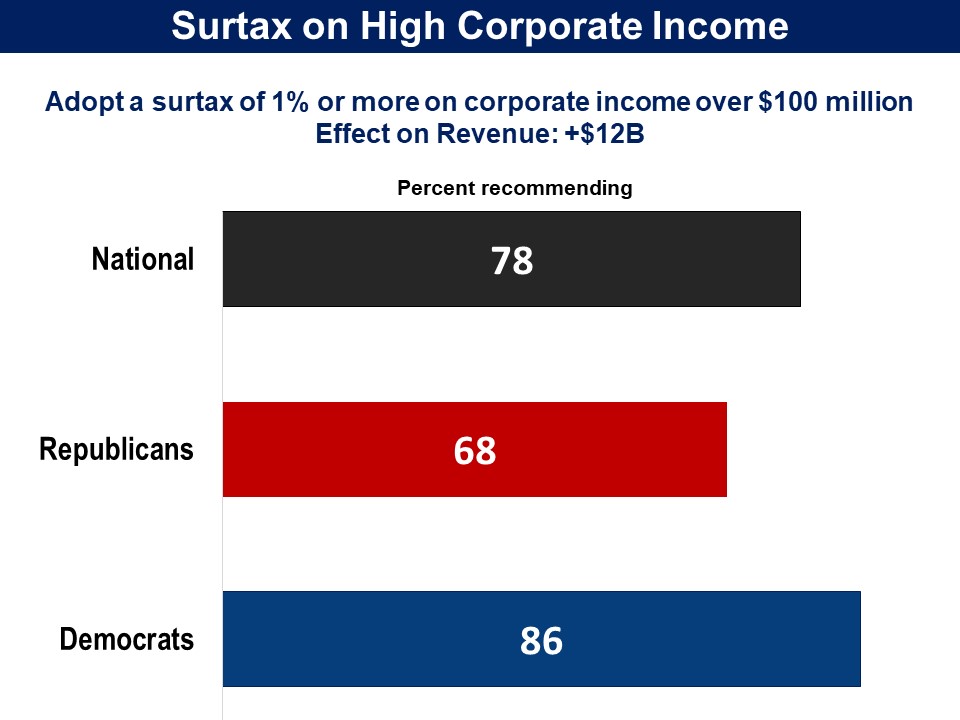

Respondents were introduced to a proposal to increase revenue by adopting a seven percent surtax on corporate income over $100 million, which was proposed by Senator Elizabeth Warren (D) in her presidential campaign.

They were given the opportunity to adopt a surtax on corporate income over $100 million of one, three, five, seven or nine percent. They were told that this, “would affect approximately 1,200 corporations.”

Overall, more than three quarters favored the surtax of one percent or higher, including eight in ten Democrats and two thirds of Republicans, generating $12 billion. Democrats went further, with 63% imposing a three percent surtax, generating an additional $24 billion.

Related Standard Polls

When asked whether corporations pay too much, too little, or about the right amount in taxes, without being told what the current tax rate is, majorities overall have said they pay too little, including majorities of Democrats and a majority or plurality of Republicans.

- Asked about federal taxes on “large corporations,” 73% said they pay too little (81% of Democrats, 57% of Republicans). (October 2017, AP-NORC)

- Asked whether “large business corporations pay their fair share in taxes, pay too little, or pay too much,” 65% said too little as did 77% Democrats and 50% of Republicans (fair share 26%, too much 16%). (September 2017, ABC News/Washington Post)

- Asked whether “corporations,” are “paying their FAIR share in federal taxes, paying too MUCH or paying too LITTLE,” 66% said they pay too little in 2018. Since 2004, when the question was first asked, a majority has always said they pay too little. Partisan breakouts were not provided. (2018, Gallup)

When asked whether taxes on large corporations should be increased, decreased or kept the same, without being told what the current tax rate is, majorities nationally and among Democrats, but not Republicans, have said they should be increased:

- Asked about “tax rates on large businesses and corporations,” 65% said they should be raised, including 85% of Democrats. Among Republicans, 45% said they should be raised a lot (30% kept the same, 23% lowered). (April 2023, Pew)

- Asked about “tax rates on large businesses and corporations,” 68% said they should be raised, including 84% of Democrats and 50% of Republicans (kept the same 26%, lowered 19%). (September 2019, Pew)

- Asked about taxes on “large corporations,” 56% said they should be increased, including 64% of Democrats. Among Republicans, 40% said they should be increased, but 57% said keep the same (27%) or decrease (30%). (October 2017, CBS News)

When the proposal of reducing taxes on corporations or businesses is put forward, a majority or plurality is opposed, but, as one would expect from research on “acquiescence bias”, support is higher than when a respondent is presented the three options (increasing, decreasing or keeping the same). This effect was very strong among Republicans: while small numbers of Republicans called for reductions in the three-way question, a clear majority has approved of the proposal for reductions. Both the polls below were conducted in the fall of 2017 when the Republican tax bill calling for a reduction in the corporate tax was being debated in Congress.

- Asked whether they favor or oppose, “lowering taxes on corporations,” 34% favored it (Republicans 59%, Democrats 14%) while 59% were opposed (Republicans 33%, Democrats 59%) (September 2017, Fox)

- Asked whether they support or oppose, “reducing income taxes paid by businesses,” 45% were in support (Democrats 32%, Republicans 60%) and 48% were opposed (Democrats 60%, Republicans 34%). (September 2017, ABC News/Washington Post)

