Low Income Assistance

Since the War on Poverty in the 1960s, one of the most polarizing issues in the American political discourse has been the question of how much the federal government should invest in efforts to mitigate poverty.

While the American economy has grown 400% over the last 50 years, the percentage of the population living under the poverty line has barely budged and is currently around 12% with 38 million individuals living under the poverty line, including about 12 million children. Various pieces of Congressional legislation and other proposals have called for both expanding and for cutting back Federal poverty programs.

- National Sample: 2,613 Registered Voters

- Margin of Error: +/- 1.9%

- Fielded: July 29 – Aug 23, 2021

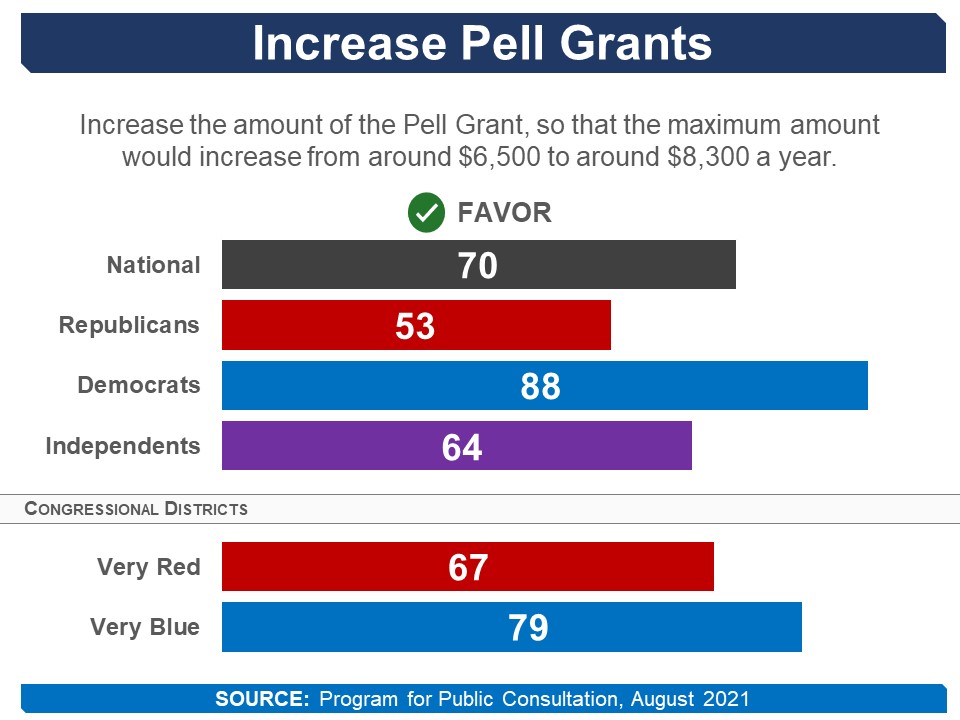

Proposal with bipartisan support discussed below:

- Increase the amount of the higher education aid for low-income students

- National Sample: 7,128 Registered Voters

- Margin of Error: +/- 1.2%

- Fielded: November 11, 2016 – January 18, 2017

There were also an oversample of 317 respondents from Texas, North Carolina, Florida, Ohio, Virginia, California, Maryland and New York. This data can be found in the questionnaire.

Proposals with bipartisan support discussed below:

- Increasing SNAP benefits for single individuals and single mothers

- Prohibiting the use of SNAP benefits for certain foods (e.g. sodas, candy)

- Providing discounts on fruits and vegetables when purchased with SNAP

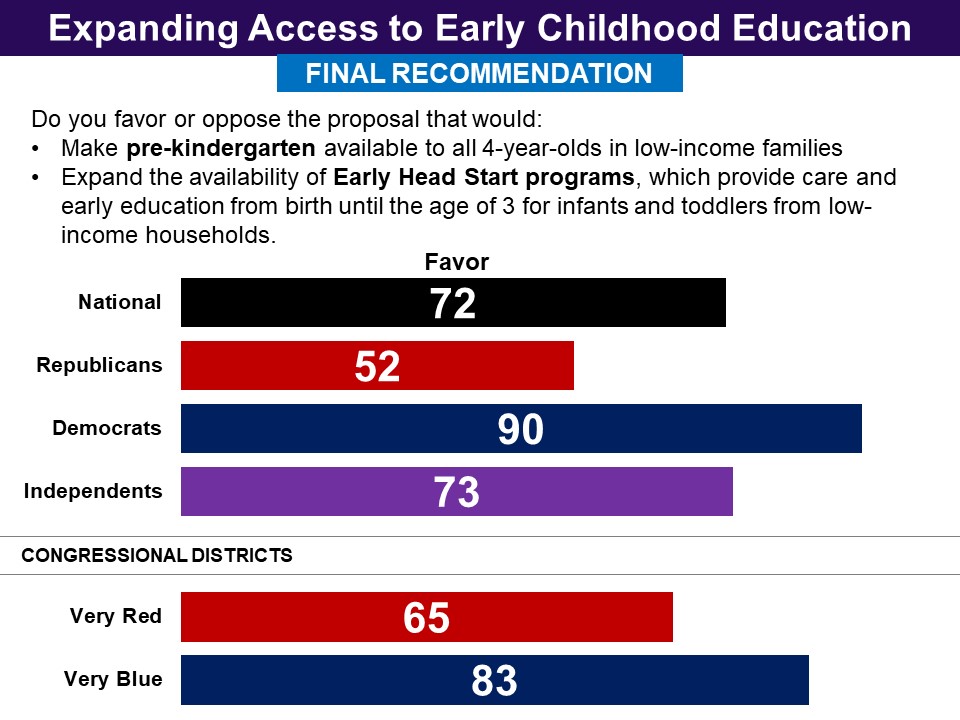

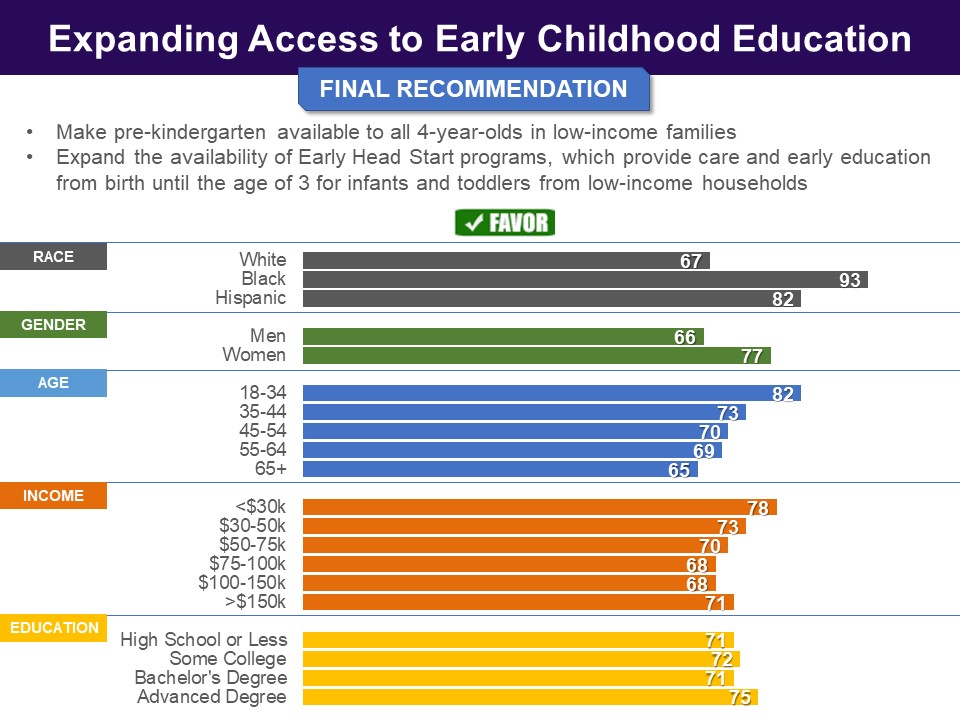

- Making pre-kindergarten available to all 4 year olds in low-income families and expanding Early Head Start programs

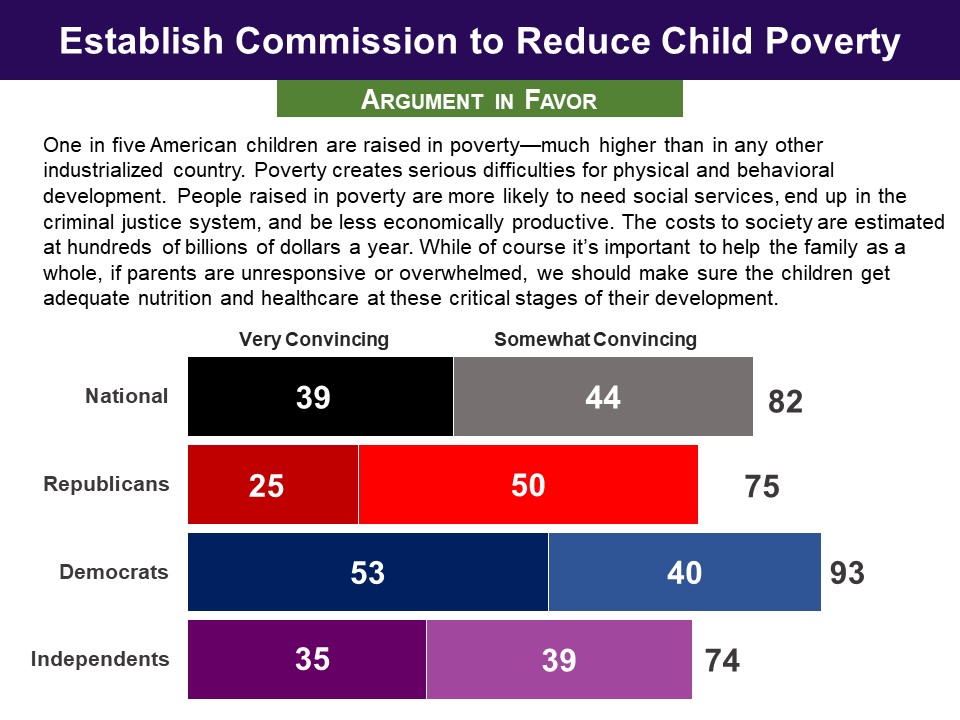

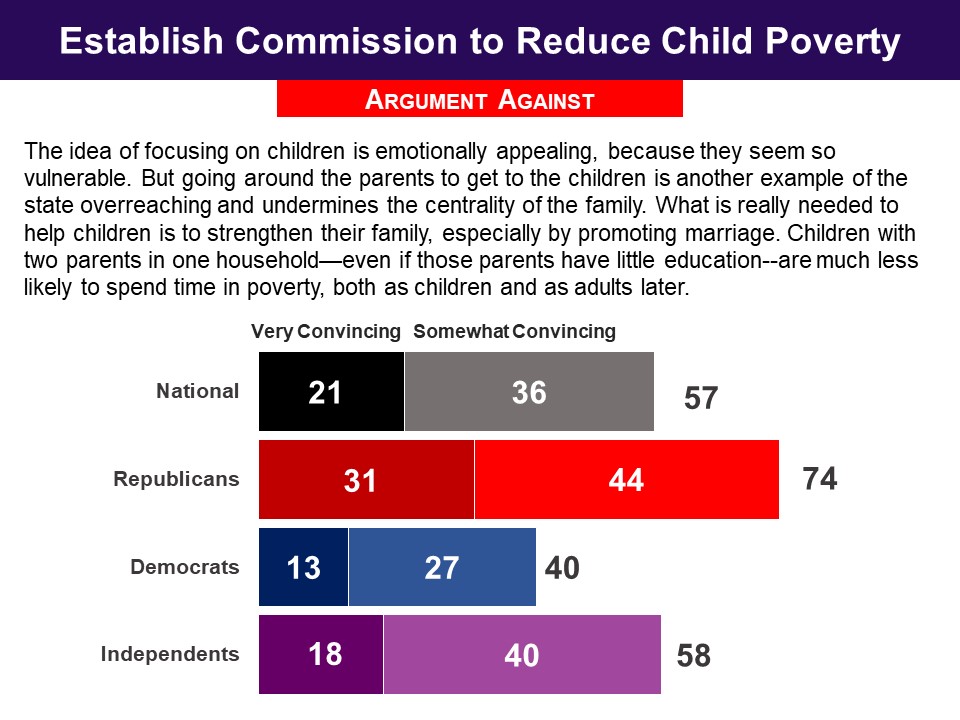

- Setting up a Congressional committee to develop a plan to eliminate child poverty

- Raising the federal minimum wage

- Increasing the maximum earnings that a worker without children can make and still be eligible for Earned Income Tax Credits (EITC)

- Prohibiting companies that have engaged in wage theft from bidding on government contracts

- Funding job creation programs

- Giving states the option to receive federal poverty program funding as block grants

- Raising the federal poverty line

Proposals that did not have bipartisan support:

- Changing the level of savings low-income individuals may have and still qualify for SNAP benefits

- Changing the requirement that low-income tenants contribute 30% of their monthly income toward the cost of public housing.

- Increasing the maximum Earned Income Tax Credit from $503 to $1,000

- Indexing minimum wage to inflation

- Expanding state Medicaid programs under the Affordable Care Act, in which the federal government covers 90% of the cost

|

FOOD ASSISTANCE |

|

Members of Congress have introduced legislation that would increase SNAP benefits. The proposals presented to respondents were based on Closing the Meal Gap Act (H.R. 1276). Respondents were first given a background briefing on the SNAP program. They were told that in 2015, the program cost $74 billion, with 23 million households receiving benefits, including about 26 million adults and 20 million children. They were told that the Federal guidelines for SNAP eligibility were:

Respondents were told “Benefits vary on a sliding scale depending on household income. As income goes up, benefits go down, and then stop entirely when income is a bit above the poverty line.” They were then given two examples of average SNAP benefits as follows.

