Social Security

The Social Security Board of Trustees has reported for some years now that as the Baby Boom generation has been retiring, the cost of benefits have been superseding revenues, depleting the Social Security’s Trust Fund. This is known as the Social Security “shortfall”. The most recent report concluded that if no changes are made to Social Security revenues and/or benefits, by 2034 the Trust Fund will be fully depleted and current benefit levels will have to be reduced by 23%.

Nonetheless, there have been no reforms to Social Security since 1983. Social Security is often characterized as being a “third rail,” meaning that policymakers are afraid that any change to the Social Security system will elicit a severe public backlash.

In addition to the problem of the Social Security shortfall, there are also voices calling for an increase in the minimum Social Security benefits for workers who have worked for 30 years. The current minimum benefit level is below the poverty line.

- National Sample: 2,545 Registered Voters

- Margin of Error: +/- 1.9%

- Fielded: April 11 - May 15, 2022

- National Sample: 4,591 Registered Voters

- Margin of Error: +/- 1.4%

- Fielded: February 16 - March 24, 2016

There were also an oversample of 1,797 respondents from California, Florida, Maryland, New York, Ohio, Oklahoma, Texas and Virginia. This data can be found in the questionnaire.

In developing the survey, reform options were selected from a list put forward by the Social Security administration and were foreground in Congressional discussions of Social Security reform according to lead Congressional staffers. All of the options were scored by the SSA in terms of their impact on the shortfall.

Respondents first went through a briefing about how the Social Security program is structured. They were then told about the nature and extent of the Social Security shortfall, along with its multiple causes, and how, if no changes are made, there would ultimately be reductions in benefits.

Respondents were then presented a series of options for reforming Social Security, including ones that mitigated the shortfall, ones that increased benefits for certain populations, and options for recalculating the annual cost of living adjustment.

For each option they were given a brief explanation and what impact it would have on the Social Security shortfall. Each option was scored in terms of what percentage of the shortfall it would mitigate--at 100% there would be no need for any reduction in benefits.

After evaluating pro and con arguments they evaluated each option separately in terms of how tolerable it would be on a scale of 0 to 10, with 0 being completely unacceptable, 10 being completely acceptable and 5 being just tolerable.

Finally, respondents were presented all the reform options in a spreadsheet enabling respondents to make their own comprehensive and integrated set of recommendations. Each option, including tiered levels, was shown with their potential impact on the shortfall. As respondents made their selections an interactive feature gave them immediate and cumulative feedback on the impact of their choices on the shortfall.

Proposals with bipartisan support, discussed below, included:

- Reducing benefits for high income earners

- Raising the retirement age gradually

- Raising the Social Security payroll tax

- Applying the payroll tax to higher incomes

- Raising the minimum monthly benefit

- Changing the method for calculating the Cost of Living Adjustment (COLA) for Social Security benefits

- Increasing benefits for the very elderly, starting at age 81.

ADDRESSING THE SHORTFALL |

|

|

Bipartisan majorities supported four options that would reduce the Social Security shortfall. Combined, including silver and gold levels of support, the proposed steps would eliminate 105% of the shortfall. Including only gold levels of support, the proposed steps would eliminate 66% of the shortfall. Majorities also increased the minimum benefit which increased the shortfall by 7%. |

|

Respondents were told that one option under consideration for addressing the Social Security shortfall is to reduce the benefits that are presently scheduled for future retirees whose lifetime average earnings are above a certain level. It was presented as follows: “Currently, the more people earned while working (up to $147,000), the more they receive in monthly benefits. One option --for new retirees only--is to gradually lower benefits for people who had higher earnings. Their benefits would still be higher than for people who had lower earnings, but their benefits would be less than people in that income group are currently scheduled to receive.” They were given three options for reducing benefits for higher income earners: reducing benefits for the top 20%, the top 40% or the top 50%, which they were told would reduce the shortfall by 11%, 23% and 30%, respectively. The arguments in favor of reducing benefits for high income earners were found convincing by majorities of 61% overall, as well as majorities of Democrats (74 and 73%)and independents (64% for both), but just under half of Republicans (48 and 49%). The arguments against did better, with seven in ten overall finding them convincing, as well as majorities of both Democrats (69 and 61%) and Republicans (75 and 81%). In the end, respondents could choose one of the three options, or not choose any. Interestingly, while a larger percentage found the con arguments convincing, in the end, a large bipartisan majority of 81% recommended reducing benefits for at least the top 20% of earners, including majorities of Republicans (78%) and Democrats (86%). Results from PPC’s 2016 Survey Response Without Undergoing Policymaking Simulation Related Standard Polls