|

|

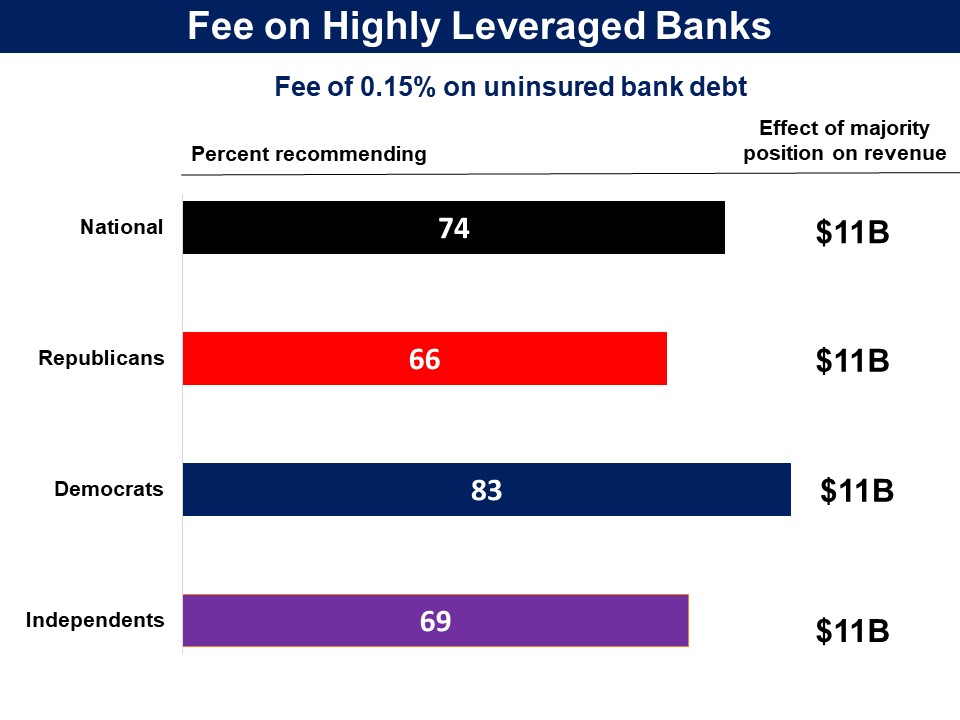

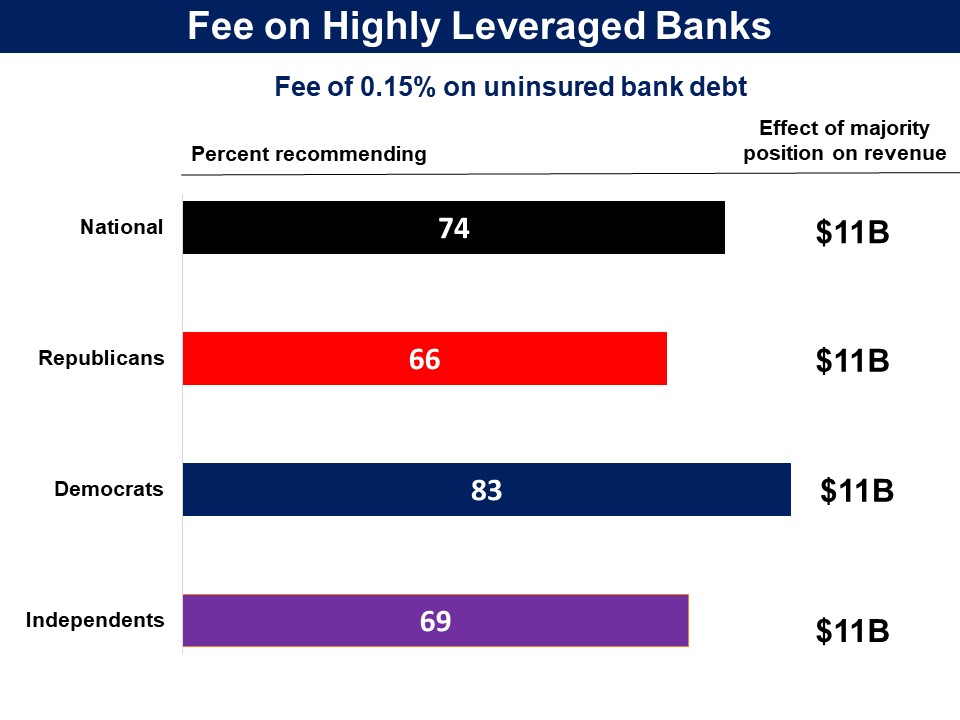

Respondents were introduced to a proposal to adopt a fee on the uninsured debt of large financial institutions that is based on a Congressional Budget Office recommendation for reducing the federal deficit:

One proposal is to impose a fee on very large financial institutions (such as banks) that have taken on large amounts of uninsured debt. This is meant to discourage them from taking on high levels of risk, as well as to generate revenue for the federal government. Institutions with assets over $50 billion (these are roughly the 100 largest firms) would pay a fee of 0.15 percent of their uninsured debt. This would increase revenues by $11 billion.

A robust majority of 74% endorsed this plan, which generated $11 billion in revenue. Two thirds of Republicans were supportive of this fee as were 83% of Democrats. Related Standard Poll Related Standard Poll

When presented the proposal for a fee on the largest banks and financial institutions, paired with a financial transactions tax, and the rationale for doing so, a bipartisan majority has been in favor:

- Asked whether they favor a policy to, “Institute a financial transactions tax and a ‘too big to fail’ fee on the largest banks and financial institutions to discourage risky investments and guard against more bailouts,” 66% were in favor, Including 79% of Democrats and 52% of Republicans. (November 2012, Democracy Corps)

Without the rationale included, and without the stipulation that it would apply to uninsured debt, only a plurality has been in favor of adopting a fee on the debt of large financial institutions:

- Asked whether they favor, “Instituting a fee on debts of banks and other financial institutions with more than $50 billion in assets,” 47% were in favor and 13% opposed, with 36% choosing “neither favor nor oppose”. Partisan breakouts were not provided. (January 2015, AP/GfK)

|

|

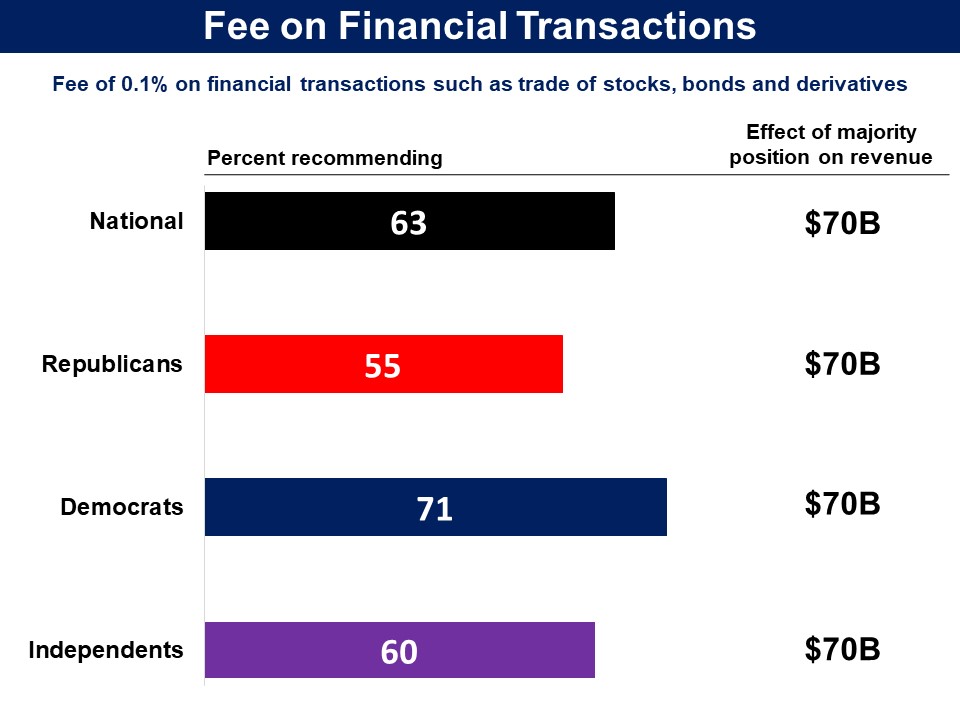

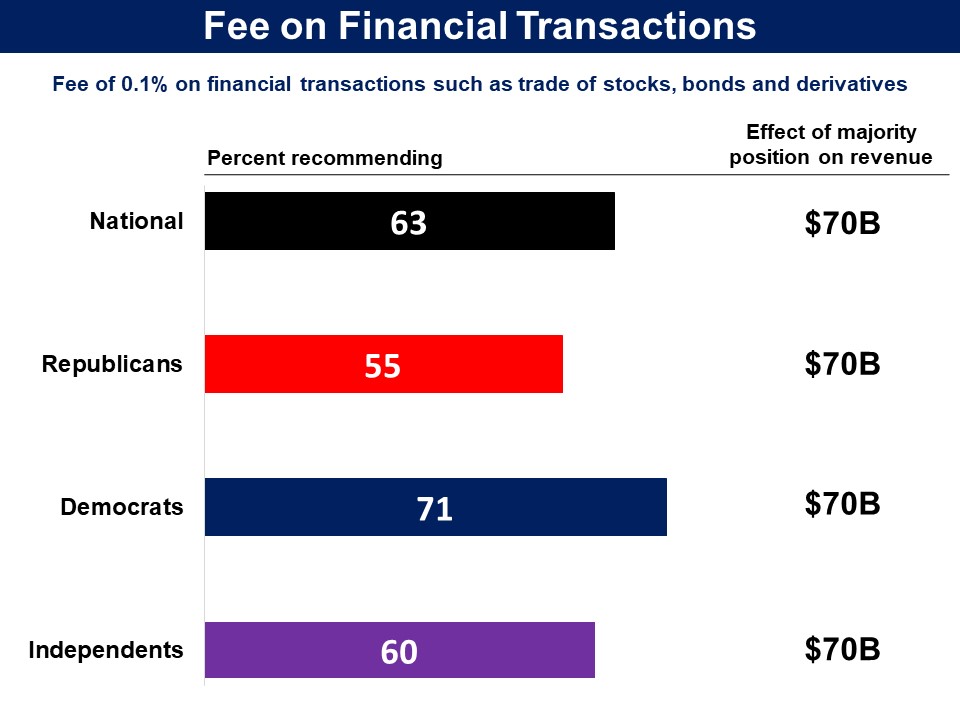

Respondents were introduced to a proposal to adopt a tax on financial transactions that is based on a Congressional Budget Office recommendation for reducing the federal deficit:

Every day that financial markets are open, roughly $1 trillion worth of stocks, bonds and derivatives are traded. Another proposal would tax each trade transaction by one tenth of one percent (0.1%) of the value of the security being traded. For example, this would be a tax of $1 on a trade worth $1,000. This would increase revenues by $70 billion.