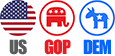

They were then asked whether these levels seemed low, about right, or high. Majorities nationally (57%) found these benefit levels low. More than seven in ten Democrats found them low. Less than half of Republicans (40%) found them low, but only one in five found them high. SNAP Benefits for Individuals Living Alone Response Without Undergoing Policymaking Simulation Related Standard Polls

Even in the context of reducing the federal deficit, a majority has been opposed to cutting food stamps:

Status of Legislation Response Without Undergoing Policymaking Simulation Related Standard Polls

Even in the context of reducing the federal deficit, a majority has been opposed to cutting food stamps:

Status of Legislation |

|

|

|

|

|

|

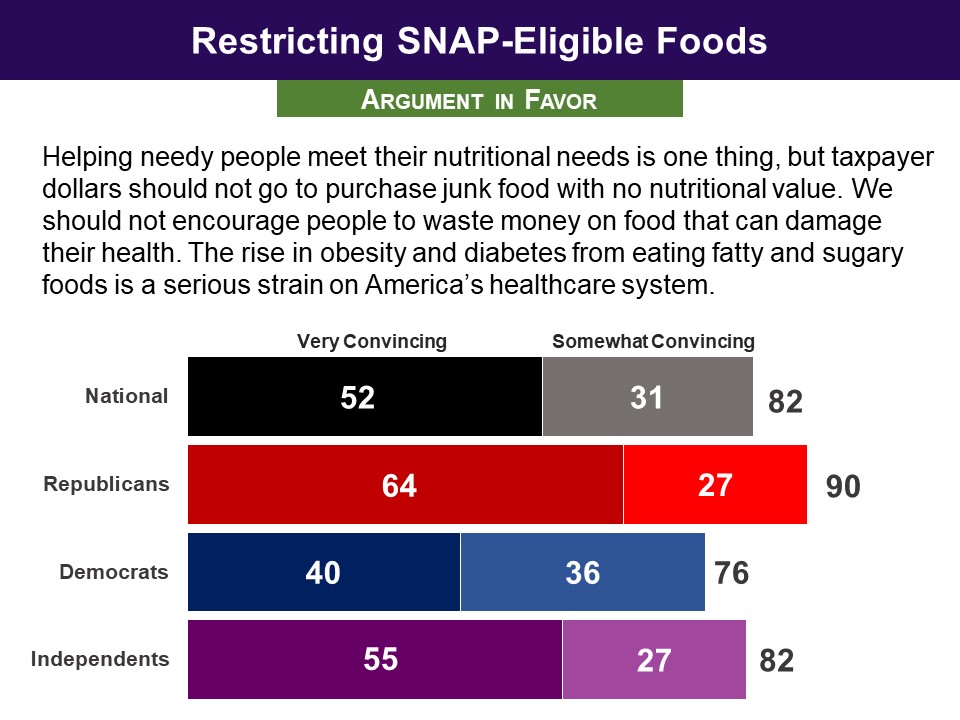

Members of 114th Congress introduced legislation that would restrict unhealthy foods (e.g. sodas, candy, cookies) from being purchased with SNAP benefits. The proposals presented to respondents were based on H.R. 2383 and H.R. 4881. Respondents were first told: Recently, there has been a debate over whether some kinds of food people can buy with SNAP benefits should be restricted. Currently, SNAP cannot be used for alcoholic beverages, and usually not for hot ready-to-eat food. One proposal is to extend these limits to other food items with little nutritional value, such as sweetened sodas, candy, cookies, cakes, and ice cream. They were then presented an argument in favor of restricting SNAP eligible foods. It was found convincing by an overwhelming bipartisan majority, including 91% of Republicans and 76% of Democrats.

Related Standard Polls

When no reason for the proposal was provided, a bare, but bipartisan majority have opposed prohibiting soda from being purchased with SNAP benefits:

Status of Legislation |

|

|

|

|

|

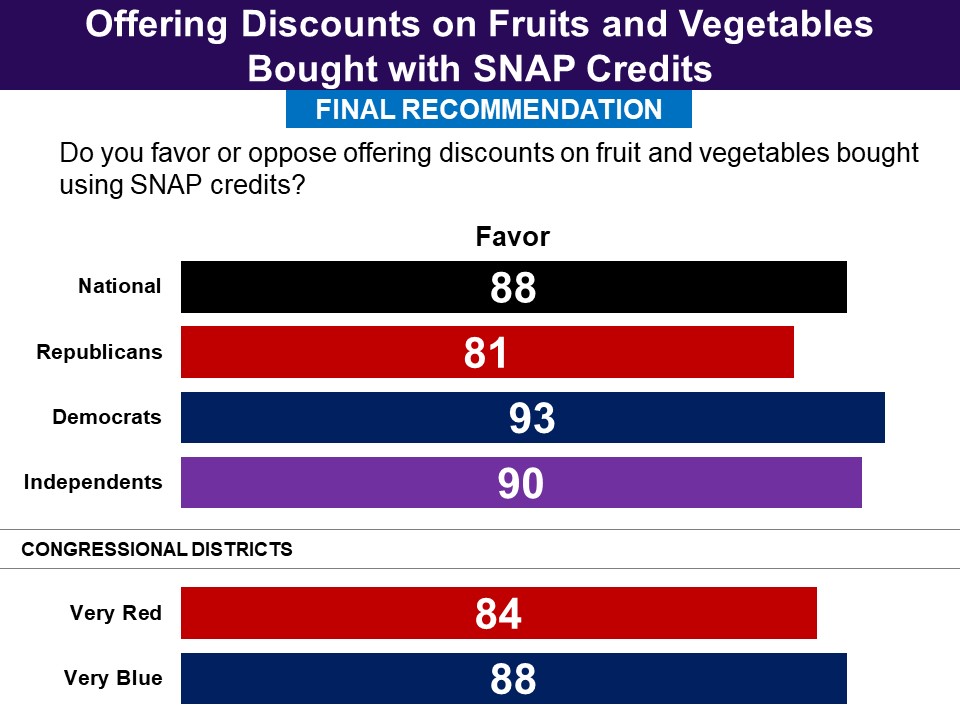

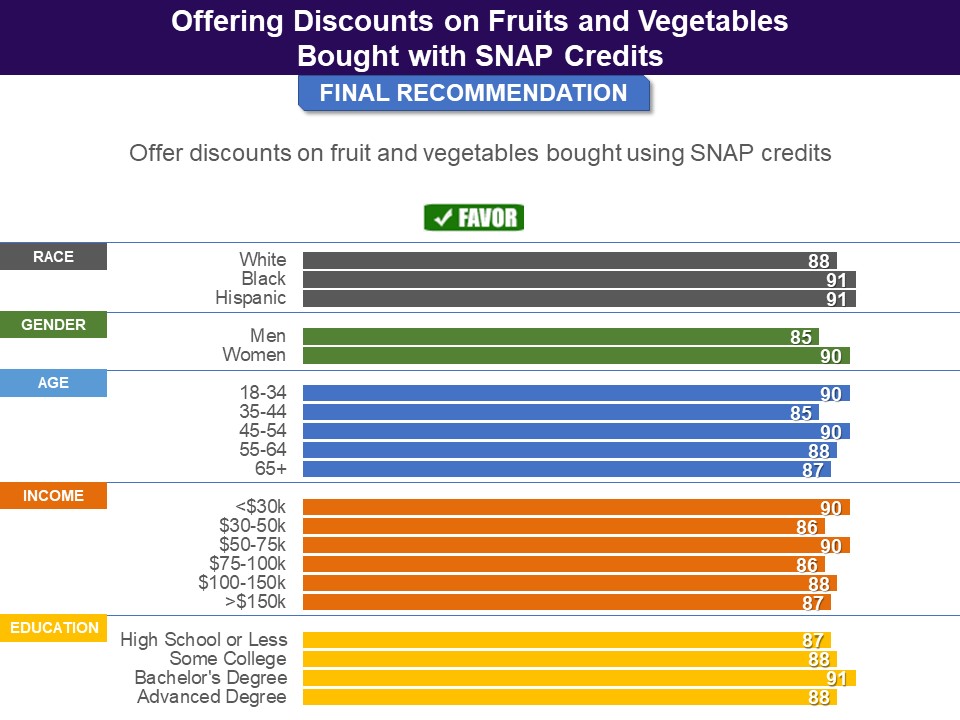

Members of Congress have introduced legislation to incentivize the purchase of fruits and vegetables among SNAP beneficiaries, by providing discounts on those foods when purchased with SNAP benefits. The proposals presented to respondents were based on H.R. 1933, H.R. 3072, and H.R.4904 from the 113th Congress, and H.R. 5423 from the 114th Congress. As a follow-on to the above discussion of making SNAP benefits contingent on foods being nutritious, an additional dimension was presented as follows: Another idea that has been considered for the SNAP program is to try to encourage people to eat more healthy food like fruits and vegetables. Research shows that if SNAP recipients are given a discount on fruits and vegetables they are more likely to buy them, as it helps their food stamps go further. On the one hand, these discounts would be an extra cost for the program; on the other hand, they are likely to have positive health effects, which might produce some savings for government spending on healthcare benefits for SNAP beneficiaries, who are also on Medicaid. An overwhelming 88%, including 81% Republicans and 93% of Democrats, favored providing discounts on fruit and vegetables bought with SNAP benefits. Status of Legislation |

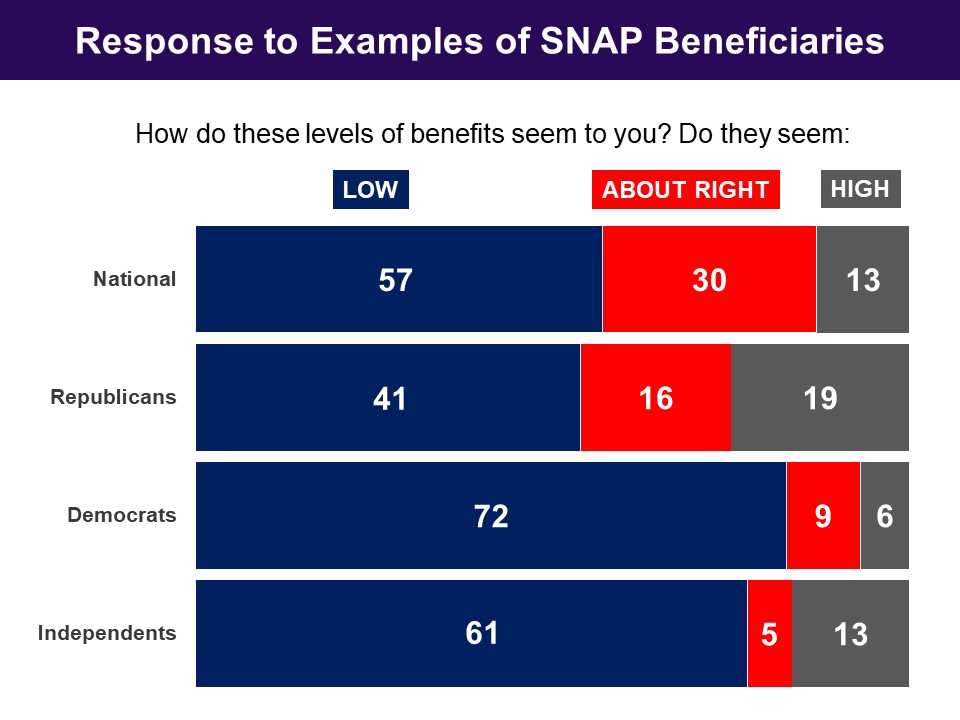

Respondents then evaluated arguments for and against raising benefits. The argument in favor of raising benefits did very well with more than seven in ten finding it convincing nationally. Republicans were lower, but still nearly six in ten found the argument convincing.

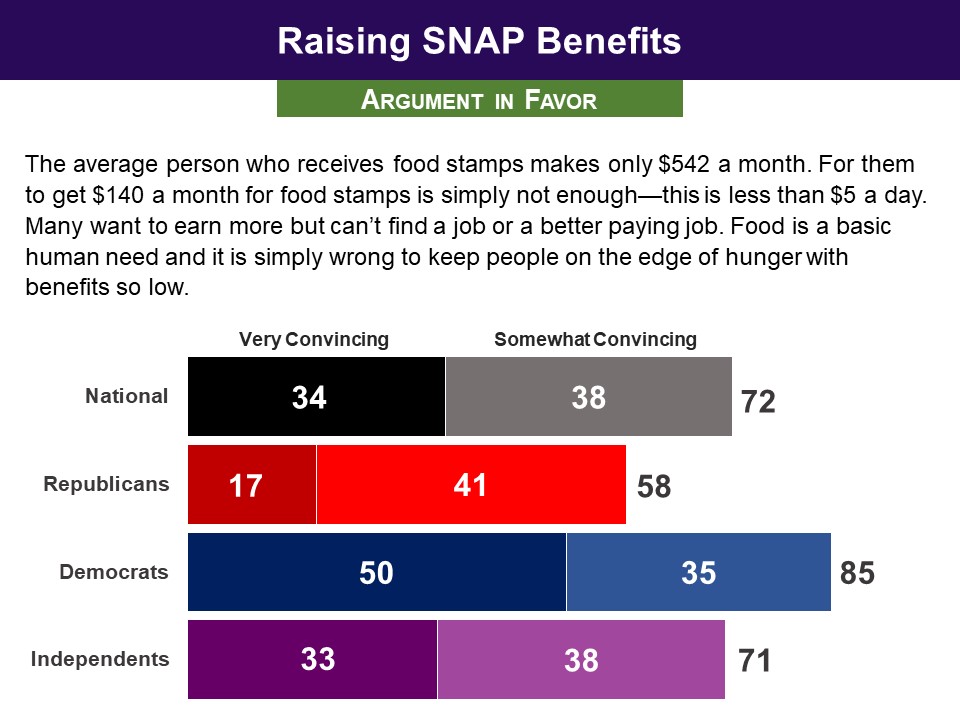

Respondents then evaluated arguments for and against raising benefits. The argument in favor of raising benefits did very well with more than seven in ten finding it convincing nationally. Republicans were lower, but still nearly six in ten found the argument convincing. The argument against raising benefits was much less convincing. A bare majority found it convincing. Among Republicans, though, seven in ten found it convincing.