When asked about reducing benefits for “wealthy” retirees as a way to decrease the budget deficit, support has been higher, but not always a majority:

Support increases to a substantial and bipartisan majority when reducing benefits for “wealthy” retirees is framed as a means to help fix Social Security:

|

|

Respondents were told that an option to reduce the Social Security shortfall is to reduce its costs by raising the full retirement age. This would reduce the total amount of benefits that a person receives over their lifetime. They were told this would not change the early retirement option, which would remain at age 62, with correspondingly lower benefits. They were told that, according to current law, there are scheduled increases to the full retirement age as follows: “Currently, the full retirement age is 66 years. According to current law, it is scheduled to gradually rise until it reaches 67 by the year 2027 and then will stop rising. This has no effect on those already receiving Social Security. It does affect those born in 1960 or later.” They were presented three options for gradually increasing the normal retirement age: to 68, 69 or 70, which they were informed would reduce the shortfall by 14, 21 and 29%, respectively. The two arguments in favor were found convincing by modest majorities of 53% overall, and similar percentages of Republicans and Democrats. The two arguments against were found convincing by much larger majorities of over seven in ten overall, and between two thirds and three quarters of Republicans and Democrats. In the end, they could choose any of the three proposals, or choose not to raise the retirement age at all. Raising the retirement age to at least 68 was chosen by three in four – overall and among Republicans (75%) and Democrats (76%). There were no majorities in favor of raising it any higher. Respondents were also asked how acceptable the proposal would be on a 0-10 scale, with 5 being just tolerable. This question was asked after they had evaluated the arguments, but before they had made their final recommendations. Interestingly, a large majority of 61% found the proposal to raise the retirement age to 68 unacceptable (0-4). So, while respondents did not like this proposal, in the end they did recommend that it be implemented in order to address Social Security’s solvency. This finding may reveal some of the shortcomings of standard poll questions: asking about a stand-alone proposal, with no justification as to why it has been proposed, may produce a different result than asking about a proposal presented within a larger framework of tackling a specific problem (e.g. Social Security’s solvency). Results from PPC’s 2016 Survey Response Without Undergoing Policymaking Simulation Related Standard Polls

|

|

Respondents were told that an option for reducing the shortfall is to increase its revenues through higher payroll taxes. Respondents were first reminded that: “At present both workers and employers pay a tax of 6.2% on the amount of an employee’s salary and wages subject to the payroll tax. Self‐employed people pay both the employer and employee share.” They were given three options for gradually increasing the tax rate .05% per year for both the employer and the employee, rising ultimately to 6.5%, 6.9% or 7.2%. They were told the impact of these increases on the monthly payroll taxes of an individual with an income of $39,000 would be $9, $22, and $32, respectively. The arguments for and against raising the payroll tax rate were both found convincing by large bipartisan majorities. The pro argument was found convincing by 67% (Republicans 62%, Democrats 74%), and the con argument by 70% (Republicans 73%, Democrats 67%). In the end, they could choose any of the three proposals, or choose not to raise the payroll tax rate at all. A large majority of 73% recommended raising it to at least 6.5%, including 70% of Republicans and 78% of Democrats. There were no majorities in favor of raising it any higher. Results from PPC’s 2016 Survey Response Without Undergoing Policymaking Simulation Related Standard Polls

Posed as a choice between raising taxes and cutting benefits, a very slight majority goes for raising taxes, but many do not provide an answer.