Overall, sixty-three percent recommended a financial transactions tax, while 36% recommended against it. Fifty-five percent of Republicans recommended this tax as did seven in ten Democrats.

Related Standard Poll

When the amount of the tax is not presented, a majority overall, including a majority of Republicans and a plurality of Democrats, has opposed increasing taxes on financial transactions:

- Asked whether they favor, “raising taxes on financial transactions such as the sale of stocks or bonds,” 59% opposed, including 75% of Republicans and 48% of Democrats (43% favor). (May 2015, CBS/New York Times)

When presented the proposal for a a financial transactions tax and financial institutions, paired with a fee on the largest banks, and the rationale for doing so, a bipartisan majority has been in favor:

- Asked whether they favor a policy to, “Institute a financial transactions tax and a ‘too big to fail’ fee on the largest banks and financial institutions to discourage risky investments and guard against more bailouts,” 66% were in favor, Including 79% of Democrats and 52% of Republicans. (November 2012, Democracy Corps)

Status of Legislation

A similar proposal for adopting taxes on financial transactions is currently in the 118th Congress, in the Wall Street Speculation Tax Act by Rep. Barbara Lee (D) (H.R. 4119) and Sen. Bernie Sanders (I) (S. 1990). Specifically, trades would be taxed at a rate of 0.5 percent for stocks, 0.1 percent for bonds, and 0.005 percent for derivatives. This bill has not yet made it out of committee.

|

|

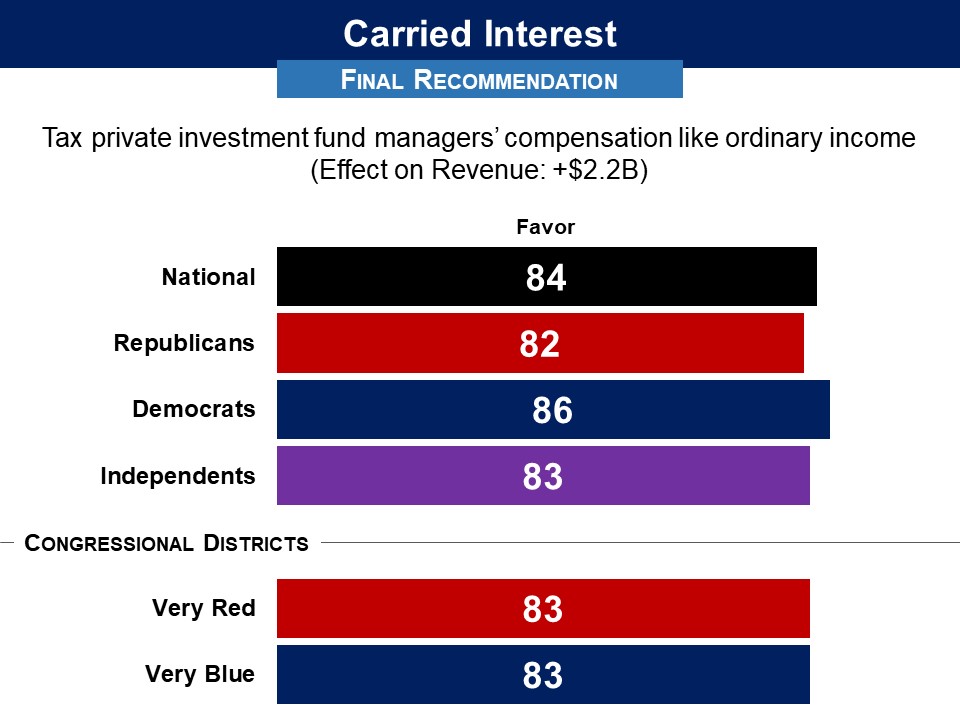

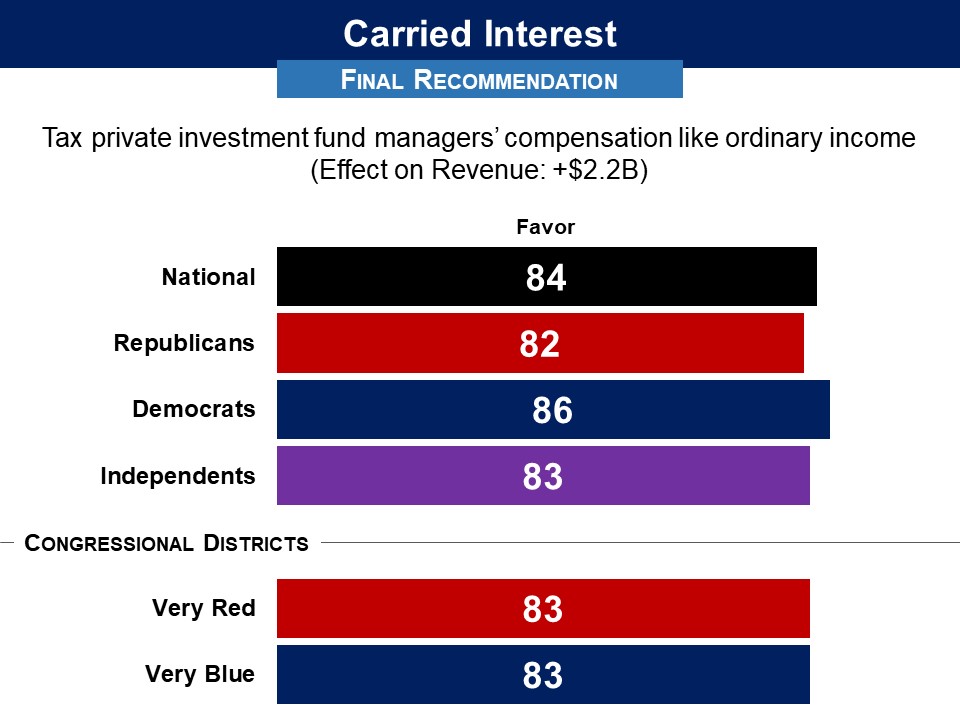

Respondents were introduced to a proposal to eliminate a special tax break known as the ‘hedge fund managers tax’. This proposal is in the Carried Interest Fairness Act (H.R. 1735, S. 781).

They were briefed on the ‘hedge fund managers’ tax as follows:

Managers of private investment funds, such as hedge funds, are paid in part by giving them a percentage of the profits of the firm even though they have not invested money that is at risk. Currently this income is taxed at the same level as dividends or capital gains – that is, with a top rate of 23.8%, which for high income managers is substantially less than it would be if it were taxed like ordinary income.

They were then presented a proposal to: …tax this “carried interest” compensation like ordinary income, such as wages. This would raise extra revenue of $2.1 billion and reduce the deficit accordingly.

In their final recommendation, 78% were in favor, including 75% of Republicans and 81% of Democrats.