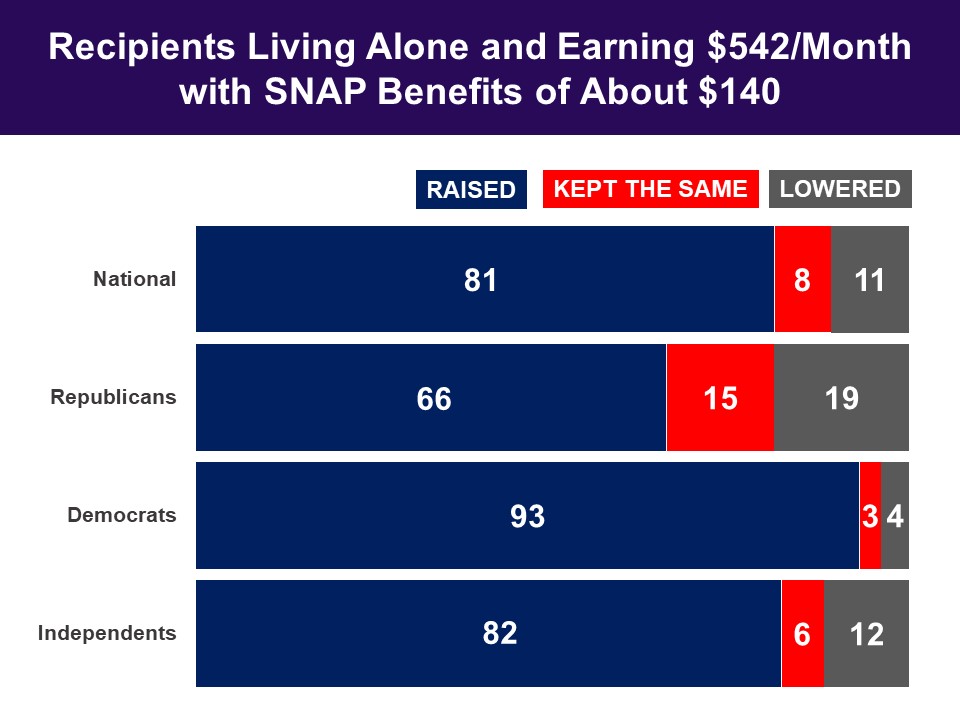

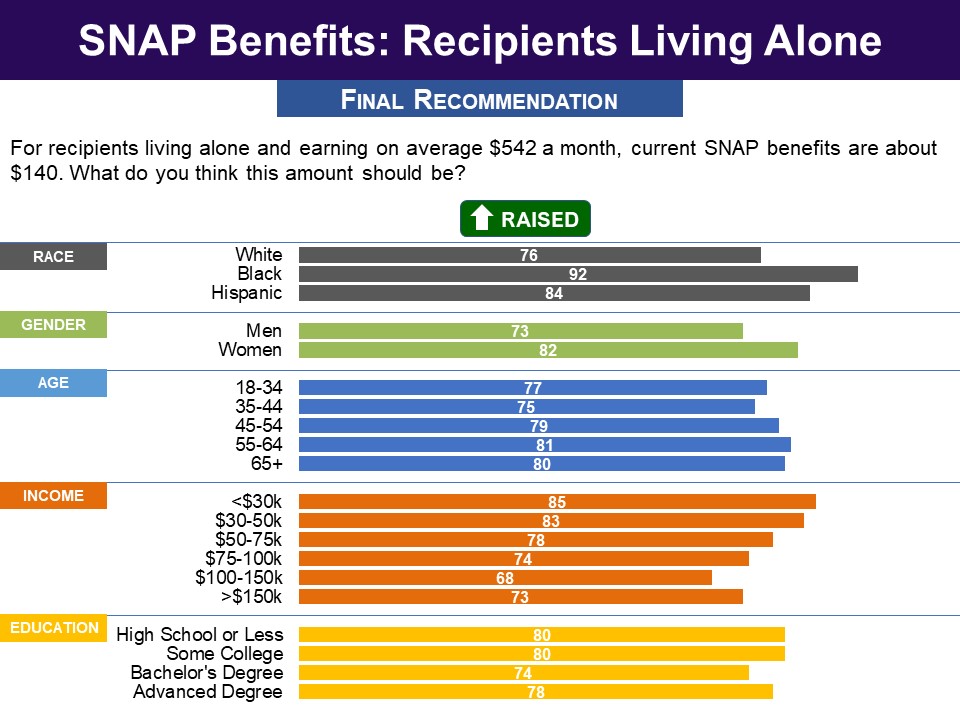

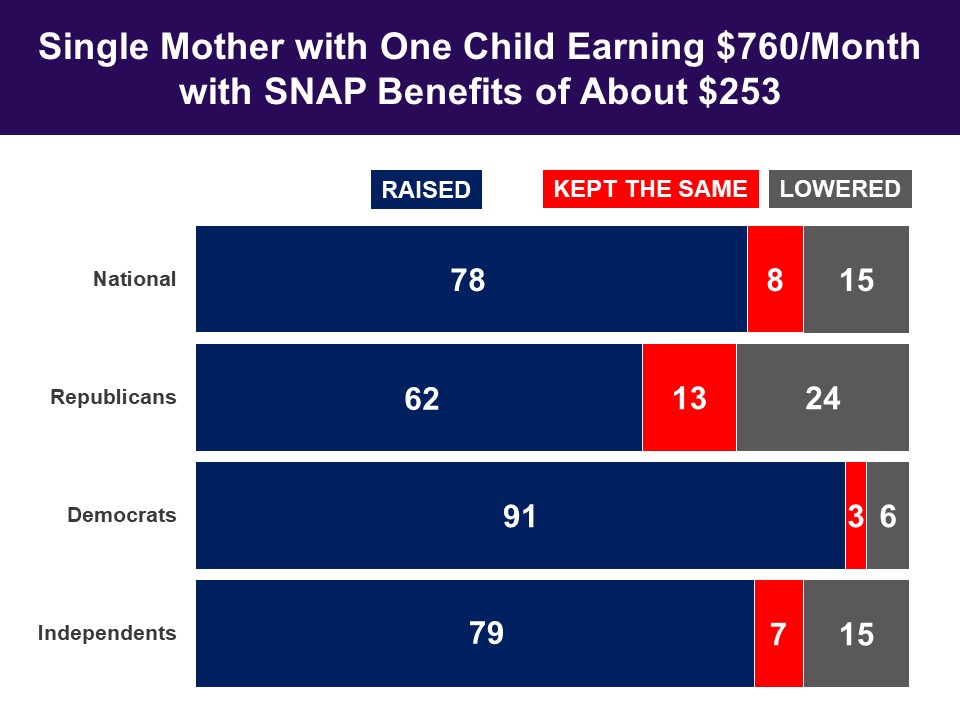

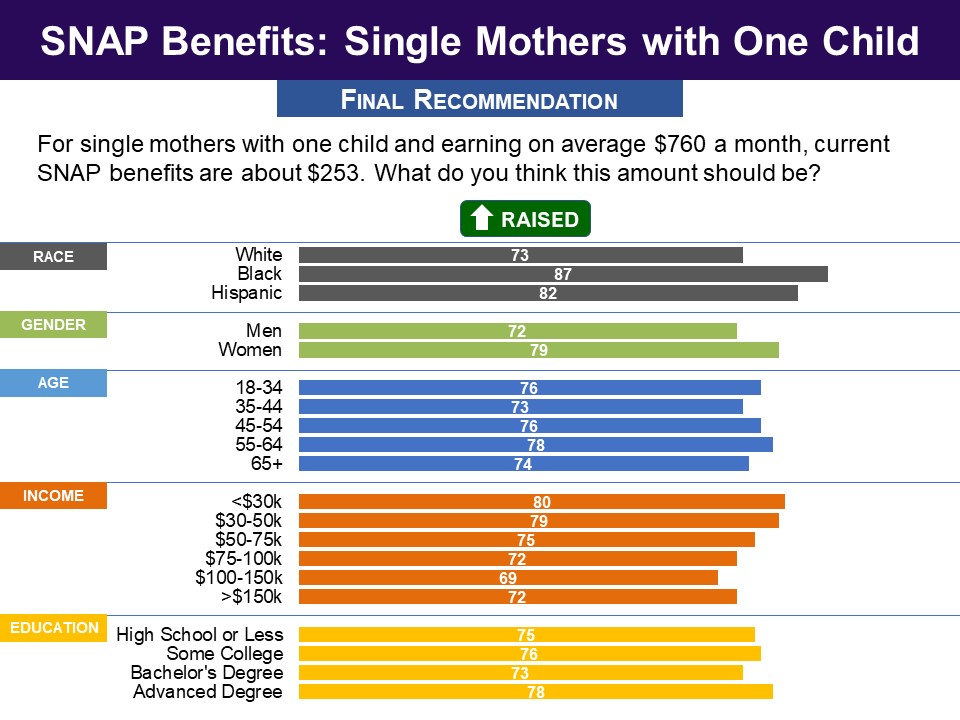

The argument against raising benefits was much less convincing. A bare majority found it convincing. Among Republicans, though, seven in ten found it convincing.  Coming back to the two specific cases of benefit levels--individuals living alone and single mothers with one child--respondents were asked to select what they thought the level should be and were able to give any number. For both cases, a bipartisan majority substantially raised benefits from the current level.

Coming back to the two specific cases of benefit levels--individuals living alone and single mothers with one child--respondents were asked to select what they thought the level should be and were able to give any number. For both cases, a bipartisan majority substantially raised benefits from the current level.

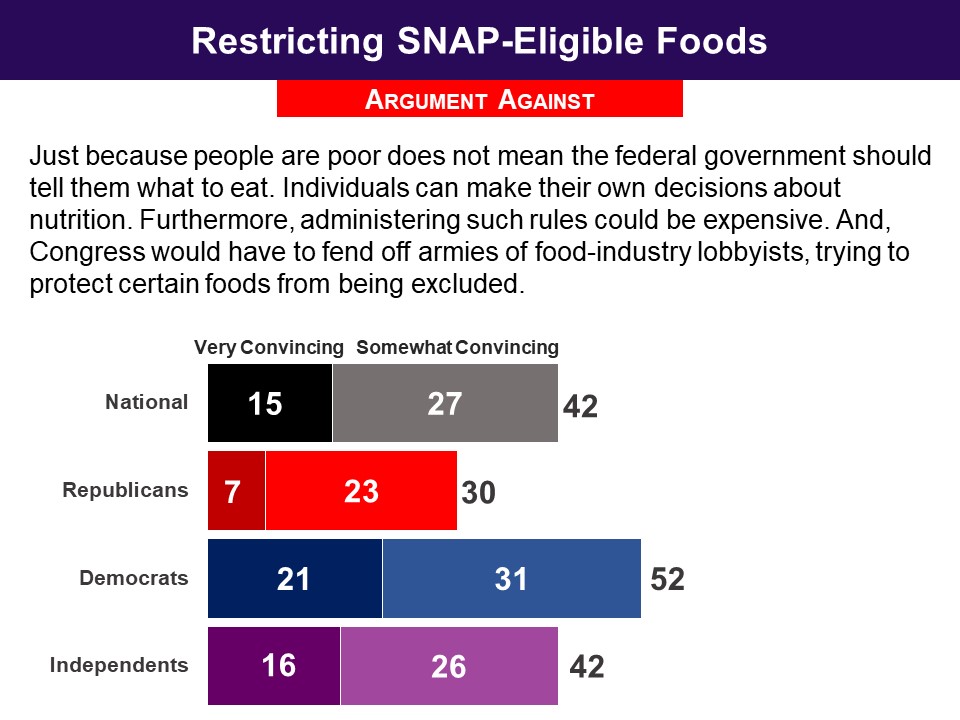

The argument against such restrictions did much more poorly, with just 42% finding it convincing, including 30% of Democrats. A bare majority of Republicans (52%) found it convincing.