Status of Legislation |

|

One proposal that has been put forward to raise a substantial amount of revenue for the Trust Fund, and cover most of the shortfall, is to increase the amount of wages subject to the payroll tax. Respondents were introduced to the proposal as follows: “Currently, the amount of wages that are subject to the Social Security payroll tax includes all wages up to a cap of $147,000 per year. One policy option is to make all wages over $400,000 taxable as well, effective immediately. This would not include income from dividends or capital gains. Wages between $147,000 and $400,000 would not be taxable initially. But, over time the cap of $147,000 would rise with inflation, as it currently does. At some point, decades in the future, this cap could reach $400,000 so that all wages would be taxed. By this plan, the amount of taxes paid by people with very high wages would rise. Their benefits would also rise, but only slightly.” They were informed that this proposal would reduce the shortfall by 61%. The argument in favor of this proposal was found convincing by substantially more respondents (80%, Republicans 77%, Democrats 86%) than the con argument, which was not found convincing by any majority (36%, Republicans 44%, Democrats 27%). In the end, 81% recommended this proposal, including very large majorities of Republicans (79%) and Democrats (88%). Results from PPC’s 2016 Survey An overwhelming 88% either raised the cap to $215,000 or eliminated it entirely. This included 84% of Republicans as well as 92% of Democrats. A majority of 59% eliminated the cap entirely, including 54% of Republicans and 64% of Democrats. Response Without Undergoing Policymaking Simulation Related Standard Polls

When framed as a means to reduce the federal deficit, a bipartisan majority has favored eliminating the cap:

When framed as a means to prevent spending cuts driven by sequestration legislation, majorities have favored increasing the payroll tax of high earners.