Status of Legislation

The Carried Interest Fairness Act, sponsored in the House by Rep. Bill Pascrell (D) (H.R. 1735) and in the Senate by Sen. Tammy Baldwin (D) (S. 781) were introduced in the 116th Congress. These bills have not made it out of committee.

|

|

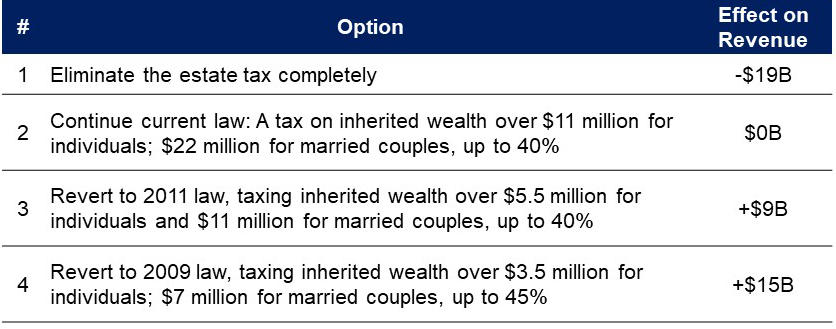

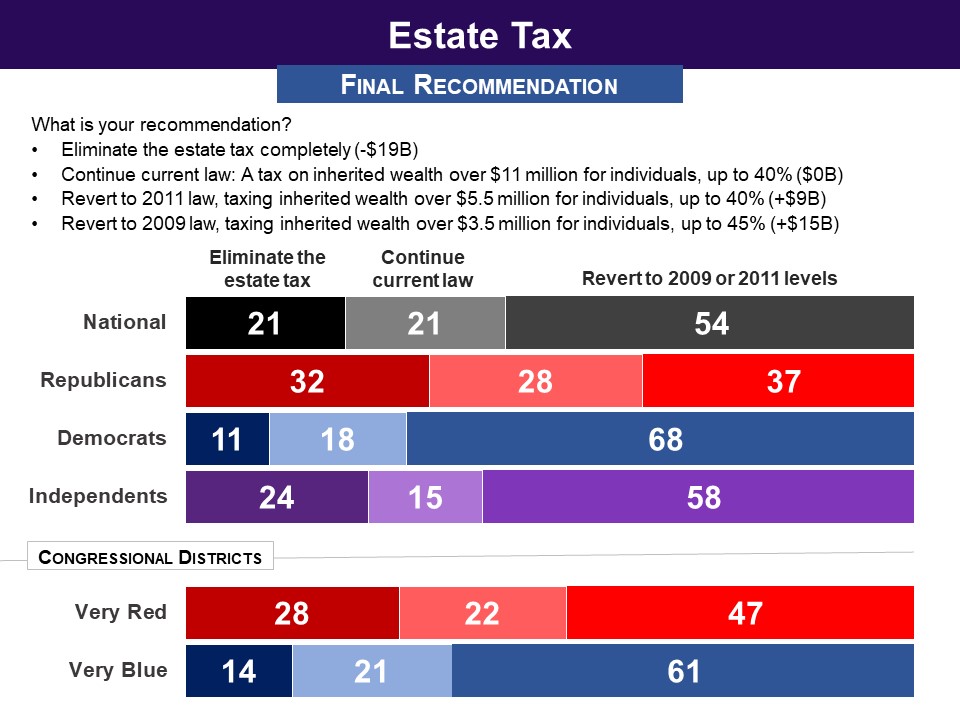

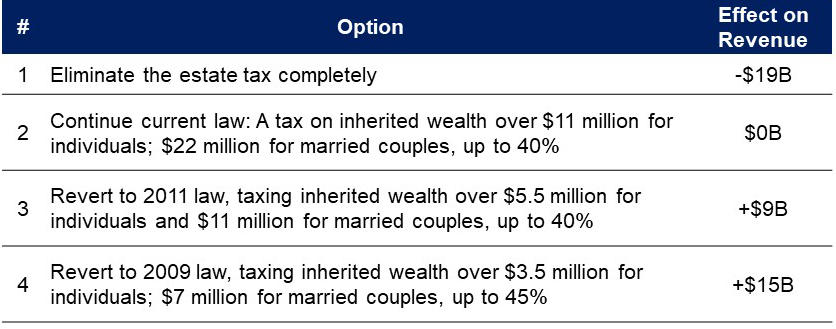

Respondents were introduced to proposals for changing the estate tax, including raising it to previous levels, as well as eliminating it.

They were first presented a brief history of the estate tax levels since 2009, leading up to the recent reductions. They were told that there is discussion about whether the estate tax should be changed and were presented four options with their revenue effects (see table).

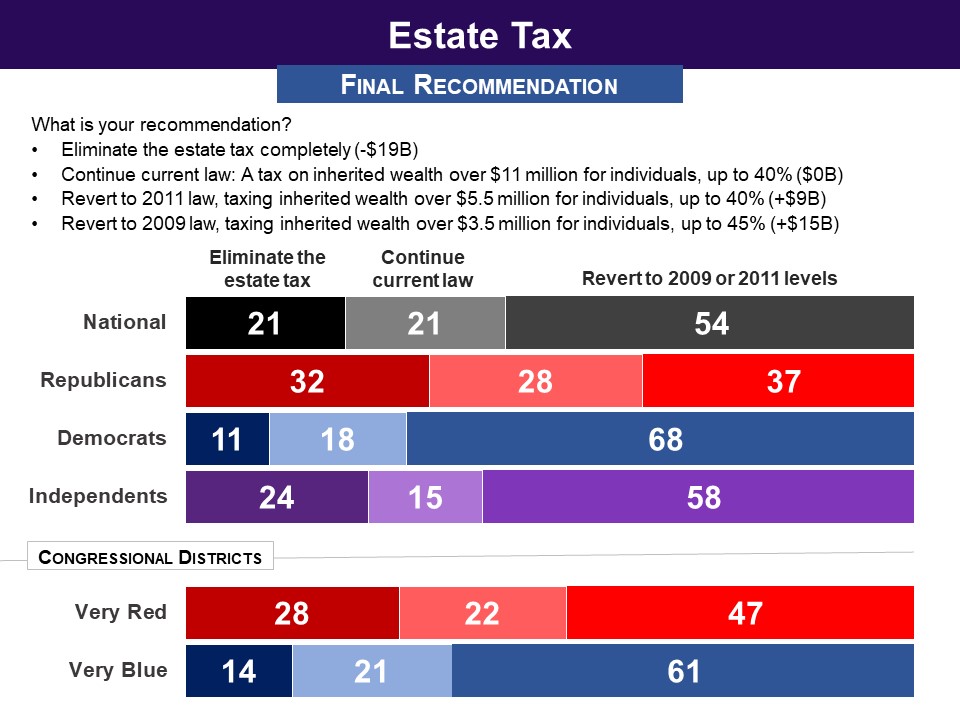

Only 21% favored eliminating the estate tax (Republicans 32%, Democrats 11%). Nationally, 75% recommended one of the three other options for the estate tax, including 65% of Republicans and 86% of Democrats.

A majority of 54% recommended rolling back the 2018 estate tax cut, thus reverting it at least to the levels established in 2011 . Three in ten went further, reverting all the way to 2009 levels. However, this was not a bipartisan majority.

Among Democrats, seven in ten supported reverting the estate tax to at least 2011 levels, with 37% choosing the 2009 level.

But among Republicans, only 37% endorsed reverting to the 2011 level or further. A majority of Republicans (65%) favored at least continuing the current law.

Related Standard Polls

A bipartisan plurality has favored lowering the threshold for the estate tax from the current $11 million to $3.5 million, which is where it was in 2009. A large share of respondents did not provide any answer.

- Respondents were first told that, “the federal government currently taxes the estates of Americans who inherit $11 million or more.” Then, asked whether they favor, “a recent proposal to lower the threshold for the estate tax to $3.5 million,” 50% favored (opposed 29%), including 59% of Democrats and 43% of Republicans (23% opposed). Twenty one percent did not provide any answer. (Morning Consult/Politico, February 2019)

When given information about the existing estate tax and given four options, a bipartisan majority has not chosen to eliminate it, but there was also not majority support for increasing it when no alternative is provided:

- Respondents were told that, “the federal government does not tax estates valued under $11.4 million. Estates valued over $11.4 million are taxed at 40 percent.” Then, asked whether estate taxes should be eliminated, kept the same, raised somewhat, or raised significantly, just 31% said they should be eliminated, including 40% of Republicans and 21% of Democrats. The other 69% said they should be kept the same (37%, Republicans 38%, Democrats 37%) or raised somewhat or significantly (32%, Republicans 23%, Democrats 42%).(Hill/Harris-X, January 2019)

When told that the estate tax applies to inheritances of $11 million or more, a plurality has opposed repealing it, but a plurality of Republicans has favored it, with a remarkably large share of respondents not expressing an opinion.