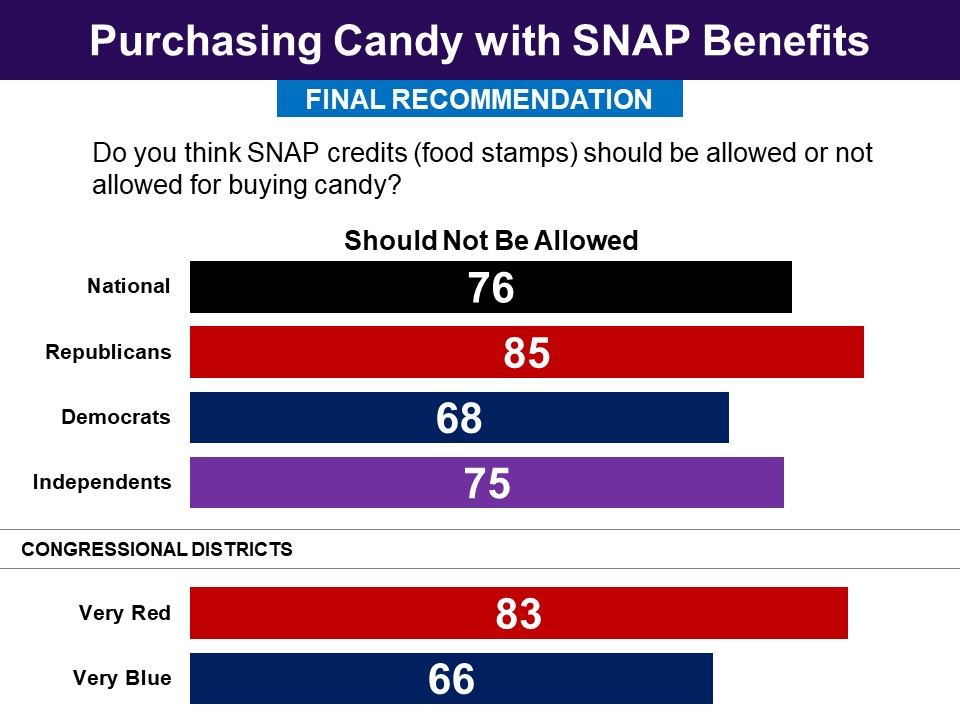

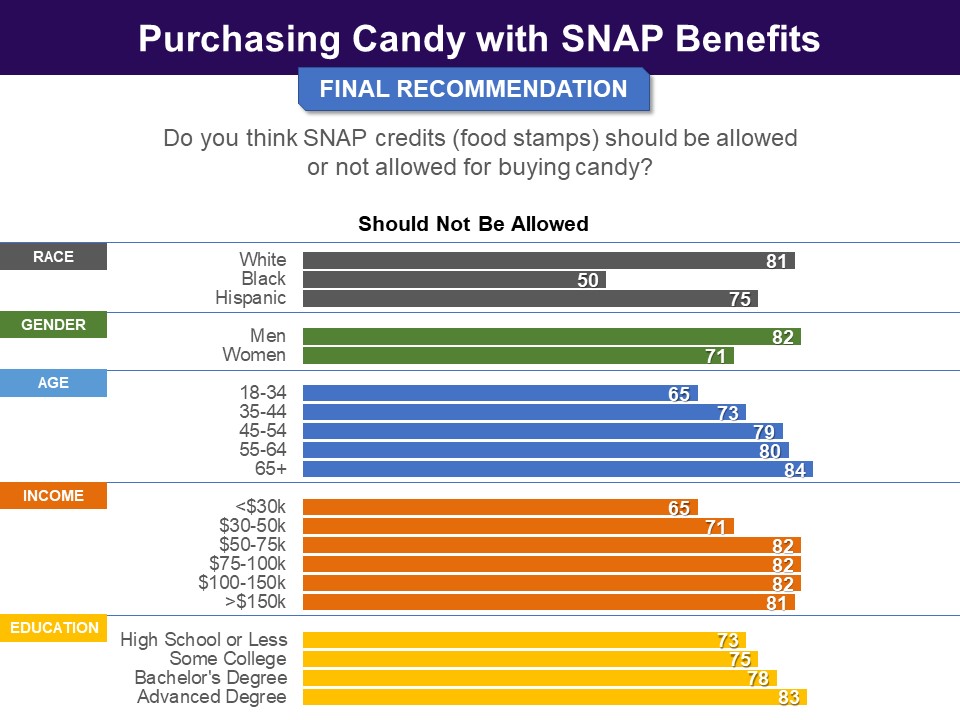

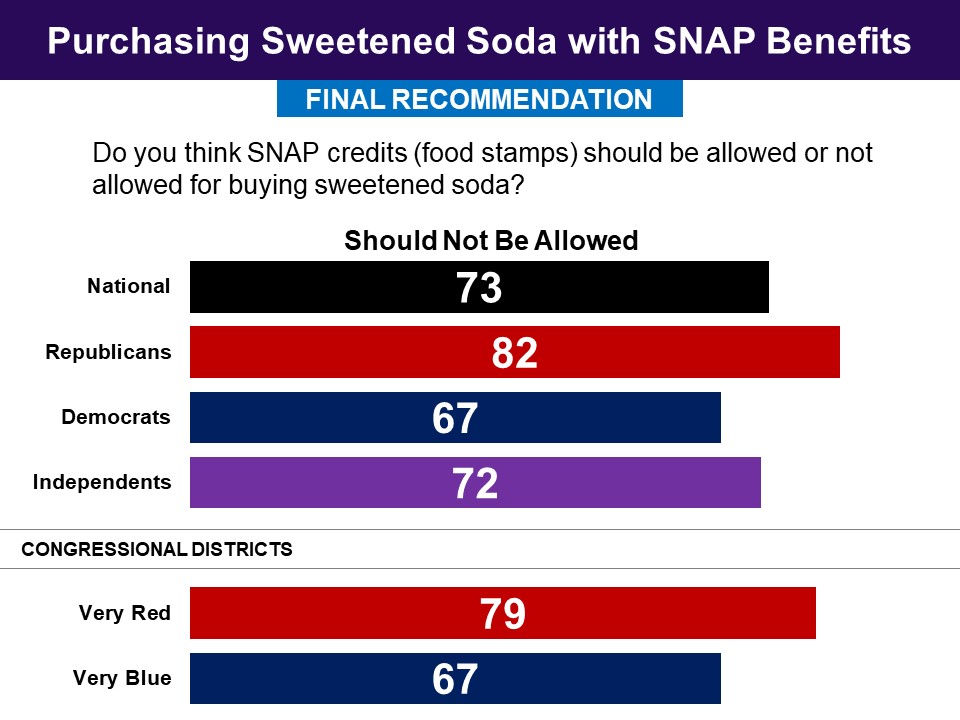

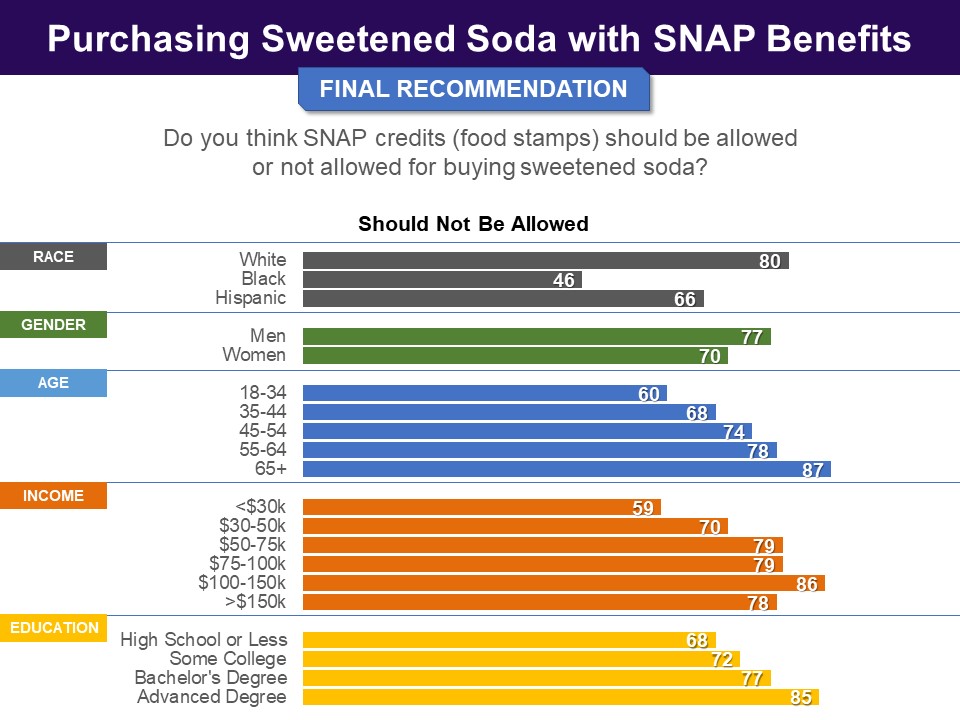

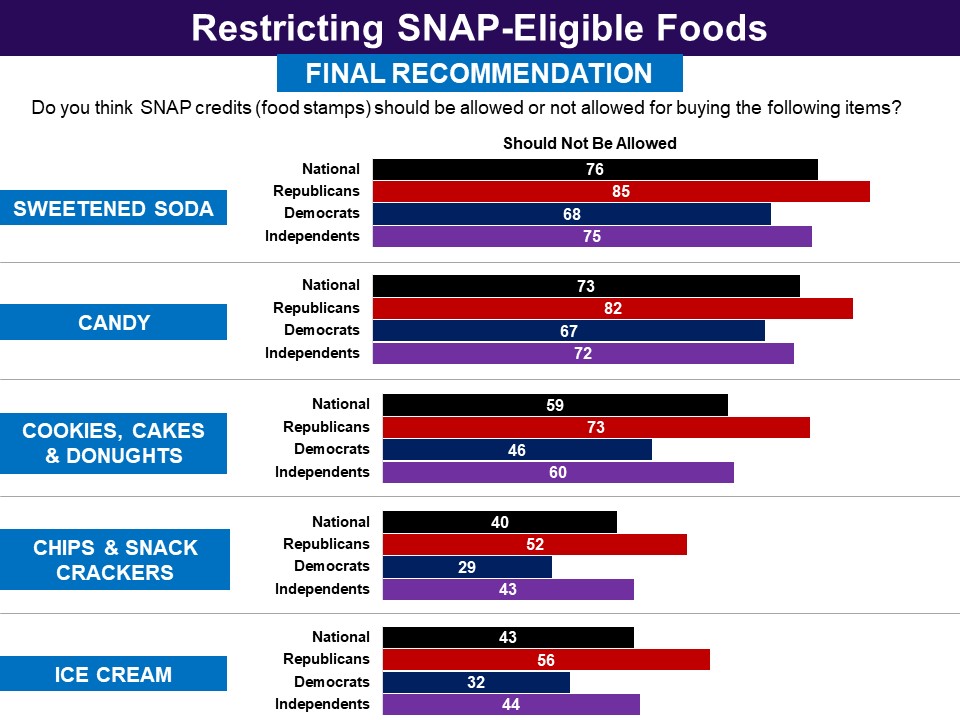

The argument against such restrictions did much more poorly, with just 42% finding it convincing, including 30% of Democrats. A bare majority of Republicans (52%) found it convincing. They were then given a list of food items and asked whether each one should be allowed for purchase with SNAP benefits. There was substantial variation depending on the item. The largest bipartisan majorities favored disallowing candy, followed closely by sweetened sodas. Restricting candy was recommended by 73%, including 85% of Republicans and 68% of Democrats; restricting sweetened soda by 76%, Republicans 82% and Democrats 67%.

They were then given a list of food items and asked whether each one should be allowed for purchase with SNAP benefits. There was substantial variation depending on the item. The largest bipartisan majorities favored disallowing candy, followed closely by sweetened sodas. Restricting candy was recommended by 73%, including 85% of Republicans and 68% of Democrats; restricting sweetened soda by 76%, Republicans 82% and Democrats 67%.

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Respondents were then asked whether they would favor or oppose a proposal that would:

Respondents were then asked whether they would favor or oppose a proposal that would:

Related Standard Polls

Related Standard Polls

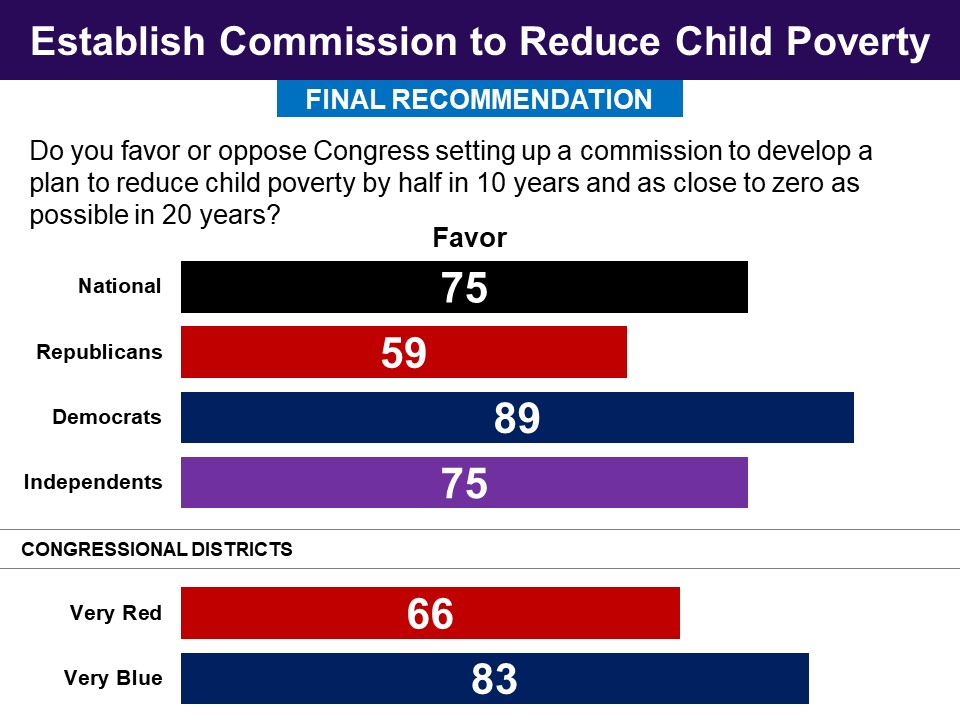

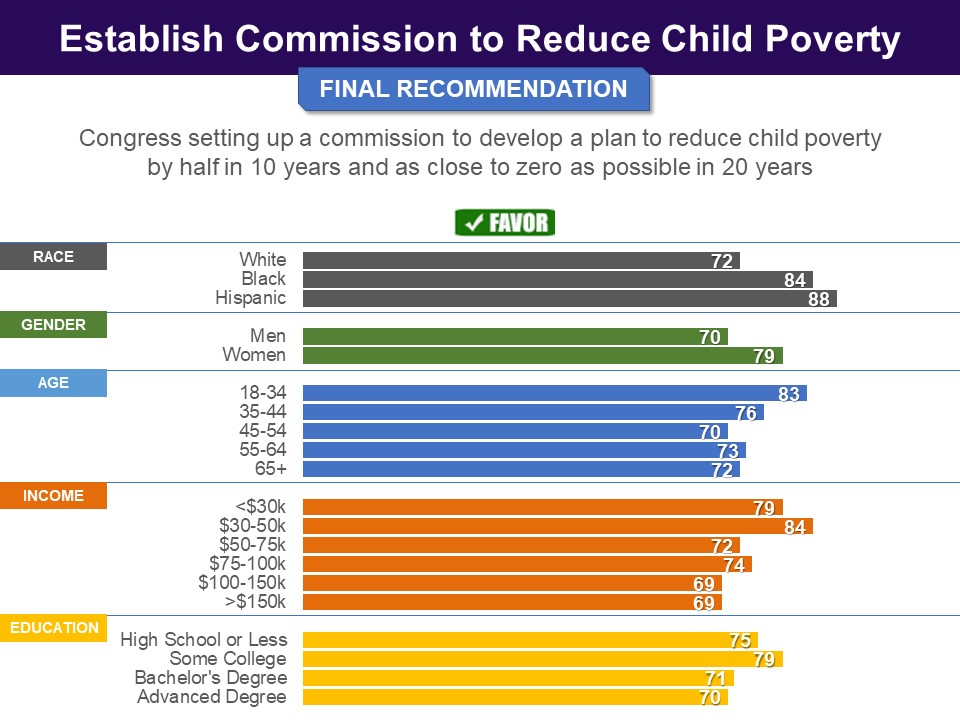

In the end, a large bipartisan majority of three in four favored Congress setting up a commission to develop a plan to reduce child poverty by half in 10 years and as close to zero as possible in 20 years. This included a substantial majority of Democrats (89%) as well as nearly six in ten Republicans.