Status of Legislation |

|

INCREASING BENEFITS |

|

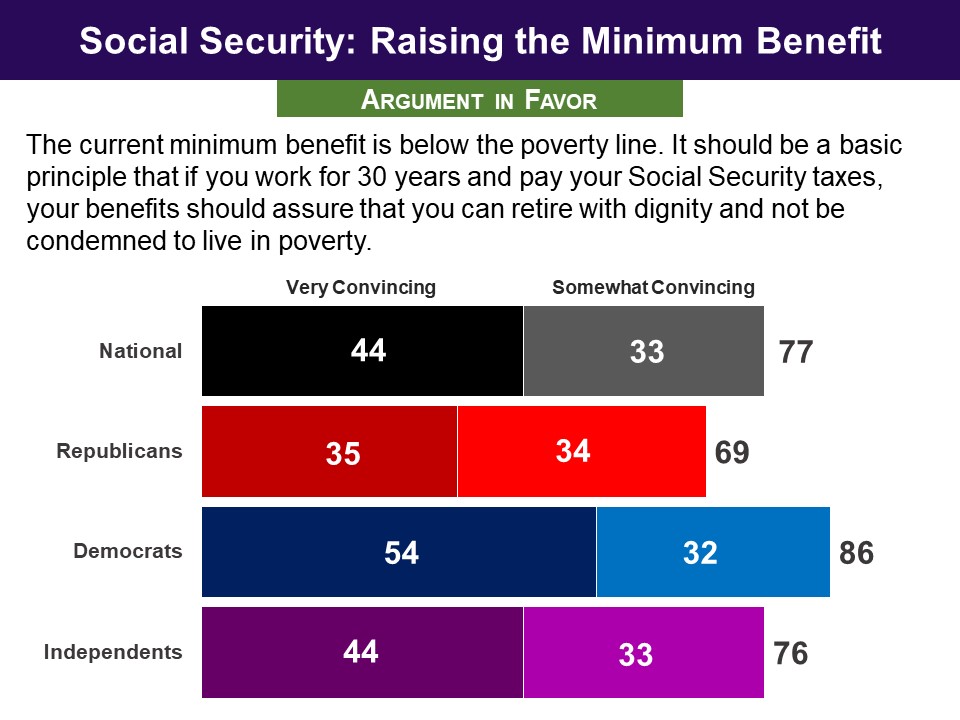

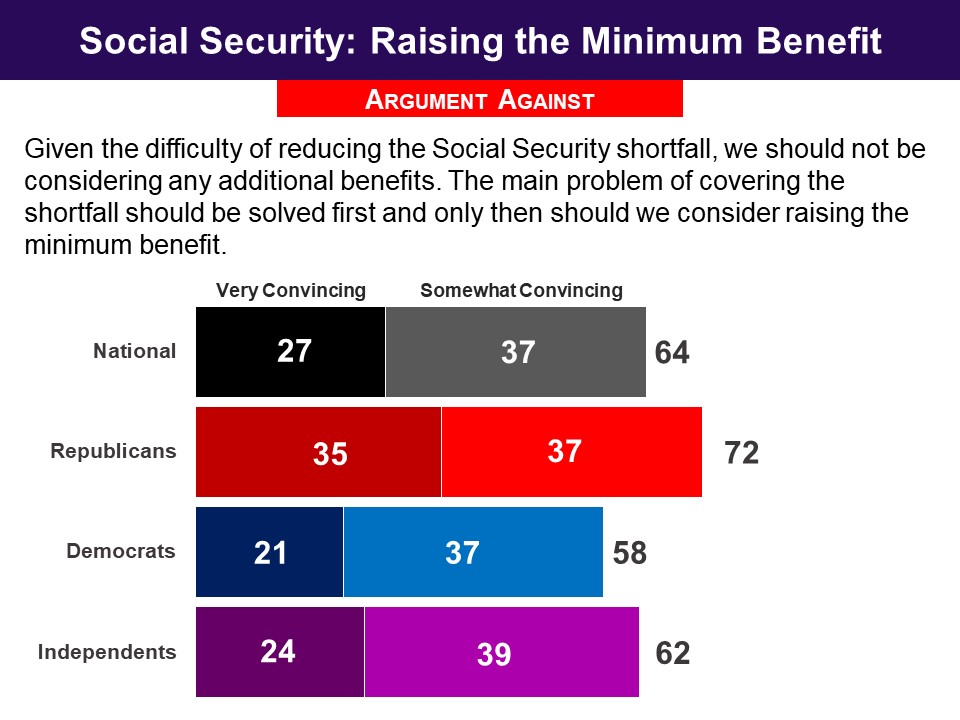

There has been concern that the inflation-adjusted value of Social Security’s minimum benefit has been declining, and that it is inadequate for many beneficiaries. Respondents were introduced to an option: |

|

Respondents were introduced to a proposal to increase benefits for those 85 and over, as follows: “This proposal focuses on Social Security recipients who are in their eighties, sometimes called “the oldest old.” Benefits would begin to gradually increase at age 81 and by age 85 the increase would be an extra five percent, or about $97 a month on average in current dollars.” The argument in favor was found convincing by a bipartisan three in four (76%, Republicans 75%, Democrats 82%). The argument against did not fare as well, with just under half finding it convincing (49%), including just 35% of Democrats, but over six in ten Republicans and half of independents. In the end, a modest bipartisan majority recommended this proposal (53%, Republicans 53%, Democrats 56%). Less than half of independents, however, were in favor (43%). Results from PPC’s 2016 Survey Status of Legislation |