- Asked whether they favor or oppose, “a recent proposal to repeal the federal estate tax, which currently taxes the estates of Americans who inherit $11 million or more,” 42% were opposed (Democrats 51%, Republicans 32%) and 33% were in favor (Democrats 27%, Republicans 43%).

Twenty-five percent did not express an opinion (Democrats 22%, Republicans 25%). (Morning Consult/Politico, February 2019)

|

TAXES THAT DISCOURAGE CERTAIN BEHAVIORS |

|

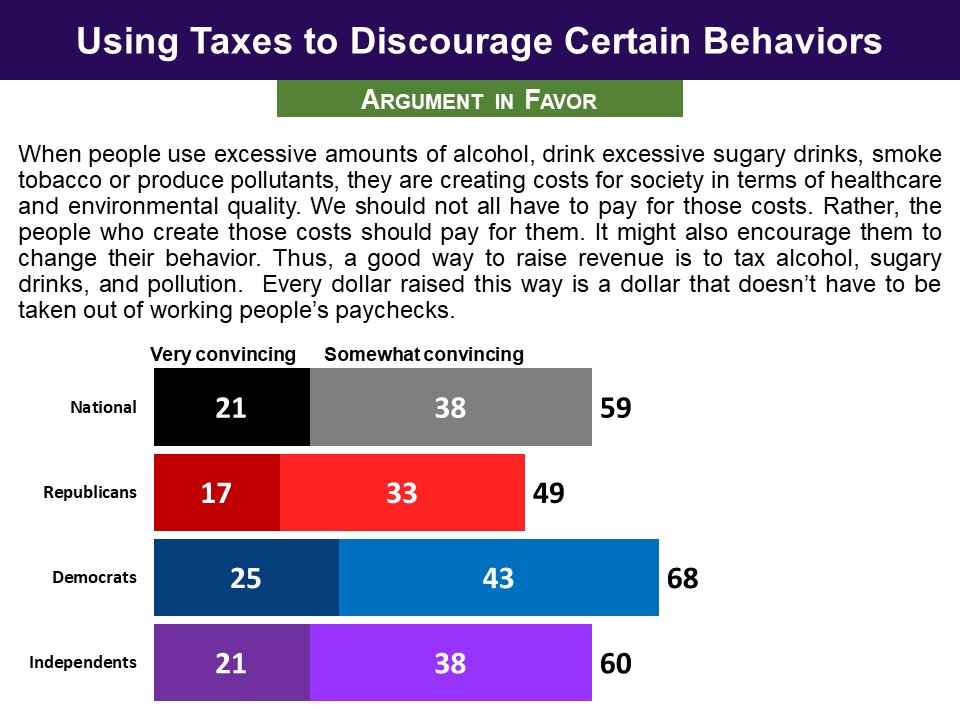

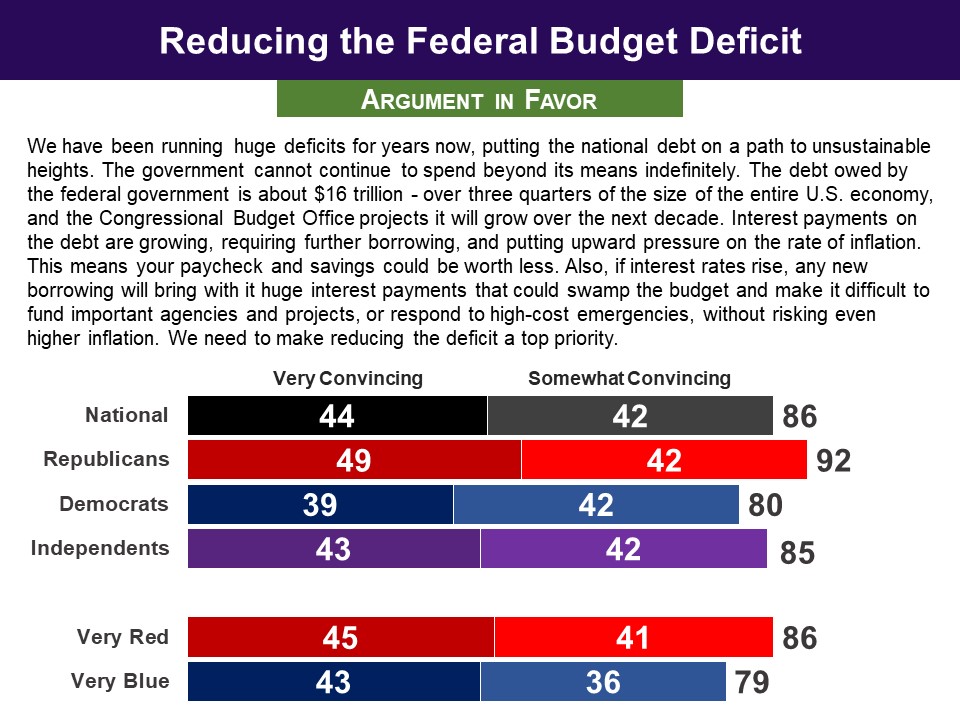

We are next going to explore another kind of tax that, in addition to raising revenues, discourages certain activities that create costs for society - such as consuming alcohol, or producing pollutants.

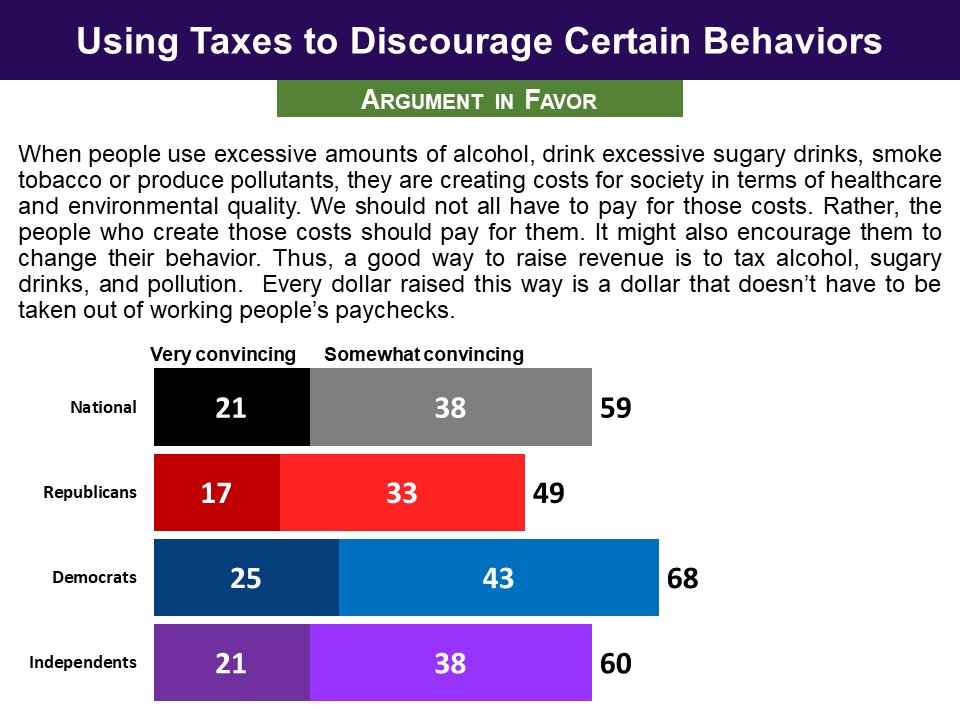

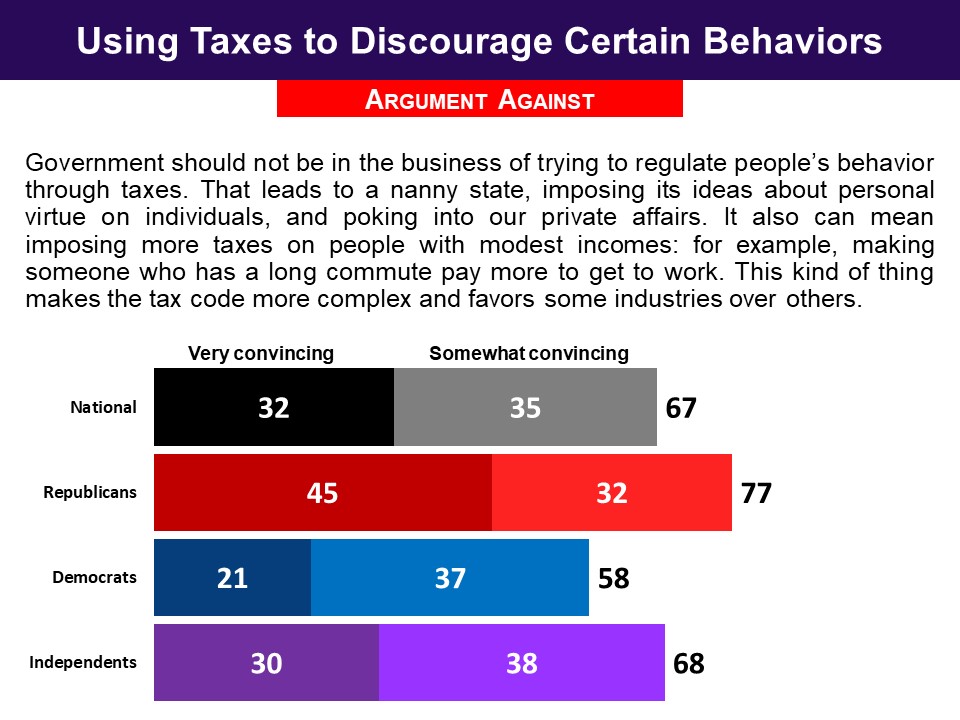

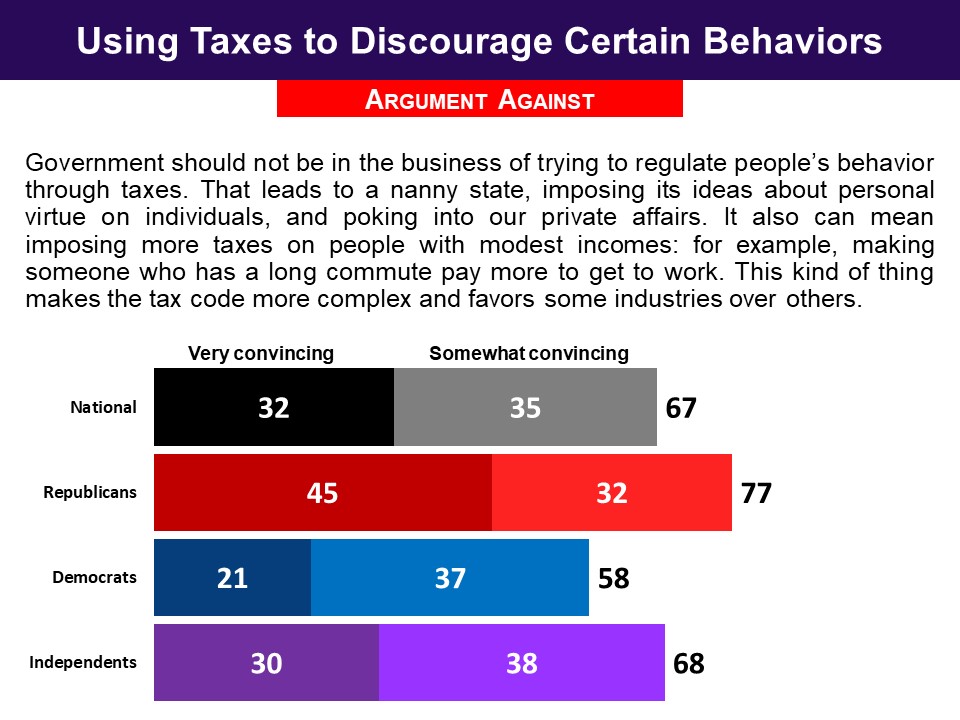

They evaluated arguments for and against the Federal government using taxes to discourage people from doing things that are harmful and create costs for society (e.g. smoking, drinking).

The argument in favor of using taxes as disincentives for activities that create costs to society, was found convincing by six in ten (59%) including about two thirds of Democrats (68%). Republicans were divided.

The argument against invoked the “nanny state” as something to be avoided and argued that these kinds of taxes are regressive, falling disproportionately on people with low or modest incomes. This argument did a little better with 67% finding it convincing, including over three quarters of Republicans and nearly six in ten Democrats.