In the end, a large bipartisan majority of three in four favored Congress setting up a commission to develop a plan to reduce child poverty by half in 10 years and as close to zero as possible in 20 years. This included a substantial majority of Democrats (89%) as well as nearly six in ten Republicans.

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

Pre-Deliberation Poll

Pre-Deliberation Poll

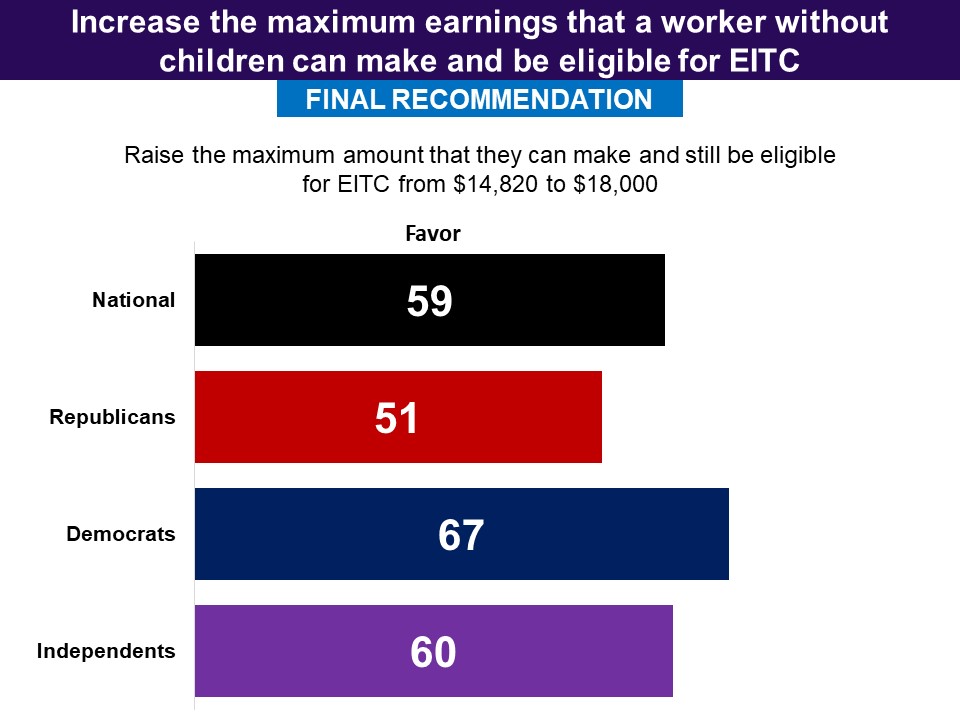

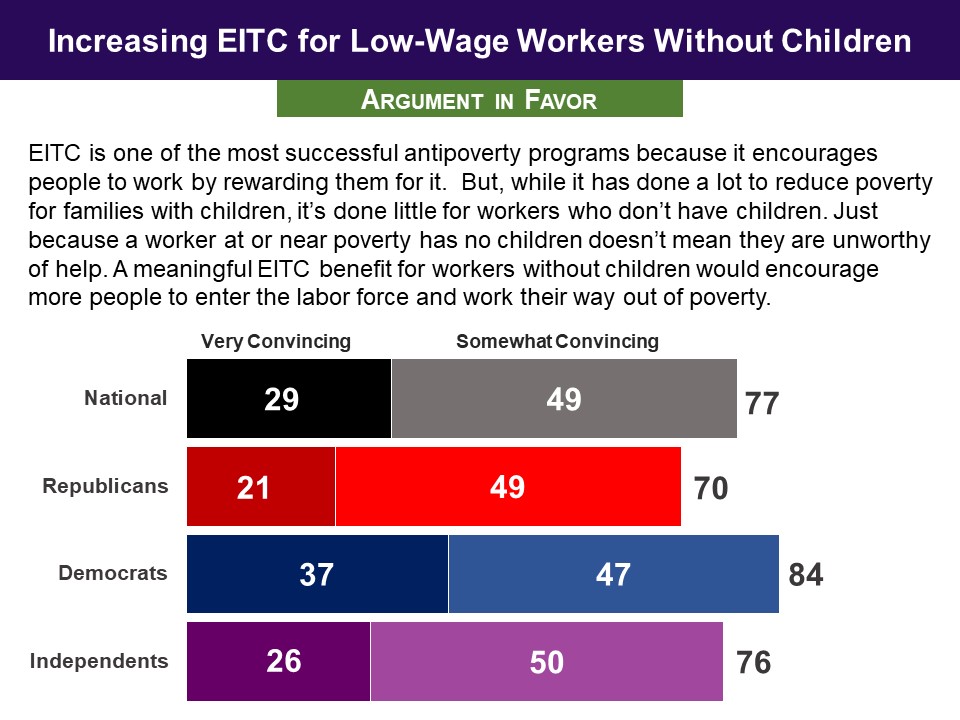

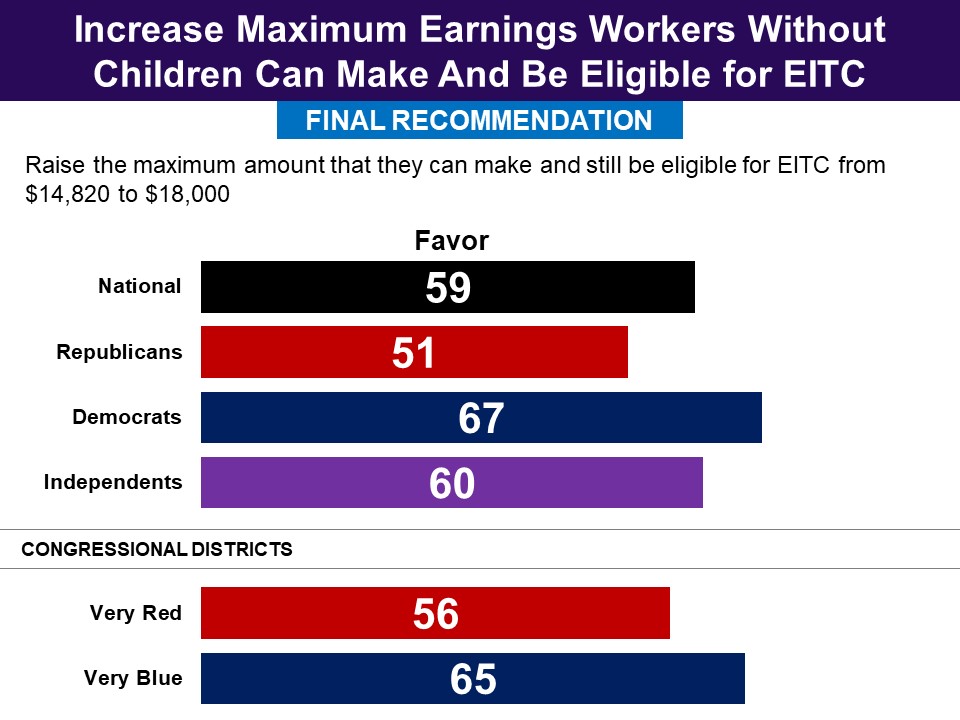

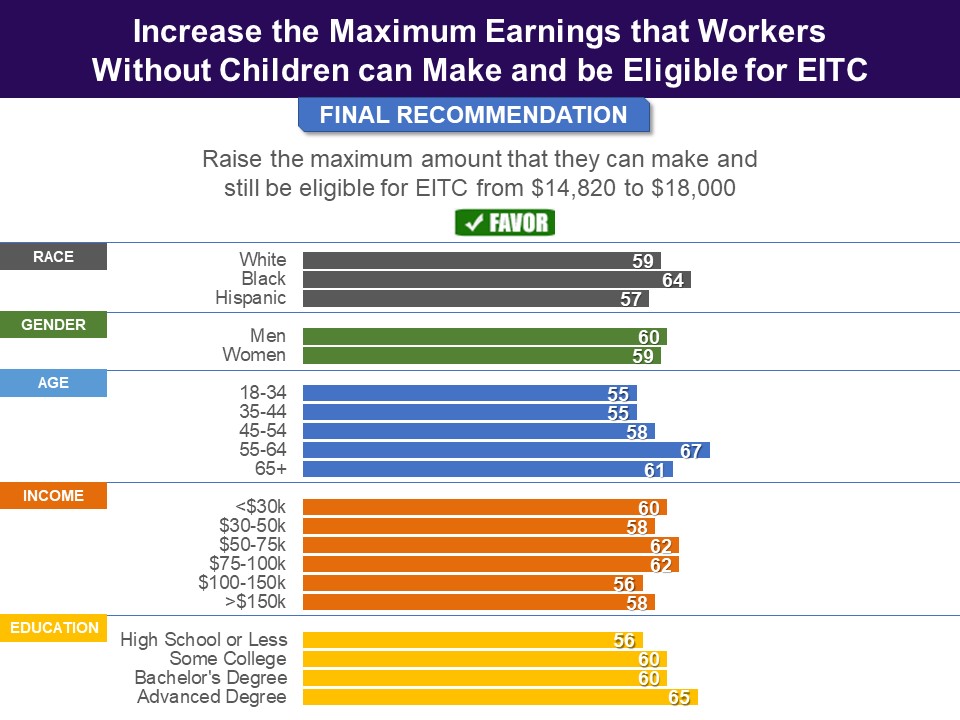

When asked for their recommendations, six in ten recommended increasing the maximum amount a worker can make and still receive benefits from $14,820 to $18,000, including two thirds of Democrats. Among Republicans 51% were in favor.

When asked for their recommendations, six in ten recommended increasing the maximum amount a worker can make and still receive benefits from $14,820 to $18,000, including two thirds of Democrats. Among Republicans 51% were in favor.

Proposals one and three did not get majority support.

Proposals one and three did not get majority support.

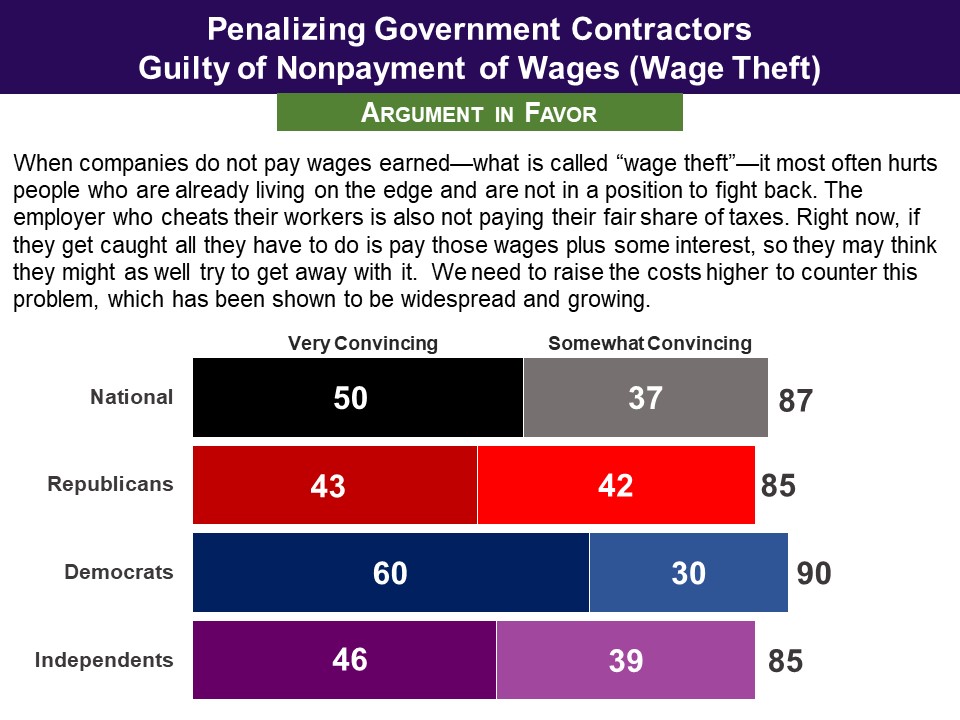

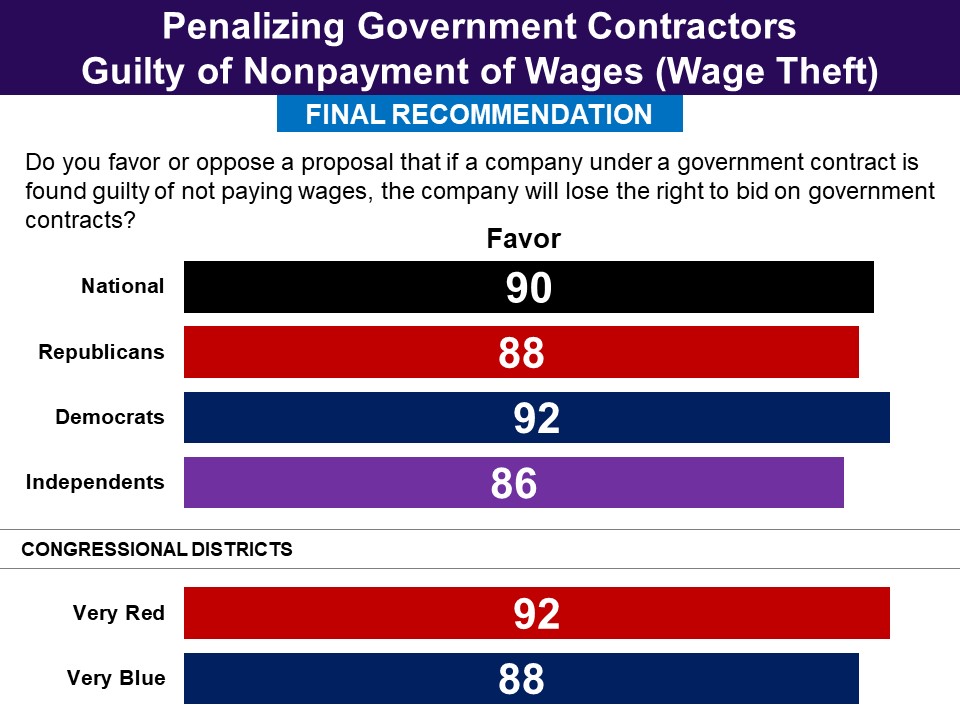

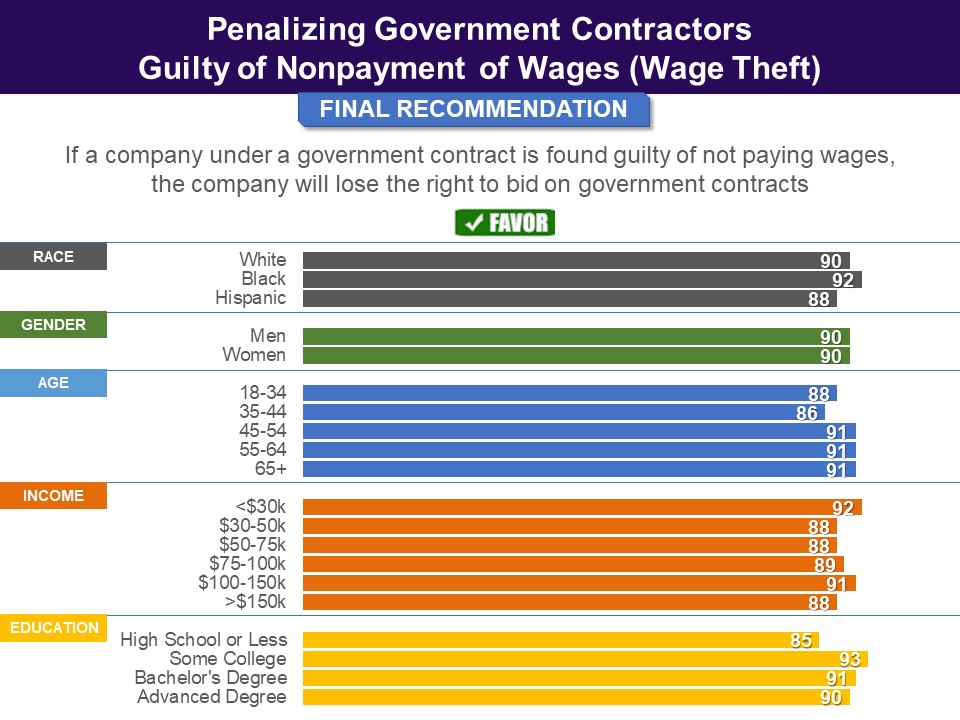

In making their final recommendation, an overwhelming majority nationally of nine in ten , with similar numbers in both parties, endorsed the proposal to take away a business’ right to bid on government contractors if they are found guilty of wage theft.

In making their final recommendation, an overwhelming majority nationally of nine in ten , with similar numbers in both parties, endorsed the proposal to take away a business’ right to bid on government contractors if they are found guilty of wage theft.

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

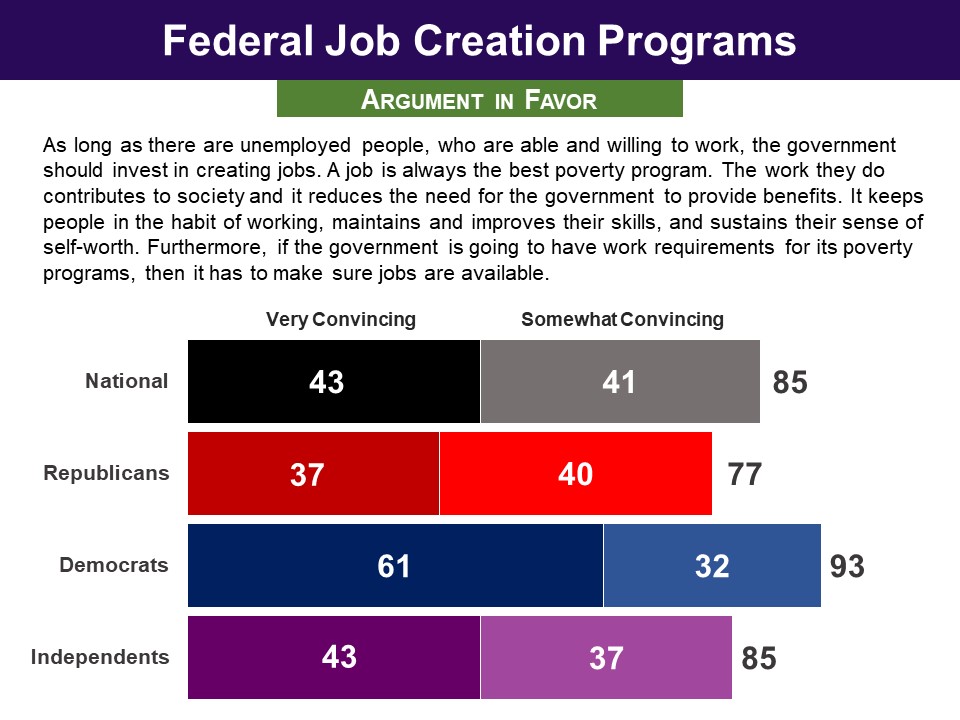

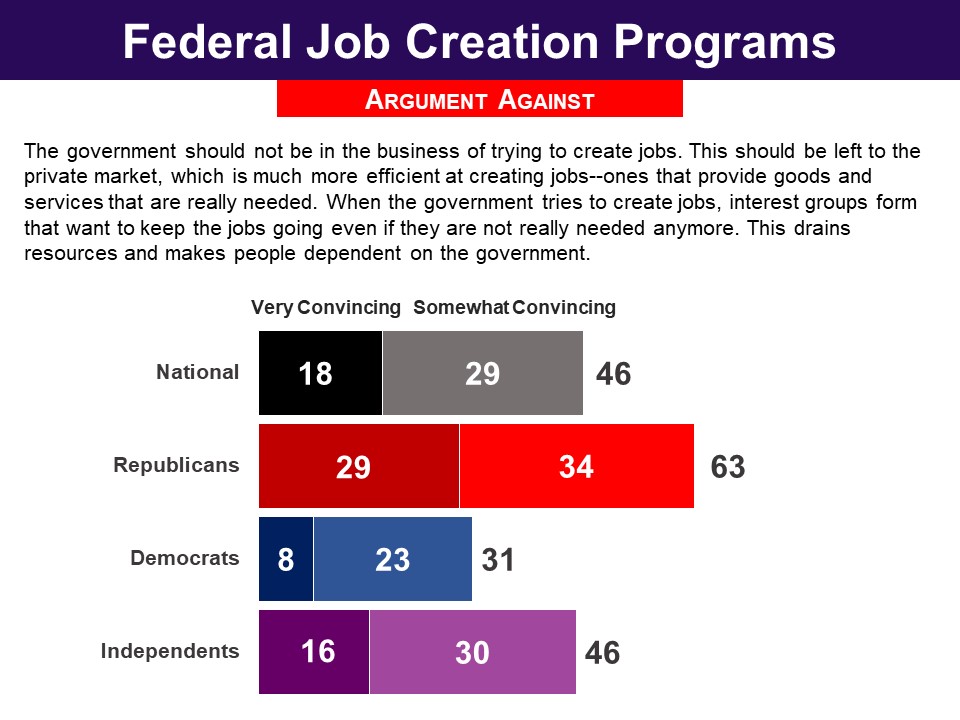

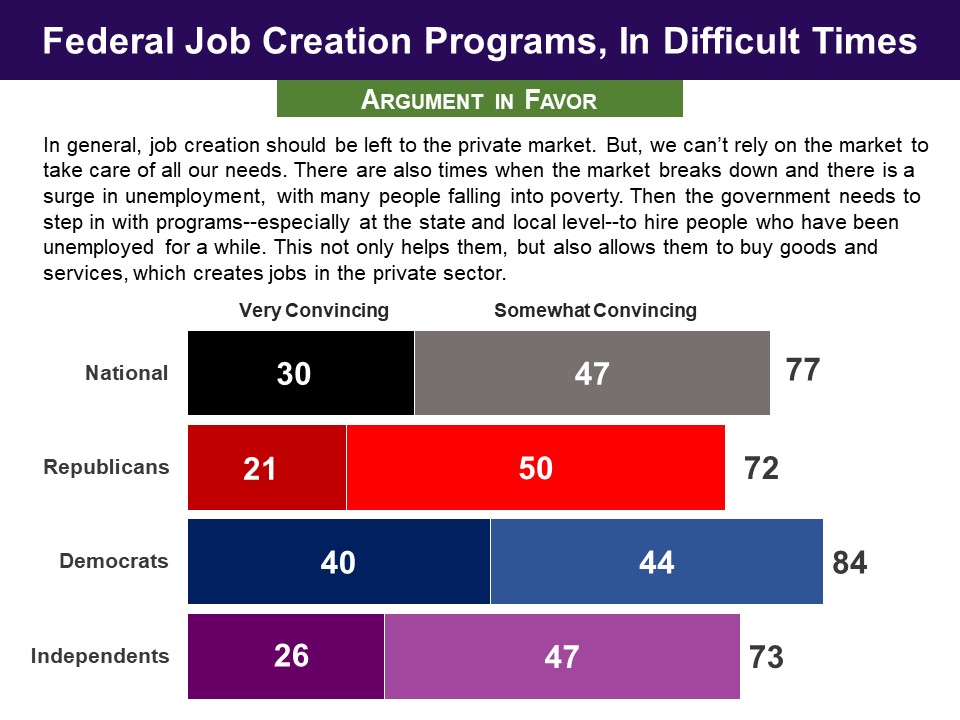

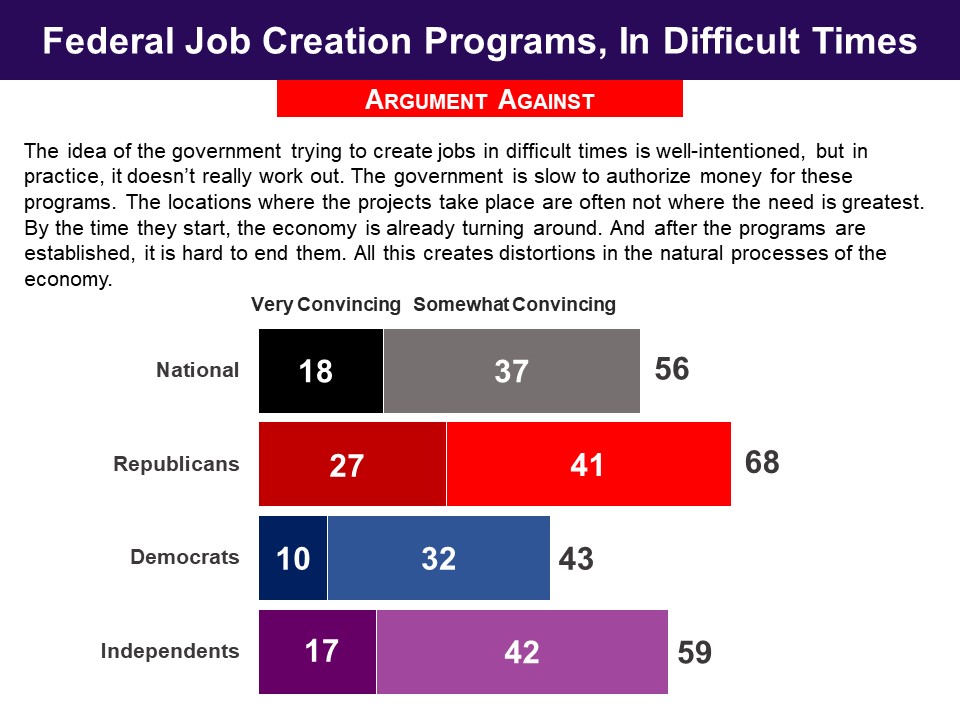

The second pair of arguments concerned the idea that the government should not generally seek to create jobs, but should do so in difficult times. Again, the argument in favor did better than the argument against, except among Republicans who found both arguments convincing at similar rates.

The second pair of arguments concerned the idea that the government should not generally seek to create jobs, but should do so in difficult times. Again, the argument in favor did better than the argument against, except among Republicans who found both arguments convincing at similar rates.

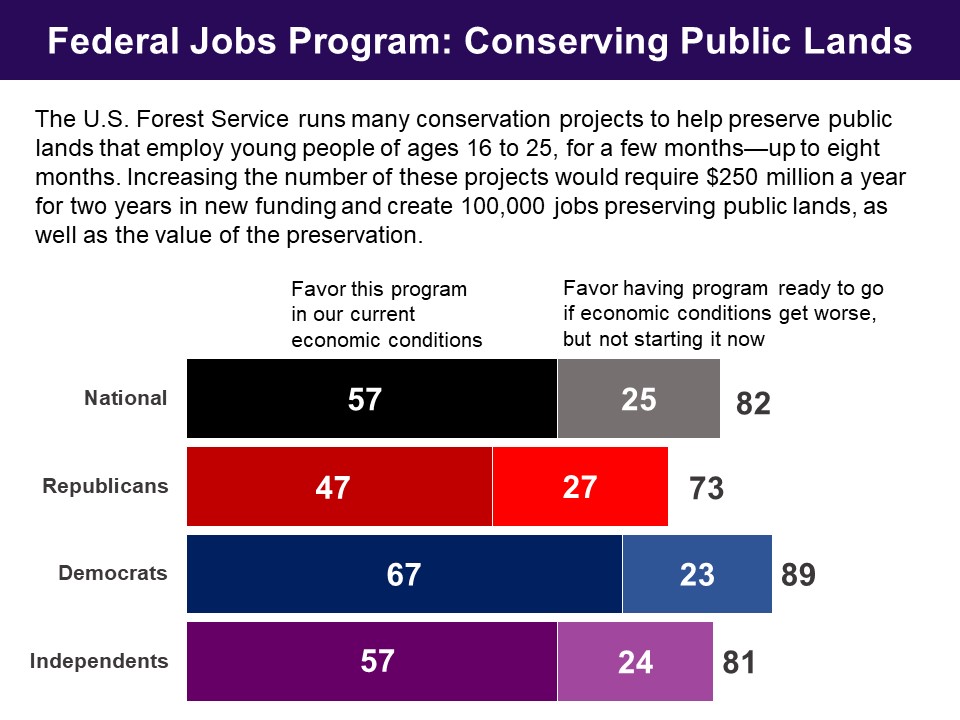

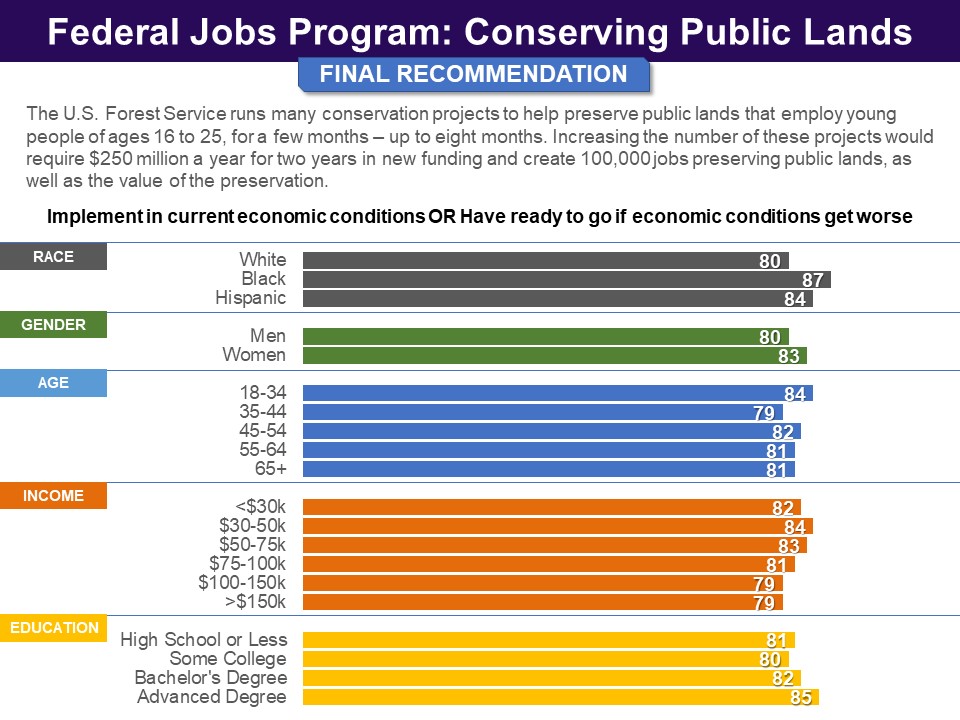

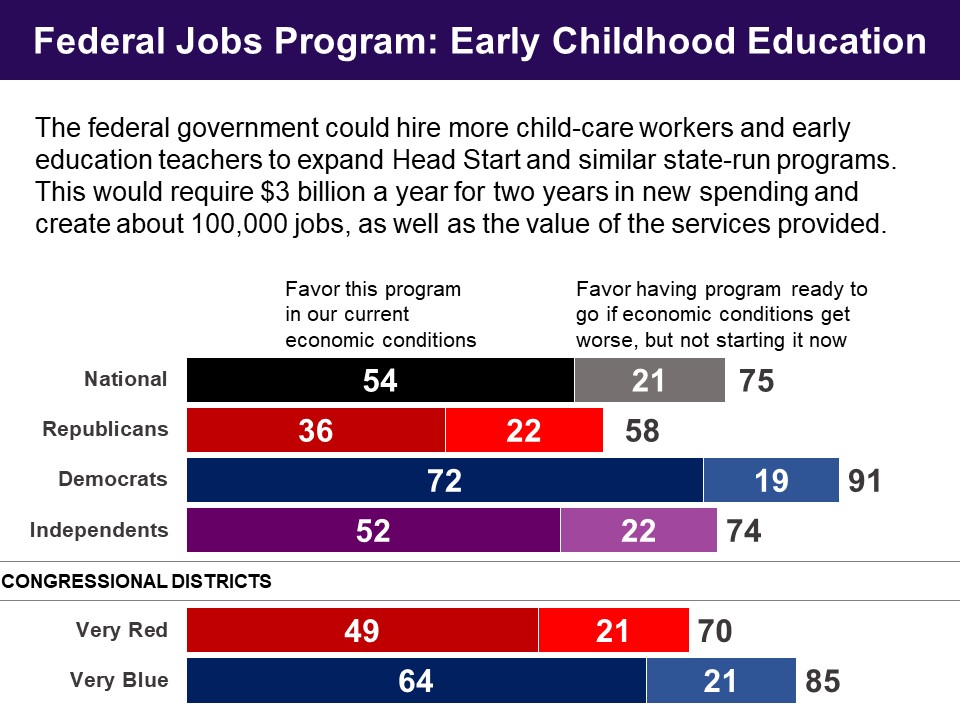

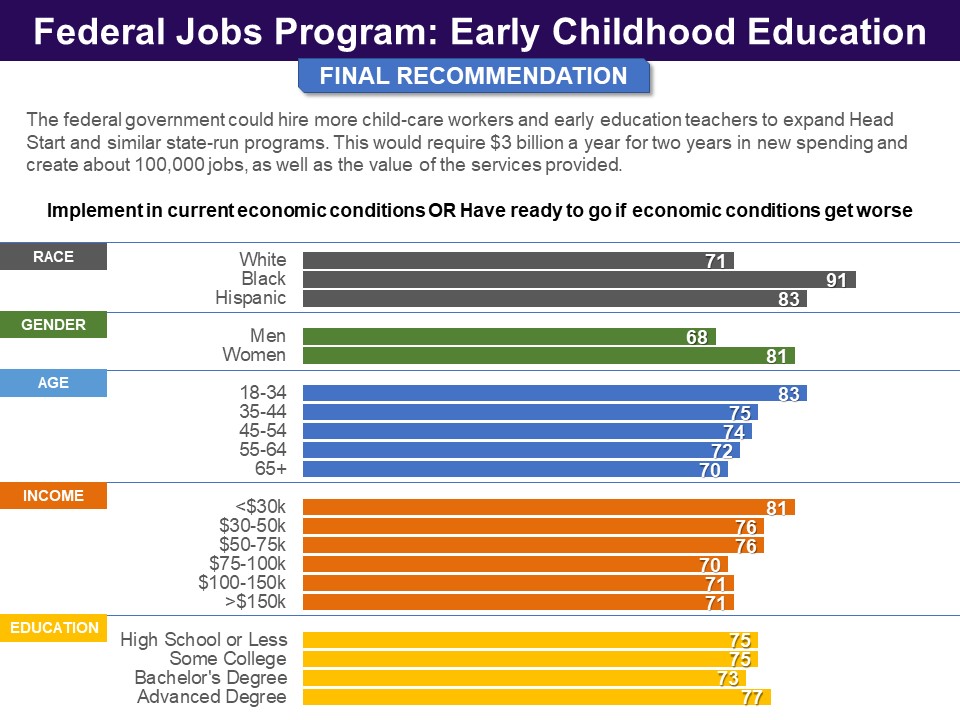

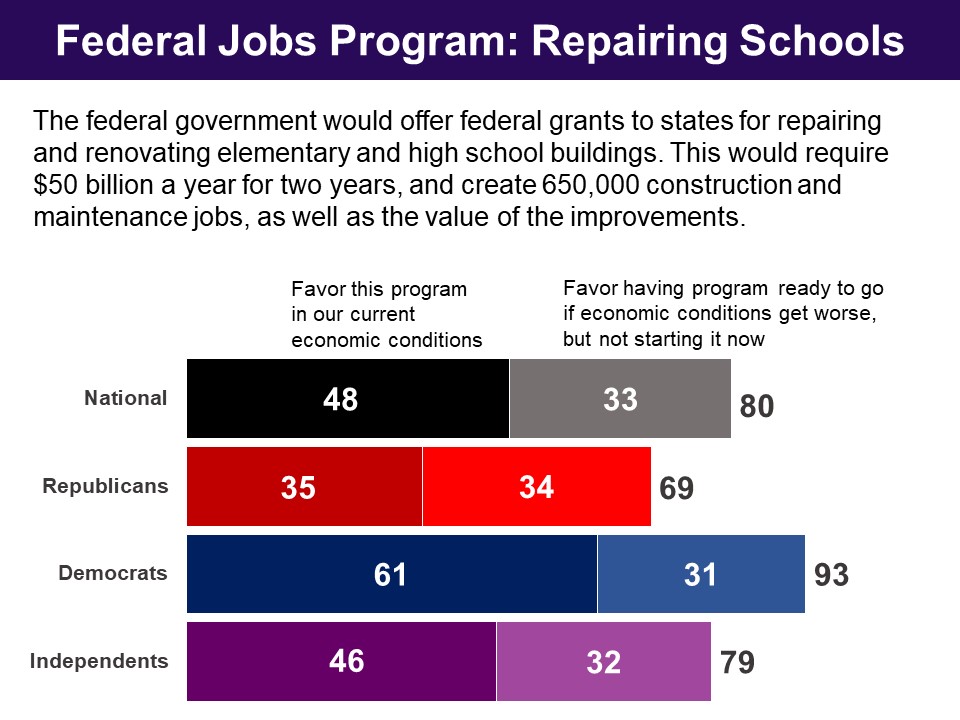

Respondents were then presented four proposals for job creation with costs and the number of jobs they would likely produce. They were told that “For all these proposals, people who have been unemployed for a period--and are qualified to do the work--would be first to be hired.”

Respondents were then presented four proposals for job creation with costs and the number of jobs they would likely produce. They were told that “For all these proposals, people who have been unemployed for a period--and are qualified to do the work--would be first to be hired.”

Childcare and Early Education

Childcare and Early Education

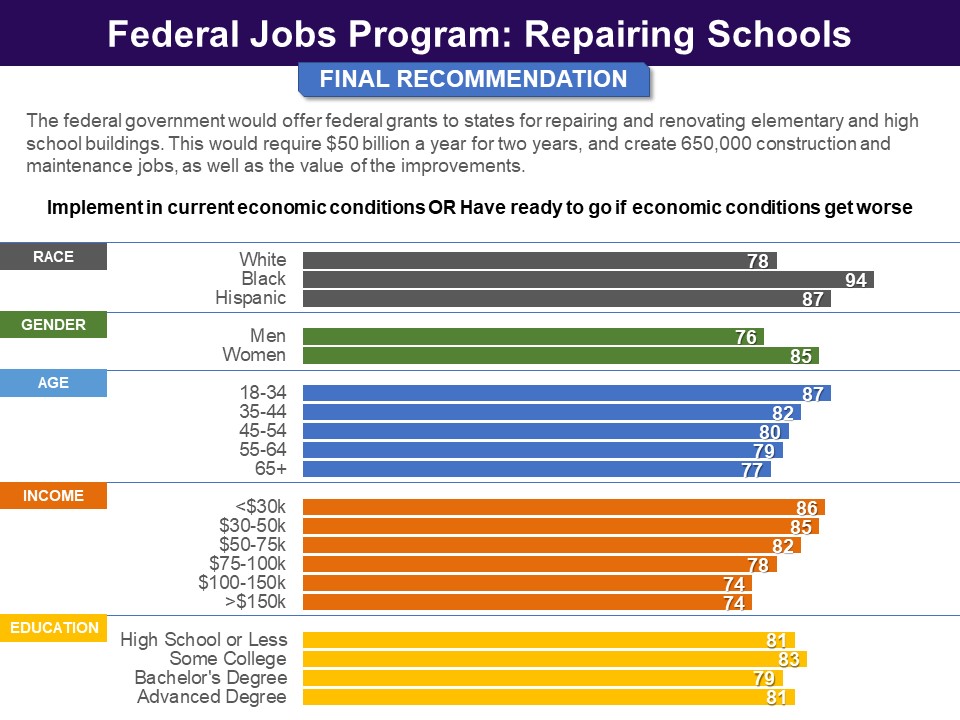

School Renovation

School Renovation

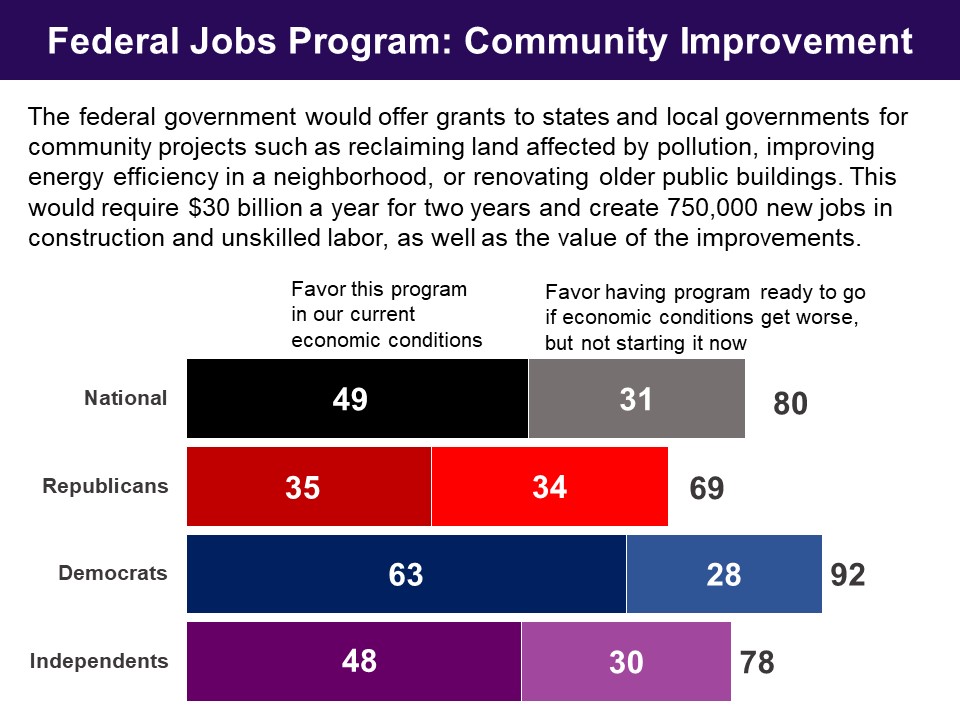

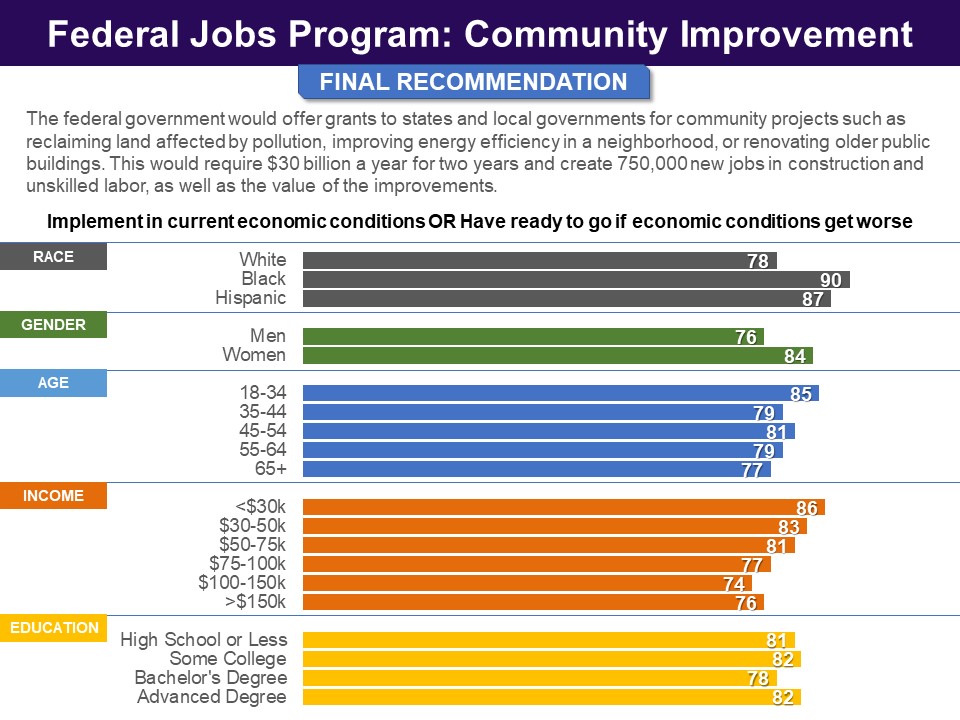

Community Projects

Community Projects

Response Without Undergoing Policymaking Simulation

Response Without Undergoing Policymaking Simulation

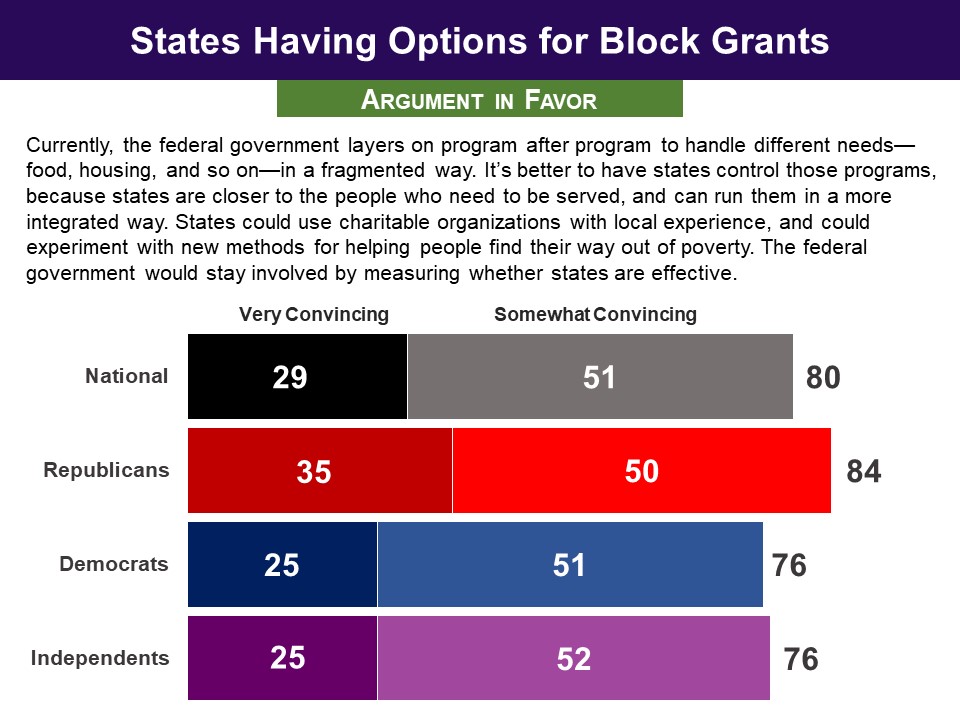

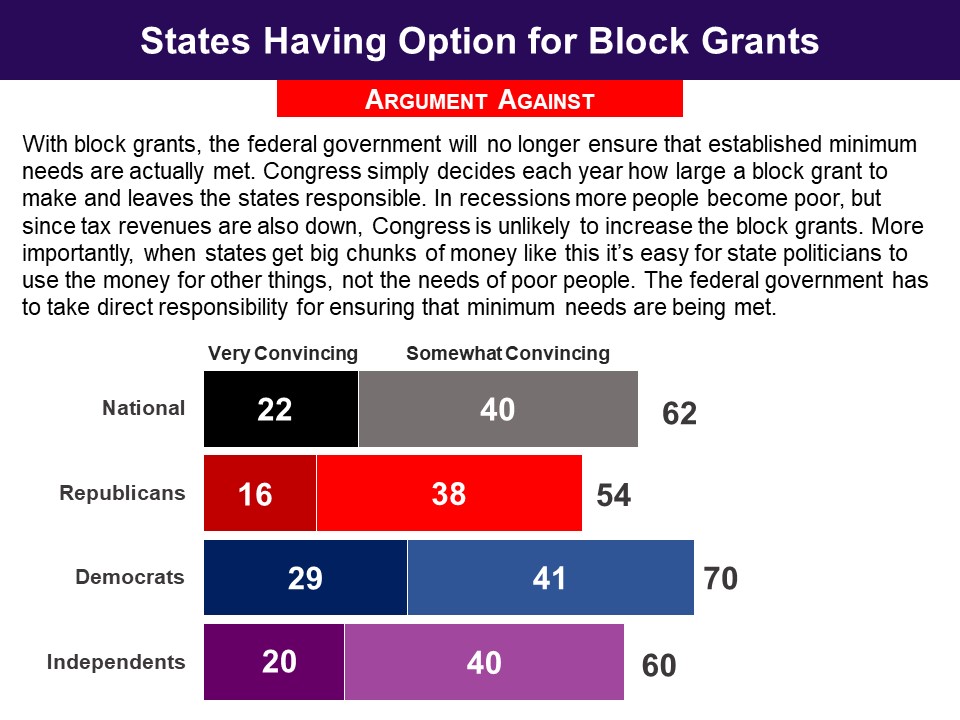

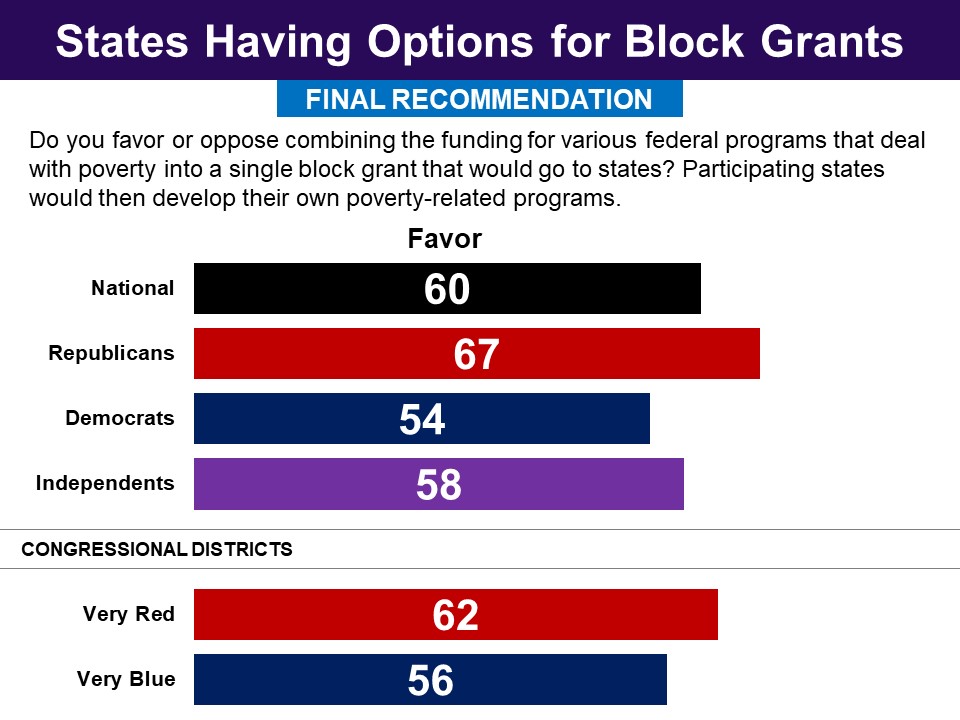

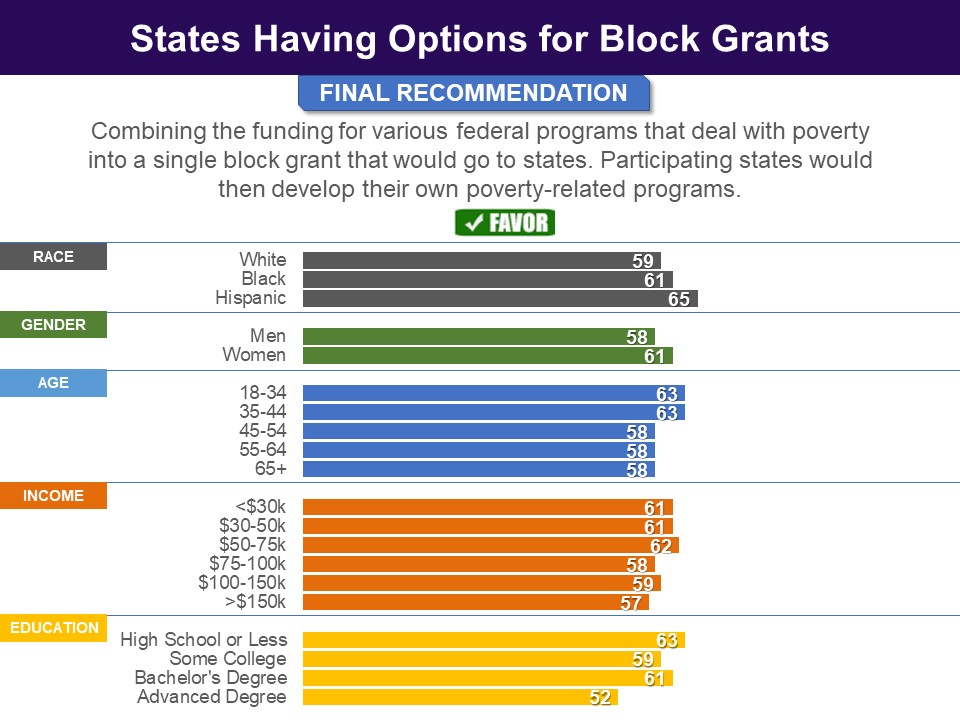

Six in ten overall, including 54% of Democrats and two thirds of Republicans, approved of the idea of states having the option of receiving Federal poverty program funds in the form of block grants for some programs, which the states would then administer.

Six in ten overall, including 54% of Democrats and two thirds of Republicans, approved of the idea of states having the option of receiving Federal poverty program funds in the form of block grants for some programs, which the states would then administer.

Status of Proposal

Status of Proposal

Pre-Deliberation Poll

Pre-Deliberation Poll Pre-Deliberation Poll

Pre-Deliberation Poll