|

COST OF LIVING ADJUSTMENTS (COLAs) |

|

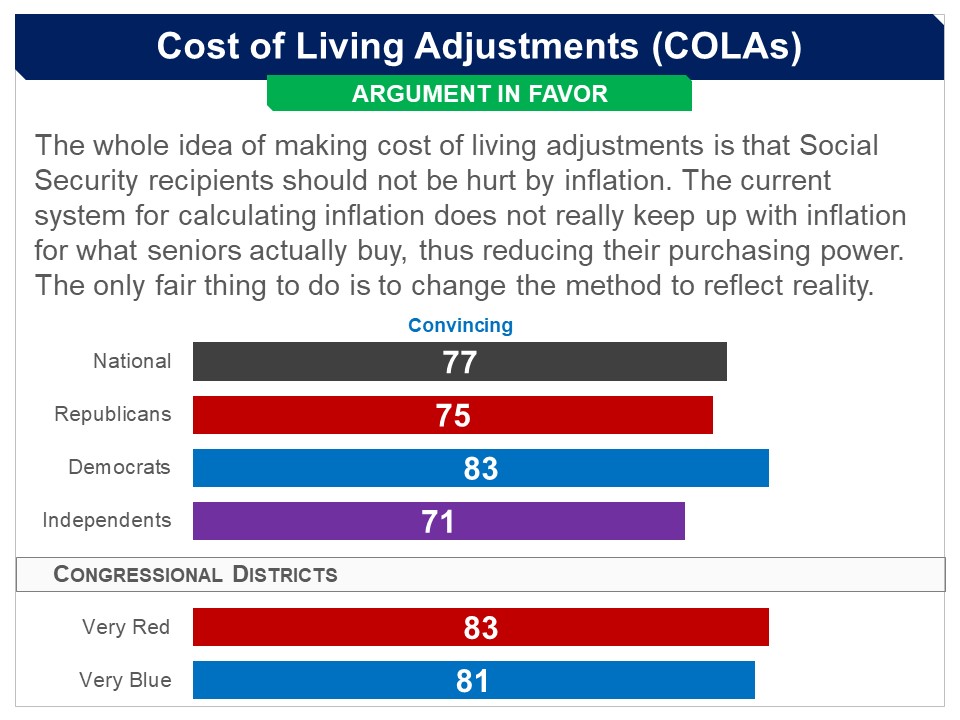

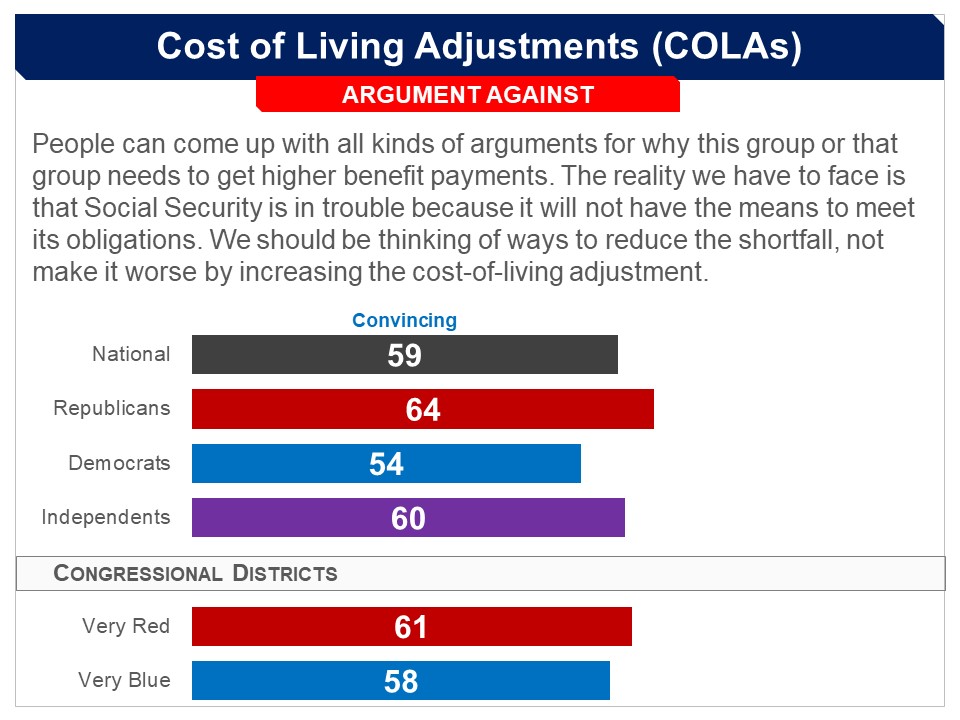

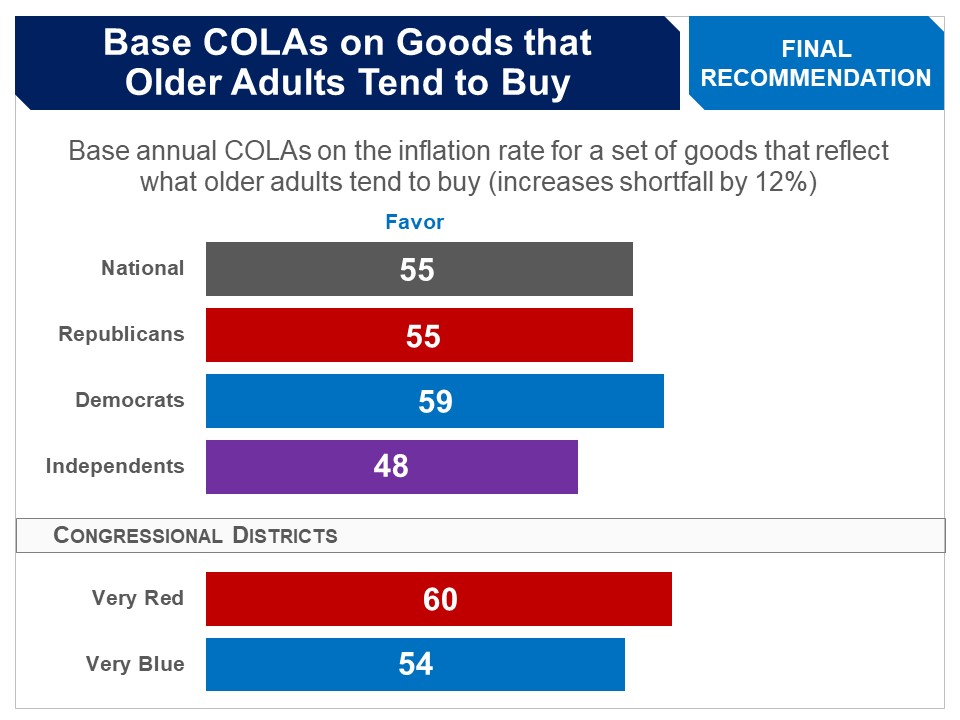

Respondents were first informed about the cost of living adjustments which are used to calculate annual benefit increases: “The annual cost of living adjustments (or COLAs) are calculated to keep pace with inflation. Since 1975, Social Security has based such annual adjustments on the consumer price index, which measures changes in the prices of a fixed list of consumer goods and services.” The proposal to change how COLA is calculated was then outlined, with an explanation how benefits would be affected over time: “There is a proposal for changing the COLA to use a measure for inflation based on a set of goods that reflects what ELDERLY people tend to buy. Because they spend more than other Americans for out-of- pocket health care costs and those costs rise faster than average inflation, this method would make the cost-of-living adjustments go up faster than the present method. As an illustration, it is estimated that if prices for the current fixed set of goods goes up 2.5% a year, the amount that prices go up for the goods ELDERLY people buy would be 2.7%. The effect of a higher COLA would compound over time. It is estimated that by making this change, benefits would grow more quickly, so that 10 years after retiring, average monthly benefits for a person retiring at the full retirement age would be about $50 more than they would be under the current method. After 30 years average monthly benefits would be about $261 more than by the current method. This proposal would increase the Social Security shortfall by 12%.” The argument in favor was found convincing by a very large bipartisan majority of 77% (Republicans 75%, Democrats 83%). The argument against was also found convincing by a bipartisan majority, albeit not as large (59%, Republicans 64%, Democrats 54%). |