|

|

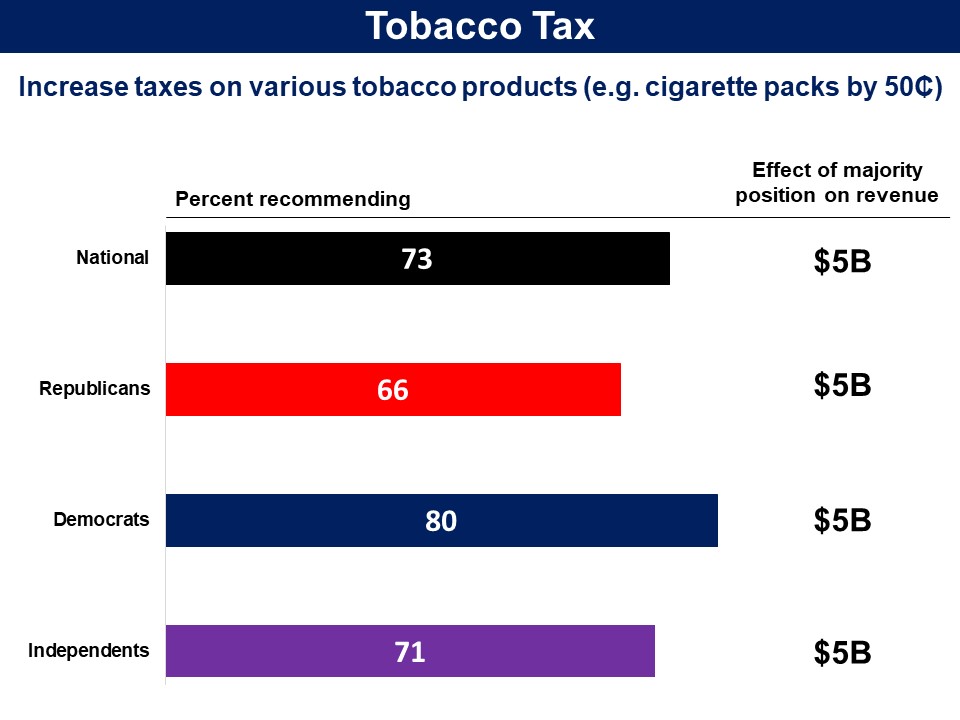

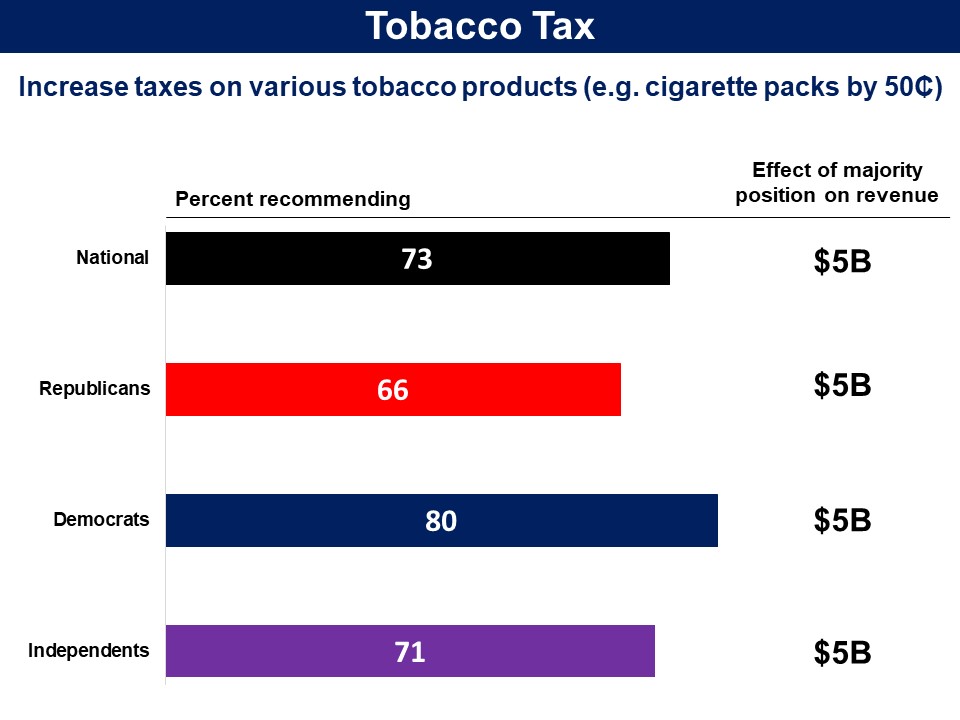

Respondents were introduced to a proposal to increase taxes on various tobacco products that is based on a Congressional Budget Office recommendation for reducing the federal deficit:

- The federal tax on cigarettes would be raised from $1.01 per pack to $1.51 per pack

- The federal tax on large cigars would be raised to be equal to the tax for cigarettes

- The federal tax on pipe tobacco would be raised to be equal to the current tax on roll-your own tobacco, which is $1.55 per ounce.

They were informed that, “Research shows that increasing tobacco taxes leads to reduced tobacco consumption, which has health benefits, particularly among teenagers and low-income people.” They were also told that the proposal would generate $5 billion in revenue.

The proposal received large bipartisan support, with nearly three quarters recommending it, including 66% of Republicans and 80% of Democrats.

|

|

Respondents were introduced to a proposal to raise alcohol taxes that is based on a Congressional Budget Office recommendation for reducing the federal deficit:

Currently, alcoholic drinks carry a federal tax of 8 cents per ounce of alcohol in wine, 10 cents per ounce in beer, and 21 cents per ounce in spirits, such as whisky or vodka.

They were offered three positions:

- Do not raise taxes on alcohol;

- Increase tax on all alcoholic drinks by 25₵/ oz. of alcohol (generating $5 billion in revenue); or

- Increase tax on all alcoholic drinks by 50₵/ oz. of alcohol (generating $11 billion).

A majority (61%) supported raising the alcohol taxes at least to at a rate of 25 cents per ounce of alcohol, yielding $5 billion, including 65% of Democrats and 56% of Republicans.

|

|

ADDITIONAL TAX REFORMS FROM OTHER SURVEYS |

|

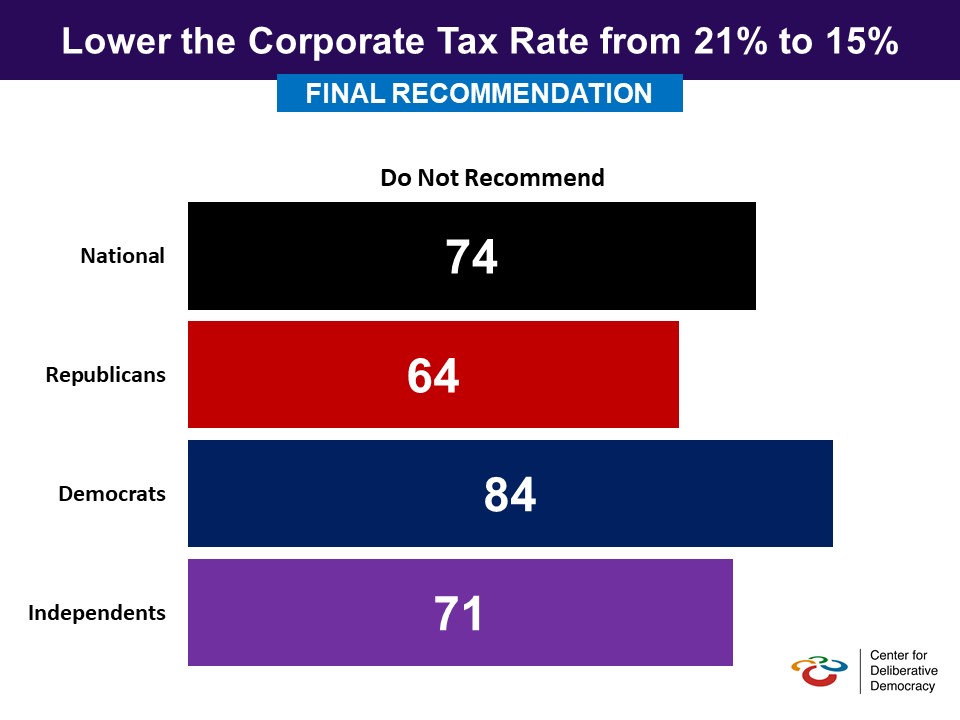

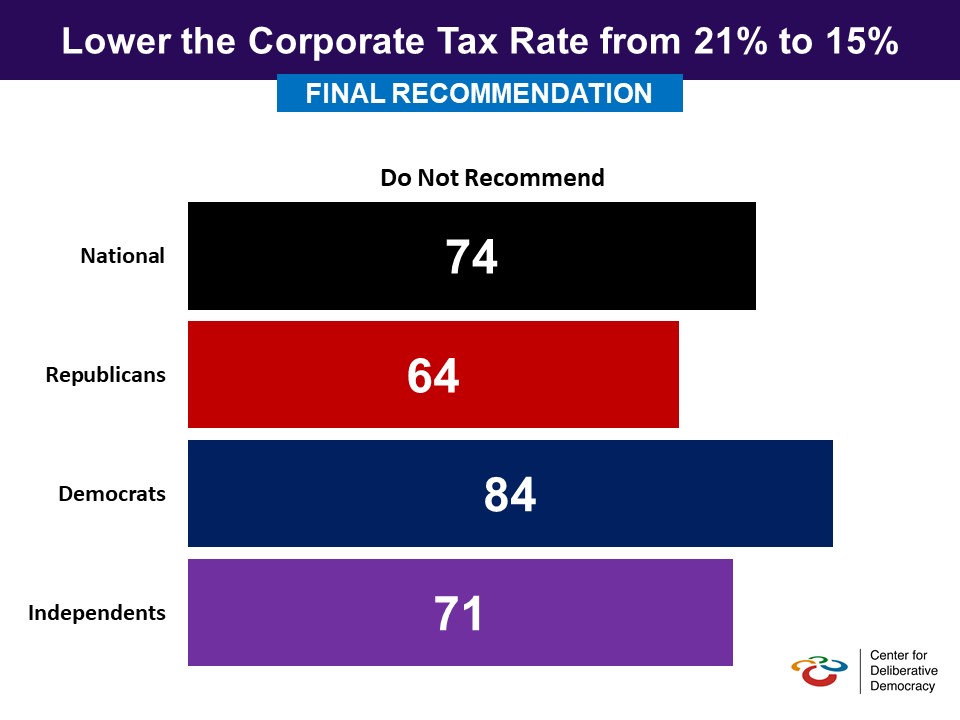

There has been a debate about a proposal to lower the corporate tax rate from 21% to 15%. Respondents were presented the debate in the following briefing material as part of an in-person deliberative poll conducted by Stanford University’s Center for Deliberative Democracy in September 2019:

The 2017 tax cuts reduced the tax on corporate profits from 35% to 21%. Supporters of a higher corporate tax rate say that some corporations make billions of dollars in profits each year, so they can afford this. Raising corporate taxes, they say, brings in badly needed revenue to the federal government. Also, corporations benefit from a number of legal protections in the US, so a higher level of taxation is a fair trade-off. These supporters add that even if the US raises the corporate tax rate, it will continue to attract investment because the US is a wealthy country that has a large number of consumers and a strong legal system.

Advocates of further lowering the corporate tax rate — for example, from 21 to 15% — say that not all businesses are wealthy and can easily pay this tax. In other words, higher corporate taxes may harm small business investments. Higher corporate tax rates make investing in high-tax countries less attractive compared to countries with lower taxes. Thus, they argue, raising the corporate rate will send investors looking for other countries, which would reduce employment in the US.

In support of lower corporate taxes in the US, others point to the strong economic growth that followed the 2017 corporate tax cuts. Under higher taxes and to generate the same profits for investors, companies might have to cut wages and jobs in order to generate the same profits for investors. Employees would end up bearing the burdens of higher corporate tax rates, they add.

Moreover, setting the corporate tax rate at 21% does not mean that every business pays 21% of its profits in taxes. Companies can use so-called loopholes to reduce the taxes, and some firms and industries — especially technology— are better positioned to take advantage of them than others. In other words, wealthier and well-advised companies in certain industries may pay little in taxes, no matter what the tax rate is. Raising taxes will therefore disproportionately hurt smaller businesses.

They were presented the following proposal and arguments for and against it:

Proposal: The US should lower the corporate tax rate from 21% to 15%

Argument in Favor: While the US corporate tax rate is now in line with the rate of other leading economies, reducing the rate further would make America an even more attractive place to do business, spurring employment and economic growth.

Argument Against: The 2017 corporate rate cut from 35% to 21% was already drastic, and it’s uncertain whether it benefited workers. Cutting the rate again would further increase the national debt, already at a record high, and, like the 2017 cut, would fail to benefit workers.

Asked to rate the proposal on a 0-10 scale, with 5 being “in the middle”, 74% were opposed (0-4), including 64% of Republicans and 84% of Democrats.

Pre-Deliberation Poll

Before receiving any briefing materials or engaging in the deliberation process, respondents were given the same poll question as those asked afterwards. Opposition to lowering the corporate tax rate increased from the pre-deliberation poll to the post-deliberation poll, overall (53% to 74%), among Democrats (69% to 84%) and an extraordinary amount among Republicans (29% to 64%).

Related Standard Polls

See Related Standard Polls in above section on 1% surtax on corporate income which discusses polls on corporate tax rates. It is interesting to note that in the standard polls that simply asked whether respondents favor or oppose a reduction in corporate taxes, a majority of Republicans were in favor, however when they went through the deliberative process they did not favor it.

|

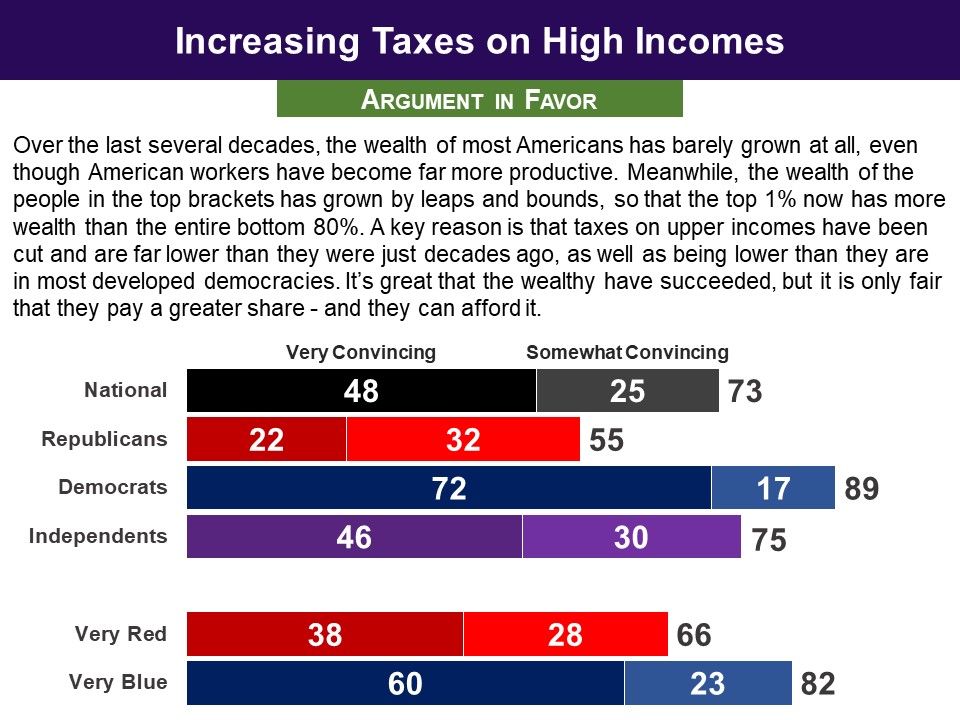

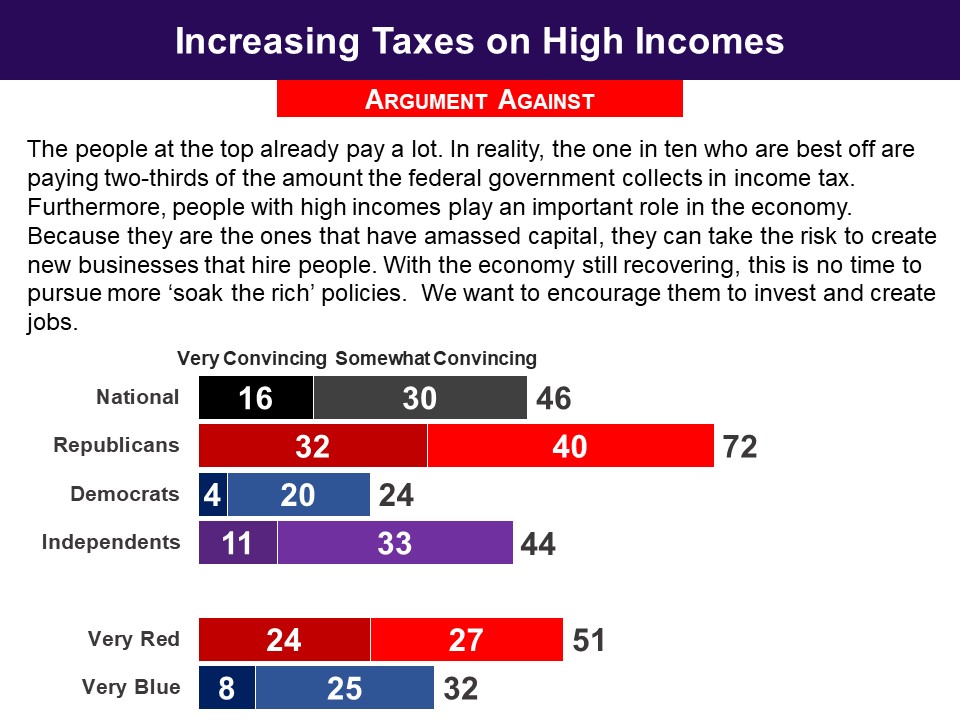

The next pro argument proposed higher income taxes for the top levels, and was found convincing by 73%. Democrats were almost unanimous on it, and a clear majority of Republicans also found it convincing. The counter argument was not very successful, with under half (46%) finding it convincing, including just a quarter of Democrats. However, seven in ten Republicans did find it convincing.

The next pro argument proposed higher income taxes for the top levels, and was found convincing by 73%. Democrats were almost unanimous on it, and a clear majority of Republicans also found it convincing. The counter argument was not very successful, with under half (46%) finding it convincing, including just a quarter of Democrats. However, seven in ten Republicans did find it convincing.

Related Standard Polls

Related Standard Polls

Alongside the briefing, they were shown a chart with the current tax rates on capital gains and dividends for different income levels.

Alongside the briefing, they were shown a chart with the current tax rates on capital gains and dividends for different income levels.

Related Standard Poll

Related Standard Poll