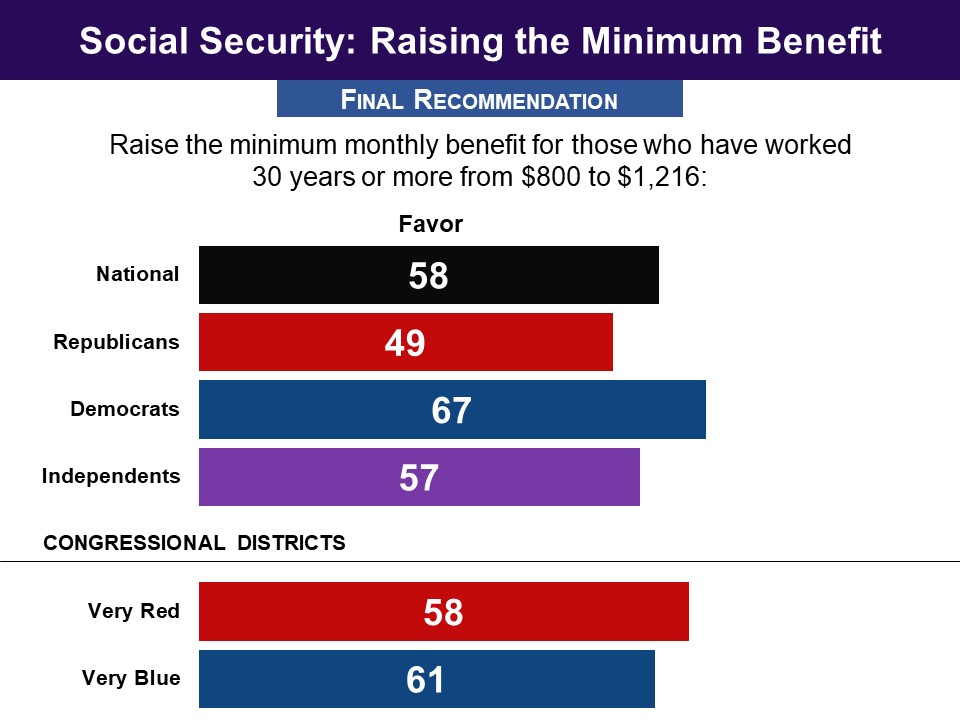

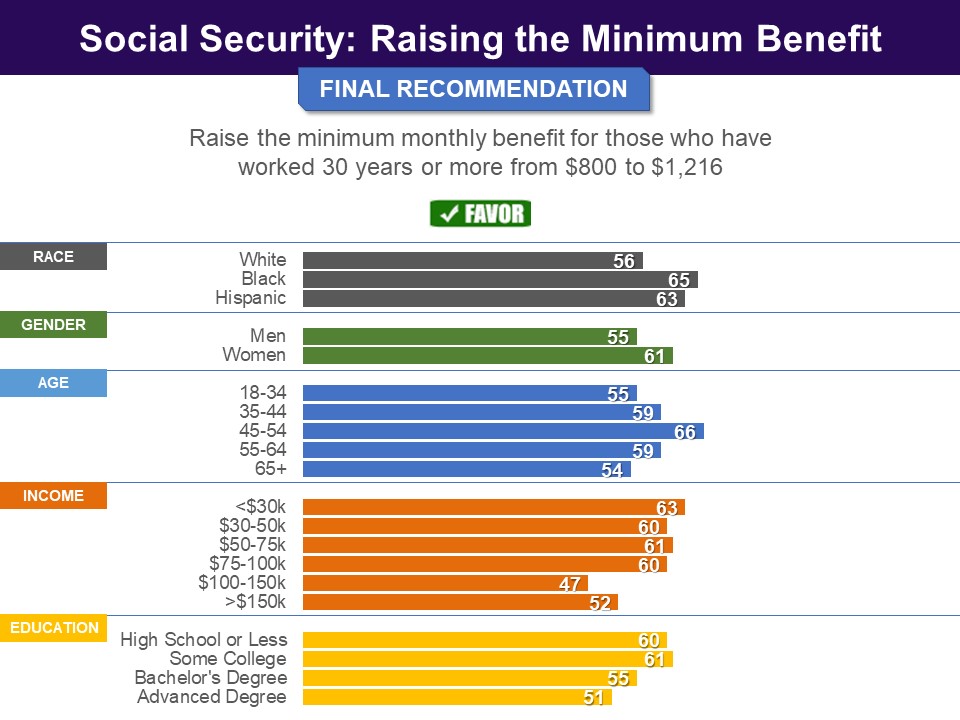

Respondents were asked to rate how acceptable the proposal would be using a 0-10 scale. It was found at least tolerable (5-10) by 69% (Republicans 62%, Democrats 76%). In their final recommendation, a clear majority nationally (58%) recommended raising the minimum benefit. Among Democrats, a large majority was in favor (67%), while Republicans were divided (49% - 51%).

Respondents were asked to rate how acceptable the proposal would be using a 0-10 scale. It was found at least tolerable (5-10) by 69% (Republicans 62%, Democrats 76%). In their final recommendation, a clear majority nationally (58%) recommended raising the minimum benefit. Among Democrats, a large majority was in favor (67%), while Republicans were divided (49% - 51%).

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation